- Financial Discipline: WBA demonstrates resilience with Q1 adjusted EPS of $0.66, navigating a tough retail environment.

- International Resilience: Boots UK and Germany lead global performance, emphasizing diverse market strength.

- Strategic Financial Flexibility: Bold moves include reducing dividends, monetizing assets, and addressing pension plan obligations.

- Healthcare Innovation: WBA diversifies into healthcare with strong US Healthcare growth, VillageMD success, and gene/cell therapy initiatives, positioning itself as a healthcare leader.

Walgreens Boots Alliance (WBA) demonstrating resilience and strategic maneuvering. In retail dynamics of the healthcare sector, the article delves into the company's Q1 fiscal 2024 performance, dissecting key financial strategies and market responses. From bold moves in cost reduction to forays into cutting-edge healthcare, Walgreens' moves unfolds at the intersection of adaptability and market prowess.

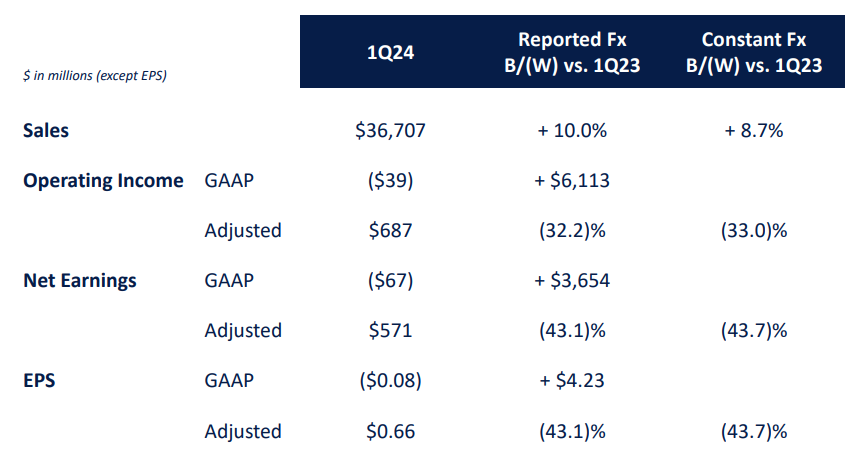

Walgreens Q1 2024 Performance

Walgreens has demonstrated a commendable level of financial discipline, particularly evident in the first quarter's adjusted earnings per share (EPS) of $0.66. This figure reflects the company's ability to navigate a challenging retail environment while maintaining profitability.

Source: Earning Presentation

A pivotal aspect of Walgreens' financial strategy is its focus on cost reduction. The planned reduction of approximately 20% in the headquarters' support office workforce is a bold move aimed at streamlining operations and improving efficiency. The company is on track to achieve $1 billion in cost savings this year, a significant milestone that indicates management's proactive approach to financial management.

Additionally, Walgreens' focus on capital expenditure (CapEx) management is noteworthy. The first-quarter CapEx being over $100 million lower year-over-year and an expected $600 million reduction for the full year demonstrate prudent financial decision-making. The reduction in CapEx not only contributes to immediate cost savings but also aligns with a strategic prioritization of customer-facing activities.

Finally, The focus on delivering $500 million in working capital benefits in fiscal 2024 further illustrates Walgreens' financial acumen. Working capital optimization is crucial for enhancing liquidity and supporting ongoing operations.

Walgreens International Performance

While facing challenges in the U.S., Walgreens Boots Alliance's international segment has emerged as a source of strength. The first-quarter results highlight the robust performance of Boots UK and Germany, underlining the company's global resilience.

Notably, Boots UK's solid 6.2% sales growth is a testament to the brand's strength in the UK market. The growth across all categories, particularly in beauty and health and wellness, reflects consumer trust and demand for Boots' products and services.

On the other hand, Germany's wholesale segment contributing to a 3.7% sales growth emphasizes the diversified geographical presence of Walgreens. The positive performance in Germany signifies the company's ability to navigate diverse market conditions and adapt to local dynamics.

Moreover, the inclusion of VillageMD's sales growth in the international segment further diversifies the revenue streams. VillageMD's 14% sales increase on a pro forma basis indicates positive momentum in the U.S. Healthcare segment, contributing to the overall international performance.

Conclusion:

Overall, Walgreens' international segment has proven to be a stronghold, with Boots UK and Germany leading the way. The company's ability to adapt and thrive in different markets, coupled with the positive contribution from healthcare initiatives, indicates a well-rounded international strategy.

Walgreens Strategic Actions for Financial Flexibility

Financial flexibility is a cornerstone of Walgreens' strategy, and the company has undertaken strategic actions to fortify its balance sheet and enhance cash position. The decision to reduce the quarterly dividend payment, monetize Cencora stake, and secure the Boots pension plan exemplifies a proactive approach to financial management.

Notably, the 48% reduction in the quarterly dividend payment to $0.25 per share starting in March is a bold move aimed at freeing up capital. This decision reflects a focus on investing in driving sustainable growth in the pharmacy and healthcare businesses, as well as paying down debt.

Monetization of Assets:

Also, the monetization of an additional portion of the Cencora stake, yielding nearly $700 million, is a strategic move to generate immediate liquidity. This decision aligns with Walgreens' focus on financial flexibility and ensures the company is well-positioned to capitalize on growth opportunities.

Furthermore, the full buy-in for the Boots pension plan with Legal and General demonstrates a focus on fulfilling obligations and ensuring the well-being of plan members. The buyout scheduled for calendar 2025 will eliminate the company's plan obligations and commitments, providing long-term financial relief.

Overall, Walgreens' strategic actions for financial flexibility indicate a balanced approach to managing cash flow, investing in growth, and addressing long-term liabilities. The reduction in dividends, monetization of assets, and pension plan actions collectively contribute to a strengthened financial position.

Walgreens Healthcare Strategy and Diversification

The healthcare sector is a focal point of Walgreens' growth strategy, and the company has taken strategic steps to diversify its healthcare offerings. The notable increase in US Healthcare segment sales, VillageMD's performance, and the growth at Shields suggest the lead of this approach.

Additionally, VillageMD's sales increase of 14% on a pro forma basis is a significant achievement. The growth in full-risk lives, improved clinic performance, and increased productivity demonstrate the positive impact of VillageMD's integration into the Walgreens healthcare ecosystem.

Fundamentally, Shields' solid 27% sales increase in the first quarter, driven by growth at existing customers and new partner contract signings, highlights the lead of Walgreens' specialty pharmacy assets. The focus on accelerating hospital-owned specialty pharmacy programs positions Shields as a key player in a rapidly growing market.

On the other hand, Walgreens' foray into gene and cell therapy reflects a forward-looking approach to healthcare. With the FDA anticipating approval of more than 20 gene and cell therapies by 2025, Walgreens' initiatives in this space align with the evolving landscape of healthcare. This positions the company as a player in cutting-edge therapeutic solutions for patients with rare conditions.

In short, Walgreens' healthcare strategy is characterized by diversification, innovation, and a focus on staying at the forefront of healthcare trends. The positive performance of VillageMD, Shields, and the focus on gene and cell therapy initiatives suggest the company's potential to become a key player in the evolving healthcare landscape.

Walgreens Innovation and Strategic Partnerships

Innovation is a key driver of growth for Walgreens, and the company's emphasis on clinical trials, strategic partnerships, and specialty pharmacy assets reflects its focus on staying ahead of industry trends. The partnership with pharma companies and the emphasis on clinical trials indicate Walgreens' innovative approach to patient engagement. By leveraging its community presence and patient engagement, the company is actively contributing to greater patient diversity in clinical research.

Furthermore, Shields' consistent strong performance, with sales up 27% in the first quarter, signifies the lead of the company's strategic focus on serving hospital systems. The growth at existing customers and new partner contract signings demonstrate the effectiveness of Walgreens' partnerships in the specialty pharmacy space.

Additionally, Walgreens' exploration of gene and cell therapy initiatives positions the company at the forefront of cutting-edge healthcare solutions. With the FDA anticipating the approval of numerous therapies in this space, Walgreens' initiatives reflect a forward-looking approach to meeting evolving patient needs.

Overall, Walgreens' focus on innovation and strategic partnerships is evident in its focus on clinical trials, strong performance in specialty pharmacy, and initiatives in gene and cell therapy. These endeavors position the company as a leader in embracing new healthcare technologies and solutions.

Walgreens Adaptability and Market Responsiveness

Walgreens' adaptability to market conditions and responsiveness to changing consumer behavior are key factors in its ability to thrive in a challenging retail environment. Despite challenges, the growth of 6.4% in US Retail Pharmacy sales suggests Walgreens' adaptability and resilience. This growth is indicative of the company's ability to meet consumer needs and maintain a strong presence in the competitive retail pharmacy sector.

Additionally, the emphasis on pharmacy services, with a 13.1% increase in comp pharmacy sales, reflects market responsiveness to evolving healthcare trends. By aligning with the demand for essential health services, Walgreens positions itself as a trusted provider in the changing landscape of healthcare.

Overall, Walgreens' adaptability to macroeconomic conditions and its focus on essential services, particularly in pharmacy, demonstrate a market-responsive approach. The ability to navigate challenges in the retail sector and maintain growth in pharmacy services highlights the company's resilience and strategic acumen.

WBA Stock Technical Take

The stock price of Walgreens Boot Alliance is experiencing a long-term downtrend, as observed in the alignment of 156-week (red line) and 52-week (green line) exponential moving averages (EMAs).

However, for long-term investors, Walgreens stock price is hovering at a multi-decade support level. To be specific, the stock can be accumulated at $22, $18, and $13 using the dollar average method, as these levels serve as critical support levels for the current trend. These levels are driven by Fibonacci retracement and the current momentum.

At the current price level, Walgreens stock is offering a dividend yield of 8.40%, now 4.30%, after dividend reduction, which provides an opportunity to earn a solid long-term dividend that may act as decisive passive income with growth potential. Apart from that, rapid capital appreciation during the accumulation and markup phases of the stock price can also be considered an added advantage (from the holding period return perspective).

Finally, 52-week and 156-week EMAs may serve as critical navigators for the trend during the year. Here, the 52-week EMA serves as dynamic resistance. Similarly, in the case of heightened volatility, the 156-week EMA may act as resistance for the prices on the upside.

Source: tradingview.com

Specific Downsides and Risks

There is a concerning trend in Walgreens Boots Alliance's U.S. Retail business with a notable 5% decline in comparable sales during the first quarter. This decline is attributed to various factors, including a weaker respiratory season, reduced discretionary spending by customers, and a deliberate decision to close stores on Thanksgiving. Furthermore, the retail gross margin was negatively impacted by a significant 110 basis points due to higher shrink.

Fundamentally, the trend of declining retail sales is a red flag for Walgreens, indicating challenges in adapting to evolving market dynamics. The weaker respiratory season had a substantial impact, causing a 160 basis points decline in the health and wellness category, which, in turn, affected prescription sales—a critical driver for the pharmacy business. Additionally, reduced discretionary spending and actively seeking promotional opportunities resulted in a 90 basis points impact from weaker holiday seasonal sales. The decision to close stores on Thanksgiving, while a commendable move to support store team members, presented a headwind of about 60 basis points.

Additionally, the first-quarter adjusted EPS of $0.66 reflects a substantial 44% decline on a constant currency basis. This decline is primarily attributed to lower U.S. retail sales and a 21 percentage point headwind from a higher adjusted effective tax rate. Despite the continued strong performance in the international and U.S. Healthcare segments, the core weakness in retail has significantly impacted overall earnings.

To be specific, the trend in adjusted EPS provides insights into the direct correlation between the challenges in the U.S. retail segment and the financial performance of Walgreens. The decline in adjusted EPS emphasizes the vulnerability of the company to the headwinds faced by its retail operations. While international and healthcare segments contribute positively, the core weakness in the U.S. Retail business poses a substantial risk to the overall financial health of the company.

In conclusion, while Walgreens Boots Alliance demonstrates strategic resilience, it's essential to note the stock's long-term downtrend. Investors should carefully consider critical support levels at $22, $18, and $13. Despite a reduced dividend, the current 4.30% yield may attract income-seeking investors. However, the declining retail sales trend, particularly in the U.S., poses a risk. Walgreens' stock performance depends on its ability to address challenges, adapt to market dynamics, and capitalize on growth opportunities, making it crucial for investors to monitor the evolving situation closely.