Many crypto enthusiasts are familiar with Dogecoin and Bitcoin- two popular cryptocurrencies. Although Bitcoin started as a challenge to the central nature of the traditional currency while Dogecoin was meme-inspired, they have captured the attention of the media, government and influential individuals.

With cryptocurrencies continuing to make headlines, many investors are switching to the market. In 2021, more than 100,000 investors held one million dollars or more in Bitcoin. Bitcoin and Dogecoin have proved their potential for providing financial gains to traders.

Are you curious about the differences between Bitcoin and Dogecoin as well as choosing the best option for investment? Then, you are at the right place. This article will explore the critical differences between Bitcoin and Dogecoin.

Introduction to Dogecoin and Bitcoin

Bitcoin, launched in 2009, is the first cryptocurrency created as a hedge against economic inflation. It operates on blockchain technology that secures and records transactions. Bitcoin is a peer-to-peer currency that works on a decentralized network- the government or third-party central financial institutions cannot regulate it.

Dogecoin was launched in 2013 by Jackson Palmer and Billy Markus as a reaction to the trending "dog meme" of a Shibu Inu. It is not an effective store of value because the market capitalization is unlimited. Dogecoin is an open-source altcoin built by copying the source codes from Bitcoin, Lucky Coin, and Litcoin.

Supply, mining process, range of adoption, infrastructure, and effect on the climate are some critical areas where Bitcoin and Dogecoin are contrasting.

Similarities between Bitcoin and Dogecoin

Bitcoin has the first and reference codes for other cryptocurrencies. Therefore, it is a pioneer cryptocurrency. When we talk about crypto, many individuals unconsciously think of Bitcoin. The first comparison between Bitcoin and Dogecoin is their codes. Dogecoin is a Lucky Coin fork, which is a fork of Litecoin, and a fork of Bitcoin. In other words, the developer of Dogecoin copied codes from Bitcoin, Lucky Coin, and Litecoin.

Another similar factor between Dogecoin and Bitcoin is the use of a proof-of-work consensus mechanism. It is necessary for verifying transactions and mining.

Furthermore, Bitcoin and Dogecoin can be used to make a payment or as a store of value. In other words, you can buy Bitcoin or Dogecoin, hold them until the price increases, and sell them to make a profit.

A Brief History of Dogecoin and Bitcoin

Billy Marcus and Jackson Palmer, the generators of Dogecoin were friends on Reddit. They created Dogecoin as a joke, but to their greatest surprise, it was well received by crypto fans all over the globe. In the early days of launching Dogecoin, the active community on Reddit played a role in sustaining and creating awareness about it. Surprisingly, many investors were adopting Dogecoin mainly due to its low price (a small fraction of the penny) and its abundance (no limit to supply)

After a hacking incident, Dogecoin was trending on social media on December 25, 2013. This indirectly increased the awareness around Dogecoin as it went viral on TikTok. A TikTok challenge caused a 600% price spike; at the end of 2020, the price was half a penny. Later on, Elon Musk openly supported Dogecoin, and the price rose to 70 cents. Snoop Dogg and Mark Cuban are other influential people that affected the price of Dogecoin.

Bitcoin is undoubtedly the most popular cryptocurrency. Although it did not have much value when it was launched, it reached an all-time high of $65,000 in 2021.

As a result, co-operations and governments are recognizing and adopting it as a legal means of transaction. One unique feature of Bitcoin is its limited supply. Bitcoin's supply is capped at 21 million, making it a deflationary asset. In addition, Bitcoin was created as an alternative to "traditional money" and a store of value.

The journey of Bitcoin has been anything but smooth. You can read a recent article here that gives a comprehensive analysis of the history of Bitcoin from its inception in 2009 until date.

Mining Process of Dogecoin and Bitcoin

Mining Bitcoin involves solving complex mathematical problems; the difficulty level is about 3.5110606 X 1012. In addition, it demands powerful computers and a massive supply of electricity- about 91 terawatt-hours of electricity annually. The energy requirement for mining Bitcoin is quite substantial and a cause for worry among environmentalists. Bitcoin mining is the process in which transactions are verified and the miner is rewarded after the block is added to the network.

Mining Dogecoin difficulty is about 2.7983 × 106 and does not require as much energy as Bitcoin. Dogecoin miners perform complex calculations to validate transactions on the network. When the transaction is confirmed, a new block is added to the network, and the miner is rewarded.

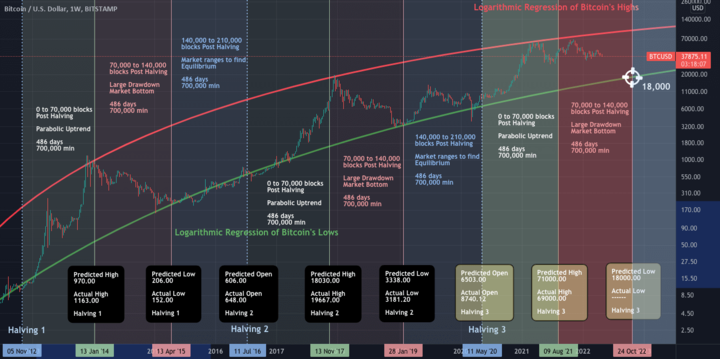

Halving affects the reward for mining Bitcoin. This event occurs every four years, whereby the reward for mining Bitcoin falls by half. Bitcoin halving occurred in 2012 and 2016 and they caused an increase in BTC's value. Another halving took place in 2020, after which BTC's value skyrocketed in 2021. As a result, the current reward for mining BTC is 6.25BTC per block. Halving is critical to Bitcoin to control the circulating quantity due to the limited supply.

On the other hand, Dogecoin has stopped halving activities. Therefore, miners can earn as much as 10000 Doge per block. In addition, creating a block for a Dogecoin consumes less energy- about 2.35 terawatt-hours of electricity annually.

The algorithm (a set of rules every cryptocurrency follows for mining) for Dogecooin mining is Scrypt, while that of Bitcoin is SHA-256. Block time (the time taken to verify a new block of transactions) is one and ten minutes for Dogecoin and Bitcoin, respectively.

Technical Differences: Difference in Blockchain Technology between Dogecoin and Bitcoin

Bitcoin runs on blockchain technology, a secure decentralized network that stores all transactions. Since the Dogecoin source code is closely related to Bitcoin, its blockchain technology is similar. However, the security of the network sets both cryptocurrencies apart. Bitcoin security is more reliable and advanced because the hash rate exceeds 238 ExaHash per second (EX/s). On the other hand, Dogecoin's hash rate is about 540 TeraHash per second (TH/s).

One TeraHash equals one trillion hashes, while one ExaHash equals one quintillion hashes. This implies that a cyber-attack to own the majority (51%) of the hashing power against Dogecoin is simpler but almost impossible on the Bitcoin network.

Differences in Transaction Times and Fees

Although Bitcoin a top cryptocurrency, the transaction time is one area where Dogecoin has an edge. The transaction time on the Dogecoin network is as low as a minute but as high as 10 minutes on the Bitcoin network. Bitcoin is more popular, and therefore traffic is higher, which could cause a lag in transaction time.

The average fee of the Bitcoin network is $0.69-$1.70 per transaction. On the other hand, the fee per Dogecoin transaction is between $0.24- $0.74, depending on the market value.

Differences in Supply Limits and Emission Rates

Another significant difference between Bitcoin and Dogecoin is the supply. The supply of Bitcoin is limited, but the opposite is the situation with Dogecoin.

The impact of Bitcoin mining on the environment is severe thanks to carbon dioxide (a greenhouse gas) emission. Bitcoin mining produces "62 megatons of "carbon-dioxide equivalent each year." One study indicated that "in 2020 BTC mining used 75.4 TWh/year of electricity, which is more energy than used by Austria (69.9 TWh/year in 2020) or Portugal (48.4 TWh/year in 2020). However, some argue that Bitcoin mining is adopting renewable resources to reduce the environmental impact.

Since Tesla's CEO, Elon Musk, partnered with Dogecoin developers, the carbon emissions dipped by 25%- from 1,423 tons of emissions released in 2021 to 1,063 tons in 2022. Reducing carbon footprint is a factor that can increase the adoption of Dogecoin.

Adoption and Acceptance of Dogecoin and Bitcoin

According to Chainalysis, the adoption rate of Dogecoin has skyrocketed since its 2017 bull market. About 82% of Dogecoin is held by about 535 investors holding over 10 million each. The chief economist at Chainalysis noted that few wealthy people hold the majority of Dogecoin. As a result, there is a potential for Dogecoin to be used in business.

At the end of 2022, MyDoge Wallet on Twitter announced a new feature that allows investors to buy gift cards with Dogecoin. This is an attempt to increase the adoption of Dogecoin, possibly to drive up the price. However, this news has yet to trigger an increase in the market value of Dogecoin.

Bitcoin's acceptance is evident, as it has grown from an almost worthless coin to a global sensation. The adoption of Bitcoin is also growing as the cryptocurrency has proved its resilience over the years. Mainstream financial institutions are adopting Bitcoin- a process called institutionalization. JPMorgan and Goldman Sachs are examples of big names adopting Bitcoin in their operations. This growing adoption can cause price stability, increased liquidity, and further adoption of Bitcoin.

Dogecoin's popularity in social media and the meme culture

Dogecoin is the most popular meme cryptocurrency. Meme coins are often created as a joke, but online communities usually maintain their relevance. The online communities comprise Millennial, Gen Z, and youthful minds.

Meme coins have gained traction due to influential figures like Elon Musk, Snoop Dogg, and Mark Cuban showing open support. The influence of Elon Musk on the popularity of Dogecoin is significant. Elon's companies accept Dogecoin as a means of payment for goods. He also proposed a partnership with McDonald's to accept Dogecoin for food. However, McDonald was not too keen on the idea.

Mark Cuban, the owner of the NBA's Dallas Mavericks, does not hold out on his support for Dogecoin. In 2021, he announced that the NBA team would accept Dogecoin in exchange for tickets. Cuban encouraged the adoption of Dogecoin because it is simple and easy to use.

Market Capitalization and Value: Dogecoin and Bitcoin

In terms of market capitalization, Bitcoin has the lead over Dogecoin. The market capitalization is about $8.5 billion and $387 Billion for Dogecoin and Bitcoin, respectively. Over the years, Bitcoin has been hitting new all-time highs incomparable to Dogecoin. Before Dogecoin could reach a $1 billion market cap, Bitcoin had already exceeded $100 billion.

However, Doge has the potential for growth. Therefore, with increasing adoption, market capitalization could increase over time. The current market value of Dogecoin is 0.084 USD. On the other hand, the current value (21/04/2023) of Bitcoin is 28,207.60 USD.

Impact of Market Volatility on the Value of Cryptocurrencies

The cryptocurrency market is highly volatile, and volatility can be described as the deviation in the price of crypto assets. For example, the demand, supply, social media hype, government regulation, and public sentiment can affect the price of Bitcoin. These factors create the volatility associated with the value of cryptocurrencies.

Volatility is a measure of risk to consider before investing in any cryptocurrency. The reality is that cryptocurrencies are more volatile than "traditional currency" due to their decentralized network and smaller market size.

Potential Risks and Rewards of Investing in Dogecoin or Bitcoin

Bitcoin is the oldest and most popular coin in the market, which operates on a decentralized network. Transactions are completed using public and private keys to enhance anonymity and security. One advantage of Bitcoin is it is more than a payment system and a better alternative for long-term investment. In addition, Bitcoin has a team dedicated to updating its technology.

Sustainability and scalability are primary areas of concern regarding Bitcoin. In addition, mining Bitcoin is very expensive and may negatively affect the planet.

Dogecoin may have started as a joke, but the network can process more transactions per second than Bitcoin. Due to the low market value of Dogecoin, it is a good place for beginners to start their cryptocurrency journey. In addition, Dogecoin has a very supportive community, which is one of the reasons why the coin has survived.

One of the fears surrounding Dogecoin is the absence of a supply cap, which may lead to extreme inflation. Another risk to investing in Dogecoin is its lack of utility. In addition, the low price of a cryptocurrency like Dogecoin may not always be good. Some investors who do not understand how the market works may be tempted to make significant

Potential Future Developments of Dogecoin and Bitcoin

The market supply of Bitcoin is limited. Therefore, many investors will likely consider it a long-term investment. On the other hand, Dogecoin will be considered a short-term investment to make a quick profit.

Bitcoin is a well-thought and funded ecosystem, which cannot be said for Dogecoin. Some crypto experts worry that once the enthusiasm for the meme coin declines, Dogecoin may become redundant.

The adoption and performance of Bitcoin and Dogecoin is paving the way for the future of cryptocurrency. The decentralized nature of Bitcoin provides a level of credible, transaction speed and security that cannot be rivalled by “traditional currency.” Therefore, many organizations accept the use of Bitcoin.

On the other hand, Big organizations like Tesla, NBA Dallers Maverick are accepting Dogecoin in exchange for goods and services. Nevertheless, volatility and hackers attack are factors that can affect the future impact of Dogecoin and Bitcoin on the economy.

Which Is Better for Investment: Bitcoin Vs Dogecoin?

Volatility is a general issue around cryptocurrency, but Bitcoin has proved reliable. However, whether Dogecoin can survive over the long term remains to be seen as the years' progress.

The price of Dogecoin largely depends on social media influencers. For example, in 2020, Elon tweeted about his support for the project. As a result, the price of Dogecoin increased by over 20%. Moving on, at the beginning of April 2023, Elon changed Twitter’s logo to the Doge meme, which caused the price of Dogecoin to rise to about $0.10.

Therefore, the meme coin is unsuitable for long-term investment for several reasons- unlimited supply, low price, limited adoption, etc. However, the short term price trends makes it suitable for CFD trading.

Cryptocurrencies like Bitcoin, suitable for long-term investments, have a high chance of bouncing back after a downtrend. In addition, the price trend of Bitcoin is relatively stable and the long-term appreciation is larger. As a result, they can maintain a competitive advantage over other cryptocurrencies in the market.

The cryptocurrency industry is highly speculative, so that nobody can give a 100% guarantee of its future. A mainstream cryptocurrency like Bitcoin is a better choice for investment. On the other hand, Dogecoin has limited utility, which experts find to be unsustainable.

The main advantage of Doegcoin over Bitcoin is the speed of transactions. However, the Bitcoin network is more secure.

Factors that Influence the Choice of Investment

Several factors determine which option is best for you. They include individual preferences, investment goals, and risk tolerance.

Individual preference

One of the factors that can influence your choice between Bitcoin and Dogecoin is a personal preference. Bitcoin is a more established currency with higher market capitalization and a better performance track record. On the other hand, Dogecoin is driven by support from the Doge community and high-profile investors like Elon Musk and Mark Cuban. Therefore, you can choose your investment based on what you prefer.

Investment goals

Investment goals must be carefully decided as it plays a significant role in choosing between Bitcoin and Dogecoin. If you are looking for a more stable option for a long-term investment, you may want to consider Bitcoin.

Risk tolerance

Another critical factor to consider is your risk tolerance-the the ability to accept the outcome of risk and available plans to control or absorb the situation. Bitcoin and Dogecoin are volatile assets, but Bitcoin may be less risky because it has a longer track record. However, investors of Bitcoin or Dogecoin should have plans to minimize loss and increase profit.

Carry out Research

The power of knowledge cannot be overestimated. Before you make any final decision to invest in any cryptocurrency, dedicate time to research. The internet has made information readily available to the public. Your research should focus on market trends, price history, technology, factors affecting price, technical indicators, and events surrounding cryptocurrency.

Seek an Expert Opinion

Once you have gained research knowledge, seek a professional to assist you. Experts can provide valuable insights to help you navigate crypto investment's complex workings. In addition, speaking to an expert like Vstar can help you mitigate risks, understand the market, and make better investment decisions.

Vstar is an expert crypto broker with a reliable trading platform. We offer 24/7 customer support to clients to help them make the best decisions. You can also use our demo account to test your risk appetite to evaluate your trading goals. Vstar offers institutional-level trading experience, including the lowest trading cost, meaning tight spread and lightning-fast execution. In addition, we are regulated by CySEC, which is essential when choosing a broker.

Another reason why consulting an expert is critical is that they could offer better solutions. For example, trading CFDs may be a great alternative if you do not want to own Bitcoin or Dogecoin.

Bitcoin CFD or Dogecoin CFD is a trading method that provides leverage against the highly-volatile nature of the cryptocurrency market.

Trading CFD involves an agreement between two parties to exchange the price difference of an asset between when you open your position versus when you close it. CFD trading allows traders to implement flexible trading strategies. Investors can go long or short, depending on the market price prediction.

Conclusion

The main similarity between Dogecoin and Bitcoin is that the source code was forked from Luckycoin, a fork of Litcoin, which was also copied from Bitcoin. Dogecoin and Bitcoin differ in terms of supply, market capitalization, transaction speed, block reward, security, encryption, transactions per second, transaction fee, and block confirmation speed.

The crypto market is highly volatile; therefore, conducting research and consulting a professional is best before making investment decisions. Volatility is synonymous with cryptocurrencies, so it is difficult to predict the future of Bitcoin or Dogecoin. Bitcoin is older, more stable, and has greater adoption. However, the influence of Elon Musk and Mark Cuban could affect the future performance of Dogecoin.

Whether you are looking to trade Bitcoin, Dogecoin CFD, or other cryptocurrencies, Vstar is the place for you. Sign up today to experience a whole new level of trading!