Has it been challenging to make a profit on trades? Or are you a newbie attempting to navigate the stormy waters of crypto trading? Then you are in the right place!

The decentralized nature, high volatility, potential for significant profit, and ease of use have made crypto trading an excellent option for traders. However, successful crypto trading requires the right knowledge, strategy, and dedication.

This guide will examine the secrets to successful crypto trading- the magic that can help you maximize profit. Let us dive in!

Why Become a Crypto Trader?

Cryptocurrency trading involves buying and selling digital currencies to make a profit. Unlike traditional money, cryptocurrencies are decentralized, which means the central government or financial institutions do not control them.

Over the years, the crypto industry has become more popular, capturing the interest of investors globally. Therefore, we shall explore why crypto trading is a thrilling opportunity in this section.

❖ High potential profits

One of the most attractive features of trading cryptocurrencies is the potential for high profit. Usually, financial institutions offer a fixed interest rate on your investment.

However, the highly volatile nature of the crypto industry can trigger exponential returns within a relatively short time. Volatility is the degree to which the price of an asset changes, and it is a critical feature of crypto trading.

❖ 24/7 market

Another unique feature of crypto trading is the market is always open. Unlike traditional financial institutions or stock markets with set trading hours, you can trade crypto assets 24 hours a day, 7 days a week.

This around-the-clock feature offers flexibility and freedom to millions of traders across the globe. Therefore, traders can enter or exit trades at their convenience regardless of their time zone.

❖ Learn valuable trading skills

The goal of crypto trading is not limited to financial gains. The journey of crypto trading involves learning various skills. The crypto market requires commitment, continuous learning, and adaptability.

When trading crypto, you use various trading strategies and learn how to read charts as well as understand various technical indicators. These skills are necessary to understand fundamental factors that may trigger public sentiment, which may affect the price of an asset.

❖ High liquidity

Another exciting reason to delve into crypto trading is high liquidity. Liquidity is the ease at which traders can buy or sell an asset. In the crypto market, high liquidity provides a significant advantage for traders. Since the cryptocurrency industry is global, high liquidity is critical to cater to a large number of participants- short-term and long-term traders alike.

What Does It Take to Become Successful?

The world of crypto trading is exciting and offers numerous opportunities. However, what does it take to be a successful crypto trader? This section will examine some of what it takes to become a successful trader.

Discipline

If you want to be successful in crypto trading, you need discipline. Like any other venture related to money, discipline is critical to trading cryptocurrencies. Discipline is a trait that ensures you adhere to rules and principles irrespective of what other people are saying. A disciplined trader understands the significance of avoiding emotional trading and resisting impulsive decision-making.

Greed and fear are two factors that will thrive in the absence of discipline. Making decisions in the moment of greed or fear are emotional decisions that may have dire consequences. Discipline is critical for traders to attain the emotional control and patience required to make rational decisions based on analysis instead of emotions.

A trading strategy

A trading strategy is critical to succeed in crypto trading. It serves as a blueprint that guides your trading activities. The crypto market is subject to sudden and drastic changes, so you need a strategy that helps you adapt and get the most from the situation.

A trading strategy is a framework that helps traders to execute trades based on analysis, indicators, and market conditions. Therefore, it considers trading goals, experience, and risk tolerance. Data from fundamental and technical analysis inform it.

Risk management skills

Risk management skills are critical for successful crypto trading. The volatile nature of the crypto market poses a high risk if not appropriately managed. Aggressive price movement can result in the loss of profit and capital. However, effective risk management can protect your capital, minimize loss, and maximize profit.

Therefore, risk management skills involve understanding the significance of stop-loss orders, position sizing, and risk-reward ratio. The risk-reward ratio gives insight into the potential of the risk outweighing the reward. On the other hand, stop-loss orders automatically exit a trade when the price reaches a pre-set value to limit potential losses.

Continued learning

To be a successful crypto trader, you must have an open mind and be willing to learn. The crypto industry is rapidly evolving with new assets that have unique functionalities. Therefore, a crypto trader must stay informed about general market trends, network development, and social media hype that may affect price movement.

To enhance your knowledge, you can read whitepapers, research articles, and blog posts. Also, you can watch YouTube videos to optimize your skills. Another tip is to follow industry experts on social media.

You can also learn by being an active member of the online crypto communities. Several individuals on these platforms are willing to share insights to help you gain new perspectives. Continuous learning is critical because it helps you expand your knowledge, refine your trading strategies, and adapt to the fast-paced crypto market.

Choose a Cryptocurrency Broker

Another aspect of successful crypto trading is choosing a broker. While this may seem simple, your choice of broker can affect the success of your trading. A crypto broker is a firm that acts as an intermediary between traders and crypto assets. There are various exchange platforms and brokers, and it becomes challenging to select a good one. Therefore, this section will examine what to look for when choosing the best broker.

A. Look for a regulated broker

The first thing to look out for is a regulated broker. Many brokers are unregulated, so they do not comply with industry standards. As a result, they may charge you high fees that may erode any profit you make. However, using a regulated broker ensures high security for your funds and personal information.

Therefore, before using any platform, verify if they are licensed and regulated by reputable financial authorities in the jurisdictions they operate. Regulatory bodies impose certain requirements that promote fair trading practices. As a result, you can trade cryptocurrencies and other financial instruments with confidence.

VSTAR is a reputable and regulated broker that provides institutional-level trading experience. We are regulated by CySEC, MiFiD, FSC, The Slovenian Securities Market Agency, The Dutch Authority for the Financial Markets, The Portuguese Securities Market Commission, and others.

B. Features to consider

Apart from regulations, there are other features to look out for when choosing a broker. Let us explore these features and their impact on crypto trading.

Low fees and spreads

Fees and spreads can have a significant impact on your trading profit. Therefore, traders must review brokers’ fee structures. Compare fees charged for deposits, withdrawals, overnight trades, and transactions to determine the best broker.

In addition, it is critical to consider the spreads the broker offers. The spread is the difference between a financial asset's buying and selling prices. Look out for brokers offering lower spreads, which signifies tighter pricing. Therefore, traders must select brokers with competitive fees and tight spreads to protect profit.

VSTAR does not charge platform or commission fees. The platform aims to provide flexibility and transparency so prospective traders can review the fee structure. In addition, we offer a tight spread from 0.0 Pips, which allows VSTAR to provide industry-leading spreads.

Demo account

A demo account is an invaluable tool for every successful crypto trader. The aim is to allow you to practice your trading plan and familiarize yourself with the platform without risking your capital. A demo account can simulate real market conditions and allows you to test different trading strategies.

Therefore, when choosing a crypto broker, look out for those who offer a demo account. An efficient demo account must resemble a live trading environment with real-time market data and trading tools. A demo account is essential to help traders refine their skills before opening a live position. Additionally, it helps them build skills for minimizing risk and maximizing profit.

Our experts at VSTAR understand the importance of a demo account. Therefore, VSTAR offers a demo account where traders can get familiar with the platform and implement their trading strategies. Traders can trade with virtual funds instead of their capital to explore various risk management strategies.

Access to research and tools

Another feature to consider when selecting a broker is access to research and tools. Market analysis and trading tools are critical to assist trades in analyzing trends, identifying potential trading, and making informed decisions. Therefore, it is essential to check whether brokers offer the tools necessary to make informed trading decisions.

VSTAR caters to both novice and expert traders by providing educational resources. We provide comprehensive guides on trading various assets to help traders make informed decisions. Additionally, we provide technical analysis indicators that allow traders to stay updated on market trends.

Range of cryptocurrencies

There are various digital assets in the crypto industry. When choosing a broker, look out for those who offer a wide range of cryptocurrencies. This is essential to help traders diversify their portfolios. Portfolio diversification is a crucial aspect of successful crypto trading. Therefore, a broker with a broad range of cryptocurrencies provides flexibility and caters to your trading preference.

The company provides an extensive selection of financial markets and assets to meet the various trading needs of clients. VSTAR offers various markets, including crypto, forex, indices, stocks, and commodities. Therefore, our investors have a wide range of assets to diversify their portfolios and explore opportunities in various markets.

Develop a Trading Strategy

Having a well-defined strategy is critical to successful crypto trading. The trading strategy helps traders navigate the complexities of the crypto market. Therefore, every trader must develop a strategy that may be influenced by goals, experience, and risk tolerance. Let us examine the components of an efficient trading strategy.

A. Choose a time frame

The first step in developing a trading strategy is to choose a time frame that aligns with your goals, risk tolerance, and experience. Here are three common time frames to consider:

Day trading

The concept of day trading involves opening and closing a trading position within a single day. Therefore, traders can profit from short-term price fluctuations within a trading day. However, this strategy requires focus, commitment, and dedication. Traders must closely monitor charts, patterns, and trends to identify potential profit opportunities.

Swing trading

Swing trading is a strategy that involves holding a trading position for a few days. Traders can capitalize on medium-term price fluctuations. Therefore, traders must analyze patterns and utilize technical indicators to identify potential trends and reversals.

One of the advantages of swing trading is it allows more flexibility as it requires less time commitment. However, the need for a risk management strategy becomes prominent.

Long-term investing

Long-term investment involves buying a crypto asset like BTC and holding it for months or years. The goal is to buy an asset when the price is low and hold it until the price experiences a significant price surge to make a profit when sold. However, traders must utilize fundamental analysis to identify assets with the potential for positive performance in the long term.

B. Technical analysis and fundamental analysis

Technical and fundamental analysis is critical to developing a trading plan. Once you have determined a time frame, you need a combination of fundamental and technical analysis to make informed trading decisions.

Technical Analysis involves examining historical price data, charts, and various technical indicators to predict price trends, strong momentum, and trend direction. Therefore, traders should evaluate price charts, including line trends, bar charts, and candlestick charts, to identify patterns and trends. Moving averages, MACD, RSI, and Bollinger Bands are popular technical indicators to help traders identify market sentiments and potential trends. In addition, it is critical to use technical analysis to identify key support and resistance levels. The data from the technical analysis is objective and provides insights into potential entry and exit points.

On the other hand, fundamental analysis involves understanding the factors that can affect the price movement of a crypto asset. These factors may include technology, market demand, adoption, supply, partnership, and team. Understanding these fundamental factors is critical to identify the long-term potential of a crypto asset. Fundamental analysis is significant because it can help traders identify the catalyst for price movements.

C. Define trading rules

Another aspect of developing a trading strategy is to define rules for entry triggers, exit triggers, stop losses, and profit targets. These rules are essential because it helps to maintain discipline and consistency in your trading plan.

- Entry triggers

Entry triggers are signals that could prompt traders to enter a trade. You can use data from technical indicators like MACD and RSI to identify profitable entry positions. Determining entry triggers is critical to a trading plan because it protects you from impulsive trading.

- Exit triggers

Exit triggers are indicators that signal traders to close a trade. Indicators like trend reversals or trailing stops are critical to inform the decision to exit a trade. However, it is crucial to have predefined exit triggers to ensure consistency.

- Stop losses

A stop-loss order is a risk management strategy that automatically closes your trading position. You can set an order to close your trade when the price of the cryptocurrency crashes to a certain level. Stop loss orders protect your capital in case the market moves against you.

- Profit targets

Profit targets are risk management strategies to protect your profit. You can set a profit target to automatically close trades when your profits have reached a preset level. Reward-risk ratio and technical indicators can help you select a profit target. Profit targets are essential because it protects you from making decisions based on greed.

Master Technical Analysis and Chart Reading

Technical analysis and chart reading are integral to successful crypto trading. Mastering technical analysis provides insight into market trends and potential entry or exit points. Let us explore critical concepts around mastering technical analysis and chart reading

A. Learn about technical indicators

Technical indicators are used for technical analysis, and here are some common ones:

- Moving averages:

They can help traders identify trends and price directions. Traders can use simple moving averages and exponential moving averages to determine the price direction of a cryptocurrency.

- MACD:

Moving Average Convergence Divergence indicator is a momentum indicator. It is useful to identify changes in the strength, direction, momentum, and duration of a trend of a cryptocurrency.

- RSI:

Relative strength index is a popular momentum indicator for technical analysis. The RSI measures the speed and magnitude of the current price trend of a cryptocurrency. This indicator oscillates between 0 and 100- below 30 indicates an oversold condition, while above 70 is considered overbought.

- Bollinger bands:

Bollinger bands are a useful technical analysis indicators. It can help traders identify sharp and short-term price trends. In addition, it is a flexible tool that indicates potential entry and exit points.

B. Identify chart patterns

Chart patterns help traders understand price history and possible future price movement. Some common chart patterns include:

- Head and Shoulders:

This pattern predicts a bullish-to-bearish trend reversal with three peaks resembling the shape of a head and two shoulders.

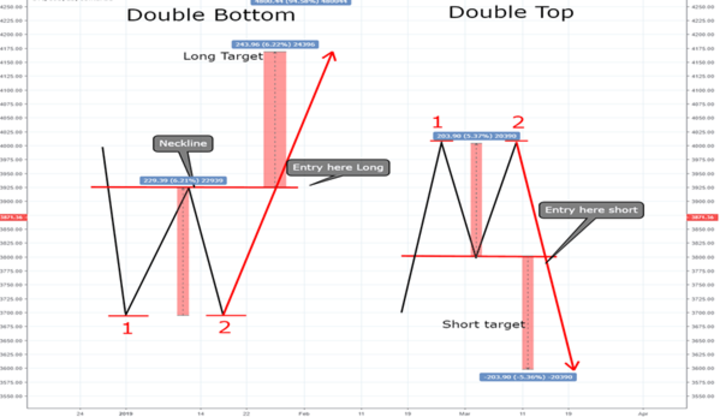

- Double Tops and Bottoms:

These patterns indicate potential resistance or support levels. They occur when the price reaches similar highs or lows on two occasions. A double top has an 'M' shape and indicates a bearish reversal in trend. A double bottom has a 'W' shape and signals a bullish price movement.

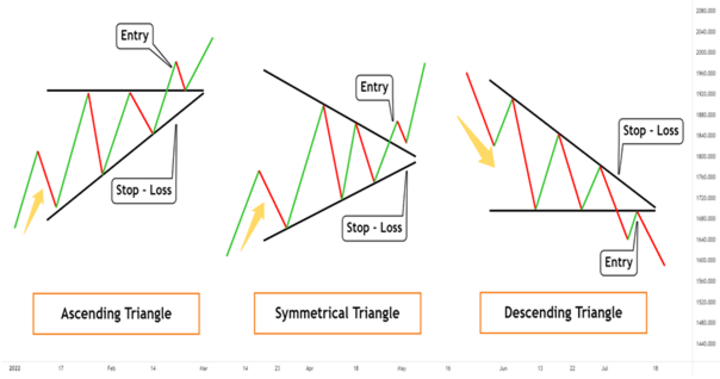

- Triangles:

Triangles form when the price consolidates, creating higher lows and lower highs. They indicate a potential breakout in price. There are three different types of triangles- the ascending triangle, the descending triangle, and the symmetrical triangle.

C. Use support and resistance levels

The technical analysis reveals critical support and resistance levels. The support level is the price zone where a price downtrend is expected to reverse. At this level, the buying pressure increases to prevent further price decline. Therefore, it indicates an increase in demand for the cryptocurrency. The support level can help traders identify potential entry points. Various technical indicators can be used to identify support levels.

On the other hand, the resistance level is a zone associated with a potential decline in the current price uptrend. You can identify resistance levels by analyzing historical charts and technical tools. The current price trend is expected to reverse when there is increased selling pressure. However, monitoring support and resistance levels is crucial to jump on breakout trends quickly.

D. Understand order flow and volume

Understanding order flow and volume are critical for successful crypto trading. It helps traders get a comprehensive understanding of market trends and potential price movements. Order flow refers to the number of orders waiting to be executed at a specific price. Therefore, it can help traders open a trading position with more confidence.

Volume analysis can also serve as a confirmation for buying or selling signals. It helps to assess liquidity and the strength of the current market movement. Higher volume may signify higher market participation and increasing demand. You can use Volume Weighted Average Price to determine trend strength and direction based on volume.

E. Integrate news and announcements

News and announcements are fundamental factors that may affect the price of cryptocurrency. Therefore, traders must stay updated with relevant news such as partnerships, network upgrades, and technological advancements. Integrating news and announcements analysis into technical analysis can provide a better overview of market conditions.

Practice Risk Management

Risk management strategies are central to successful crypto trading. In this section, we shall explore some risk management practices that can help you have better trading results.

i. Set a maximum risk limit

The first principle is setting a maximum risk limit on every trade. This allows traders to protect their capital. However, we recommend using about 1-5% of your capital on any single trade

ii. Use stop losses consistently

A successful crypto trader must use stop losses consistently. Using a stop-loss order can limit potential losses if the market moves against you.

iii. Diversify across cryptocurrencies

Portfolio diversification is critical risk management practice. Diversification reduces any single asset's impact on your overall performance.

iv. Manage open positions actively

Active management of open positions is central to successful crypto trading. This involves regularly reviewing and updating your trading strategy to help you maximize profit and minimize risk.

v. Limit the use of leverage

Be wary of the use of excessive leverage. While leverage can amplify your profit, it can also magnify your loss. Therefore, it is critical to understand the implication of leverage on various opening positions.

Develop Strong Discipline

Discipline is an integral part of successfully trading crypto. The crypto market is highly volatile, so it requires traders to maintain discipline to maximize profit. Let us examine practices that can help you maintain discipline in trading.

a. Stick to your trading rules

First, stick to your trading rules. This may include adhering to predefined entry and exit points, certain risk management strategies, and position sizing. When you stick to rules, it ensures your decisions are not driven by emotion.

b. Ignore short-term market noise

Short-term market fluctuation may cause temporary hype. However, ignore this noise and focus on your well-defined trading strategy. Discipline ensures you focus on your long-term goals without being swayed by temporary market fluctuations.

c. Automate parts of your strategy

Another way to enforce discipline is to automate some parts of your trading strategy. Automation is useful because it sets your plan in motion. Therefore, it promotes you from making decisions based on greed or fear

d. Control emotions when trading

Emotions like greed and fear can significantly affect your trading outcome. They blind you to the facts and cause you to deviate from your trading plan. Therefore, it is critical to control your emotions when trading.

e. Learn from mistakes

Mistakes are inevitable in life. However, they provide an opportunity for you to learn. Therefore, discipline is a skill that allows you to learn from mistakes such that you can refine your trading approach to maximize profit.

How to Execute Trades Efficiently

To be a successful crypto trader, you must be able to execute trades efficiently. Various strategies can help you execute your trades for better performance. They include:

a) Choose optimal order types

Choosing the optimal order types is critical for successful crypto trading. Common orders include market orders, limit orders, and stop orders can help you execute a trade. Therefore, it is critical to understand the advantages and drawbacks of these orders to select the best one.

b) Monitor order fill quality

Traders should monitor order fill quality to ensure trades are efficiently executed without slippage. Slippage occurs when the executed price varies from the expected price due to sharp and quick price fluctuations. Therefore, it is critical to continuously review order fill quality and make necessary adjustments to minimize risk.

c) Limit trading frequency

While crypto trading holds many exciting opportunities, limiting trading frequency is critical. Instead, focus on trades with quality strategies and be disciplined to get profit. Overtrading can lead to frustration, emotion-driven acts, and increased transaction costs.

d) Review the performance of each trade

Self-evaluation is a critical aspect of being a successful crypto trader. It helps to identify your strengths, weaknesses, mistakes, and general performance. As a result, you can refine your trading approach to maximize profit and minimize risks.

Continued Learning: A Key Component to Success

Continued learning is a crucial component of being a successful crypto trader. The crypto market is continuously evolving with new opportunities and challenges. Therefore, staying updated can help you refine your strategies and adapt to changes in the crypto market. Here are some essential components of continued learning:

i. Read books on cryptocurrency trading

Read books, research articles, and whitepapers related to cryptocurrency to acquire in-depth knowledge. Reading helps shape your perspective and expand your skill, which may translate into better trading strategies.

ii. Follow experts on social media

Social media allows for connection with people from various parts of the globe. Therefore, it is necessary to follow crypto experts on social media like Twitter or Facebook. Also, being an active member of crypto communities/forums provides an opportunity to interact with industry experts.

iii. Study case studies of top traders

Another way to learn is to study case studies of successful and established crypto traders. This allows you to analyze their trading approaches and learn from their mistakes to become better. Case studies are invaluable study tools as they provide insights into what to do and mistakes to avoid during trading.

iv. Learn about the latest innovations

Staying updated on news, technological advancements, and partnerships can give you an edge as a crypto trader. When you know about these latest innovations, you can understand their potential impact and identify opportunities they present. As a result, you can quickly open a potentially rewarding position.

Managing Drawdowns Associated with Trading

Managing drawdowns is a critical part of being a successful crypto trader. These are periods of losses due to extreme price fluctuations. However, how you respond to drawbacks may significantly impact your overall trading experience. Here are some practices to help you manage drawdowns:

a. Accept losses as part of trading

While crypto trading is a lucrative venture, it is essential to understand that sometimes loss is inevitable. Therefore, you should accept loss as a part of the trading process. Accepting this reality helps you focus on the bigger picture such that you do not give in to impulsive decisions.

b. Exit positions quickly when rules breached

During drawdowns, exit positions quickly when rules are breached. Every trader must have a blueprint that includes measures to protect their capital. However, if the trade is not performing as speculated, you need to quickly close the position to minimize risk exposure.

c. Preserve cash and liquidity

Preserving cash and liquidity is critical during drawdowns. One rule of trading that becomes relevant is investing only about 2-5% on a single trade. After a drawback, you still have enough capital to take opportunities that arise as the market recovers.

d. Recover using an improved strategy

Drawbacks present a unique learning opportunity for traders to reflect on their trading strategies and make necessary adjustments. Therefore, traders should implement an improved strategy to optimize profitability as the market recovers.

Conclusion

This comprehensive guide has covered every aspect of becoming a successful crypto trader. Discipline, a trading strategy, continuous learning, and risk management are critical behaviors that can lead you to success.

We discussed the significance of developing a trading plan, mastering technical analysis, implementing appropriate risk management strategies, and how to execute trades efficiently. Remember that crypto trading comes with periods of drawbacks, and proper management is required.

Congratulations on reading to this point. We are excited as you begin a successful crypto trading journey. VSTAR is the platform that caters to all your trading needs with our institutional-level services and features.