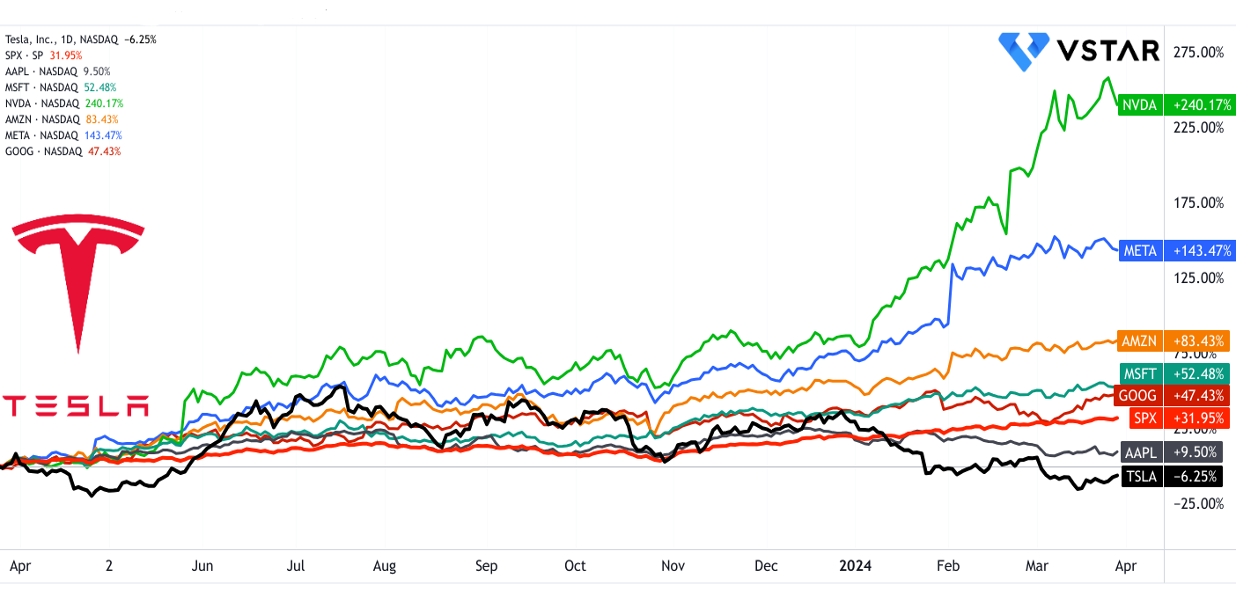

- Tesla's recent stock performance trails behind S&P500 and Magnificent 7 peers due to short-term fundamental issues, AI hype, and a high-interest rate environment.

- Tesla outperforms the market and peers in long-term price performance, with Nvidia as an exception.

- Fundamental growth drivers include robust vehicle production, energy storage deployment, financial performance, technological edge, and strategic market expansion.

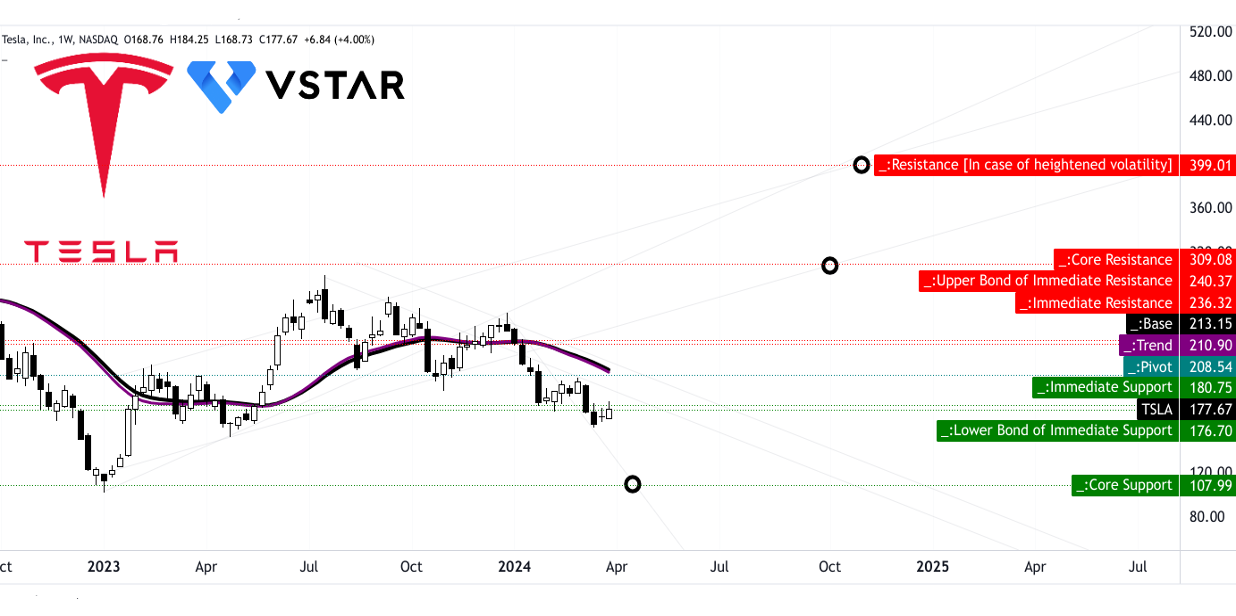

- Technical analysis suggests TSLA as a high-return opportunity in 2024.

As the electric vehicle (EV) market surges forward, Tesla stands as a progressive market leader. Yet, recent scrutiny over its stock performance against industry peers raises questions. This article navigates through Tesla's recent price performance against benchmarks and peers, explores its fundamental growth drivers spanning vehicle production to advanced technological capabilities, and assesses valuation potency.

Tesla Stock Price Performance

Over the last 12 months, Tesla’s stock has underperformed against the S&P500's and Magnificent 7 peers'. This performance was based on short-term fundamental issues, a high interest rate environment, and slowing topline and bottomline growth. The stock has delivered a negative 6% return over the year, while the S&P 500 provided a 32% price return over the same period. The stock price performance of NVDA (240%) and META (143%) is supported by AI hype and solid financial performance.

Sources: tradingview.com

However, from a long-term perspective, the stock has delivered decisive returns (near 900%) over the past 5 years. The performance is unmatched based on the massive difference in price return. The S&P 500 yielded 87%, while the rest of the Magnificent 7 peers (except NVDA) delivered a price return rating of 268%–104% over the same period.

Sources: tradingview.com

Interestingly, NVDA is outperforming TSLA only since 2024 based on rapid market interest in AI tech, with Street analysts estimating hyper performance in the upcoming years (for NVDA). Based on its long-term performance, TSLA is a must-have portfolio stock for savvy investors. It is ideal for traders too, due to its extreme price volatility.

Tesla Fundamental Growth Drivers

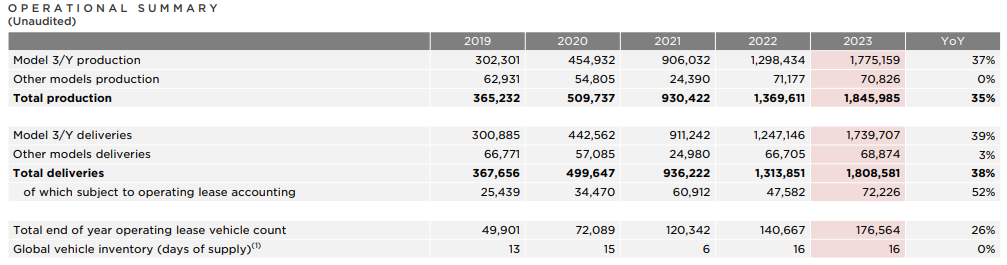

Vehicle Production and Sales Growth:

Tesla has remarkable vehicle production and sales growth. In 2023, Tesla achieved record-breaking production and deliveries, surpassing 1.8 million vehicles, including the Model 3, Model Y, and Cybertruck. The Fremont factory alone produced nearly 560,000 vehicles, marking the highest output of any automotive plant in North America. Additionally, the Model Y became the best-selling vehicle globally, with over 1.2 million units delivered. These achievements underscore Tesla's ability to scale production rapidly and meet increasing consumer demand for electric vehicles (EVs).

Source: 2023 Q4 Quarterly Update Deck

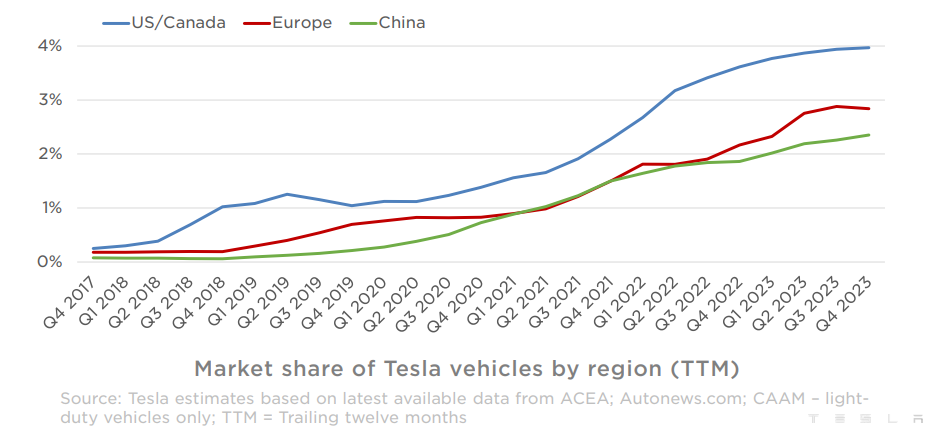

The rapid expansion of Tesla's vehicle lineup, coupled with its global market presence, positions the company for sustained growth in the automotive sector. By leveraging its manufacturing expertise and innovative technologies, Tesla continues to dominate the EV market and capture market share from traditional automakers.

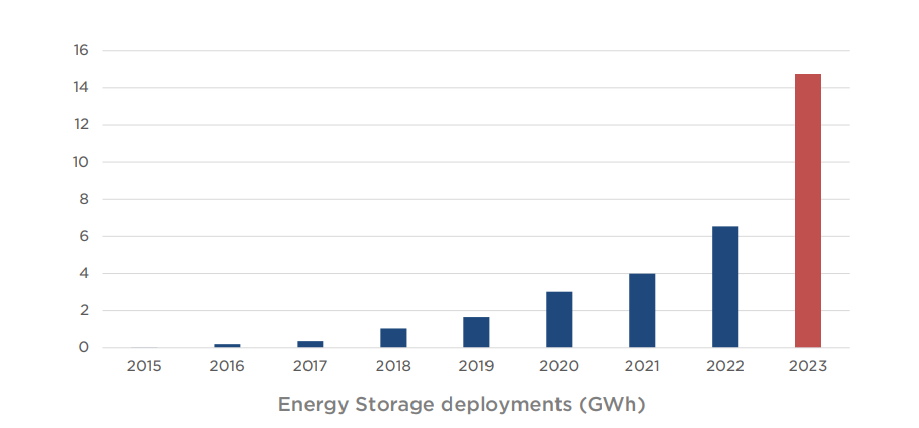

Energy Storage Deployment and Growth:

Tesla's energy storage business witnessed a significant 125% YoY growth in 2023, with deployments reaching 14.7 gigawatt-hours (GWh), more than double compared to the previous year. This triple-digit year-over-year growth highlights the increasing demand for energy storage solutions, driven by renewable energy adoption and grid modernization initiatives.

Source: 2023 Q4 Quarterly Update Deck

With the ramp-up of its Megafactory in Lathrop, California, Tesla aims to further expand its energy storage capacity and capture opportunities in the growing energy storage market. The company's focus on innovation and cost optimization in energy storage technologies positions it as a leader in the transition to a sustainable energy future.

Financial Performance and Profitability:

Tesla's strong financial performance is reflected in its robust revenue growth and profitability. In 2023, Tesla generated over $96 billion in revenue and achieved a GAAP net income of $15.0 billion, with $8.9 billion in GAAP operating income. The company's profitability underscores its ability to effectively manage costs, drive operational efficiency, and capitalize on revenue opportunities across its business segments.

Moreover, Tesla's consistent free cash flow generation, totaling $4.4 billion in 2023, demonstrates its financial resilience and capacity for investment in future growth initiatives. By maintaining a strong balance sheet and liquidity position, Tesla is well-positioned to fund its product roadmap, capacity expansion plans, and strategic investments, supporting its long-term growth objectives.

Advanced Technological Capabilities:

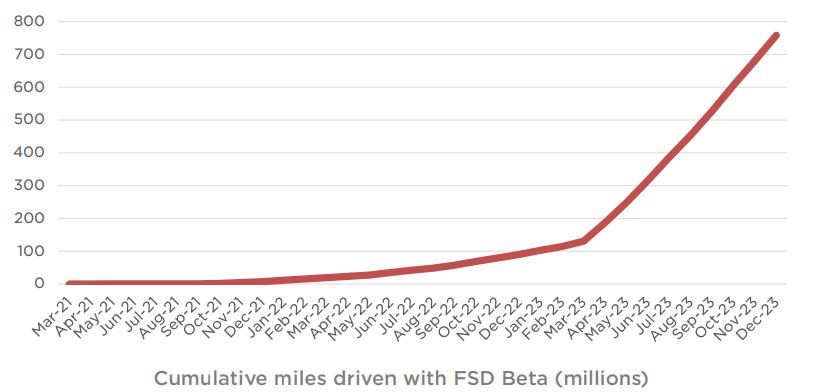

Tesla's advanced technological capabilities, particularly in artificial intelligence (AI), software development, and manufacturing, serve as key competitive advantages. The company's focus on AI-driven autonomous driving technology is evident in the development of Full Self-Driving (FSD) software, such as Version 12 (V12) of FSD Beta.

Source: 2023 Q4 Quarterly Update Deck

V12 represents a significant architectural rewrite, leveraging AI for end-to-end driving tasks, including object perception, path planning, and vehicle controls. By harnessing neural networks and real-world data, Tesla aims to achieve higher levels of autonomy and safety in its vehicles, positioning itself at the forefront of the autonomous vehicle industry.

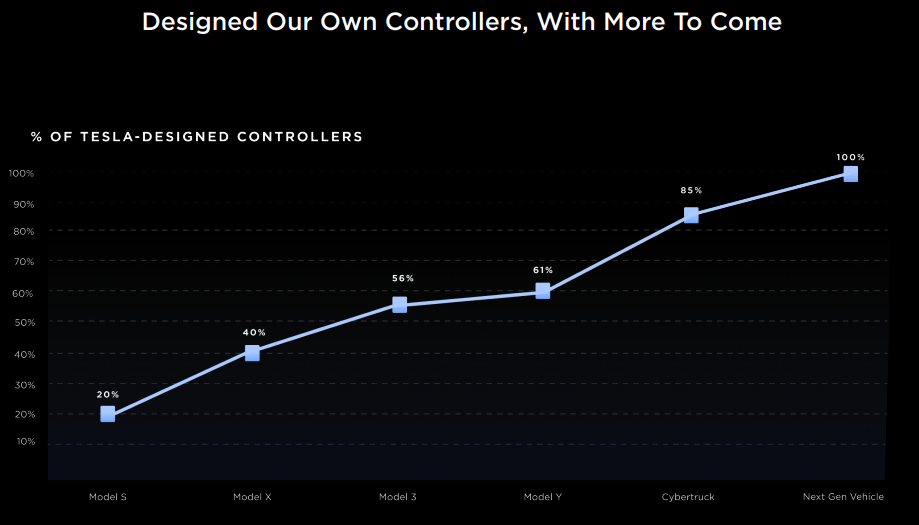

Additionally, Tesla's innovative manufacturing technologies, highlighted by its next-generation vehicle platform, demonstrate its commitment to redefining automotive production processes. The revolutionary manufacturing system, planned for deployment at Gigafactory Texas, is poised to enhance efficiency, scalability, and cost-effectiveness in vehicle manufacturing, setting new industry standards.

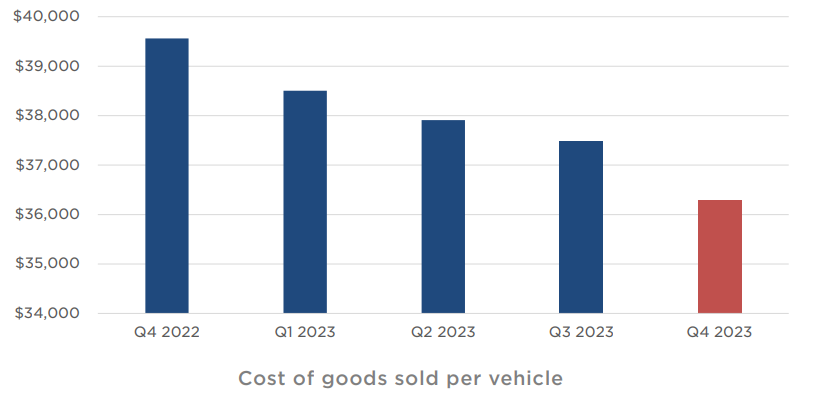

Cost Efficiency and Optimization:

Tesla's relentless pursuit of cost efficiency and optimization is evident throughout its operations, from vehicle production to energy storage deployment. The company's focus on reducing the cost of goods sold (COGS) per vehicle, which declined sequentially in Q4 (near $36K), reflects its commitment to driving down production costs and improving margins.

Source: 2023 Q4 Quarterly Update Deck

By continuously optimizing supply chain management, engineering design, and manufacturing processes, Tesla aims to achieve further cost reductions across its product portfolio. This disciplined approach to cost management enables the company to enhance competitiveness, expand market reach, and drive profitability in both automotive and energy sectors.

Innovative Product Development:

Tesla's innovative product development initiatives (like Etherloop and FleetAPI) underscore its commitment to delivering cutting-edge solutions that redefine industry standards. The introduction of the updated Model 3 with significant improvements in cabin comfort, range, and features highlights Tesla's focus on enhancing customer experience and product quality.

Moreover, Tesla's investment in next-generation vehicle platforms, such as the low-cost vehicle planned for production at Gigafactory Texas, demonstrates its forward-thinking approach to product innovation and differentiation. By leveraging advanced technologies and design principles, Tesla aims to create vehicles that not only exceed customer expectations but also revolutionize the automotive industry.

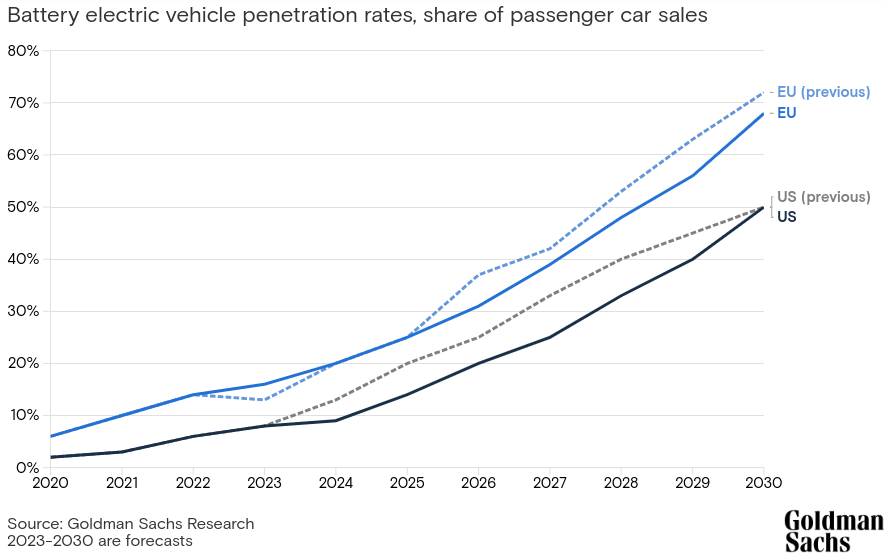

Strategic Market Expansion:

Tesla's strategic market expansion initiatives are aimed at capturing opportunities in both domestic and international markets. The company's global footprint, with manufacturing facilities in the US, China, and Europe, enables it to cater to diverse customer segments and capitalize on aggressive regional demand trends.

Source: goldmansachs.com

By prioritizing the launch of new products and services tailored to specific markets, Tesla seeks to strengthen its market position and drive sustainable growth. The establishment of manufacturing hubs, such as Gigafactory Texas and Gigafactory Shanghai, facilitates localized production and enables Tesla to mitigate supply chain risks while optimizing operational efficiency.

Source: 2023 Q4 Quarterly Update Deck

Tesla Valuation

The stock price of Tesla can be considered undervalued (on an absolute basis) as per the forward PE ratio (non-GAAP) at 58. Historically, the ratio holds a long-term (5Y) average of 117. Considering the mean revision theory, the ratio will move towards the long-term average over time. This suggests a 50% difference from the average (117). Therefore, at the current price levels ($180), the stock may deliver a 100% price return (to hit $360) to attain the long-term average. If it is assumed that the price may not reach levels over the average (117 PE), the 100% price return is still a conservative estimate.

Sources: tradingview.com

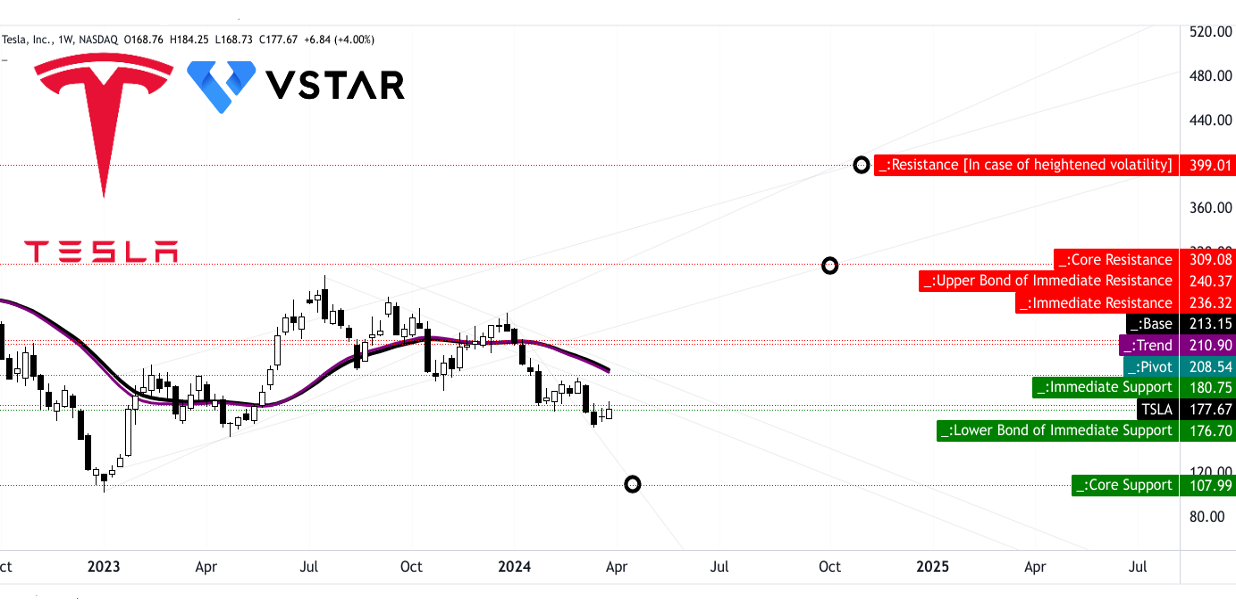

Tesla Stock Forecast Technical Take

The stock price of Tesla is near the immediate support zone, which is $180.75 to $176.70. The stock price may reach $108 in the worst-case scenario by the end of April 2024. On the upside, the price may need to breach $208.55, which serves as a current pivot, to enter a bullish trajectory.

On the course, upward, Tesla stock price needs to breach $236.30 to $240.35 to completely recover from the current bearish momentum. The range signifies the immediate resistance zone of the current horizontal price channel. On up moves, the vitality of the pivot magnified due to its current alignment with the trendline (purple line). These up moves may be relatively large due to the intensity of the resistance levels.

Critically, by the end of 2024, TSLA stock price may reach $400 based on the current momentum observed in the change of polarity. Over the course of hitting this level, the price may experience major resistance near $310 that may lead to a correction to test $240. These estimations are based on Fibonacci retracement/expansion projected forward following the recent price swings.

Sources: tradingview.com

Looking at the relative strength index (RSI) and moving average convergence divergence (MACD), the price is currently in a down trend. As observed in the MACD histogram, the downtrend is getting stabilized. However, MACD is still below the signal line, which suggests a potential conclusion of the downtrend in the coming weeks. Similarly, RSI (at 33) points out the oversold state of the stock price. However, RSI is still well below the regular bullish level of 38, along with a double bottom. This pattern reflects an emerging accumulation phase that may lead to a rapid markup phase.

Overall, the stock is currently a buy. However, if stock moves down to hit the core support, the dollar-cost averaging method can be applied to establish long positions systematically between $176 and $108.

Sources: tradingview.com

Tesla (Nasdaq: TSLA) Downsides

Product Pipeline Execution: Tesla's ambitious plans for future projects, including full self-driving technology, next-generation vehicles, and energy storage solutions, hinge on successful execution. Any delays or setbacks in product development and deployment could impede revenue growth and profitability.

Additionally, Tesla's focus on expanding its product lineup and global footprint may strain its operational capabilities and financial resources, particularly if not accompanied by commensurate efforts to streamline costs and enhance operational efficiency. The company's ambitious plans for capital expenditure in 2024, exceeding $10 billion, suggest a significant commitment to expansion and growth initiatives. However, without adequate attention to cost management and operational optimization, such aggressive expansion strategies could lead to inefficiencies and financial strain in the long run.

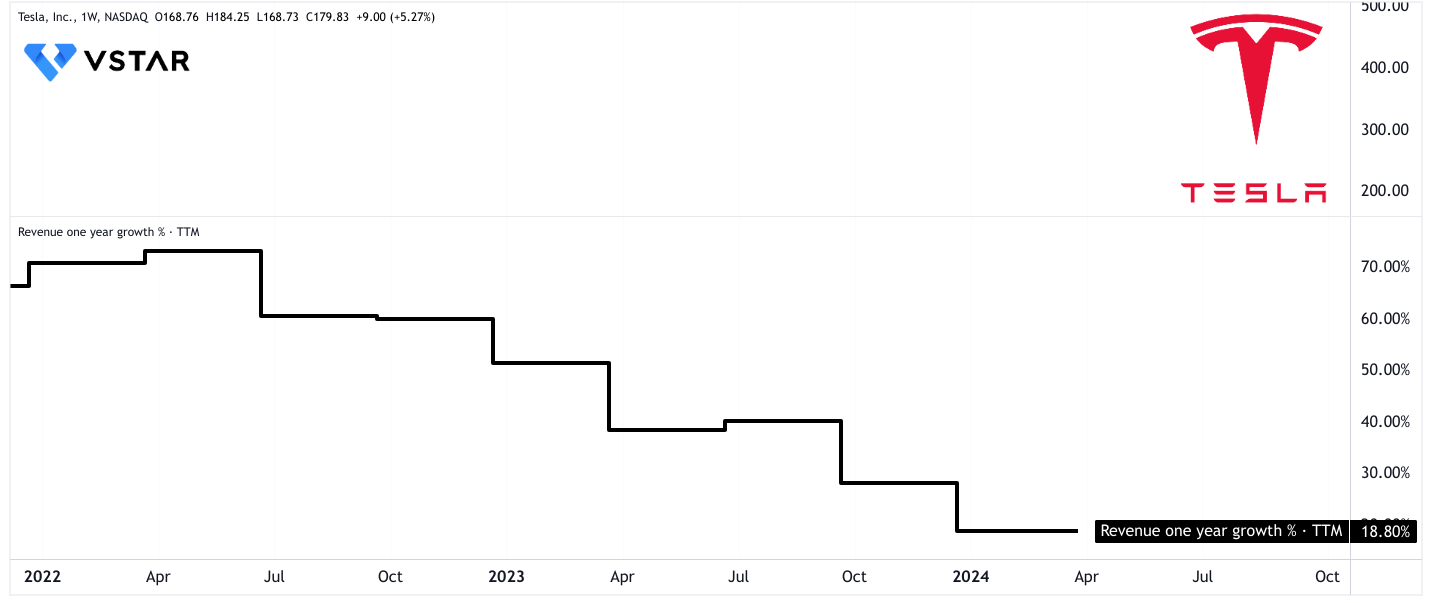

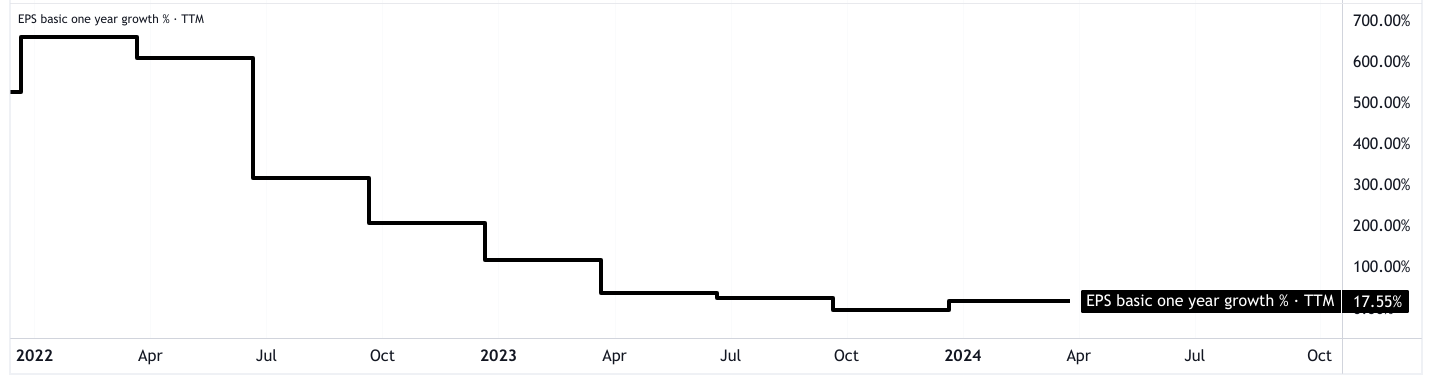

Notably, these effects are already in motion and can be observed in the deceleration in topline and bottomline YoY growth on a trailing twelve-month basis.

Sources: tradingview.com

Currently, Tesla's lead is heavily reliant on its electric vehicle segment, particularly the Model Y, which accounted for the majority of its vehicle deliveries. While EVs are gaining popularity, dependence on a single product line exposes the company to risks associated with market saturation, changing consumer preferences, and technological advancements by competitors.

Production Challenges: Tesla's ambitious production targets and rapid expansion, particularly with new vehicle models like the Cybertruck, pose significant operational challenges. The company's ability to efficiently ramp up production while maintaining quality standards will determine its success in meeting market demand and sustaining growth. Additionally, Tesla's emphasis on revolutionary manufacturing technology for Tesla's next-generation vehicle platform suggests a potential risk of overreliance on technological advancements to drive manufacturing efficiency.

Uncertain Future Growth Waves: Tesla is currently between two major growth waves, with the next wave expected to be initiated by the global expansion of the next-generation vehicle platform. However, uncertainties surrounding the timing and success of future product launches, such as the next-generation vehicle and full self-driving technology, may affect Tesla's growth trajectory in the near term. Tesla's continuous pursuit of technological innovation and product development, such as the development of FSD Beta software and the Optimus humanoid robot, may divert significant resources and attention away from optimizing existing operations and reducing production costs.

Source: Investor Day 2023 Keynote

Marco Dependency: Despite Tesla's dominance in the EV market, it remains vulnerable to shifts in consumer demand and regulatory changes. Any significant decline in EV demand or changes in government policies, such as subsidies or emissions regulations, could adversely affect Tesla's growth prospects. Moreover, Tesla's profitability is influenced by interest rates, impacting margins. Lower interest rates enable more affordable monthly payments, thus driving demand. However, the company is operating in a high-interest rate environment, affecting margins and potentially hindering growth if rates don't decrease quickly.

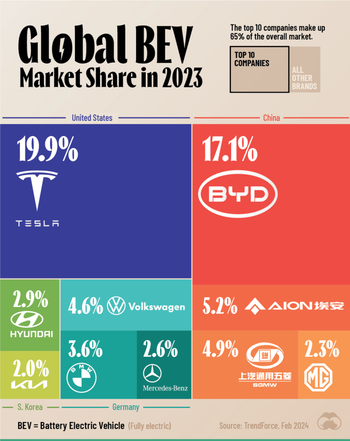

Critically, increasing competition in the electric vehicle (EV) market poses a threat to Tesla's market dominance. As other automakers enter the EV space with competitive offerings, Tesla may face pressure to maintain its market share, potentially impacting pricing strategies and margins.

Source: www.visualcapitalist.com

In short, Tesla's stock may ride on an upward trajectory soon. Technical analyses suggest stabilization amidst downward trends, potentially heralding a bullish reversal. Long-term fundamentals remain robust, signaling undervaluation and growth potential. Despite short-term hurdles, Tesla's advancements and strategic initiatives position it for a performance expansion that may drive upward stock price momentum in 2024.