Nio Inc has been making headlines in the EV industry since it was founded in 2014, enough for industry experts to regard NIO Inc as the Tesla hunter. With its sleek, high-tech electric cars, the EV maker is gradually amassing a solid consumer base for itself but now, investors have more doubts than praise for the company.

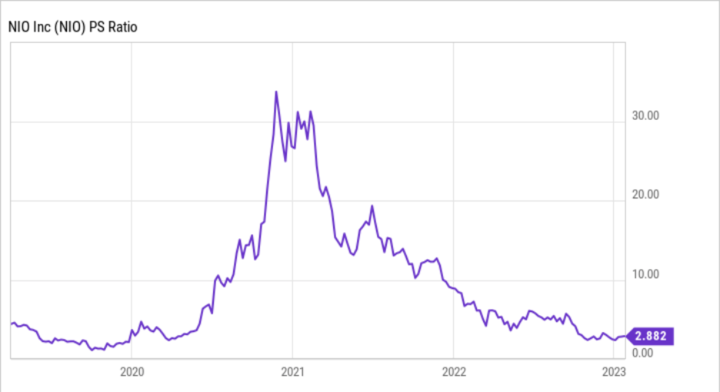

Nio stock price is down by 85% from its all-time highs and the stock price currently stands at $9. But despite its recent earnings miss, industry experts still regard NIO Inc as a good company to invest in. As EV sales continue to rise, NIO will become a more active player in the industry, taking on Tesla and pushing forward the adoption of EVs.

Trading and Investing in NIO Stocks and CFDs

The Chinese automaker is focusing on manufacturing smart EVs to improve autonomous driving and artificial intelligence. Investors who want to buy or trade Nio stock or CFD can use these strategies to achieve their goals.

Strategies for Investing in NIO Stocks

1. Value Investing: Value investing is an investment tactic where an investor buys stocks that appear to be trading for less than their book value. Investors who use this strategy, invest in stocks in the hopes that the stock price will eventually pick up as people come to appreciate the fundamentals of the company and its true nature.

But how does that apply to Nio stocks? Despite outperforming all US-based EV companies apart from Tesla, Nio is still undervalued and is also the cheapest EV stock compared to its Chinese rivals. NIO stock price forecast by industry experts has not been very positive with prediction that it will be between $12-$22 by the end of 2023. However, Nio has a strong top-line growth which is just below 40% and increasing delivery volume coupled with its production capacity means that you can get a growth stock like this at a bargain price.

2. Dollar-cost averaging: Rather than setting up your overall position size at once, dollar-cost averaging requires that you split up your investment into small sizes and buy the stock at smaller amounts at regular intervals over some time.

Nio share price is currently experiencing increased volatility due to the short-term obstacles the company is facing. Since there is still a high potential for the EV maker to return to its previous growth trajectory, Nio stock investing might be profitable as long as you use the right strategies. Therefore, using dollar-cost averaging enables you to invest in Nio stock and establish a reasonable position. In turn, barring unforeseen circumstances and allows you to invest consistently for long-term growth.

3. Momentum trading: For traders who are not confident in Nio’s potential enough to invest in the company, trading the stock is another way to generate profits from the momentum and volatility it is experiencing.

To take advantage of Nio using momentum trading, use technical indicators like trend lines, the Average Directional Index, stochastic oscillator, and moving averages to determine how strong the prevailing trend is. Although the current stock is currently in a downtrend, price movement is not static and there will be periods of highs and lows. Take a position in the direction of an uptrend and sell when you notice a reversal in the trend For instance if there is a divergence between the momentum indicators and price action, it is a possible sign that the momentum is weakening.

4. Long-term Hold: When people think of how to buy Nio stock, the first thing that comes to mind is long-term investment. Nio’s management is playing the long game and has released a lot of new products over a short period which has seemed to go unnoticed. Introducing such a wide range of products in a short time might affect their short-term growth but will gain more traction in the long run. Once its production capacity improves and increases the delivery of its strong lineup of models, Nio’s growth will pick up as everything falls into place.

However, if you plan on holding it long-term, make sure to do your research and aim to hold it for at least 3-5 years to enjoy the accruing profits.

Strategies for Trading NIO CFDs

CFD is a short-term trading method that typically involves a broker and trader trading the price difference of an underlying asset without having to own it. What makes Nio CFD trading strategies popular among traders and investors alike because you can trade regardless of the direction of the market. Whether the Nio share price rises or falls, all that matters is that you can accurately predict what the price is going to be.

Here are some strategies that can help you maximize Nio CFD trading:

1. Hedging: Hedging is a strategy primarily used to reduce trading risk. To do this, traders will open buy and sell positions of Nio CFD simultaneously. These positions must also be of equal value to offset any losses that could occur when trading. For instance, if the sell position results in a loss, the buy position will bring in profits of the same amount.

2. Scalping: Scalping works best if you want to trade Nio CFD in any direction. For this strategy, traders have to execute trades within seconds to minutes to get the most out of any trend. The best time frames to use for this are M5-M15 combined with technical indicators like trendlines, channel indicators, and chart patterns.

3. CFD day trading: Instead of holding Nio CFDs for days or weeks, day trading requires you to execute trades within 24 hours without rolling them over to the next day. This is a suitable method for trading Nio CFD because it is volatile and you can profit from both local corrections and intraday price movement.

To trade correctly, it is advisable to study the support and resistance levels from the previous day to decipher price movements when it arrives at those defined levels.

To trade correctly, it is advisable to study the support and resistance levels from the previous day to decipher price movements when it arrives at those defined levels.

Is Holding NIO stock long-term a good idea?

Nio was one of the EV companies that suffered the most in 2022 but is there any hope for its future? There are a lot of positive things working in favor of a profitable 2023 for Nio.

The company plans to start deliveries of five new products and also build up to 1000 power-swap stations. Although Nio's delivery numbers are relatively low, demand is still high for various reasons. Since Nio is ramping up production in its factories and moving to a new technology platform, the current fall in sales might be a short-term issue.

Management also expects Nio to break even this year and eventually rise back to $67 once the long-term foundation has been established. However, the problems facing the company cannot be ignored. Nio is struggling to grow its vehicles and gross margins. Plus, the company faces stiff competition from other companies like Tesla, Ford, Rivian, GM, and more; competition that it might not be able to stand against.

Nio might just be the perfect opportunity for a long-term investment, but it is advisable not to go all in at the beginning. Use position sizing and dollar-cost averaging to invest in Nio with reduced risk or trade the stock instead if you have no confidence in its long-term growth.

The Potential of NIO Stock Options

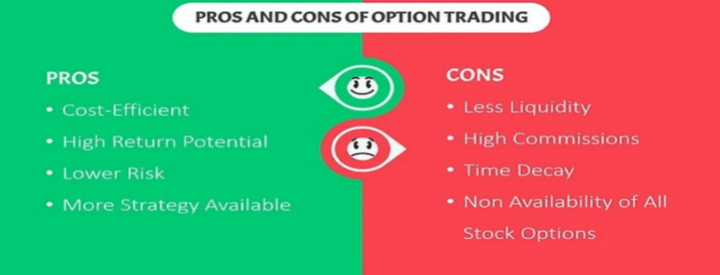

Investors who don't want to risk their capital holding Nio long-term by buying the stock outright can use stock options instead.

Buying Nio options gives you a significant hedge against losses and serves as a means of reducing the volatility of your investment portfolio. Plus, Nio stock options provide leverage for investors meaning that they get the same exposure as they would normally get but risk less capital.

Like all forms of investment, there are still significant risks involved in options trading. You could end up losing your capital and the loss will increase if leverage was used. Traders using options with speculative strategies like uncovered Nio calls will face increased losses since there is no limit to how high the stock price can rise.

Analysis of Trading NIO CFDs

Although analysts expect Nio stock to have a considerable increase by the end of the year, it is clear that the company’s current financials and decrease in stock price aren't increasing investor's confidence in the stock. February was particularly bad for the company as Nio stock price fell by nearly 25% and is currently trading below $9. While investors may consider adding Nio to their portfolio a risky move, it pays to trade its CFDs.

Nio stock remains very volatile with an expected monthly volatility of 16.2% and share price at $9.85 by May 2023. Currently Nio is trading between $8.75 and $10.75 and there is always the risk of encountering some resistance when the stock price tries to breakout at the resistance level. In addition, Nio stock CFD has an average trading volume of around 36.80 million making it possible for investors to profit from Nio CFDs. Most brokers offering CFDs also provide leverage meaning that you only have to trade with a small amount to make a good profit.

However, the stock's volatility increases depending on the timeframe. For instance the smaller the timeframe you are working with, the more volatility you are going to deal with when trading Nio CFD. So, take your time to evaluate the market and possible price changes before trading.

How to Trade/Invest in NIO Stock and its CFDs

If investing or trading Nio appeals to you, here's how you can easily achieve good results:

1. Choose a regulated broker

If you don't have one already, it is advisable to get a reliable broker. This way you can invest in Nio along with other tradable assets. These firms also provide platforms for easily making stock purchases and a convenient means to place orders and make quick trades.

Before you choose a broker, make sure it offers Nio and other preferred assets as part of its offerings. Another factor to consider is the number of fees or commissions you will have to pay. Most firms require you to pay account minimums and other fees to the platform to get the best perks. But if you have little capital or want to reduce your cost to maximize profit there are firms like VSTAR where you can start investing with little trading cost.

Once you choose VSTAR as an investment broker and create an account, you can trade Nio with $50 or more and execute trades quickly. The online broker also offers zero-commission trading allowing you to build your portfolio quickly.

2. Make an effective trading plan

A trading plan provides the framework that guides you through the trading process. Nio stock trading might be profitable but without an effective trading strategy, your success will be limited.

When creating a trading plan, decide on the amount of time you want to dedicate to trading and the number of assets or markets you wish to focus on. One crucial factor to consider in your trading plan is your risk appetite and how much capital you want to dedicate to trading. This can influence the financial instruments you use and help in shaping your trading style as well.

Plus, it is recommended to have a method of recording your overall trading performance or each trading day. Keeping a record of both your winning and losing trades, makes it easier to analyze what went wrong.

3. Improve your trading skills

The best stock traders who succeed in making a career out of trading always seek to improve themselves. There is always room for growth when trading and investing if you want to take advantage of the many opportunities the market provides. You can improve your skills by:

● Practicing: It always pays to use a demo account whether as a beginner or experienced trader because it gives you the chance to analyze the market without facing losses. By practicing, you can learn key principles of fundamental and technical analysis such as market cap, dividend yield, return on equity, moving average, RSI, stochastic oscillator, and more.

● Understand the Risks: Whether you choose to go long or short when trading, it is important to understand the risk your trading decisions carry. Let’s take a look at this example.

You spend $500 to purchase 55 shares at $9 expecting it to rise to $9.85 after a few weeks bringing in a total of $541.75. But due to the volatility of the market, the share price drops to $8. If you did not protect your trade against the reversal by using risk management tools, you will end up losing $60.

So, keep in mind that the market can change at any moment and hedge your existing investments against any losses.

How to invest in NIO Stock CFD with VSTAR

To invest or trade in Nio Stock CFD, you can:

● Create or log into your VSTAR trading account

● Search for Nio using the search panel

● Select your position size

● Choose your position whether short or long

● Confirm your order and set stop losses to monitor your position

4. Include proper risk management strategies

It is easier to get carried away with the desire for profits that you ignore the possibility of losses whenever you trade or invest. Incorporating risk management into your trading strategy right from the start, can minimize trading risk and protect your portfolio.

To manage the risks of trading, determine your exposure before entering into a trade. It is also advisable to set stop losses such as the trailing stop to mitigate losses.

Trading Tips for Nio Stock and CFDs

As an extremely volatile asset, Nio stocks and CFDs might be risky. But there is a way to harness this volatility for profits using certain Nio stock trading tips. To trade Nio successfully, you can:

Conduct technical analysis to identify market trends

Technical analysis for a stock investor is the foundation of success. It helps you to predict future price movements and market trends. It also provides valuable information for making profitable trading decisions. While fundamental analysis focuses on the use of news, or economic events, technical analysis uses tools like chart patterns and technical indicators to forecast price movement.

The best way to conduct technical analysis is by:

● Studying the chart visually: Learn to visually identify the dominant trend whether it is an uptrend, downtrend or a sideways trend.

● Using support and resistance lines: Drawing support and resistance lines identifies areas where the price is likely to reverse or breakout. Once the support and resistance levels it provides excellent opportunities for traders to execute new trades.

● Applying technical indicators: Technical indicators can help with position sizing and risk management. These indicators can also be used to set entry and exit points. In addition, some indicators like the Moving Average can help to determine when the trend is going to change.

Stay up to date on the latest news about Nio

Reports on earnings, or the release of new products, along with government policies affecting the EV industry are news that can heavily impact the volatility of Nio stocks and CFDs.

Pay attention to trading volume and volatility indicators

Trading volume tends to signal when a stock investor should sell and take profits because of low activity or declining strength of the overall trend. Trading volume is also often used to confirm the existence or continuation of a trend or a trend reversal.

Volatility indicators on the other hand, help measure changes in the volatility of a stock or the market as a whole. By defining the market's volatility, these indicators can be used to make strategies.

But when using trading volume or volatility indicators, they should never be used alone. Adding additional indicators makes the trading signal stronger by providing additional confirmation.

Conclusion

Every investment comes with its fair share of risks especially when the market is uncertain about its future direction. So, it is important to only trade or invest in Nio if you are confident about its future.

Take time to determine if it is the right fit for you using fundamental and technical analysis. Also, if you choose to invest or trade, start small and gradually build your position depending on your profitability.