What is Hang Seng Index (HSI)

The Hang Seng Index is a market capitalization-weighted stock market index that tracks the performance of the largest companies listed in Hong Kong. It was first launched on November 24, 1969, and measures the performance of approximately 50 of the largest companies listed on the Hong Kong Stock Exchange. The Hang Seng Index is operated by Hang Seng Indexes Company Limited, a subsidiary of Hang Seng Bank, and has been compiled and published daily since its inception. The constituents of the index are drawn from the four major sectors of the Hong Kong economy - trade and industry, finance, utilities and property. The Hang Seng Index is regarded as a key indicator of overall market performance in Hong Kong and is an influential index in Asia. It provides a benchmark for institutional investors to manage their funds and gauge the overall health of the Hong Kong economy.

Hang Seng Index 50(HK50) trading hours

The constituents of the Hang Seng 50 Index are listed on the Hong Kong Stock Exchange (HKEX). The index has two main trading sessions each day - the first from 9:45am to 12:30pm Hong Kong time (01:45 - 04:30 GMT) and the second from 1:30pm to 3:15pm Hong Kong time (05:30 - 07:15 GMT).

Traders can follow the Hang Seng 50's live price movements and trade the index through brokers such as VSTAR.com from Monday to Friday during the extended market hours of 6:20am to 11:55pm Hong Kong time (22:20 GMT Sunday to 03:55 GMT Friday). The Hang Seng 50 chart on the VSTAR app allows traders to visually track the index's performance.

How is the Hang Seng Index 50 measured?

The Hang Seng 50 Index tracks the share prices of 50 major companies listed in Hong Kong. As with other stock market indices, changes in the individual share prices of the constituent companies will cause the overall index level to fluctuate throughout the trading day.

The Hang Seng 50 uses a free-float-adjusted market capitalization weighting methodology. This means that the index calculation takes into account factors such as the total market value of each constituent company's shares, the number of shares freely available for trading, and the closing price of the stock on the previous trading day.

Companies with larger market capitalizations have a greater weight and impact on the index. Smaller companies have less impact on the index movements. The Hang Seng 50 Index value is calculated in real time every 2 seconds during the Hong Kong Stock Exchange trading hours from 9:45am to 4:15pm Hong Kong time. This frequent calculation allows the index to closely track the performance of its constituents.

Why trade HangSeng Index 50?

The Hang Seng 50 Index is an important benchmark for the Hong Kong stock market. It tracks the performance of the 50 largest and most liquid companies listed on the Hong Kong Stock Exchange. The Hang Seng 50 provides traders with exposure to the top blue-chip stocks that dominate Hong Kong's financial-heavy market.

As a bellwether for Greater China and emerging Asia, the Hang Seng 50 is an important barometer of the region's economic health. The index comprises the most heavily traded stocks in Hong Kong, making it popular for its liquidity and ability to profit from volatility.

Traders are attracted to the Hang Seng 50 because its constituents can experience significant price swings on a daily basis. Compared to other major Asian indices, the Hang Seng 50 is known for its often dramatic price movements. This makes it attractive to short-term and day traders looking to capitalize on both up and down price movements. The high volatility and liquidity of the Hang Seng 50 stocks provide ample trading opportunities for those looking to profit from short-term momentum.

Benefits of Trading HK50

Good for Day Trading

The Hang Seng 100 is an ideal index for day trading strategies. Its constituents experience frequent volatility and price swings. This dynamic price action allows short-term traders to capitalize on momentum and trends. The HS50 gives day traders exposure to 50 large, liquid Hong Kong stocks that regularly exhibit exploitable short-term moves. By closely following the index's components and technical levels, intraday traders can identify opportunities to profit from the index's price fluctuations. The Hang Seng 50's volatility and liquidity make it a great choice for day trading Hong Kong stocks.

Keeps up with China’s economic growth

The Hang Seng 50 Index offers traders exposure to the booming Chinese economy. As China's economy has experienced tremendous growth in recent years, this index allows traders to capitalize on this expansion. Investing in the Hang Seng 50 offers the opportunity to participate in the world's second-largest economy as it continues its upward trajectory.

What moves the HK50 index's price

● Economic and Political Events

The Hang Seng 50 Index is heavily influenced by economic and political events in mainland China. This is due to the index's geographic proximity to China and the large number of large Chinese companies that are constituents of the HS50.

Developments in the Chinese economy, including growth rates, policy changes and trade data, can have a significant impact on the share prices of mainland companies listed in Hong Kong. As these Chinese companies make up a significant portion of the Hang Seng 50, their performance will affect the overall index.

Similarly, China's trade relations with other major countries, such as tensions over tariffs and trade wars, affect the business prospects and stock valuations of its largest companies. Given China's outsized role in Hong Kong's economy and stock market, events on the mainland are often the main driver of price movements and investor sentiment in the Hang Seng 50. Traders closely follow news and data from China when analyzing the outlook for the index.

● Earning Report

The Hang Seng 50 Index can be significantly affected by the earnings reports of its constituent companies. When major constituents of the index release their quarterly or annual earnings results, it is important to check whether the reports cause large changes in the company's market capitalization.

Stocks that have a significant weight in the Hang Seng 50 can have an outsized impact on the index. If one of these heavyweights reports earnings that are much better or worse than expected, it can cause a significant swing in the company's market capitalization. This, in turn, directly affects its weighting in the index calculation.

For example, if a prominent Hang Seng 50 component such as Tencent or AIA Group reports earnings that are significantly different from forecasts, causing the company's market capitalization to rise or fall sharply, it will drag the entire index down with it. Traders should closely monitor the earnings announcements of the largest HS50 members to predict potential volatility or directional moves.

● Currency Rates and Fluctuations

Currency fluctuations have a direct impact on the performance of the HS50. The index's constituents operate globally, so their profits depend on exchange rates such as HKD, CHF and JPY. Frequent changes in currency rates lead to volatility in the index price. As a HS50 trader, it is important to be aware of currency movements. Large currency fluctuations can significantly alter the valuation of the index and lead to trading opportunities. Monitoring the Forex markets and understanding how currency fluctuations affect HS50 companies will help traders take advantage of currency fluctuations.

How to trade Hang Seng Index 50

1. HK50 CFDs

As a trader, you can trade the Hang Seng Index live using CFDs (Contracts for Difference). CFDs allow you to go long or short in the market without going through traditional exchanges. You simply trade directly with your CFD broker for seamless execution.

The Hang Seng 50 Index has excellent volume and volatility as it consists of very liquid instruments. This makes it a popular index for CFD traders worldwide.

Trading Hang Seng CFDs is easy with VSTAR.com. Register and download the mobile app to trade the HK50 and other top global markets anytime, anywhere. VSTAR.com gives you the flexibility to capitalize on market moves with CFDs on the robust Hang Seng Index.

2. Trade Hang Seng ETF CFDs for Flexibility

ETF CFDs allow you to gain exposure to the Hang Seng Index with the ability to go long or short. Here are some of the key benefits:

- Implement strategic bullish or bearish positions based on your market outlook using ETF CFDs.

- Hedge exposure from existing stock portfolios by going short on Hang Seng ETF CFDs during expected downturns.

- Speculate on ETF price movements rather than the underlying index level. ETF CFD prices are based on the fund's net asset value.

- Enjoy the flexibility of not having to own the actual ETF shares, unlike traditional ETF investing.

Keep in mind, however, that ETF CFDs tend to have wider spreads and less liquidity than HS50 Index CFDs. Use both products to suit your trading style and strategies. ETF CFDs offer directional exposure, while HS50 CFDs allow you to trade the index itself with precision.

3. Trade CFDs on Individual Hang Seng Stocks

For more targeted exposure, trade CFDs on specific Hang Seng stocks rather than the entire index.

- Choose the individual companies you want to gain exposure to rather than the broader movements of the index.

- Take advantage of bullish or bearish strategies by going long or short with stock CFDs.

- Avoid the need to buy actual shares in your trades. CFDs allow you to simply speculate on price movements.

- The minimum commission per trade is HKD100, making it a cost-effective way to enter the stocks of your choice.

In summary, Equity CFDs give you flexible and targeted exposure to Hang Seng stocks according to your specific trading ideas. You can target opportunities in individual names while managing risk with stop losses. Just be aware of the higher financing costs and spreads associated with equity CFDs.

How to start trading the Hang Seng HK50

1. Start Trading the Hang Seng with a CFD Account

Opening a CFD trading account allows you to speculate on the movements of the Hang Seng without owning the underlying asset.

With CFDs, you make a small deposit to gain leveraged exposure to the full value of your chosen index, stock or ETF. Your profits and losses are calculated on the full position size. Leverage magnifies your gains and losses, so manage your risk accordingly.

Key Benefits of Trading the Hang Seng with CFDs:

- Go long or short to take advantage of rising and falling prices

- Leverage your capital for greater market exposure with less initial investment

- Hedge your portfolio by offsetting the risks of existing equity investments

- No shareholder voting rights or dividends as you do not own the asset

Overall, CFDs offer flexible trading options that allow you to take strategic positions based on your outlook. Manage risk wisely when trading with leverage. And consider using stop losses on all positions. Or you can practice your trading skills with a 30-day demo account with $100,000 in funds at VSTAR.

2. Build a trading plan and strategy

Choose your trading style

Before trading the Hang Seng, you should decide which trading style suits you best. Your trading style should match your risk tolerance and how actively you'll manage your positions. Common styles for beginners include

- Long-term investing - Take longer-term positions based on fundamentals. Requires less frequent trading.

- Swing Trading - Hold positions for days or weeks. Aim to profit from short-term price fluctuations.

- Day trading - Open and close positions within the same trading day. Requires constant monitoring of the market.

Use indicators for analysis

Use technical indicators to identify trading opportunities. Indicators such as moving averages, RSI and MACD can reveal momentum, support/resistance levels and overbought/oversold conditions. Combining indicators provides confirmation signals.

Read the price action

Analyze price charts to determine market sentiment and likely direction. Look for patterns such as double bottoms, head and shoulders, and flags/pennants. Candlestick charts also provide visual clues to supply and demand dynamics.

Practice risk management

Use stop losses on every trade to control potential losses. Consider position sizing to risk only a small percentage of your capital per trade. Maintain a sufficient account balance to withstand normal market fluctuations. And avoid overleveraging. Smart risk habits are key for beginners.

The right trading style, analysis, chart reading and risk management will help you trade the Hang Seng successfully as a new CFD trader.

3. Make Your First Hang Seng CFD Trade

CFDs allow you to profit from Hang Seng's price movements without owning the underlying asset. Here's how it works:

- Decide whether you think the Hang Seng will go up or down.

- Open a long position if you expect prices to go up. Open a short position if you expect prices to go down.

- Select your trade size and leverage. Leverage allows you to trade with more capital than you deposit.

- Set a stop loss to control potential losses. The stop loss will automatically close your position if the price moves against you by a specified amount.

- Monitor the trade. The profit or loss is the difference between the open price and the close price multiplied by the position size.

- When ready, close the trade by taking an offsetting position. For example, close a long trade by selling.

That's the basics for your first Hang Seng CFD trade! Start small to familiarize yourself with trade execution and risk management. Over time you can increase the size of your trades as you gain experience.

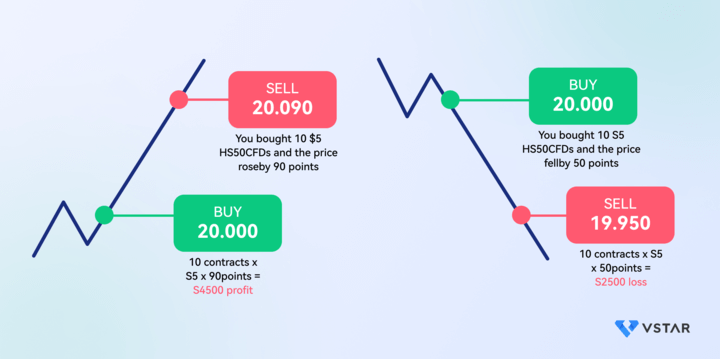

Example of Trading Hang Seng 50

Let's go through a sample CFD trade on the Hang Seng Index. Suppose the current price of the HS50 index is 20,000 and you believe it will rise.

You decide to buy 10 CFD contracts at $5 per index point. This means that for every point the index rises, you will make $5 per contract.

If the index rises to 20,090 before you close your position, you will make a profit of 90 points x $5 per contract x 10 contracts = $4,500. This does not include trading costs such as commissions and financing costs.

However, if the index falls to 19,950 before you exit, you would lose 50 points x $5 per contract x 10 contracts = $2,500. Again, not include costs.

The important things to remember are:

- You make or lose based on the price change between open and close.

- Your profit or loss is multiplied by the number of contracts and the contract value.

- CFDs allow you to profit from the rise or fall of an index without owning the underlying asset.

So in this example, the CFD trade allows you to profit from your bullish view on the Hang Seng while defining and limiting your risk exposure.

Why Trade HK50 with VSTAR?

- Leverage your trades with margin

VSTAR offers Hang Seng Index CFDs with 100:1 margin, giving you greater exposure with less initial capital. This leveraged trading allows you to open larger positions than your account balance would normally allow.

- Trade price movements, not assets

CFDs allow you to trade the price movements of the Hang Seng Index without owning the underlying stocks. You can speculate on the rise and fall of the index. CFD strategies such as long, short, stops and limits can be tailored to suit different trading objectives. Whether bullish or bearish, you can trade in both directions.

- Robust analysis for informed trading

VSTAR's interface-enhanced mobile platform provides real-time quotes, news and charts to inform your HK50 trades. Technical indicators, multiple chart types and market analytics help you perform analysis to inform your trading decisions.

- Security and Protection Priorities

VSTAR is committed to trader safety. Regulated by top authorities such as the CySEC, customer funds are segregated in bank accounts. Traders can withdraw funds 24/7. Strict privacy and security measures provide peace of mind.

The focus is on highlighting the benefits of trading Hang Seng CFDs with VSTAR, especially leverage, flexibility, analysis tools, and protection for traders.

FAQs

1. What is HKEX?

HKEX stands for Hong Kong Exchanges and Clearing Limited. It operates the Hong Kong Stock Exchange and related clearing houses. HKEX is one of the largest exchange groups in the world by market capitalization. It was formed in 2000 after the merger of Hong Kong's three financial markets - the Hong Kong Stock Exchange, the Hong Kong Futures Exchange and the Hong Kong Securities Clearing Company. HKEX facilitates trading in equities, derivatives, commodities, fixed income, and other products. It also provides market data, technology services and risk management products. HKEX is Asia's leading exchange and a gateway for international investors to China.

2. What is the Hang Seng 50 index?

The Hang Seng China 50 Index provides exposure to top Chinese stocks listed in mainland China and Hong Kong markets within a single index.