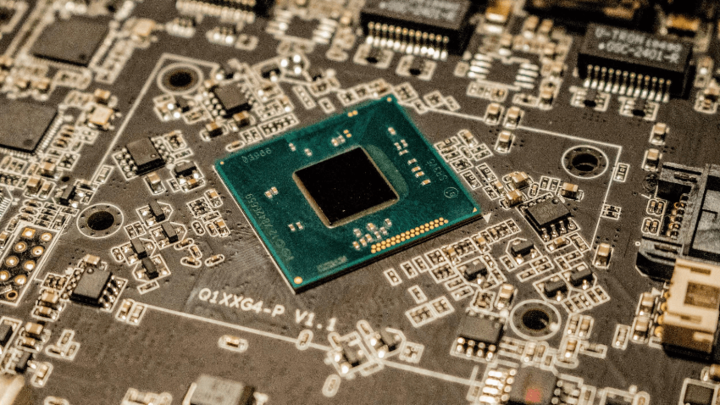

The semiconductor industry is one of the global economy's most essential and innovative sectors. And you may be wondering, why is that? Well, semiconductors are the critical components of electronic devices, such as computers, smartphones, tablets, TVs, cars, and many more. They enable the development and advancement of various technologies, such as artificial intelligence (AI), cloud computing, 5G, the Internet of Things (IoT), and autonomous vehicles. In other words, semiconductors are the backbone of modern technology.

When it comes to investing, semiconductor stocks are worth considering. Here's the thing: semiconductor stocks are the shares of companies that design, manufacture, or sell semiconductors or related products and services. And they can offer attractive returns for investors looking for exposure to the future of technology and innovation. But wait, there's more: they can also be volatile and risky due to supply and demand imbalances, competition, trade tensions, regulatory issues, and unpredictable market forces. So, it's essential to be mindful of the risks and do your due diligence before investing.

In this article, we'll explore the semiconductor industry's trends, challenges, and opportunities. We'll also introduce the top 6 best semiconductor stocks to watch in 2023. And here's where it gets interesting: we'll show you how to trade them with VSTAR, a leading online trading platform that offers CFD trading on various assets, including semiconductor stocks.

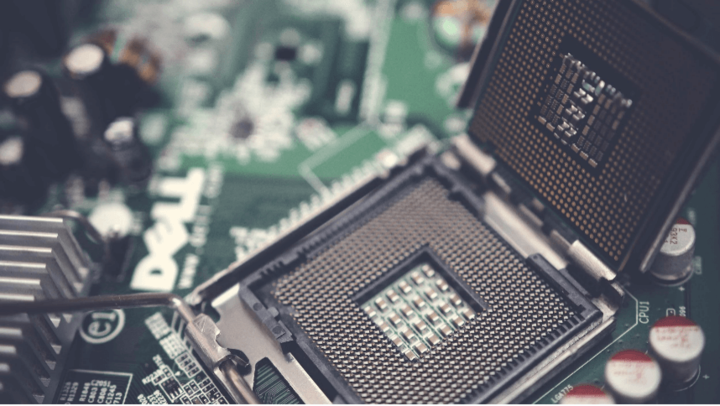

Who is the Biggest Semiconductor Maker?

The semiconductor industry is highly competitive and dynamic, with many players vying for market share and technological leadership. And you might be wondering, who's the biggest semiconductor maker in the world? Well, it's Taiwan Semiconductor Manufacturing Co Ltd (TSM), or TSMC for short. This company is the world's largest contract chipmaker, producing chips for other companies, such as Apple, AMD, Qualcomm, and Nvidia.

TSMC dominates the advanced chip manufacturing segment, and here's the kicker: it has a market share of over 50% in the 7-nanometer (nm) and 5-nm nodes. That's impressive considering the intense competition in the semiconductor industry. But TSMC's success is not just due to its market share; it's also because of its cutting-edge technology, high-quality products, and customer service. TSMC invests heavily in research and development to maintain its technological leadership, which is essential in the fast-evolving semiconductor industry.

What Are the Top 6 Best Semiconductor Stocks 2023?

According to analysts and experts, here are some of the best semiconductor stocks to check out in 2023. These stocks are top 6 based on their revenue growth, market share, financial performance, analyst ratings, future growth potential, and key risks and challenges.

Taiwan Semiconductor Manufacturing Co Ltd (TSM)

As mentioned earlier, TSM is the world’s largest contract chipmaker and the leader in advanced chip manufacturing. TSM's diversified customer base includes Apple, AMD, Qualcomm, Nvidia, and many more. TSM also benefits from the growing demand for chips in various sectors, such as AI, cloud computing, 5G, IoT, and autonomous vehicles.

TSM’s revenue in 2022 was $75.9 billion, a 32.6% increase from 2021. TSM’s net income in 2022 was $34.07 billion, a 59.56% increase from 2021. TSM’s stock price has fluctuated wildly in the past year, at $16.77 as of April 20, 2023. As of April 2023, TSM’s market capitalization was $456.32 billion with an analyst consensus of buy.

TSM faces competition from other chipmakers, such as Samsung, Intel, and SMIC. TSM also faces challenges such as rising costs and complexity of chip manufacturing, geopolitical uncertainties, trade tensions, and potential supply chain disruptions due to natural disasters or cyberattacks.

However, TSM should maintain its leading position in the semiconductor industry in the near future as it continues to invest heavily in developing the next-generation 3-nm and 2-nm technologies.

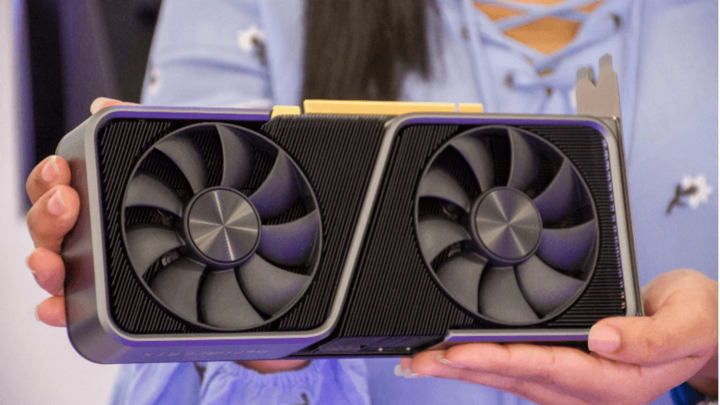

NVIDIA (NVDA)

NVIDA is a leading semiconductor company specializing in graphics processing units (GPUs) and artificial intelligence (AI) solutions. Their GPUs are widely used for gaming, professional visualization, data center, and automotive applications. NVDA’s AI solutions get used for various domains, such as cloud computing, robotics, healthcare, and education.

NVDA has been one of the best-performing semiconductor stocks in recent years, as it has capitalized on the growing demand for its products and services. The company has also made strategic acquisitions and partnerships to expand its market reach and diversify its revenue streams. For example, in 2022, NVDA tried to acquire Arm Holdings, a leading chip design company, for $40 billion. There was an expectation that the deal would create a powerhouse in the semiconductor industry and accelerate NVDA’s growth in the Internet of Things (IoT) and edge computing markets. Unfortunately, the deal collapsed in 2022, and NVIDIA called off its acquisition plans.

NVDA has delivered stellar revenue growth, market share gains, financial performance, and analyst ratings. In 2022, the company reported a revenue of $26.91 billion, up 61% year-over-year, and a net income of $9.75 billion, up 125.12% year-over-year. As of April 20, 2023, Nvidia Stock price stands at $279.31 with a market capitalization of $689.90 billion. NVDA has a robust balance sheet, with $13.29 billion in cash and equivalents as of January 2023. The company has a return on equity of 26.61%, a profit margin of 23.37%, and a consensus analyst rating of ‘buy.’

NVDA faces some key risks and challenges, such as the regulatory hurdles and integration issues related to its Arm acquisition; the competition from other GPU and AI players such as AMD and Intel; the supply chain constraints and chip shortages that could affect its production and delivery; and the potential slowdown in demand for its products due to market saturation or economic downturns.

However, NVDA also has a solid future growth potential, as it leverages its innovation capabilities and market leadership in the GPU and AI segments. The company also has opportunities to grow in new markets such as cloud gaming, metaverse, autonomous vehicles, and healthcare.

Intel (INTC)

Intel is the largest chipmaker in revenue and the leader in the PC and server markets. Intel’s chips get used for various applications, such as personal computers (PCs), laptops, data centers, cloud computing, and artificial intelligence (AI).

Intel’s revenue in 2022 was $63.05 billion, a 20.2% decrease from 2021. Intel’s net income in 2022 was $8.02 billion, a 59.6% decrease from 2019. Intel’s stock price declined last year to $31.15 as of April 20, 2023. As of April , 2021, Intel’s market capitalization was $129.93 billion with analysts giving a consensus rating of hold.

Intel faces competition from AMD and Nvidia, which have gained market share and technological leadership in the PC and server markets. Intel also faces challenges, such as its chip manufacturing delays and defects, affecting its product quality and delivery. Intel also faces regulatory scrutiny for its dominant position in the PC and server markets.

However, Intel should improve its performance and regain its competition soon, as it's investing $20 billion in building two new fabs in Arizona, outsourcing some of its chip production to TSMC and Samsung, and launching new products based on the 10-nm and 7-nm technologies.

Advanced Micro Devices (AMD)

AMD is a leading chipmaker that competes with Intel in the PC and server markets and with Nvidia in the GPU market. AMD’s chips are popular for their high performance and energy efficiency. AMD has recently gained significant market share from Intel, thanks to its superior products based on the 7-nm and 5-nm technologies.

AMD’s revenue in 2022 was $23.6 billion, a 43.61% increase from 2021. AMD’s net income in 2022 was $1.32 billion, a 58.32% decrease from 2021. AMD’s stock price is $89.94 as of April 20, 2023. As of April 20, 2021, AMD’s market capitalization was $144.75 billion with analysts giving a consensus rating of buy.

AMD faces competition from Intel and Nvidia, which invest heavily in developing their products and technologies. AMD also faces challenges such as integrating its acquisition of Xilinx (a leading provider of programmable logic devices), managing its supply chain amid the global chip shortage, and maintaining its technological edge over its rivals.

However, AMD can sustain its strong growth momentum in the near future as it continues to launch new products and expand into new markets, such as data centers, cloud computing, gaming, and AI.

Micron Technology (MU)

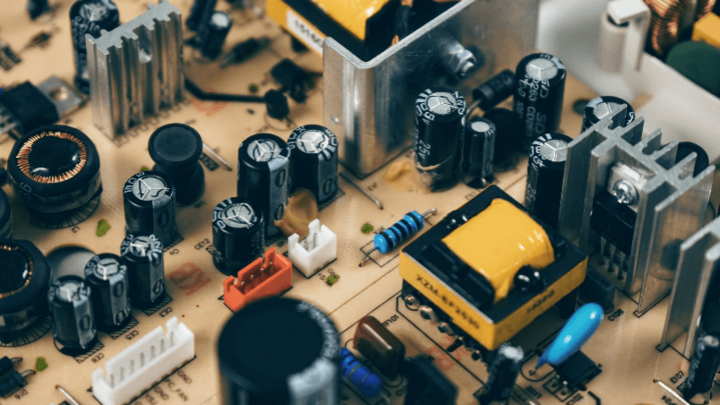

Micron Technology is one of the largest memory chipmakers in the world. Micron’s products include dynamic random-access memory (DRAM) and NAND flash memory chips, which are often used for storing and processing data in various devices, such as PCs, smartphones, tablets, servers, and SSDs.

Micron’s revenue in the fiscal year 2022 was $30.8 billion, an 11% increase from the fiscal year 2021. Micron’s net income in the fiscal year 2022 was $8.69 billion. Micron’s stock price stands at $60.65 as of April 20, 2023. As of April 20, 2023, Micron’s market capitalization was $66.37 billion with an analyst rating of buy.

Micron faces competition from other memory chipmakers, such as Samsung and SK Hynix. Micron also faces challenges such as cyclical demand and pricing pressures for memory chips, trade tensions and sanctions that affect its access to crucial markets such as China, and technological shifts that require constant innovation and investment.

However, Micron should benefit from the recovery of the memory chip market in 2021 and beyond as demand for memory chips increases across various sectors, such as cloud computing, 5G, AI, and IoT.

Qualcomm (QCOM)

Qualcomm is a leading chipmaker that specializes in wireless communications and mobile technologies. Qualcomm’s products include mobile processors (Snapdragon), modems (Snapdragon X), RF front-end solutions (QTM), and connectivity chips (Wi-Fi and Bluetooth). Qualcomm also licenses its patents and technologies to other companies in the wireless industry.

Qualcomm’s revenue in the fiscal year 2022 was $44.2 billion, a 31.68% increase from the year 2021. Qualcomm’s net income in 2022 was $12.94 billion, a 43.05% increase from the fiscal year 2021. Qualcomm’s stock price has also risen in the past year, currently at $118.54 as of April 20, 2023. As of April 20, 2023, Qualcomm’s market capitalization was $133.11 billion with analysts giving it a consensus rating of buy.

Qualcomm faces competition from other chipmakers, such as MediaTek and Samsung. Qualcomm also faces legal disputes with some of its customers and regulators over its patent licensing practices, trade tensions and sanctions that affect its access to crucial markets such as China and Huawei, and supply constraints due to the global chip shortage.

However, Qualcomm can still benefit from the growth of the 5G market, as it has a strong position and portfolio in the 5G chipset segment. Qualcomm also has opportunities to expand into new markets, such as automotive, IoT, and edge computing.

What Are the Factors Affecting the Semiconductor Industry?

Significant factors affecting the semiconductor industry's performance include demand and supply dynamics, technological innovation and competition, geopolitical and trade issues, and environmental and social concerns.

Demand and Supply Dynamics

The semiconductor industry is often cyclical and volatile. Demand and supply can fluctuate due to various factors, such as economic conditions, consumer preferences, product cycles, inventory levels, and market competition. For instance, the COVID-19 pandemic has caused both a surge and a slump in demand for chips in different sectors while disrupting the supply chain and creating a global chip shortage. The semiconductor industry also faces the risk of oversupply and price erosion when demand slows down or capacity exceeds demand.

Technological Innovation and Competition

The semiconductor industry faces various challenges in terms of technological innovation and competition. The semiconductor industry must invest heavily in research and development (R&D) and capital expenditures (CAPEX) to maintain its technological edge and leadership. The semiconductor industry also faces technological shifts and disruptions that can render its existing products and technologies obsolete or less competitive. For instance, the emergence of new chip architectures (such as Arm) or new computing paradigms (such as quantum computing) could challenge the dominance of existing chip designs (such as x86) or platforms (such as cloud computing).

Geopolitical and Trade Issues

The semiconductor industry operates in a global and interconnected environment, where chips get designed, manufactured, and sold across different regions and countries. The semiconductor industry also relies on international trade and supply chains to access key markets, customers, suppliers, and resources.

Geopolitical tensions and conflicts can also affect operations and security. For instance, the US-China trade war and the US sanctions on Huawei have disrupted the trade and supply of chips between the two countries and affected the revenues and profits of many chipmakers. The semiconductor industry also faces trade barriers and restrictions that can limit its market access and growth opportunities. For instance, the export controls and tariffs imposed by different countries can increase the cost and complexity of doing business in the semiconductor industry.

Environmental and Social Concerns

The semiconductor industry's products, processes, and practices impact the environment and society. The sector also faces expectations and pressures from various stakeholders, such as customers, investors, employees, communities, and regulators, to address its environmental and social responsibilities and performance.

How to Invest in Semiconductor Stocks

If you get interested in investing in semiconductor stocks, you have several options. Here are three of the most common ways to invest in this dynamic industry:

Hold the Share

One way to invest in semiconductor stocks is to buy and hold the shares of individual companies. You can benefit from these stocks' long-term growth potential and dividend payments. However, this also means that you have to research and analyze each company and get prepared to face the volatility and risks of the stock market.

Option

Another way to invest in semiconductor stocks is to use options contracts. Options are financial instruments that give you the right, but not the obligation, to buy or sell a stock at a specified price and time. You can use options to speculate on the direction of a stock price, hedge against losses, or generate income from premiums. However, options are also complex and risky and require high skill and knowledge to trade successfully.

CFD

A third way to invest in semiconductor stocks is to use contracts for difference (CFDs). CFDs are derivatives that allow you to trade on a stock's price movements without owning the underlying asset. You can use CFDs to go long or short on a stock, leverage your position, and access a wide range of markets. However, CFDs are also leveraged products, meaning you can lose more than your initial investment if the market moves against you.

From the above, each way of investing in semiconductor stocks has advantages and disadvantages. However, consider CFDs if you’re looking for a flexible, convenient, and cost-effective way to trade in this industry.

CFDs offer several benefits over holding shares or options, such as:

- No commissions or fees:Unlike shares or options, CFDs do not incur commissions or fees when opening or closing a trade. You only pay the spread, the difference between the bid and ask prices.

- No expiry dates:Unlike options, CFDs do not have expiry dates. You can keep your positions open as long as you want, as long as you have enough margin in your account.

- No ownership issues: Unlike shares, CFDs do not involve ownership issues. You do not have to worry about voting rights, dividends, or corporate actions. You only trade on the price movements of the stock.

- No minimum deposit:Unlike shares or options, CFDs do not require a minimum deposit to start trading. You can trade for as little as $50 with VSTAR, a CFD broker where you can trade semiconductor stocks.

- No restrictions:Unlike shares or options, CFDs do not have any restrictions on short selling or day trading. You can trade on rising and falling markets and open and close positions as often as possible.

Why Trade Semiconductor Stocks CFD With VSTAR?

If you have interest in trading semiconductor stocks CFDs, choose VSTAR as your trading platform. VSTAR is a global regulated trading platform that offers access to over 1000 markets of currencies, stocks, indices, gold, and oil.

Here are some reasons why you should trade semiconductor stocks CFD with VSTAR:

- Lowest trading cost:VSTAR offers 0 commission and super-tight spreads on all CFD trades. This means that investors can save more money and increase their profit potential.

- Deep liquidity:VSTAR provides reliable and super-fast order execution with deep liquidity from multiple sources which means that investors can trade with confidence and avoid slippage or requotes.

- Global regulation and security:Cyprus Securities and Exchange Commission (CySEC) authorizes and regulates VSTAR, a Cyprus Investor Compensation Fund member, under the European Regulatory Framework of MiFiD II. This means that funds are safe and secure with VSTAR.

- User-friendly app for beginners and pro traders:VSTAR offers an easy-to-use interface that allows investors to trade on their mobile devices anytime and anywhere. They can also enjoy features such as a minimum deposit of only $50, negative balance protection, popular real-time markets, and risk-free demo accounts.

Conclusion

Semiconductor stocks are among the most exciting and profitable investments in the technology sector. They offer exposure to the global demand for computer chips and electronic devices and the emerging technologies that drive growth and innovation in this industry.

However, investing in semiconductor stocks also involves risks and challenges, such as volatility, competition, geopolitical factors, and market forces. Therefore, investors must do their research and analysis before making investment decisions.

Investors looking for a flexible, convenient, and cost-effective way to trade semiconductor stocks, should consider CFDs with VSTAR, a global regulated trading platform with low trading costs, deep liquidity, a user-friendly app, and many other features.

To start trading semiconductor stocks CFD with VSTAR, visit the website at www.vstar.com and sign up for a free account today. Try the risk-free demo account to practice your trading skills and strategies.