Introduction

In a whirlwind of events, The Walt Disney Co. has made headlines by pulling out its $1 billion investment in Florida, citing "changing business conditions" amid a clash with the state's Republican governor over LGBTQ+ education. Meanwhile, Disney+ faced a dip in subscribers, losing 4 million in the last quarter, but managed to cut streaming losses by $400 million. To optimize costs, certain content will be removed, and brace yourselves because price hikes for the ad-free Disney+ tier are on the horizon. CEO Bob Iger also unveiled Disney's grand plan to launch an all-in-one streaming experience, merging Disney+ and Hulu in the U.S. by the end of 2023, showing their dedication to providing the ultimate streaming solution. From political conflicts to subscriber woes and streaming strategies, Disney continues to captivate audiences with its rollercoaster ride of entertainment endeavors.

Now, you might be wondering whether Disney stocks are a good investment idea. Well, Disney is expected to experience substantial growth in earnings and revenue, with forecasts indicating a 27.6% and 5.2% annual increase, respectively. EPS is projected to grow by 27.2%. Additionally, a return on equity of 10.9% is anticipated within the next three years. These optimistic projections demonstrate the company's potential for financial success.

Disney is making impressive financial progress under CEO Bob Iger's leadership, with a focus on achieving positive growth. The latest quarter showcased increased revenue, profits, and ongoing cost-reduction efforts. Promising projections for earnings, revenue, and EPS, along with a favorable return on equity, contribute to a positive outlook for Disney. Furthermore, the undervalued stock, with a fair value estimate of $145, indicates potential market growth. Disney's commitment to sustainable growth is evident in its projected average annual top-line growth rate of 6% through fiscal 2027.

The Walt Disney Company's Overview

The Walt Disney Company, a renowned entertainment conglomerate, has a rich history that began in the early 1920s. Founded by Walt Disney and Roy O. Disney, the company is headquartered in Burbank, California. Let's explore some critical milestones in Disney's journey that have shaped its success and legacy. In 1928, Disney introduced the iconic character Mickey Mouse in the animated short film "Steamboat Willie," which propelled the company to fame and success. In 1955, Disney opened its first theme park, Disneyland, in Anaheim, California. This groundbreaking venture revolutionized the amusement park industry and began Disney's expansion into immersive entertainment experiences.

Throughout the years, Disney continued to produce beloved animated classics such as "Snow White and the Seven Dwarfs" (1937), "The Lion King" (1994), and "Frozen" (2013). The company's success extended beyond animation with the opening of Disney World in Florida in 1971 and subsequent theme park expansions worldwide, including Disneyland Paris (1992), Tokyo Disneyland (1983), and Hong Kong Disneyland (2005).

Source: Unsplash.com

Disney made significant acquisitions, including purchasing Pixar Animation Studios in 2006, Marvel Entertainment in 2009, and Lucasfilm, the creator of the Star Wars franchise, in 2012. These acquisitions further solidified Disney's global influence and expanded its reach across various entertainment mediums.

Disney's Company Structure

Disney's Media Networks entertain us with ABC, Disney Channel, ESPN, and National Geographic. The Parks, Experiences, and Products division brings us the magic of Disneyland, Walt Disney World, and more. Disney's Studio Entertainment delivers blockbuster films from Walt Disney Studios, Pixar, Marvel, and Lucasfilm. The Direct-to-Consumer & International division takes us on streaming adventures with Disney+, Hulu, and ESPN+. Leading the way is CEO Robert Allen Iger, who launched Disney+, acquired 21st Century Fox, and shaped Disney's success with visionary leadership and strategic investments. He's the magic behind Disney's rise as an entertainment titan.

Disney's Business Model and Products/Services

A. Disney's Business Model

Disney excels in content creation with renowned studios like Pixar, Marvel, and Lucasfilm, delivering captivating entertainment that resonates worldwide. Its theme parks provide immersive experiences, fostering joy and wonder. Merchandise sales leverage beloved characters, creating a substantial consumer products business. With a diverse product portfolio, including films, TV shows, theme parks, resorts, and Disney+, Disney brings joy to millions of people around the world.

Source: Pexels

Disney's Financials, Growth, and Valuation Metrics

A. Review of Disney's Financial Statements

Disney Net Worth: Walt Disney's market capitalization of $167.98 billion solidifies its status as a global leader in entertainment, ranking 63rd among the world's most valuable companies.

Disney's net income has experienced impressive growth, with a 55.45% year-over-year increase in the twelve months ending March 31, 2023. Disney revenue has shown positive growth over the past five years, with a notable 13.33% increase in the quarter ending March 31, 2023. Disney's gross profit margin has remained strong, with the latest twelve months' gross profit margin at 33.0%. Cash flow from operating activities has generally increased, with a 45.37% increase in the quarter ending March 31, 2023.

Balance sheet strength and implications

Disney's balance sheet is strong, with a growing asset base, decreasing debt, and positive equity. This provides a solid foundation for the company's operations, investments, and growth strategies.

Here are some specific highlights:

● Total assets have consistently increased over the past four years, reaching $203.6 billion in the most recent period.

● Liabilities have decreased over the past two years, to $95.3 billion in the most recent period.

● Total equity has grown to $108.4 billion, indicating a strong net worth and positive shareholder equity.

● Total capitalization increased to $140.3 billion, demonstrating the company's ability to finance its operations through a combination of debt and equity.

● Common stock equity has shown a positive trend over the four-year period, indicating increasing Disney shareholder value.

● Net tangible assets improved to $2.3 billion, suggesting a stronger asset base.

● Working capital was positive at $207 million in the most recent period, indicating the company's ability to meet short-term obligations.

● Invested capital increased to $143.4 billion, highlighting the funds available for long-term investment and growth.

● Total debt decreased to $48.4 billion, and net debt (total debt minus cash and equivalents) decreased to $36.8 billion. These figures suggest effective debt management.

● Disney has 1,800,000 shares issued, with 1,781,000 ordinary shares and 19,000 treasury shares.

Overall, Disney's balance sheet is strong and provides a solid foundation for the company's future.

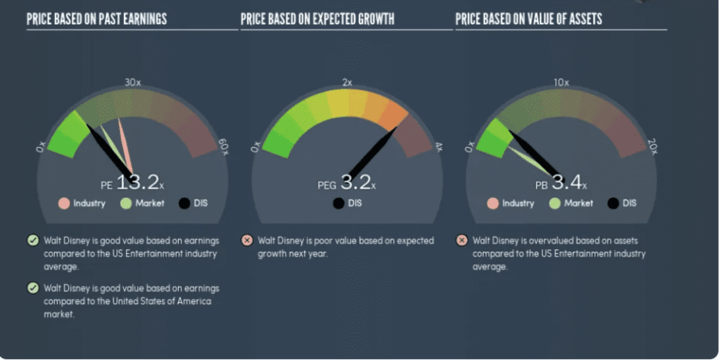

B. Disney Valuation Metrics

Source: Simply Wallstreet

- Price to Earnings Ratio and Earnings Yield

Based on the trailing twelve months, Walt Disney maintains a price-to-earnings ratio of 13.16, which translates to an earnings yield of approximately 7.6%. This metric suggests that investors are willing to pay a reasonable price for Disney's earnings, making it an attractive investment option.

- Impressive Earnings Growth

Walt Disney achieved a remarkable 47% increase in earnings per share (EPS) last year, demonstrating its ability to generate substantial profitability and improve shareholder value. This significant growth showcases Disney's strong performance and efficient management practices.

- Steady EPS Growth Rate

Over the past five years, Walt Disney has maintained a steady annual EPS growth rate of 15%. This consistent growth reflects the company's ability to expand Walt Disney earnings over an extended period, showcasing its resilience and strategic positioning in the entertainment industry.

- Market Sentiment and Investment Opportunities

A lower price-to-earnings ratio relative to its industry peers may indicate that market participants view Disney as potentially underperforming compared to other companies in its sector. This sentiment provides an opportunity for investors who seek to buy stocks when the market sentiment is pessimistic about a company's prospects.

Source: Pixabay

DIS Stock Performance

DIS stock trading information

Disney Stock Trading Hours: Investors can trade Walt Disney stock during Pre-Market (4:00-9:30 a.m. ET) and Disney After Hours Market (4:00-8:00 p.m. ET).

Disney Simbol: Disney's stock symbol on the NYSE is DIS, making it easily recognizable.

Walt Disney Stock Splits

Disney has undergone several stock splits, increasing accessibility and market liquidity. The splits occurred on the following dates:

July 9, 1998: 3-for-1 split.

May 15, 1992: 4-for-1 split.

March 5, 1986: 4-for-1 split.

January 15, 1973: 2-for-1 split.

March 1, 1971: 2-for-1 split.

November 15, 1967: 2-for-1 split.

August 20, 1956: 2-for-1 split.

Disney Stock Dividend

Current Disney Dividend Yield and Annual DIS Dividend Payment:

Disney offers a 1.9% dividend yield, reflecting the return on investment from dividends relative to the stock price. Shareholders receive an annual DIS stock dividend payment of $1.76 as a regular distribution of profits.

Overview of DIS Stock Performance

First of all, here is the latest stock data for Walt Disney (DIS):

● Current price: $88.10

● 52-week high: $126.48

● 52-week low: $84.07

● Market capitalization: $161.7 billion

● Volume: 13.5 million shares

● PE ratio: 39.07

Disney Stock History

Historically, Disney stock has been quite volatile, with a wide range of highs and lows. The all-time high was $126.48, which was reached on August 16, 2022. The all-time low was $26.19, which was reached on March 17, 2020.

Disney stock price has been on a downward trend since the beginning of 2022, but it has shown some signs of recovery in recent weeks. The stock is still down about 30% from its all-time high, but it is up about 10% from its 52-week low.

There are a number of factors that could impact Disney stock price in the future. These include the company's financial performance, the overall health of the economy, and the performance of the entertainment industry.

So, is Disney a good stock to buy? Disney stock is a volatile investment, but it has the potential to deliver significant returns over the long term. You should carefully consider the risks and rewards before investing in Disney stock.

Source: Pixabay

Key drivers of DIS stock price

- ESPN - 28%:

ESPN, the leading sports programming network, holds broadcasting rights to major sporting events and generates revenue through subscription fees and advertising.

- Disney Channel, A&E & Others - 21%:

This segment includes various channels like Disney Channel, A&E, and History Channel, contributing to Disney's stock value through subscription fees and advertising.

- Disney Studios - 19%:

Disney Studios produces and distributes films, generating revenue from DVD sales, content licensing, and box office sales.

- ABC Broadcasting - 12%:

ABC Television Network earns revenue through advertising and licensing its productions.

- External Factors:

Economic conditions, industry trends, and regulatory changes can influence the performance of Disney stock.

- Analyst Insights and Market Sentiment:

Market analysts' views and investor sentiment impact the stock's performance.

An analysis of prospects for Disney stock

- Streaming Growth:

Disney's Disney+ streaming service has revolutionized the industry. With a vast content library and popular franchises, Disney is well-positioned for significant growth in the expanding streaming market. With a solid subscriber base and plans for international expansion, Disney's streaming services offer promising revenue and stock growth potential.

- Theme Park Recovery:

Despite the impact of the COVID-19 pandemic, Disney's iconic theme parks are gradually recovering as vaccinations progress and travel restrictions ease. As visitors return to Disneyland and Walt Disney World, revenue is expected to increase, positively impacting the company's stock performance.

- Content Development:

Disney's commitment to producing high-quality content across various platforms remains a core strength. Through subsidiaries like Pixar, Marvel, and Lucasfilm, Disney continues to create compelling movies, TV shows, and original programming. Investment in content development ensures a steady revenue stream and solidifies Disney's position as an industry leader.

- Strategic Partnerships and Acquisitions:

Disney's history of successful partnerships and acquisitions has expanded its reach and revenue streams. Collaborations with major brands like Marvel and Star Wars have enhanced Disney's growth potential and appeal to investors. Identifying and integrating acquisitions into its portfolio further strengthens Disney's position.

Disney Stock Forecast: Is Disney stock a buy?

The 22 analysts offering 12-month Dis stock forecast has a median DIS price target of 125.00, with a high Disney stock price target of 147.00 and a low estimate of 94.00. The median DIS stock price target represents a +35.91% increase from the last price of 91.97.

Risks, Challenges, and Opportunities

A. Potential Risks/Challenges Facing Disney

Competitive Risk

- Netflix (NFLX):

Netflix is a leading streaming service with a vast library of movies, TV shows, and original content. It competes with Disney+ by offering a wide range of entertainment options and global reach.

Source: Pexels

- Roku:

Roku operates as a streaming platform and device manufacturer, providing users access to various streaming services. While not a direct content provider, Roku competes by offering a convenient and user-friendly streaming experience.

- Spotify (SPOT):

Spotify, primarily known for music streaming, has expanded into podcasts and audio content. Although different from Disney's content focus, Spotify competes indirectly by vying for users' attention and subscription dollars.

- Manchester United (MANU):

Manchester United is a professional sports team that competes indirectly with Disney in live sports entertainment. While Disney holds broadcasting rights through ESPN, Manchester United attracts audiences through live games, merchandising, and sponsorships.

Remember, these competitors may have different business models and target different segments of the entertainment industry, but they all contribute to the competitive landscape in which Disney operates.

Competitive advantages of Disney over its main competitors above

- Content Library and Brand Recognition:

Disney has an extensive content library and recognizable brands like Marvel, Star Wars, and Pixar, giving it a significant advantage in attracting and retaining audiences.

- Integrated Ecosystem:

Disney's ability to create an integrated ecosystem across theme parks, merchandise, streaming services, and consumer products enhances customer engagement and creates long-term loyalty.

- Strong Position in Streaming:

Disney's entry into the streaming market with Disney+ leverages its content library and exclusive access to major sporting events through ESPN, positioning the company for success in the streaming industry.

- Diversified Revenue Streams:

Disney's diversified revenue streams from theme parks, movies, merchandise, and streaming services provide stability and resilience, mitigating risks associated with relying on a single revenue stream.

Source: Pexels

Other risks:

- Cord-Cutting and Streaming Wars:

The shift towards streaming services and intensifying competition in the streaming market pose risks to Disney's business model. Cord-cutting and new competitors challenge Disney's pay-TV subscriber retention and market share.

- Economic Exposure and Downturns:

Disney's operations are sensitive to economic conditions, with consumer spending on entertainment and travel being discretionary. Economic downturns can impact theme park visits, movies, and merchandise sales, affecting Disney's revenue and profitability. Exchange rates and global economic conditions also pose risks to its international operations.

- Technological Disruptions and Cybersecurity:

Rapid technological advancements and the rise of virtual and augmented reality can disrupt traditional entertainment experiences. Disney faces the risk of changing consumer preferences. Additionally, cybersecurity threats expose Disney to data breaches, potentially damaging its reputation and operations.

- Regulatory and Legal Challenges:

As a global company, Disney encounters regulatory and legal challenges across jurisdictions. Compliance with content distribution, data privacy, intellectual property, and antitrust regulations is crucial. Non-compliance or regulatory changes can lead to fines, legal disputes, and reputational harm.

B. Opportunities for growth and expansion: Is Disney a Buy?

Disney is all about pushing boundaries and making dreams come true. They're not afraid to embrace innovation and take bold steps to connect with audiences in extraordinary ways. Through hefty investments in cutting-edge technologies and platforms, Disney is expanding its horizons and reaching out to international markets, especially in Asia, where the hunger for captivating content is on the rise.

But that's not all - Disney's streaming services are at the forefront of their grand vision. With Disney+, Hulu, ESPN+, and Star+ in their arsenal, they're leaving no stone unturned to deliver an unparalleled viewing experience. They're constantly expanding their content library, making sure there's something for everyone. The result? An outpouring of love and success as audiences worldwide flock to join the Disney streaming revolution.

But wait, there's more. Disney isn't content with just ruling the screens. They're on a mission to conquer new frontiers. Theme parks, cruise lines, and consumer products are just a taste of their diverse business ventures. Always at the forefront of technology, they're delving into virtual reality and augmented reality, crafting mind-bending experiences that transport audiences to unimaginable realms.

DIS stock trading tips

You may be wondering how to buy Disney stock, here are some strategies for buying and selling Disney stocks:

- Long-Term Investment Strategy:

Investors can buy Disney stock with a long-term perspective, considering the company's brand strength, diverse revenue streams, and growth potential. Holding the stock for years or decades allows investors to benefit from compounding returns and ride out market fluctuations.

- Technical Analysis and Short-Term Trading:

Investors with a shorter horizon can use technical analysis to identify short-term trends and trading opportunities. By studying price patterns and market indicators, traders can make buy or sell decisions based on short-term price movements.

- Dollar-Cost Averaging:

Dollar-cost averaging involves investing a fixed amount regularly in Disney stock at predetermined intervals. This strategy helps mitigate the impact of market volatility and removes the need to time the market. Consistent investing over time can reduce the risk of making decisions based on short-term price fluctuations.

Risk management techniques for minimizing losses

- Diversification:

Diversification is an essential risk management technique that spreads your investment across different asset classes, industries, and geographic regions. By diversifying your portfolio, you reduce the impact of a single investment's poor performance on your overall portfolio.

- Stop Loss Orders:

Stop-loss orders are an effective tool for limiting potential losses in individual investments. A stop loss order is a pre-set sell order automatically executing when a stock reaches a specified price. By setting a stop loss order, you establish a predetermined exit point for your investment, allowing you to limit losses if the stock price declines. This technique helps prevent emotional decision-making and protects against substantial downturns in individual stocks.

- Regular Portfolio Review and Risk Assessment:

You see, regularly reviewing and assessing your investment portfolio is essential for effective risk management. Conducting periodic portfolio reviews helps identify potential risks and areas of vulnerability. Analyze the performance of individual investments, monitor market trends, and assess changes in your risk tolerance.

23 analysts offering 1-year price forecasts for Walt Disney Company have a max estimate of $147 maximum and $88 minimum.

Techniques for analyzing market trends and predicting future price movements

- Momentum:

Momentum analysis focuses on identifying and following trends in price movements. It uses indicators like moving averages or RSI to spot potential buying or selling opportunities based on the strength of price movements.

- Mean Reversion:

Mean reversion assumes that prices tend to move back towards their average levels after deviating. Traders using this strategy look for overbought or oversold conditions and anticipate price corrections. Indicators like Bollinger Bands or stochastic oscillators can assist in identifying mean reversion opportunities.

- Martingales:

Martingales is a mathematical concept used in market analysis. It involves doubling the position size after a loss, with the expectation of eventually achieving a winning trade that covers the previous losses.

Tips for creating a portfolio that includes Disney stock

- Assess Risk Tolerance and Investment Goals:

Before investing in Disney stock, it's crucial to assess your risk tolerance and investment goals. Consider your time horizon, financial objectives, and comfort level with market volatility. Determine how much risk you're willing to take and align your investment strategy accordingly.

- Diversify Your Holdings:

Diversification is key to managing risk. While adding Disney stock to your portfolio can be a good move, ensure you have a well-diversified portfolio across different asset classes and industries. Include a mix of stocks, bonds, and other investment options to spread risk and optimize returns.

- Research and Monitor Disney's Financial Performance:

Stay informed about Disney's financial performance and industry trends. Regularly review the company's financial reports, earnings announcements, and news updates. Analyze factors such as revenue growth, earnings stability, and market share to assess the company's overall health and prospects.

- Consider Long-Term Growth Potential:

When considering Disney stock, evaluate its long-term growth potential. Analyze Disney's expansion into streaming services, its extensive intellectual property portfolio, and its ability to adapt to changing consumer preferences. Assess the company's competitive position and prospects for sustained growth.

Why You Should Trade DIS Stock CFD at VSTAR

VSTAR redefines your trading experience with cutting-edge features and services. VSTAR's goal is to make your journey in the financial markets exceptional.

Enjoy industry-leading tight spreads starting from 0.0 pips, maximizing your potential profits with ultra-low trading costs.

With VSTAR's top-tier deep liquidity, your orders are matched with the best prices available, ensuring seamless entry and exit positions.

Trade confidently with VSTAR's flexible leverage options up to 1:200.

VSTAR's user-friendly trading app simplifies the process, providing an easy-to-use interface and a mobile-enhanced trading experience.

Join VSTAR quickly and start trading in no time with our seamless registration process and fast KYC procedure.

As a regulated broker authorized by CySEC, VSTAR adheres to the highest standards of compliance and investor protection.

Practice your trading strategies risk-free with VSTAR's demo account before diving into live trading.

Experience a new dimension of trading with VSTAR, and get the empowerment and support you need every step of the way.

Conclusion

Disney, a global entertainment powerhouse, has a rich history and a diverse portfolio of products and services that contribute to its continued success. Its business model, focused on creating magical experiences and captivating content, has proven highly profitable. While facing risks such as cord-cutting and economic downturns, Disney employs strategic initiatives and risk management techniques to mitigate challenges and maintain its market position. Disney's future outlook is promising, with opportunities for expansion in international markets, streaming services, and innovative content creation. The company's adaptability and strategic partnerships will contribute to its continued success.

FAQs

1. What's the highest Disney stock has been?

The highest Disney stock price to date is $181.75, which was reached in March 2021.

2. What was Disney worth in 1957?

Disney went public in 1957 at an initial price of $13.88 per share, valuing the company at approximately $31 million at the time.

3. Did Disney split its stock?

Yes, Disney has split its stock several times over the years.

4. What is the fair value of Disney stock?

Based on discounted cash flow models, the estimated fair value of Disney stock today is around $120-130 per share.

5. What is the target price for DIS stock?

The average analyst 1-year target price for DIS stock is currently $126.

6. What is the prediction for Disney stock?

Most analysts are moderately bullish on Disney stock, forecasting low double-digit upside over the next 12 months.

7. What is the Disney stock forecast 2025?

Looking further ahead, the average forecast calls for Disney stock to reach around $165 by 2025, representing an upside of about 80% from current levels.