Metaverse stocks have become a hot investment theme, and it’s easy to understand why: the metaverse economy could be worth as much as $13 trillion by 2030. That’s bigger than the global electric vehicle market that is forecast to grow to just over $820 billion by 2030.

Before you wonder what the best metaverse stocks to buy now are, you would want to know what exactly is the metaverse to begin with. The metaverse is a digital space that people can enter into in their avatar form to work, study, socialize, and play among other things.

The crypto NFT platforms Decentraland and Sandbox are examples of the metaverse. You can purchase virtual plots of land on these platforms to develop into a residential space or commercial center for your own use or lease to others and earn money.

Although the metaverse already exists in some forms, it largely remains a work in progress. And here’s where the concept of metaverse stock arises. Metaverse stocks simply are stocks of the companies involved in building and operating this virtual universe called the metaverse.

Why Buy Metaverse Stocks?

The metaverse is going to impact virtually every industry. A major opportunity that the metaverse brings is marketing for brands. As a result, an increasing number of retail, fashion, auto, and real estate brands are trying to build a presence in the metaverse.

And governments are not being left behind in the metaverse as some countries have moved to extend their diplomatic missions to the metaverse with virtual embassies.

Therefore, the future of metaverse stocks looks promising in the short-term and long-term horizons. Because the metaverse impacts a diverse range of industries, investing in metaverse stocks is like getting exposure to the S&P 500 index.

If you’re interested in understanding metaverse stocks and their growth potential, this article has your back. The article features the top 6 best metaverse stocks to buy and hold or trade for short-term profit. These are: Meta Platforms (META), Microsoft (MSFT), Nvidia Corporation (NVDA), Roblox Corporation (RBLX), Unity Software (U), and Adobe (ADBE).

How to Invest in Metaverse Stocks

If you’re excited about metaverse investment opportunities for long-term growth or short-term profit, you can get exposure to metaverse stocks in a variety of ways.

The three common strategies of investing in metaverse stocks are: holding shares in the metaverse companies, trading metaverse stock options, and trading metaverse stocks CFD. Here’s a comparison of these metaverse stocks investing strategies:

1. Buying and Holding Shares in Metaverse Companies

This is the traditional method of investing in stocks. It begins with identifying fundamentally strong stocks. You then buy and hold the stocks for a period of time, such as a few months or several years.

Let’s say you purchase 100 shares of Microsoft stock at $275 apiece. After a year, the stock is up at $300 and you decide to sell your shares. That would mean a profit of $25 on each share and $2500 for your 100 shares.

Holding shares in a company can also qualify you for dividends. But only a few metaverse stocks pay dividends currently.

The problem with buying and holding shares is that you bet on the stock price moving in only one direction: up. But the reality with stocks is that prices fluctuate. Your stocks can be rising for most of the time but suddenly come down crashing and wipe out all the gains you might have accumulated over time. For someone trading stocks for short-term profit rather than holding for the long-term, every price fluctuation event presents a profit opportunity.

Another drawback of buying and holding shares is that it requires a large initial investment. From the example above, you would require $27,500 to buy the 100 shares of Microsoft stock.

If you're patient to wait for your shares to appreciate and don't mind missing short-term profit opportunities, buying and holding shares is the best strategy to capture long-term growth in metaverse stocks.

2. Trading Metaverse Stock Options

You can get exposure to metaverse stocks by trading option contracts. An option contract allows you to buy or sell a package of stocks at a preset price at a future date.

Option contracts are classified as Call or Put. You purchase a call option if you expect a stock to rise in the future. Let’s say that a stock is currently trading at $50, you may purchase a call option that allows you to buy that stock for $50 a month from now even if the price would have gone up to $60 at that time.

Similarly, you purchase a put option if you expect a stock to decline in the future. This works like shorting a stock. Let’s say that a stock is currently trading at $50. You may purchase a put option that allows you to sell that stock for $50 a month from now even if the price would have decreased to $45 at that time.

A stock option contract usually involves a package of 100 shares. That kicks up a few problems. First, you have little control over the number of shares to buy or sell in options trading. Second, you have little control over your investing costs.

The cost to purchase an option contract is called the premium and it is calculated per share. If a contract is priced at $3, a single option package of 100 shares would cost you $300 in premium. This cost is separate from the cost of buying the underlying shares in a call option contract.

Another problem with options trading is that the premium is like a non-refundable subscription fee. You don’t get back the premium if you fail to exercise your option to buy or sell the stocks represented in the contract.

Yet another issue with options trading is that contract values decline as the maturity date nears. If you purchased a contract for $3 per share a month to maturity, you would be forced to sell the contract for less than $3 if you want to pass the option to another trader less than a month before maturity.

If you're comfortable making a large initial investment and risking your premium, then options trading is a good way to get exposure to metaverse stocks.

3. Trading Metaverse Stock CFD

CFD trading involves predicting whether a stock price will rise or fall. This strategy involves buying or selling contracts, depending on the direction you expect the stock price to move.

When you buy a stock CFD, you’re betting that the price will go up. Similarly, when you sell a stock CFD, you’re betting the price will drop. You make a profit when your prediction turns out to be correct.

In CFD trading, your position size depends on the number of contracts bought. You may purchase any number of contracts depending on your broker. Your profit or loss is calculated per point of price movement. In CFD trading, you can time your trade to last a short as a few minutes or as long as weeks.

If a stock price moves from $250 to $255, that would be a 5-point movement. A point can be priced at $1, $5, 10, $20, and so on.

Let’s say you buy Meta Platforms stock CFD, which means you predict the stock price to rise. For that trade, you purchase 10 contracts and a point is valued at $10. Meta stock moves up 5 points, so your prediction turns out correct.

In this case, your profit is calculated by multiplying the 50 contracts you purchased by 5 points movement by $10 point value. The profit works out to a $500 profit.

CFD trading features the best of holding shares and trading options. This strategy makes it easier for traders to profit from short-term price fluctuation. Additionally, CFD trading makes it more flexible for traders to trade both rising and falling markets since you only predict price directions. Moreover, you can start trading stock CFDs with a far smaller amount of capital than you would need to hold stocks or trade options.

What to watch out for when trading stock CFDs are the broker fees and trading speed. High fees will erode your profit, so look out for reasonable fees. Since CFD trading is about taking advantage of short-term price fluctuation, you need a broker that can execute your trade quickly so you don’t miss an opportunity.

Why Trade Metaverse Stocks CFD with VSTAR

VSTAR offers access to a broad range of stock CFDs to suit every trader’s needs. Moreover, trading stock CFDs on the VSTAR platform can be more profitable given the platform’s tight spreads and low fees. VSTAR traders also enjoy superfast order execution as this is one of the most liquid CFD trading platforms.

If you’re new to CFD trading, VSTAR offers a demo account with up to $100,000. You can use the demo account to test your trading strategies and learn about the platform before you start investing real money.

VSTAR supports all the common payment methods, including credit cards, bank transfer, and various online payment services.

If you're wondering whether VSTAR is legit or safe, the platform is fully regulated by the CySEC.

What Are the Best Metaverse Stocks to Watch in 2023?

The metaverse has potential to bolster the economic prospects of many companies. But some companies look better suited for the metaverse success because the concept of a digital universe plays perfectly to their strengths.

If you’re wondering how metaverse stocks are changing the investment landscape, below are the top 6 metaverse stocks that investors can’t stop talking about:

Meta Platforms Inc (NASDAQ: META)

Meta Platforms is the operator of social media platforms Facebook, Instagram, and WhatsApp. The company also has a hardware division called Reality Labs. Meta Platforms, previously called Facebook, has bet its future on the metaverse to the extent that it rebranded to highlight this aspiration in its corporate name.

Socializing is going to be a major part of the metaverse. Meta is building the technologies that will power the social life in the metaverse. Meta’s social apps combined have nearly 3 billion daily active users globally.

Already the largest provider of social platforms, Meta is also developing gateways to the metaverse. The company’s Reality Labs unit builds virtual reality and augmented reality headsets that people need to enter the metaverse. The company is also building metaverse spaces for various groups, including a metaverse church platform.

Meta draws the vast majority of its revenue from offering online advertising services to businesses. With many brands launching metaverse initiatives, metaverse could extend Meta’s online advertising business opportunity.

Meta controls more than 80% of the social media market through its various social apps combined. The company’s revenue declined 1% to $116.6 billion in 2022 and profit fell 41% to $23.2 billion. Meta’s bottomline took a hit from the heavy investment in the metaverse initiatives.

The slow growth in the digital advertising market is among Meta’s biggest headaches. The company has to rely on its slowing advertising business to fund its expensive metaverse vision.

META stock price has climbed more than 60% since the beginning of 2023, making it one of the biggest gainers among the top metaverse stocks. Analysts have a consensus Buy rating on META stock with an average price target of $236.50, which implies about 10% upside potential.

Microsoft Corp (NASDAQ: MSFT)

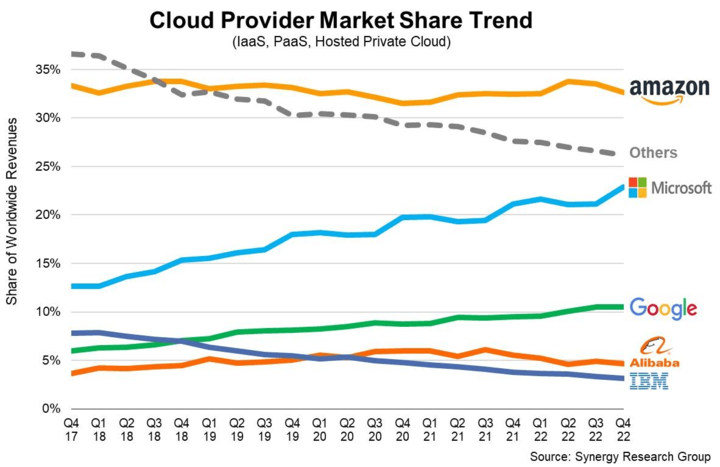

Microsoft is one of the most exciting metaverse stocks because of its multiple roles in building the digital universe of the future. Most investors know Microsoft for its Windows and Office software. But Microsoft is also one of the leading cloud computing providers, controlling 23% share of the global cloud market. Moreover, Microsoft provides powerful artificial intelligence technologies.

Since metaverse projects are largely built on cloud and leverage AI technology, Microsoft stands to benefit from metaverse-driven demand for cloud and AI services. Additionally, Microsoft’s Hololens AR hardware has a role in the metaverse as a gateway tool.

Microsoft’s revenue rose almost 18% to $198.3 billion in 2022, and profit increased nearly 19% to $72.7 billion.

MSFT stock has gained about 15% since the start of 2023. Analysts have a consensus Buy rating on MSFT stock with an average price target of $309.48, which suggests nearly 10% upside.

Although the metaverse could drive huge demand for Microsoft’s products, success may not come easily. For example, Microsoft faces stiff competition from Amazon and Google in the lucrative cloud and AI technology markets.

Nvidia Corporation (NASDAQ: NVDA)

Nvidia Corporation is a semiconductor company. The company is best-known for its graphics processors that power various applications from artificial intelligence systems to gaming machines.

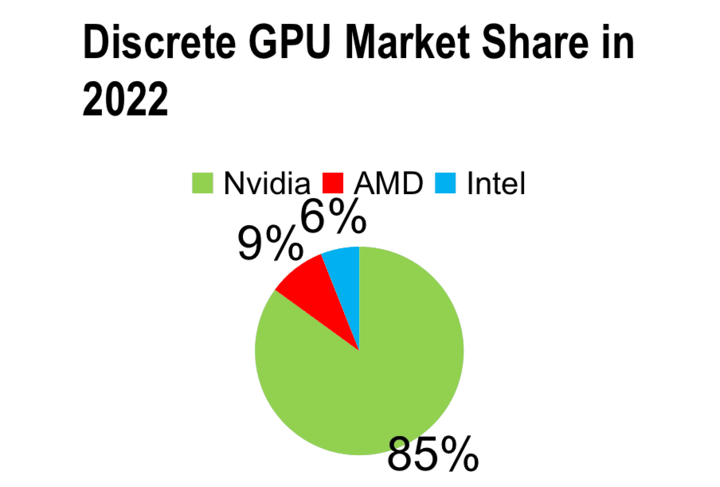

Nvidia dominates discrete GPUs (graphics processing units) category with 85% market share, easily trouncing Intel Corporation (NASDAQ: INTC) and Advanced Micro Devices, Inc. (NASDAQ: AMD).

Moreover, Nvidia has built a platform called Omniverse that developers can use to launch and operate metaverse apps. The metaverse promises to stimulate strong demand for Nvidia’s products and solutions to drive revenue growth.

Therefore, Nvidia is a strong candidate to consider if you’re looking for the best metaverse stock in the semiconductor industry.

Nvidia reported revenue of $27 billion for its fiscal 2023 ended January, mostly unchanged from the previous year. But profit dropped 55% to $4.4 billion.

But for Nvidia to make the most of the metaverse opportunity, it needs to successful defend its leading GPU market share in a highly competitive environment.

Nvidia stock price has gained over 80% since the beginning of 2023, making it one of the fastest-moving metaverse stocks. Analysts have a consensus Buy rating on Nvidia stock with an average price target of $286.94, which implies nearly 8% upside.

Roblox Corp (NYSE: RBLX)

Roblox is best-known for its digital games development platform. But the company is also big in the metaverse space. The Roblox Metaverse is a platform with resources for developers to build metaverse fun products.

Roblox makes money through advertising, membership subscriptions, and in-game purchases. The metaverse promises to bring more users to Roblox and expand the company’s revenue opportunities. Roblox has nearly 70 million daily active users globally and the number is increasing.

The company’s revenue rose about 16% to $2.2 billion in 2022. But the company is still making losses and reported a nearly $1 billion loss for 2022. The losses along with tight cash flow could cause funding challenges and slow down Roblox’s growth.

Roblox stock has gained more than 35% since the beginning of 2023, ranking it as one of investors top favorite metaverse stocks. Analysts have a consensus Buy rating on Roblox stock with an average price target of about $15, which suggests nearly 20% upside.

Unity Software Inc (NYSE: U)

Unity Software provides digital resources for creating 3D content. It serves gaming, auto, architecture, and film markets among others. The company controls about 50% of the game development software market.

The resources that Unity Software offers can be used to create things like avatars and digital cars and buildings for the metaverse life. As a result, Unity Software stands to benefit significantly from the metaverse content creation industry.

Unity’s revenue rose more than 25% to $1.4 billion in 2022. But the company is still making losses, reporting a loss of almost $1 billion for the year.

Unity’s strong position in the 3D software market gives it a head start in the race for metaverse creators spending. But the company operates in a highly competitive industry. As a result, Unity may be forced to sacrifice its profit margin to gain or defend its market share.

Although Unity Software stock has gained only about 2% since the start of 2023, this is one of the metaverse stocks with the biggest upside potential. Analysts have a consensus Buy rating on Unity stock with an average price target of about $42, which implies over 50% upside.

Adobe Inc (NASDAQ: ADBE)

Many people know Adobe as the Photoshop maker, but the company actually has a broad business. It provides a range of creative software and marketing services, making it a great fit for metaverse creators.

Indeed, Adobe has struck various important partnerships with companies like Unity Software and Meta Platforms to advance its participation in the metaverse space. Things like NFTs are expected to be a central part of the metaverse. Adobe provides software and tools that can be used to create NFTs and other virtual products for the metaverse.

Adobe’s revenue rose nearly 12% to $17.6 billion in fiscal 2022. The company reported a profit of about $4.8 billion, almost unchanged from the previous period. Adobe finished the year in a solid financial position with more than $6 billion in free cash flow.

The company’s biggest challenges are competition and piracy of its products. But Adobe has managed to grow its sales over the years even with these problems.

Adobe stock has gained about 10% since the beginning of 2023. Adobe is one of analysts’ favorite metaverse stocks. Analysts have a consensus Buy rating on Adobe stock with an average price target of about $397, which implies about 7% upside potential.

Final Thoughts

Metaverse stock has bright prospects considering the metaverse concept is set to impact a broad range of industries. The best metaverse stocks to watch in 2023 are: Meta Platforms (META), Microsoft (MSFT), Nvidia Corporation (NVDA), Roblox Corporation (RBLX), Unity Software (U), and Adobe (ADBE). These companies are working on vital technologies for the metaverse. As a result, they stand to reap many benefits if their efforts succeed.

The best metaverse stocks to buy are actively traded stocks. These are stocks that see large volumes of shares changing hands during trading sessions. Actively traded stocks are liquid, making it easy for CFD traders to open and close their positions quickly to capture short-term profit.