The recent news of AVGO stock's steady decline may not be very encouraging for investors, but this blue-chip stock is by no means a lost cause for prospective investors, as Broadcom stock is strategically poised for a rebound in the near future.

Broadcom's stock (NASDAQ: AVGO) is still a very promising semiconductor stock for so many appealing reasons. The technology giant is working underground to acquire a major cloud services company called VMware and is hinging towards a $ 61 billion purchase, which undoubtedly indicates a resounding commitment to growth. That said, Broadcom stock is still guaranteed to be rewarding despite the tough economic conditions, based on recent developments. For more insight, dive deeper.

Recent Broadcom News

- AVGO Q2 earnings outperformed expectations: In their recently announced Q2 results, Broadcom earnings per share stood at $10.32, against an estimated $10.08. Moreover, Broadcom's overall revenue stood at $8,915 million versus the predicted $7,706 million, indicating a year-over-year growth of 15.7%.

This strong performance was hugely due to the high demand for its semiconductor products and data center chips.

- Broadcom Recently Raised Acquisition Financing Fund: Broadcom Inc. recently successfully raised $28.4 billion in new debt financing as a substitute for a shorter-term loan, this fund is primarily to fund the acquisition of VMware, a leading multi-cloud services provider.

This strategic move will see Broadcom Inc. further establish itself in the cloud computing market rivaling giant software companies like Microsoft, IBM, and Google.

Overview of Broadcom Inc. (NASDAQ: AVGO)

Source: Istock Photo

What is Broadcom

Broadcom Inc. is a global tech company founded in 1991 by Henry Nicholas and Henry Samueli. The software solutions company has witnessed several acquisitions and mergers across the years while experiencing relative growth and expansion which therefore also caused several name changes. In 2016, a chip maker, firm Avago Technologies Ltd, acquired Broadcom Corp, the reason behind the inherited ticker symbol AVGO.

Headquartered in San Jose, California, Broadcom is a global technology company that is involved in designing, developing, manufacturing, and supplying semiconductor and infrastructure software products ranging from storage and systems, mainframe and enterprise software, and wireless and optical products among others. The company's products are used in a wide variety of applications, including data center, networking, wireless, storage, and industrial.

The Broadcom Software giant is a major player in two segments: Semiconductor Solutions and Infrastructure Software.

Broadcom's Top 5 Shareholders

Broadcom Inc's stock is majorly held by Institutional investors and a few individual investors. The Institutional investors constitute over 85% of its shareholders, with the top five (5) investors being:

|

Shareholder |

Stake |

|

The Vanguard Group |

9.82% |

|

Blackrock Inc |

7.68% |

|

Capital World Investors |

6.74% |

|

Capital Internation Investors |

5.55% |

|

Capital Research Global Investors |

4.65% |

Key Milestones in Broadcom Inc. Journey

1991: Founded by Henry Nicholas and Henry Samueli.

1998: Acquired NetLogic Microsystems.

2000: Acquired LSI Logic, expanding its semiconductor portfolio.

2006: Acquired SiGe Semiconductor, enhancing its capabilities in wireless and networking technologies.

2010: Acquired Emulex, strengthening its position in network connectivity solutions.

2015: Broadcom changes its ticker symbol to AVGO

2016: Broadcom acquires Brocade Communications Systems for $5.9 billion.

2018: Broadcom acquires CA Technologies for $18.9 billion.

2020: Broadcom acquires SAS Institute for $14 billion.

Broadcom Inc's Business Model

Broadcom's revenue stream is driven by selling semiconductor products and software solutions to a vast diversity of customers, including original equipment manufacturers (OEMs), value-added resellers (VARs), and end-users. The company's products are used in a variety of industries, including networking, broadband, storage, wireless communications, and industrial.

Source: Istock Photo

How Broadcom Inc. Makes Money

Broadcom generates revenue from two major business segments.

Semiconductor Products:

Broadcom designs, manufactures, and sells a wide range of semiconductor products. These products include essential components such as processors, controllers, switches, and other integrated circuits used in various electronic devices.

Software Solutions:

Apart from semiconductors, Broadcom also offers software solutions to enhance various aspects of technology systems. These include networking software, storage software, and security software. These solutions contribute to optimizing performance, increasing security, and streamlining operations in different industries.

Broadcom's Main Products and Services

Broadcom's main offerings are different categories of products some of which are:

Data Center Networking and Storage Products: These encompass switches, routers, adapters, and related components that play a crucial role in data center operations.

Enterprise and Mainframe Software: Automation, monitoring, and security solutions designed to enhance enterprise networks and mainframes.

Smartphone Components: Key components like processors and modems utilized in smartphones.

Telecom and Factory Automation Products: Devices catering to telecommunications networks and factory automation systems.

An Inside Look at Broadcom Inc. Financials

Source: Istock Photo

Broadcom's Financial Performance in Focus

Market Capitalization:

As of August 18, 2023, Broadcom Inc. is valued at an impressive market capitalization of $343.8 billion, positioning it as the 100th largest global company based on market capitalization.

Broadcom Net Income

Broadcom Inc's Q3 Net Income $3.303 billion increasing from $3.074 billion in 2022 reflecting an increase of over $220 million and over 7% growth from the prior year. The Q2 2023 earnings report, the company's net income amounted to $2.59 billion for the quarter, equaling $5.93 per diluted share. This showcases a notable year-over-year surge of 73.8% compared to the prior year's net income of $1.51 billion, or $3.33 per diluted share, for the corresponding quarter.

This remarkable boost in net income can be attributed primarily to the rise in revenue, along with enhanced gross margins and operating margins.

AVGO Earnings

AVGO's 2023 Q3 reports highlights earnings of $10.54 per share surpassing estimates by 1.15% and improving 8.3% year over year. Net revenues increased 4.9% year over year to $8.88 billion.

Broadcom Inc. continues to demonstrate its financial prowess, with a trailing twelve months (TTM) revenue of $35.45 billion, showcasing its substantial presence in the technology and semiconductor industry. On a per-share basis, the Broadcom revenue stands at an impressive $85.59. Moreover, Broadcom has sustained consistent growth, reporting a 4.90% year-over-year increase in quarterly revenue.

AVGO Profit Margins

For fiscal year 2023, the company's profit margin stood at an impressive 39.86% signaling a year-over-year increase of 24.72%. This translates to generating $39.86 in profit for every $100 in revenue.

Broadcom Inc. is thriving with impressive net profit margins, with a gross profit margin of 75.1% of revenue in the third quarter, in line with estimates. Operating income for the quarter was $5.5 billion, up 6% year over year, with an operating margin of 62% of revenue. Net income increased to $3.3 billion from $3 billion.

AVGO Return on Equity (ROE)

As an indication of its solid performance, Broadcom Inc.'s return on equity (ROE) for fiscal year 2023 now stands at 64.7%. This signifies that for every $100 invested by shareholders, an impressive return of $64.7 in profit was realized based on their recent Q3 earnings report.

AVGO Balance Sheet Strength

As of July 30, 2023, the company held $12.06 billion in cash and cash equivalents, marking an increase from $11.55 billion reported as of April 30, 2023.

The total debt, which includes a current portion of $1.12 billion, stood at $39.34 billion as of July 30, 2023.

AVGO Cash Flow

Broadcom achieved a cash flow from operations of $4.719 billion in the most recent quarter, a rise from the $4.502 billion recorded in the previous quarter. Additionally, the company generated free cash flow of $4.60 billion during the quarter, up from $4.38 billion in the previous quarter.

On June 30, 2023, the company distributed a cash dividend of $4.60 per share for common stock, totaling $1.901 billion. During the fiscal third quarter, Broadcom allocated $2.167 billion toward share repurchases and eliminations.

AVGO's Financial Metrics Comparison

|

Metric |

AVGO |

Peer Average |

Industry Average |

|

P/E Ratio |

15.3 |

19.1 |

19.0 |

|

P/S Ratio |

9.7 |

10.3 |

10.2 |

|

P/B Ratio |

8.5 |

6.7 |

6.5 |

|

EV/EBITDA |

18.2 |

17.4 |

17.2 |

As you can see, Broadcom's valuation multiples are all slightly below its peers and the industry average. This suggests that the stock is fairly valued, or perhaps even undervalued.

Broadcom Stock Price Performance Analysis

Broadcom Stock Trading Information

Broadcom's primary exchange is the Nasdaq Stock Exchange, and its ticker symbol is AVGO. With its IPO debut on July 18, 1998, the company is headquartered in the United States and has its stock traded in US dollars.

You can begin trading AVGO stock between the regular hours of 9:30 AM and 4:00 PM ET. But one can also leverage the Pre-market trading hours which begins at 4:00 AM ET and after-market trading lasts till 8:00 PM ET. On average, 10.5 million shares of AVGO stock are traded each day which means it's a popular stock and there is a lot of trading activity involved.

Broadcom's Stock Split History

Since its IPO, Broadcom (AVGO) has split its stock 3 times. The first split was a 2-for-1 split in March 1999, the second split was a 3-for-2 split in June 2000, and the third split was a 2-for-1 split in June 2006. The last time Broadcom split its stock was in June 2006. However, all these happened before Avago acquired Broadcom and adopted the name in 2015, and has never witnessed a stock split since then.

AVGO Dividend

Since 2010, Broadcom has consistently paid quarterly dividends to its shareholders. The most recent quarterly Broadcom stock dividend was $4.6 per share, which was paid on June 21, 2023, with an annual payout of $17.9 per share. This represents a Broadcom dividend yield of 2.17%. Compared to the industry average and the Tech sector average of 1.76%, AVGO stock dividend is 23% higher on a relative basis.

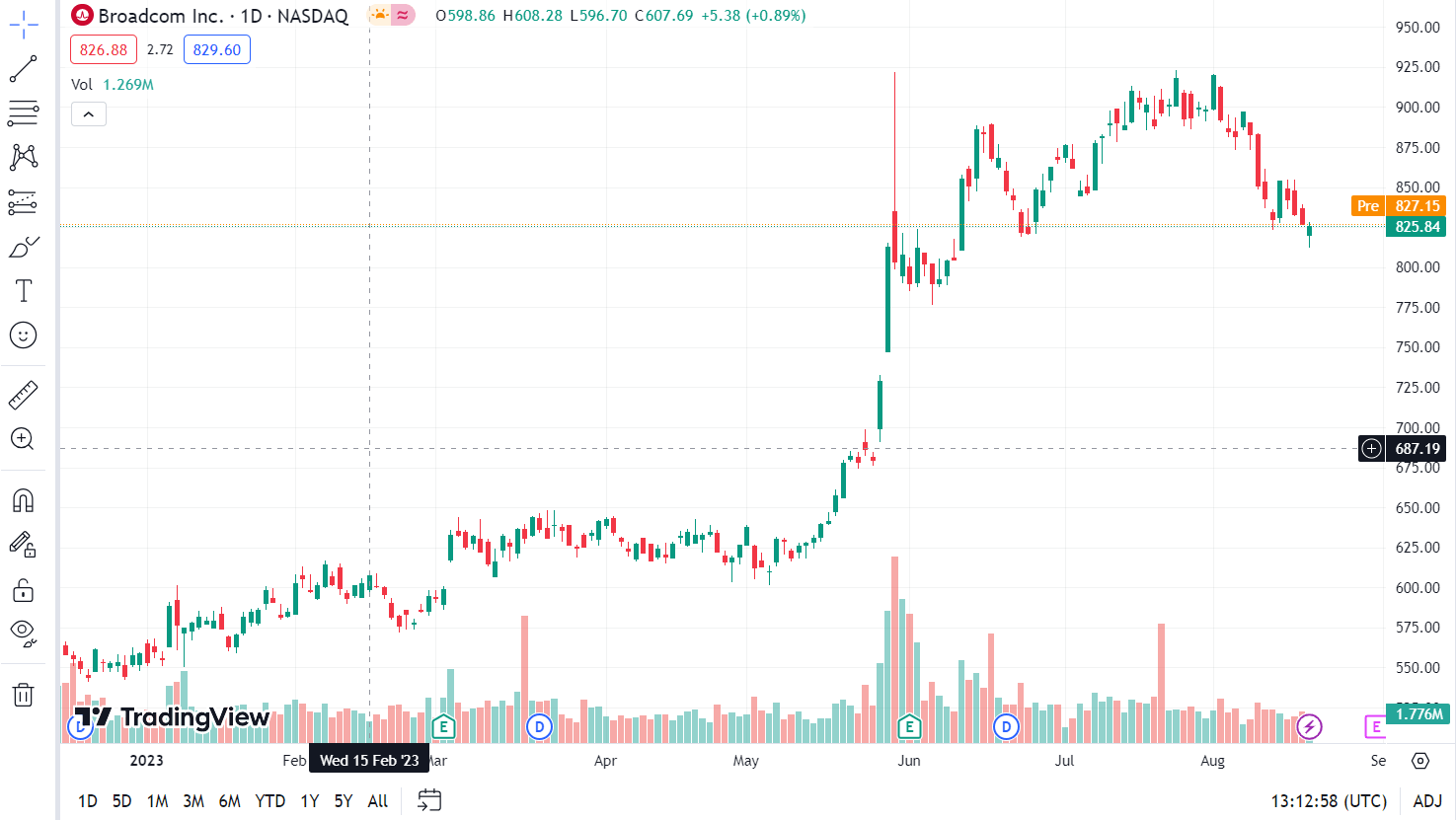

AVGO Stock Performance

Although AVGO stock price has been down by -8.59%, it has actually been rising when taking a bird's view the stock has actually been strong over the course of a year (52 weeks) at a rate of 47.88%. Gaining an all-year high of $923.18 and a 52 week low of $415.07, the stock remains a force to be reckoned with at the current Broadcom share price of $825.84 in the market as can be seen below.

AVGO stock price has been volatile in the past year. The stock price volatility is around 30.3%, which is considered to be high. This indicates that the stock price is prone to sudden swings in either direction, which is due to the headwinds that the global economy is currently facing.

Key Drivers of AVGO Stock Price

As can be seen from the previous sections, Broadcom stock price is influenced by several key factors. Notably, its revenue growth trajectory plays an important role. The company has experienced consistent revenue expansion in recent years and is expected to keep this momentum going. Additionally, AVGO's profitability supports its stock performance as the company exhibits superior operating profitability and return on investment.

Research is also key. Although currently trading at a reasonable price, the stock may be undervalued if the earnings and profit spread continue. Investor sentiment also affects AVGO's share price equally - optimistic investor optimism tends to drive up prices, while pessimism tends to drive prices lower. Macroeconomic factors, including interest rates and inflation, are heavily influenced. Higher interest rates are likely to raise borrowing costs and affect profitability, while a slowdown in economic growth could reduce demand for AVGO's products, which in turn affects its profitability.

AVGO Stock Forecast

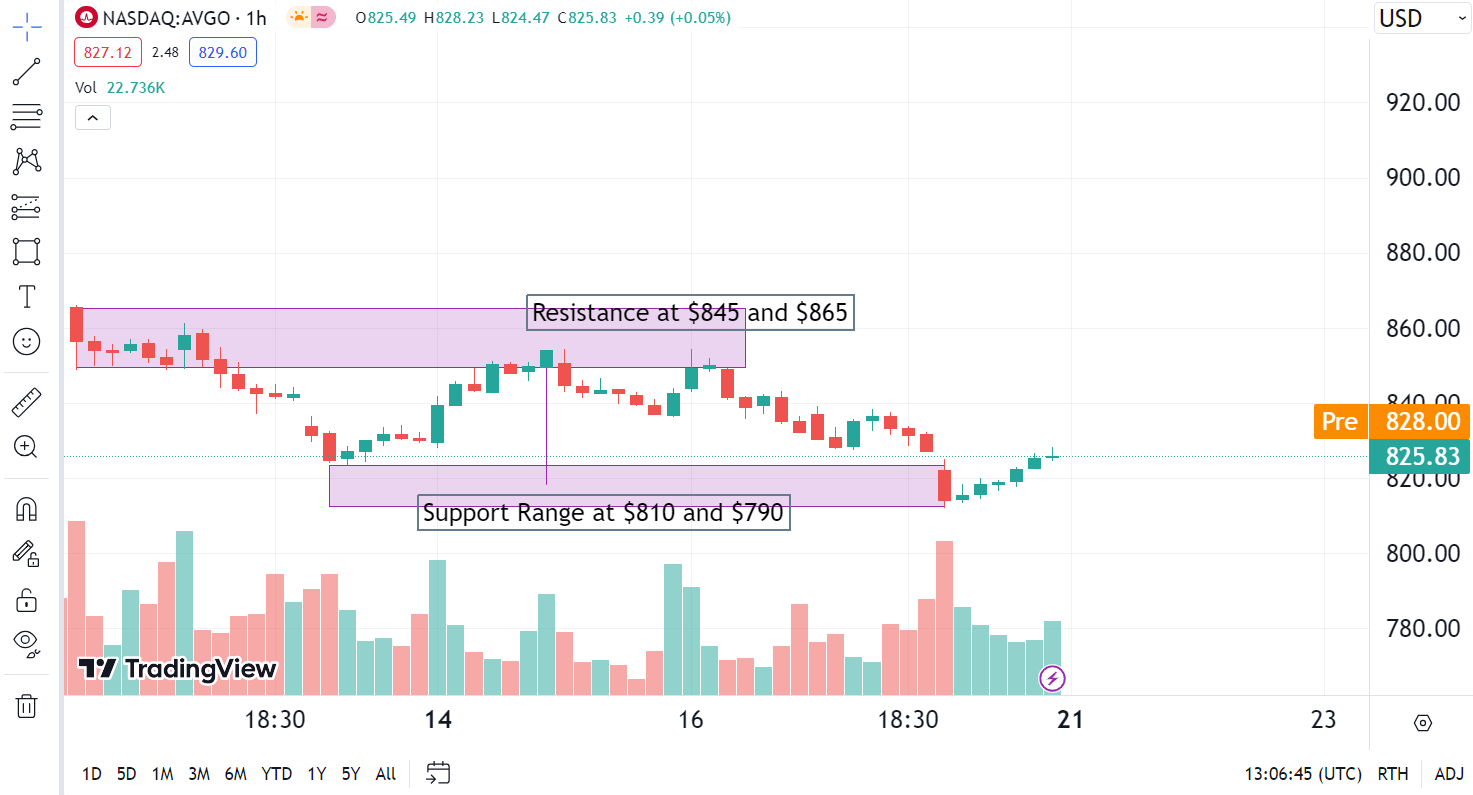

Key Resistance & Support Levels for AVGO Stock

Using data from TradingView charts, the key resistance and support levels for AVGO stock are as follows:

Resistance Levels: Notable resistance levels for AVGO stock are observed at around $845 and $865. These levels have historically acted as barriers, limiting the stock's price movement.

Support Levels: Strong support levels are identified at approximately $810 and $790. These levels have historically provided a foundation for the stock's price, preventing it from declining further.

Analyst Recommendations and Price Targets

Broadcom's stock outlook is influenced by consensus analyst recommendations and price targets, offering insights into potential future price movements.

Analyst Ratings

Strong Buy: 16 analysts (13 ratings)

Buy: 3 analysts

Hold: 0 analysts

Sell: 0 analysts

These ratings are based on assessments made by 16 analysts over the past 3 months.

AVGO Stock Price Targets

Highest Price Target: $1,050

Average Price Target: $880.79

Lowest Price Target: $775.00

The consensus 12-month price target for AVGO stock among major analysts is $880.79. The highest forecast is $1,050.00, while the lowest forecast is $775.00. This indicates an implied upside of approximately 6.65% from the stock's current price of $825.84.

Challenges and Opportunities for Broadcom Inc. (AVGO)

Source: Istock Photos

Competitive Risks

Broadcom Inc. faces intense competition from prominent players in the semiconductor industry, including Qualcomm, Intel, and Nvidia. These competitors are actively investing in research and development, potentially introducing disruptive products and technologies that could impact AVGO's market share and growth.

Main Competitors

Qualcomm:

A leader in wireless chips, Qualcomm's stronghold spans smartphone manufacturing, as well as expanding into sectors like automotive and Internet of Things (IoT).

Competitive Threat: Qualcomm's dominance in wireless technology may challenge AVGO's wireless chip market.

AVGO's Advantage: Broadcom holds a diversified portfolio of products and services, granting it a broader customer base.

Intel:

A major microprocessor provider, Intel's presence extends to PCs, data centers, and artificial intelligence (AI).

Competitive Threat: Intel's focus on AI and data centers could potentially encroach on AVGO's data center and AI expansion.

AVGO's Advantage: Broadcom's global operations in over 40 countries foster a strong global footprint.

Nvidia:

Known for graphics chips, Nvidia's influence spans gaming, self-driving cars, and AI.

Competitive Threat: Nvidia's strides in AI could intersect with AVGO's AI growth trajectory.

AVGO's Advantage: A robust financial position and profitable track record fortify AVGO's competitiveness.

Other Risks

Economic Downturn: Global economic challenges may lessen demand for AVGO's offerings.

Technological Advancements: Rapid technological progress could render AVGO's products obsolete.

Regulatory Changes: Evolving regulations may impact AVGO's business operations.

Growth Opportunities

Source: Istock Photo

5G Market Growth: As the 5G era unfolds, AVGO is poised to tap into new avenues within wireless technology.

Internet of Things (IoT) Expansion: AVGO's robust presence positions it to capitalize on the growth of IoT, connecting devices to the Internet.

Artificial Intelligence (AI) Growth: The surging AI landscape presents AVGO with prospects for expansion and innovation.

Future Outlook and Expansion

Broadcom Inc.'s promising outlook and expansion initiatives lay a foundation for sustained growth:

Data Centers: AVGO's data center expansion positions it to cater to the growing demand for data storage and processing.

Networking: Amid the increasing need for seamless connectivity, AVGO's expansion in networking reinforces its role in device interconnectivity.

Security: In a data-driven era, AVGO's efforts in security align with safeguarding valuable information from unauthorized access.

Why Traders Should Consider AVGO Stock

Diverse Competitive Landscape: AVGO navigates competition from industry giants like Qualcomm, Intel, and Nvidia. This competition fuels AVGO's drive to innovate and maintain a competitive edge, which can enhance its long-term growth prospects.

Robust Financial Strength: AVGO's profitability and solid balance sheet provide a cushion against economic downturns and enable strategic investments in growth.

Diverse Product Portfolio: AVGO's extensive array of products and services translates to a broad customer base, reducing vulnerability to shifts in demand for specific offerings.

Global Market Penetration: With operations spanning 40+ countries, AVGO's global reach taps into diverse markets, enhancing its revenue streams and reducing regional risks.

Resilience to Economic Downturns: AVGO's robust financial position and diversified offerings make it well-positioned to withstand economic downturns, providing traders with stability and confidence.

Innovation Leadership: Significant investments in research and development keep AVGO at the forefront of technological advancements, a critical edge in the dynamic semiconductor sector.

Leveraging Market Growth: AVGO's strategic positioning in expanding sectors like 5G, IoT, and AI positions it to harness the opportunities in these high-growth markets.

Trading Strategies for AVGO Stock

CFD Trading for AVGO Stock

CFD trading offers a derivative-based approach to capitalize on AVGO stock price movements without owning the shares. This strategy allows you to profit from price fluctuations, both upward and downward while avoiding the complexities and risks of traditional ownership. The benefits of CFD trading for AVGO stock include leveraging smaller capital through margin requirements, enjoying the flexibility to trade in both directions of the price movement, and taking advantage of the liquidity in AVGO CFD markets for seamless position management.

Options Trading for AVGO Stock

Options trading, another derivative trading method for AVGO stock, grants you the right, though not the obligation, to trade the stock's price. This involves the ability to buy or sell shares at a predetermined price by a specified date. The benefits encompass limited risk due to the option's cost, flexibility in selecting the strike price and expiration date, and the potential to use options as a hedge against existing stock losses.

Swing Trading for AVGO Stock

Swing trading being a short- to medium-term strategy, involves buying and selling stocks within days or weeks to capture price fluctuations. This approach is favored by traders seeking quick gains from short-term price movements. For AVGO stock, swing trading involves identifying support and resistance levels, then awaiting a breakout. A breach of support prompts short selling while surpassing resistance prompts buying. The advantages of swing trading encompass reduced risk due to shorter holding times and the potential for profits if successful price moves are identified.

Long-Term Investing for AVGO Stock

Capitalize on AVGO's growth potential by holding positions for an extended period, leveraging the company's strong financials and market positioning.

Trade AVGO Stock CFD with VSTAR

Elevate your trading journey with VSTAR - a platform tailored for all traders. Discover a world of possibilities as VSTAR presents a cost-efficient trading arena with razor-sharp spreads and commission-free accounts.

Experience trading without barriers - VSTAR welcomes you with remarkably low minimum capital requirements. Embark on your AVGO stock CFD journey with as little as $50, while enjoying leverage to maximize your potential. With VSTAR's proactive risk management tools and swift customer support, earning top ratings on Trustpilot - a testament to its trader-centric approach, you are sure to have a great experience.

You can open your free VSTAR account now to seize the AVGO stock CFD opportunities. Boost your confidence with up to $100,000 in a demo account, exclusively designed for newcomers to refine their trading prowess. Unleash your potential with VSTAR today! Also, bear in mind that VSTAR recently launched the podcast feature called "Trade & Triumph". This podcast features interviews with experienced traders, market analysts, and other experts covering a wide range of topics related to trading to provide a much refreshing experience.

Conclusion

In conclusion, AVGO stock presents a compelling opportunity for traders seeking to navigate the dynamic world of financial markets. With its robust financial position, diverse portfolio, and global presence, AVGO is well-poised for growth and stability. Traders can explore various strategies, such as CFD trading, options trading, and swing trading, to harness its potential. Leveraging platforms like VSTAR adds an extra edge to trading endeavors, providing seamless access, advanced tools, and exceptional customer support. Whether capturing short-term fluctuations or positioning for long-term gains, AVGO's trajectory, combined with effective trading strategies and reliable platforms, opens doors to a realm of possibilities for traders to explore.

FAQs

1. Is AVGO stock a buy or a sell?

AVGO stock is mostly rated a buy/hold at current levels. It is not cheap, but it has a leading market position.

2. Is AVGO a good stock to buy now?

Yes, AVGO remains a good long-term investment at today's valuation. Its growth drivers remain intact.

3. Who bought out Broadcom?

Avago Technologies acquired Broadcom in 2016, forming the current AVGO entity.

4. What is the fair price of AVGO?

The average analyst price target is around $725, suggesting that AVGO stock is currently somewhat overvalued.

5. What is the forecast for AVGO stock?

Forecasts call for mid-single digit growth in AVGO's revenues and earnings through 2024.

6. What is the AVGO stock forecast for 2024?

The consensus estimate for 2024 calls for AVGO earnings of approximately $40 per share.

7. What is the target price for Broadcom stock?

Most analyst price targets range from $650 on the low end to $800 on the high end.

8. Where will Broadcom stock be in 5 years?

In a bullish scenario, AVGO could trade near $1,200 in 5 years. A more conservative estimate is around $900 per share by 2029.