Schlumberger (NYSE: SLB) is a prominent player in the oilfield services industry with a strong track record of fundamental strengths that support its rapid value growth potential. The analysis delves into specific fundamental strengths of Schlumberger in driving value growth (as of Q3 2023).

Robust Financial Performance

Schlumberger's financial performance is a cornerstone of its value growth potential. The following financial data points underscore this strength:

Sequential Revenue Growth: In Q3 fiscal 2023, Schlumberger achieved a 3% sequential revenue growth (Q3 2023). This sequential growth indicates that the company is effectively navigating market dynamics and capitalizing on opportunities.

Year-on-Year Revenue Growth: Comparing the Q3 2023 to Q3 2022, Schlumberger's revenue increased by a substantial 11%. This robust year-on-year growth demonstrates the company's ability to adapt to changing market conditions and capture market share.

EBITDA Margin: Schlumberger's EBITDA margin reached a new cycle high at 25%. High EBITDA margins are indicative of efficient operations, cost management, and the ability to deliver value to shareholders.

Free Cash Flow Generation: Generating free cash flow of $1 billion for the second consecutive quarter indicates the company's ability to convert its operational performance into cash, which can be reinvested for growth or returned to shareholders.

Net Debt Management: Schlumberger's net debt reduced sequentially by $731 million to $9.4 billion. The net debt to trailing 12-month EBITDA leverage ratio stands at a low of 1.2, showcasing the company's financial discipline and stability.

Schlumberger's consistent revenue growth, healthy margins, and prudent financial management are fundamental strengths that support its value growth potential.

International Expansion and Market Presence

Schlumberger's strong international presence and growth are pivotal for value growth. The highlights key aspects of its international operations:

International Revenue Growth: Schlumberger achieved its highest international revenue quarter since 2015. This underscores the company's ability to adapt and grow in diverse and geographically dispersed markets.

Middle East & Asia: The company posted a remarkable 22% year-on-year revenue growth in the Middle East & Asia. Significant contributions came from Saudi Arabia, the United Arab Emirates, Kuwait, and Egypt.

Resilient Offshore Investments: Offshore markets in Africa, Brazil, and Scandinavia continued to offer opportunities. This resilience in offshore markets contributes to Schlumberger's global presence.

Schlumberger's prowess in international markets, especially in the Middle East & Asia, demonstrates its capability to tap into regions with high energy demand and opportunities for growth.

Margin Expansion Through Technological Differentiation

Schlumberger's focus on delivering differentiated value through technology has been a crucial factor in its margin expansion. Specific data points include:

EBITDA Margin: Schlumberger reached a new cycle high with an EBITDA margin of 25%. This margin expansion reflects the company's ability to deliver unique and technology-driven solutions, which often command premium pricing.

Pre-tax Segment Operating Margin: The pre-tax segment operating margin expanded for the 11th consecutive quarter year-on-year. This consistent margin growth demonstrates Schlumberger's commitment to delivering value through technology and efficiency.

Schlumberger's ability to drive margin expansion through technological innovations is a clear indicator of its competitive edge in the industry.

Diverse Portfolio Across Core Segments

Schlumberger's diverse portfolio across Core, Digital, and New Energy segments is a core strength:

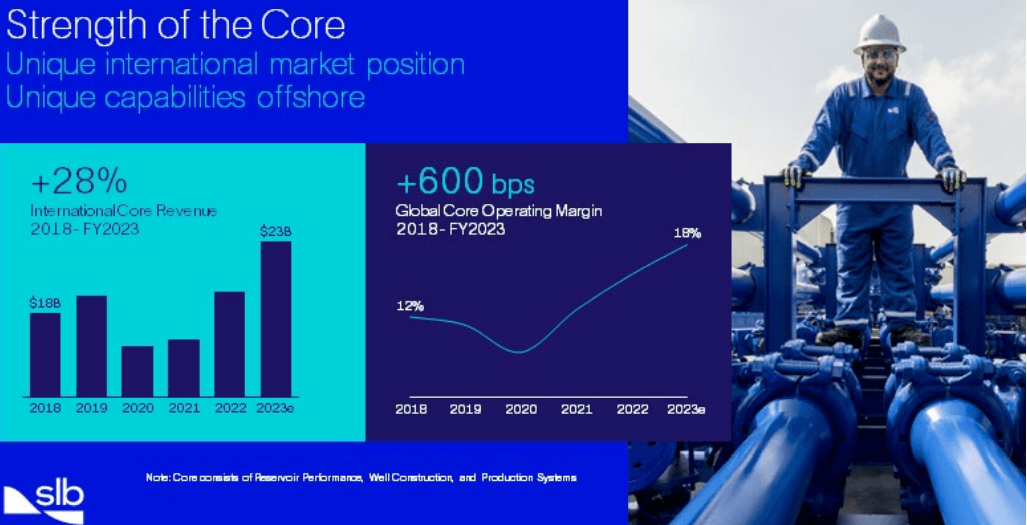

Core Business Growth: The Core business has grown by 22% year-to-date. This growth is fueled by strong performances in Reservoir Performance, Production Systems, and Well Construction.

Reservoir Performance: This segment achieved a strong performance with a 190 basis point margin improvement. The data suggests that Schlumberger's technology and capabilities within this segment are highly valued by customers.

Production Systems: Schlumberger's Production Systems segment reported the highest margin in the cycle. This was primarily led by sales of subsea, surface, and artificial lift systems, underlining the value and efficiency the company brings to the market.

Schlumberger's diversified portfolio allows it to capture various facets of the oil and gas sector, contributing to its overall value growth.

Source: SLB Barclays CEO Energy-Power Conference

Embracing Digital Transformation

Schlumberger's commitment to digital technology and data-driven solutions is instrumental in its value growth. Key data points include:

Digital Adoption: Schlumberger's digital platform Delfi experienced a 49% increase in users and an 86% increase in compute hours compared to the Q3 fiscal 2022. This data reflects strong demand for the company's digital solutions.

Autonomous Drilling Solutions: Schlumberger's customers are increasingly embracing connected and autonomous drilling solutions, with 1.9 million feet of automated drilling completed in Q3 2023, marking a 60% year-on-year increase.

Schlumberger's successful digital technology offerings and their adoption by customers demonstrate its capability to drive efficiency and reimagine workflows across the Exploration and Production (E&P) value chain.

Focus on New Energy and Sustainability

Schlumberger's commitment to addressing energy challenges and sustainability is pivotal for long-term growth. The following points highlight its dedication to these issues:

Methane Emissions: Schlumberger is actively addressing fugitive methane emissions through technology solutions. The company launched an IoT-enabled methane point instrument for continuous monitoring, improving emissions management.

Carbon Capture, Utilization, and Storage (CCUS): Schlumberger's involvement in more than 20 CCUS projects globally signifies its commitment to addressing climate change. The partnership with TDA Research highlights its investment in CCUS technology.

Schlumberger's engagement in sustainability and decarbonization aligns with the industry's changing landscape and positions the company as a leader in addressing these critical challenges.

Strategic Acquisitions and Expansion

Schlumberger's strategic acquisitions, such as the OneSubsea joint venture with Aker Solutions and Subsea7, demonstrate its commitment to expanding its offerings and footprint in the market. This positions the company to capitalize on the offshore market's long-term investments and advancements in efficiency.

Strong Liquidity and Debt Management

Schlumberger's financial discipline is underscored by its strong liquidity position and prudent debt management. The company generated substantial cash flow from operations and reduced net debt sequentially. A low net debt to trailing 12-month EBITDA leverage ratio of 1.2 indicates financial stability and sound capital management.

Focus on Shareholder Value

Schlumberger's commitment to returning value to shareholders is evident through stock buybacks and dividends, targeting $2 billion in returns to shareholders in fiscal 2023.

Specific Risks

- Energy Market Volatility: Schlumberger's performance is closely tied to the energy sector's ups and downs. Fluctuations in oil prices and energy demand can significantly impact the company's revenue and profitability. Economic, geopolitical, and environmental factors can all contribute to market volatility.

- Geopolitical Instability: Schlumberger operates in regions worldwide, including politically unstable areas. Geopolitical tensions, conflicts, and changes in government policies can disrupt operations, impact contracts, and lead to financial losses.

- Dependence on Oil and Gas Industry: Schlumberger's fortunes are closely tied to the health of the oil and gas industry. A prolonged downturn in this sector can lead to reduced exploration and drilling activities, impacting Schlumberger's revenue and profitability.

- Competition and Pricing Pressure: The oilfield services industry is highly competitive. Intense competition can lead to pricing pressure, reducing profit margins. Schlumberger must continue to innovate and provide differentiated value to maintain its competitive edge.

- Economic Downturns: Economic downturns, such as recessions or financial crises, can lead to reduced global energy consumption and, consequently, a decrease in demand for Schlumberger's services.

- Energy Transition and Decarbonization: The shift towards renewable energy sources and decarbonization initiatives may pose challenges for Schlumberger. A decrease in fossil fuel consumption could impact the demand for its traditional oilfield services.

In conclusion, Schlumberger boasts a set of specific fundamental strengths that underpin its rapid value growth potential. These strengths include strong financial performance, international expansion, margin expansion through technology, a diverse portfolio, a focus on digital transformation and sustainability, strategic acquisitions, strong liquidity, and a focus on delivering value to shareholders.

Schlumberger's ability to adapt to changing market conditions, its innovative technologies, and its commitment to sustainability and digitalization position it as a formidable force in the oilfield services industry.

The technical perspective on the weekly price moves of SLB stock can be comprehended as follows:

Source: tradingview.com