Introduction to the FTSE 100

If you're keen to grasp the dynamics of the UK stock market, the FTSE 100 is your compass. This index comprises the largest 100 blue-chip companies listed in the UK, forming the backbone of the market. These companies drive about 80% of the UK's market capitalization, offering a substantial glimpse into the nation's economic pulse.

Imagine the FTSE 100 as a mirror reflecting the highs and lows of the UK's economic landscape. Whether you're an investor seeking opportunities or someone merely curious about market trends, the FTSE 100 serves as a benchmark. It tracks the collective performance of these major players, unveiling the overall health of the UK stock market.

Today, the FTSE 100 stands as a vital instrument to understand the UK stock market. As you explore investment avenues or satisfy your curiosity, remember this index as your trusted friend offering valuable insights so you can confidently make informed decisions.

Ways to Trade the FTSE 100

Image Source: Unsplash

Trading the FTSE 100 offers various avenues. Contracts for Difference (CFDs) are a popular choice, allowing speculation on price shifts without owning stocks. Whether prices rise (going long) or fall (going short), CFDs let you profit. Leverage is a key feature, enabling bigger positions with less capital. However, this also amplifies risks, potentially causing losses beyond your deposit. For a diversified approach, consider FTSE 100 Exchange Traded Funds (ETFs) that track the index's performance.

Both CFDs and ETFs present opportunities and risks, demanding research, strategy, and risk management. Careful decision-making is crucial when exploring FTSE 100 trading options.

CFDs (Contracts for Difference)

In the realm of FTSE 100 trading, CFDs offer a dynamic and accessible avenue to capitalize on market fluctuations. The ability to speculate on price movements, leverage your trades, and adapt to bullish and bearish scenarios makes CFDs appealing for traders seeking diversity in their strategies. However, it's vital to approach CFD trading with the right mindset to recognize the potential rewards and the corresponding risks.

Image Source: Unsplash

CFDs are versatile instruments that allow you to take advantage of the FTSE 100's fluctuations by predicting whether its prices will rise or fall. Here's a rundown of why CFDs could be an excellent choice for your trading endeavors:

No Ownership, All Opportunity

With CFDs, you don't own the underlying assets. Instead, you're making predictions about the price movements of the FTSE 100. This means you can get involved in the market without needing to hold the physical stocks.

Riding the Market Waves

Whether the FTSE 100 is on an upward surge or experiencing a downturn, you have the flexibility to go long or short. Going long means you're speculating that the prices will rise, while going short means you're anticipating a decline.

Magnifying Your Power

CFDs offer leverage, a tool that allows you to control larger positions with a fraction of the total trade value. This can potentially amplify your returns, making your trading capital go further. However, remember that leverage also heightens the risk factor.

Risk Management is Key

While the potential for profit is appealing, it's essential to recognize that CFDs come with inherent risks. The leverage that enables bigger positions can also lead to larger losses. Sometimes, your losses could surpass your initial deposit, underscoring the importance of understanding your risk tolerance.

FTSE 100 ETFs (Exchange Traded Funds)

Image Source: Unsplash

As you weigh your options for FTSE 100 trading, consider the role of ETFs in diversifying your approach. They provide an accessible and relatively lower-risk entry point, particularly for those seeking long-term investment in the index. Incorporating ETFs into your strategy can be an effective way to balance out the potential risks and rewards associated with other trading methods.

When it comes to trading the FTSE 100, Exchange Traded Funds (ETFs) offer a different route worth exploring. These funds provide exposure to the index by bundling its constituent stocks together. Here's why ETFs could be a valuable addition to your trading toolbox:

Comprehensive Index Exposure

FTSE 100 ETFs function by bundling together the constituent stocks that make up the FTSE 100 index. This means that when you invest in an ETF, you're effectively investing in a diversified collection of the UK's top 100 companies.

Reduced Risk Profile

One key advantage of FTSE 100 ETFs is their lower risk than more complex instruments like Contracts for Difference (CFDs). With ETFs, your potential losses are limited to the amount you've invested, which provides a level of protection for your capital.

No Leverage, Steady Growth

FTSE 100 ETFs typically don't involve leverage, which can be a double-edged sword in trading. While leverage can amplify profits, it also exposes you to greater risks. Conversely, ETFs offer a more stable growth trajectory without the inherent risk associated with leveraged products.

Options and Futures

Image Source: Unsplash

When considering ways to trade the FTSE 100, it's essential to explore the realm of Options and Futures - advanced instruments that offer unique opportunities for strategic traders. Options and Futures trading can offer experienced traders a way to magnify their exposure to the FTSE 100 and execute intricate strategies.

However, due to their complexity and risk factors, they may not be suitable for beginners or casual traders. If you're considering these instruments, invest time in educating yourself, seeking expert advice, and practicing on paper or in simulation before diving into the live market. Always remember, while the potential for rewards exists, so does the necessity for careful planning and risk management.

Here's a glimpse into how these instruments work and what they can offer:

Leverage and Strategy

Options and Futures allow traders to place leveraged bets on the directional movement of the FTSE 100 index. They can be used for speculative purposes, aiming to capitalize on potential price changes, or as part of hedging strategies to mitigate risk in a broader portfolio.

Higher Complexity, Potentially Higher Rewards

While Options and Futures provide advanced trading avenues, they come with a steeper learning curve compared to more straightforward methods like stock trading or ETFs. The complexity stems from the need to understand how options and futures contracts work and the factors that influence their values.

FTSE 100 Trading Strategies

Image Source: Unsplash

FTSE 100 trading strategies encompass diverse approaches to navigating the dynamic stock index. Traders employ technical analysis, scrutinizing historical data for trends, support, and resistance.

Additionally, fundamental analysis delves into economic indicators and events affecting constituent companies. Pair trading involves capitalizing on correlated securities, while range trading thrives on price oscillations within defined levels. Breakout strategies trigger trades upon breaching key thresholds. Hedging strategies mitigate risk exposure.

Merging these methods fosters a comprehensive approach to navigating the FTSE 100's complexities, offering a toolbox of tactics to adapt to market fluctuations and optimize trading decisions.

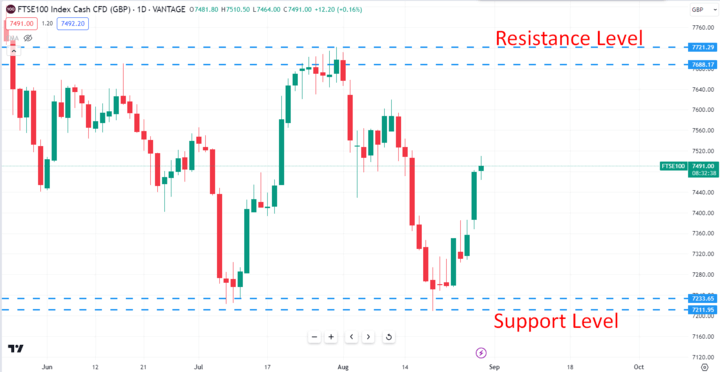

Technical analysis to identify support, resistance, trends

Image Source: TradingView

FTSE 100 trading strategies employ technical analysis to navigate market trends. Traders scrutinize price charts, seeking patterns that reveal potential support, resistance, and trend direction. Support marks the lower limit where demand is strong, preventing further price decline. Resistance, on the other hand, signifies the upper cap where supply surfaces, curtailing upward movement.

By identifying these levels and recognizing trend patterns, traders make informed decisions on when to enter or exit positions. This approach provides a framework to gauge market sentiment, helping investors anticipate price movements and execute trades with greater precision within the dynamic FTSE 100 landscape.

Fundamental analysis on UK economy, sectors, events

Image Source: Unsplash

FTSE 100 trading strategies leverage fundamental analysis to navigate the index's intricacies. Traders delve into the UK economy, scrutinizing indicators like GDP, inflation, and interest rates to gauge overall health. Sector-specific analysis dissects industry dynamics and company performance, influencing trading decisions. Key events, from policy shifts to geopolitical developments, are evaluated for potential impact.

By comprehending these broader factors, traders gain insights into market sentiment and the potential direction of the FTSE 100. This strategic blend of macroeconomic insights and sector-specific knowledge equips investors to make informed choices, balancing short-term fluctuations with long-term trends.

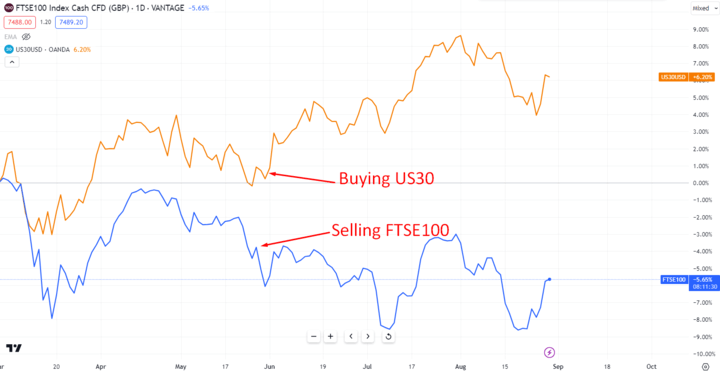

Pair trading by going long and short related securities

Image Source: TradingView

FTSE 100 trading strategies encompass pair trading, a nuanced approach involving simultaneous long and short positions in correlated securities. Traders identify related assets within the index, capitalizing on their historical price relationship. This strategy hinges on the assumption that any divergence in their performance will eventually correct itself.

By managing risk exposure to market fluctuations, pair trading offers a unique way to profit irrespective of overall market direction. This strategy demands diligent analysis of securities' historical behavior and the ability to exploit price differentials, making it a sophisticated tool in the FTSE 100 trader's arsenal.

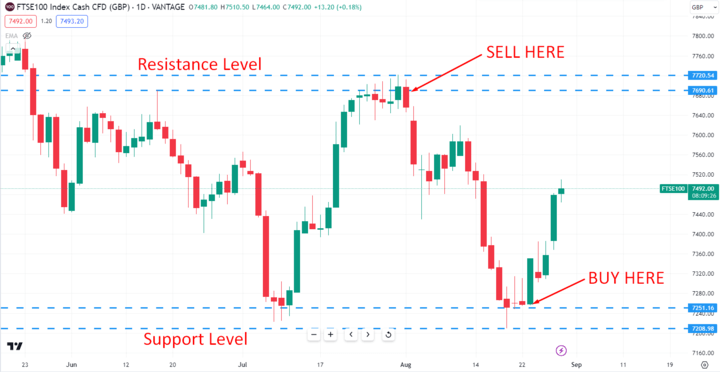

Range trading when the index oscillates between levels

Image Source: TradingView

FTSE 100 trading strategies incorporate range trading, a tactic reliant on identifying distinct price boundaries within which the index fluctuates. Traders pinpoint support and resistance levels to anticipate price reversals. This strategy capitalizes on the index's tendency to trade within established ranges, buying near support and selling near resistance. The approach requires disciplined execution and keen monitoring of price action.

Range trading offers opportunities to profit from predictable price movements, fostering a methodical approach to navigate the FTSE 100's natural oscillations while minimizing exposure to unpredictable market volatility.

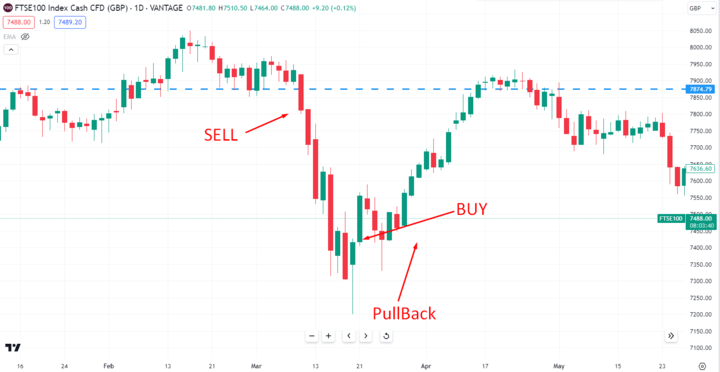

Breakout trading when prices breach key levels

Image Source: TradingView

FTSE 100 trading strategies encompass breakout trading, a dynamic approach centered on identifying pivotal price levels. Traders monitor the index as it approaches support or resistance thresholds, aiming to capitalize on strong price movements once those levels are breached. This strategy leverages the concept that breakouts can trigger significant shifts in price direction.

Successful execution demands swift action and risk management, as false breakouts can occur. Breakout trading harnesses the FTSE 100's potential for rapid price shifts, offering traders a method to seize opportunities as market dynamics evolve around key inflection points.

Hedging strategies to mitigate risks

Image Source: TradingView

FTSE 100 trading strategies encompass hedging tactics, crucial for risk mitigation. Traders employ derivatives like options or futures to safeguard against potential market downturns. They can hedge their existing investments by establishing offsetting positions, reducing exposure to adverse price movements. This strategy provides insurance against uncertainty, ensuring that losses are limited if the market takes an unexpected turn.

Hedging strategies play a pivotal role in maintaining portfolio stability and enabling traders to navigate the FTSE 100's fluctuations with greater confidence, balancing potential gains with risk management.

Managing Risks and Money Management

The FTSE 100, representing the top 100 UK-listed companies, offers a dynamic trading environment, but risk management is essential for success. Implementing effective strategies can safeguard your investments and improve overall outcomes.

Tight Stop Losses: Incorporate tight stop losses to limit potential downsides. This strategy allows you to exit a trade if the market moves against you, minimizing losses. Maintaining discipline and sticking to your stop-loss levels is crucial.

Appropriate Position Sizing: Proper position sizing is paramount. Avoid overexposure by investing only a fraction of your capital in each trade. This way, even if a trade goes awry, it won't significantly impact your portfolio.

Diversification: Diversify across various UK stocks rather than focusing solely on the index. This approach spreads risk across different sectors and companies, reducing the impact of poor performance from any single stock.

Broader Asset Allocation: Don't limit your portfolio to just the FTSE 100. Consider a broader asset allocation strategy that includes other assets like bonds, commodities, or international stocks. This diversification can further minimize risk.

Managing risk is as important as spotting profitable opportunities. By using tight stop losses, controlling position sizes, diversifying across stocks, and considering a wider asset allocation, you can navigate the FTSE 100 with confidence.

Remember, trading is a journey, and adopting these risk management practices will contribute to your long-term success.

Conclusion

The FTSE 100 offers a gateway to the UK's largest corporate players, presenting diverse trading avenues aligned with individual goals and risk appetites. Whether you're a conservative investor or a speculative trader, there's a strategy for you. Contracts for Difference (CFDs) provide a speculative means to profit from price fluctuations. However, regardless of your approach, effective risk management is the cornerstone of sustainable success.

By understanding your goals, practicing due diligence, and incorporating prudent risk management practices, you can confidently navigate the intricate landscape of FTSE 100 trading. Remember, every step you take and every decision you make contributes to your trading journey's outcomes. Start today and embrace the potential this renowned index can offer.