Trading AUDUSD CFD with $50

Key Data

Previous Close

0.643

Open

0.64248

Day’s Range

0.64095-0.64493

Contracts specifications

Contract Size

100000

Leverage

50x- 200x

Minimum Volume per Trade

100

Trading Hours

OFF

Company Profile

The AUD/USD cross represents the exchange rate between the Australian Dollar (AUD) and the United States Dollar (USD). This pair is one of the most important currency pairs in the forex market and is influenced by various economic, political and market factors. Here's a detailed introduction to the AUD/USD pair:

AUD/USD currency pair:

1. Currency codes:

- AUD (Australian Dollar): The official currency of Australia and its territories.

- USD (United States Dollar): The official currency of the United States and its territories.

2. Exchange Rate:

- The AUD/USD exchange rate indicates the amount of United States Dollars required to buy one Australian Dollar. For example, if the exchange rate is 0.75, it means that 1 AUD is equal to 0.75 USD.

3. Economic fundamentals:

- Interest Rates: Interest rate differentials between Australia and the United States affect the AUD/USD exchange rate. Changes in monetary policy by the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed) can affect the appeal of the Australian dollar.

- Economic Indicators: GDP growth, inflation rates and employment data in both Australia and the United States play a crucial role. The economic performance of one region relative to the other can influence the direction of the AUD/USD pair.

4. Market Dynamics:

- Liquidity: The AUD/USD is highly liquid, making it one of the most traded currency pairs in the forex market.

- Volatility: The AUD/USD may experience significant volatility, especially around economic releases, geopolitical events, or changes in market sentiment.

5. Commodity Prices:

- Commodity Dependence: Australia is a significant exporter of commodities, particularly mining and agriculture. Changes in commodity prices, such as iron ore and gold, can affect the Australian dollar and therefore the AUD/USD pair.

6. Technical Analysis:

- Trend Analysis: Traders use technical indicators, chart patterns and trendlines to identify trends in the AUD/USD pair.

- Support and Resistance Levels: Key price levels where the currency pair tends to stop and reverse are closely monitored for potential trading signals.

7. Other considerations:

- Global risk sentiment: Changes in global risk sentiment can influence the AUD/USD pair, as the Australian dollar is often considered a risk currency.

- U.S. Dollar Dynamics: Developments in the U.S. economy and monetary policy can have a significant impact on the USD side of the pair.

In summary, the AUD/USD is influenced by a combination of economic fundamentals, interest rate differentials, commodity prices, market dynamics, and factors specific to Australia and the United States. Traders and investors use a variety of tools, including both fundamental and technical analysis, to navigate the unique characteristics of this currency pair in the dynamic forex market.

Explore More Market Insights

AUDUSD Bears Look for More Fuel From the US Dollar DominanceTuesday was the second day the Australian dollar (AUD) has gained ground against the US dollar (USD), rising from 0.6131, the lowest point since April 2020. As the AUD benefited from strong commodity prices, the AUDUSD pair gained momentum.Read article

AUDUSD Bears Look for More Fuel From the US Dollar DominanceTuesday was the second day the Australian dollar (AUD) has gained ground against the US dollar (USD), rising from 0.6131, the lowest point since April 2020. As the AUD benefited from strong commodity prices, the AUDUSD pair gained momentum.Read article AUDUSD Bulls Remain Steady After The Hawkish RBAThe recent RBA decision and the price action in the technical chart show potential buying pressure in the AUDUSD price.Read article

AUDUSD Bulls Remain Steady After The Hawkish RBAThe recent RBA decision and the price action in the technical chart show potential buying pressure in the AUDUSD price.Read article AUDUSD Bulls Could Resume From A Valid Rectangle Pattern BreakoutThe AUDUSD maintains the buying pressure in the intraday chart, initially driven by May's hotter Australian CPI data.Read article

AUDUSD Bulls Could Resume From A Valid Rectangle Pattern BreakoutThe AUDUSD maintains the buying pressure in the intraday chart, initially driven by May's hotter Australian CPI data.Read article AUDUSD Awaits A Volatility From Multiple High Impact ReleasesAfter being dissatisfied with the Reserve Bank of Australia's (RBA) choice to adopt a neutral position, Australian traders will now redirect their attention towards the country's employment report and the wage price index this week.Read article

AUDUSD Awaits A Volatility From Multiple High Impact ReleasesAfter being dissatisfied with the Reserve Bank of Australia's (RBA) choice to adopt a neutral position, Australian traders will now redirect their attention towards the country's employment report and the wage price index this week.Read articleTrading Signals

is Pivot(0.6395)

Trade Strategylong positions above 0.6395 with targets at 0.6450 & 0.6470 in extension.

Alternative Strategybelow 0.6395 look for further downside with 0.6370 & 0.6350 as targets.

Commentsintraday technical indicators are mixed and call for caution.

supports and Resistances

0.6395

0.6370

0.6350

0.6411 (Last)

0.6450

0.6470

0.6490

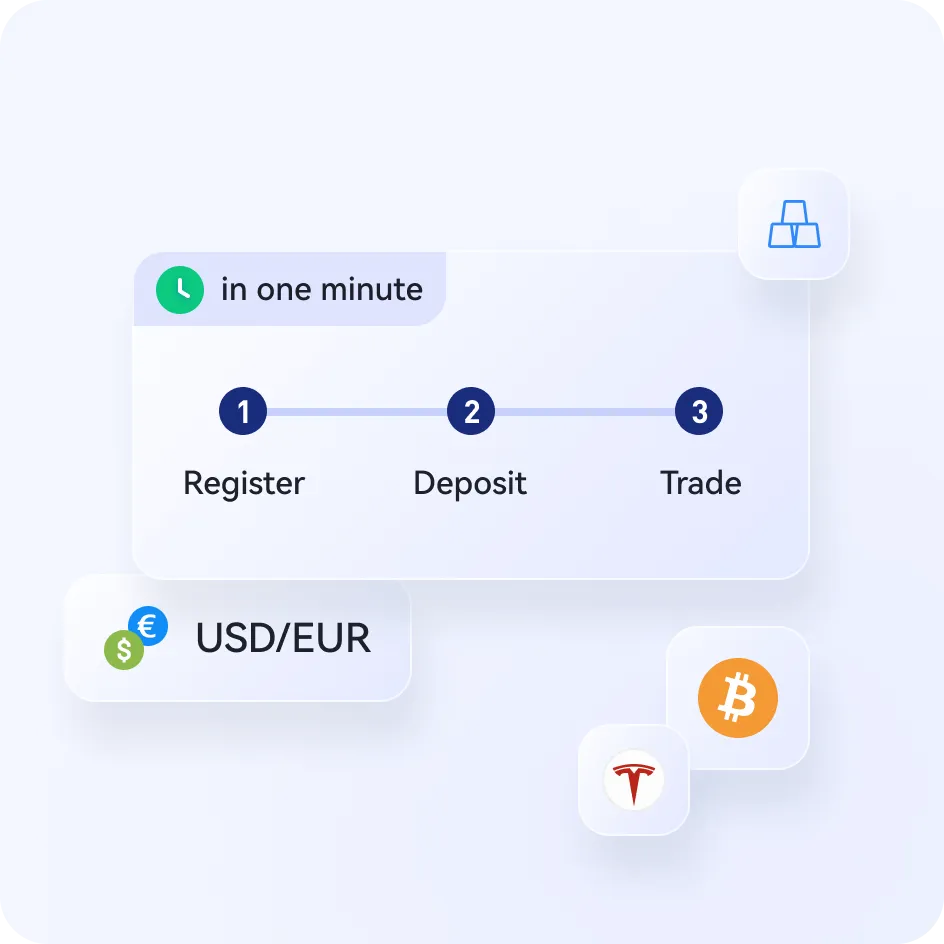

Trade AUDUSD CFDs with VSTAR

- Ultra-low trading cost with tight spreads and 0 commission

- Top-tier deep liquidity to ensure extremely low slippage.

- Lighting-fast order execution within milliseconds

- Fully regulated with several licenses, trusted across 100+ national borders.