Khi nói đến ngân hàng đầu tư và quản lý tài sản, JPMorgan Chase & Co. vẫn đứng đầu. Dựa trên uy tín và thành tựu tích lũy được trong hơn 200 năm, công ty không có dấu hiệu dừng lại ngay cả khi đối mặt với tình trạng hỗn loạn ngân hàng Mỹ hiện nay.

Công ty đầu tư này đã mở văn phòng mới tại Mumbai và Bengaluru, Ấn Độ và đánh bại kỳ vọng của các nhà phân tích trong quý hai. Họ cũng mua lại First Republic Bank trong một thương vụ trị giá 10,6 tỷ USD do các cơ quan quản lý chính phủ môi giới và đang mở rộng cơ sở khách hàng bằng cách phát triển khả năng ngân hàng kỹ thuật số của mình. Ví dụ: gần đây họ đã ra mắt tính năng Tap to Pay trên iPhone cho phép người bán chấp nhận thanh toán không tiếp xúc bằng iPhone của họ.

Mặc dù JPMorgan đang hoạt động tốt hơn hầu hết các ngân hàng khác khi hệ thống ngân hàng Hoa Kỳ ổn định trở lại nhưng họ vẫn phải giải quyết một số vấn đề. Tiền gửi bằng tiền mặt tại JPMorgan đã giảm 75 tỷ USD do khách hàng ngày càng yêu cầu lợi suất cao hơn và JPMorgan đã mất 1,1 tỷ USD do phải xóa nợ thẻ tín dụng khó đòi. Nhưng với tư cách là ngân hàng lớn nhất Hoa Kỳ, JPMorgan đủ vững chắc để đương đầu với những thách thức ngắn hạn và có thể trở thành cổ phiếu bạn muốn đưa vào danh mục đầu tư của mình.

JPMorgan Chase & Co. đã bắt đầu như thế nào

JPMorgan Chase & Co. là sản phẩm của hơn 1.200 tổ chức hợp tác với nhau trong 200 năm. Công ty có thể được truy nguyên từ năm 1799 khi Manhattan company được thành lập tại Thành phố New York bởi JP Morgan Chase, Alexander Hamilton và Aaron Burr. Lúc đầu, họ chỉ cung cấp nước uống cho thành phố nhưng 5 tháng sau khi thành lập, Ngân hàng của Manhattan Company được thành lập và trở thành ngân hàng thương mại thứ hai trong thành phố. Năm 1954, nó sáp nhập với Chase National Bank để trở thành Chase Manhattan Bank. JPMorgan & Co đã ra đời từ Drexel, Morgan & Co sau khi công ty được đổi tên sau cái chết của Anthony J. Drexel, một trong những người sáng lập.

Nguồn: JPMorgan Chase

Sau đó vào năm 2000, Chase Manhattan Bank sáp nhập với JPMorgan & Co. cũng như các tài sản giả định từ First Republic, Washington Mutual và Bear Stearns kết quả là JPMorgan Chase & Co hiện tại. Các ngân hàng lịch sử khác như Manufacturers Hanover, Chemical Bank, Texas Commercial Bank, National Bank of Detroit, Providian Financial và Great Western Bank.

JPMorgan Chase & Co. hiện có trụ sở tại Thành phố New York dưới sự lãnh đạo của Jamie Dimon và phần lớn được sở hữu bởi các nhà đầu tư tổ chức. Vanguard Group nắm giữ nhiều cổ phần nhất trong công ty với 9,41%, tiếp theo là BlackRock Inc và State Street Corp lần lượt nắm giữ 6,62% và 4,34%. Với sự hỗ trợ từ các nhà đầu tư và cơ sở khách hàng ngày càng tăng, công ty đã mở rộng ra ngoài Hoa Kỳ và hiện cung cấp dịch vụ cho mọi người trên toàn cầu.

Mô hình kinh doanh và dịch vụ

JPMorgan Chase đã tập trung chủ yếu vào việc thực hiện các thương vụ mua lại có giá trị để thiết lập sự hiện diện mạnh mẽ trong lĩnh vực ngân hàng bán lẻ và đầu tư cũng như quản lý tài sản. Họ có mạng lưới rộng khắp các công ty và công ty con trên toàn cầu và tập trung chủ yếu vào ba lĩnh vực kinh doanh:

- Ngân hàng thương mại và quản lý tài sản

- Ngân hàng doanh nghiệp và đầu tư

- Ngân hàng tiêu dùng và cộng đồng

Phần lớn doanh thu của công ty đến từ phân khúc ngân hàng tiêu dùng và cộng đồng trong khi phần lớn thu nhập ròng đến từ phân khúc ngân hàng doanh nghiệp và đầu tư. Với danh sách lớn các dịch vụ và địa điểm trên khắp thế giới, JPMorgan Chase & Co. phát triển và duy trì cơ sở khách hàng của mình bằng cách sử dụng dữ liệu để hiểu rõ hơn về khách hàng và cung cấp thông tin tài chính kịp thời. Các sản phẩm và dịch vụ của họ có sẵn thông qua các chi nhánh thực tế, nền tảng ngân hàng kỹ thuật số và máy ATM. Đối với những khách hàng giàu có hơn, JPMorgan có xu hướng cung cấp các dịch vụ chuyên biệt hơn với các đại lý môi giới và cố vấn tài chính.

Sản phẩm và Dịch vụ

Ngân hàng kiếm tiền từ nhiều loại sản phẩm và dịch vụ như quản lý tài sản và của cải, bảo hiểm, giao dịch, vốn chủ sở hữu tư nhân, quỹ tương hỗ, thẻ tín dụng, hàng hóa, cho vay thế chấp và quản lý rủi ro.

Tình hình tài chính của JPMorgan Chase & Co có mạnh không?

JPMorgan Chase & Co. là ngân hàng lớn nhất Hoa Kỳ tính theo tài sản và lớn thứ năm trên thế giới với giá trị vốn hóa thị trường là 429,607 tỷ USD. Họ kiểm soát tài sản trị giá 3,67 nghìn tỷ USD và liên tục tạo ra lợi nhuận hàng quý. Bất chấp những lo ngại về suy thoái kinh tế, năm 2022 hóa ra lại là năm mang lại lợi nhuận cao nhất cho JPMorgan trong 5 năm, khi họ tạo ra doanh thu 157,54 tỷ USD và thu nhập ròng 37,49 tỷ USD. Báo cáo thu nhập gần đây của họ cũng tích cực. Doanh thu của công ty tăng 20,58% so với cùng kỳ năm trước lên 35,71 tỷ USD trong khi thu nhập ròng và biên lợi nhuận ròng cho thấy mức tăng trưởng đáng kể lần lượt là 14,47 tỷ USD và 40,53%.

Thêm vào đó, bảng cân đối kế toán của JPMorgan là một dấu hiệu rõ ràng về lý do tại sao họ được cho là một trong những ngân hàng an toàn nhất ở Mỹ. Họ có tổng tài sản và tổng nợ phải trả lần lượt là 3,6 nghìn tỷ USD và 3,37 nghìn tỷ USD và tổng tiền gửi là 2,4 nghìn tỷ USD. Vào cuối năm 2022, công ty có khoản nợ khoảng 563,3 tỷ USD với dòng tiền tự do là 99,82 tỷ USD.

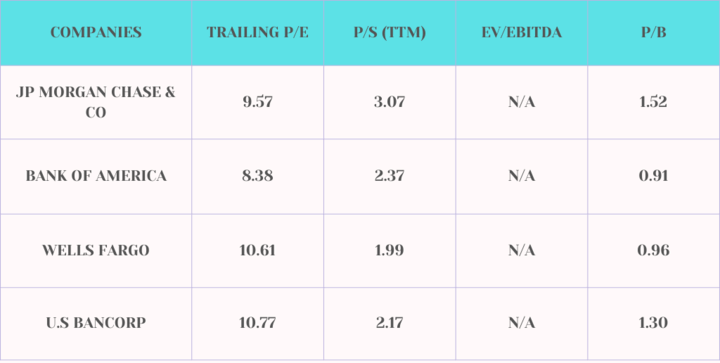

Các tỷ số và chỉ số tài chính quan trọng

Hãy so sánh các chỉ số chính của JPMorgan với các đối thủ lớn nhất.

So với các đối thủ cạnh tranh và dựa trên sức mạnh cũng như hiệu suất tài chính, JPMorgan Chase & Co. được định giá tương đối thấp.

Hiệu suất cổ phiếu JPM

Thông tin giao dịch

Sàn giao dịch chính & Mã chứng khoán: NYSE: JPM

Quốc gia & Đơn vị tiền tệ: Hoa Kỳ (USD)

Giờ giao dịch: Bạn có thể giao dịch cổ phiếu JPM trong phiên trước giờ thị trường (4:00-9:30 sáng theo giờ ET) và sau giờ thị trường (4:00-8:00 tối theo giờ ET)

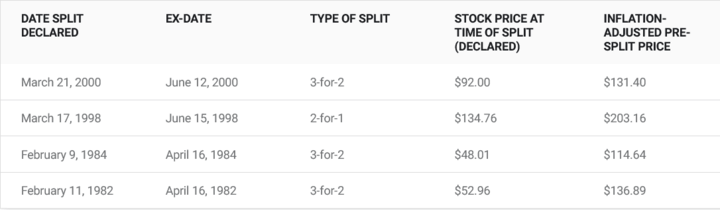

Chia tách cổ phiếu JPM: JPMorgan Chase đã chia cổ phiếu 4 lần kể từ năm 1982

Nguồn: Motley Fool

Cổ tức cổ phiếu JPM: JPMorgan trả cổ tức hàng quý là 1 USD cho mỗi cổ phiếu, tương ứng với tỷ suất cổ tức hàng năm là 2,71%.

Hiệu suất cổ phiếu JPM kể từ khi IPO

JPMorgan Chase được cho là ngân hàng hoạt động tốt nhất ở Hoa Kỳ với nguồn tài chính vững mạnh và khả năng quản lý tốt. Do đó, cổ phiếu JP Morgan vẫn là cổ phiếu ngân hàng được các nhà đầu tư yêu thích khi muốn đầu tư với mức độ rủi ro thấp hơn.

Kể từ khi IPO, giá cổ phiếu JPM đã tăng 1445,47% và không có dấu hiệu chậm lại. Cổ phiếu đạt mức cao nhất mọi thời đại là 171,78 USD vào tháng 10 năm 2021 và chưa đạt được mục tiêu tương tự kể từ đó. Công ty đã khẳng định vị thế của mình kể từ cuộc suy thoái năm 2008 như một thành trì tài chính bất kể điều kiện kinh tế như thế nào. Là một trong những ngân hàng cho vay lớn nhất ở Hoa Kỳ, JPMorgan Chase & Co. được hưởng lợi từ lãi suất cao và danh mục sản phẩm và dịch vụ ngày càng phát triển. Giá cổ phiếu JPM cũng được thúc đẩy nhờ các thương vụ mua lại mang tính chiến lược như Frank Financial Aid, Aumni và InstaMed.

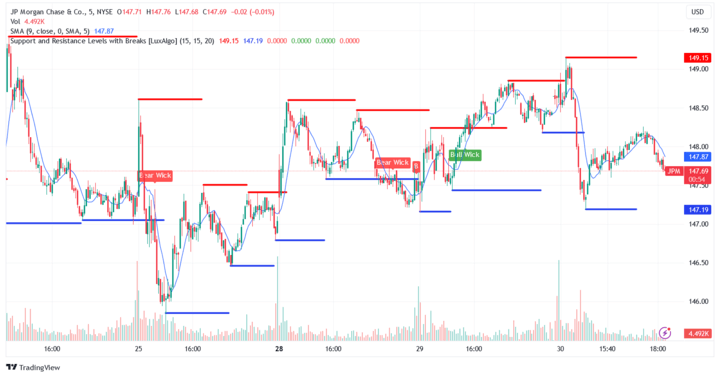

Giao dịch ở mức giá 148,16 USD, cổ phiếu JPM đã tăng 9,62% chủ yếu nhờ báo cáo thu nhập quý 2 năm 2023 bất ngờ và việc mua lại First Republic.

Dự báo cổ phiếu JPM

Cổ phiếu JPM cho đến nay vẫn hoạt động tốt nhưng liệu nó có giữ được động lượng tăng trưởng không? Các nhà phân tích tin rằng nó có thể. Xếp hạng của 27 nhà phân tích đối với cổ phiếu JPMorgan Chase trong 3 tháng qua xếp cổ phiếu này là "Mua" với mức ước tính cao là 219 USD trong năm nay. Tuy nhiên, nếu xu hướng đảo chiều và giá cổ phiếu của nó giảm, nó được dự đoán sẽ giảm xuống còn 140 USD.

Hiện tại, có một xu hướng tăng tương đối ổn định với các mức hỗ trợ và kháng cự chính lần lượt là 145,85 USD và 149,15 USD. Cổ phiếu JPM Chase đã phá vỡ mức kháng cự trong tháng qua, đạt mức 158 USD vào tháng 7 và điều này có thể xảy ra một lần nữa sau khi công bố thu nhập quý 3 năm 2023.

Thách thức và cơ hội

JPMorgan Chase & Co là công ty dẫn đầu trong ngành ngân hàng và vị thế độc tôn của họ mở ra những cánh cửa cơ hội đồng thời cũng gây ra những rủi ro về thể chế. Dưới đây là một số mối đe dọa và cơ hội mà JPMorgan cần cân nhắc:

Rủi ro JPMorgan phải đối mặt

- Cạnh tranh mạnh mẽ: JPMorgan Chase có uy tín lâu năm trong ngành dịch vụ tài chính nhưng đây là ngành có tính cạnh tranh cao với nhiều ngân hàng và tổ chức tài chính cung cấp các sản phẩm và dịch vụ hấp dẫn. Các đối thủ cạnh tranh mạnh nhất của công ty là Bank of America, Berkshire Hathaway, Citigroup, US Bancorp, American Express và Toronto-Dominion Bank.

- Thiếu niềm tin vào hệ thống ngân hàng: Sau thất bại của Signature Bank và Silicon Valley Bank, niềm tin của người Mỹ vào hệ thống ngân hàng giảm sút đáng kể. Người Mỹ không tin tưởng rằng tiền gửi của họ được an toàn trong ngân hàng, điều này ảnh hưởng đến cách mọi người nhìn nhận các ngân hàng truyền thống như JPMorgan Chase. Trong báo cáo mới nhất của ngân hàng, tổng tiền gửi giảm cho thấy khách hàng đang chuyển tiền đi nơi khác.

- Tranh cãi: Một công ty lớn như JPMorgan Chase không thể tránh khỏi những tranh cãi dù có cố gắng đến đâu, điều này đã làm tổn hại đến hình ảnh của công ty.

Nguồn: Bloomberg

Cơ hội tăng trưởng cho JPM

- Mua lại chiến lược: Là ngân hàng lớn nhất ở Mỹ xét theo quy mô tài sản, JPMorgan có đủ nguồn lực để thực hiện một cuộc mua sắm mua lại các đối thủ nhỏ hơn. Gần đây họ đã mua lại First Republic và Aumni, đồng thời tiếp tục mua các công ty fintech và ngân hàng kỹ thuật số để theo kịp sự cạnh tranh.

- Vị thế dẫn đầu: JPMorgan là một công ty có uy tín trong ngành dịch vụ tài chính, nghĩa là công ty có danh tiếng thương hiệu mạnh và sự ổn định tài chính nhất quán trong một ngành cạnh tranh. Ngoài ra, họ có nhiều loại sản phẩm đa dạng để phục vụ khách hàng bất kể nhu cầu.

- Tiếp tục tăng trưởng: JPMorgan có tốc độ tăng trưởng thu nhập là 12,2% trong 3 đến 5 năm qua mặc dù đã có mặt lâu năm trong ngành. Bất chấp tình hình bất ổn hiện tại trong ngành ngân hàng, JPMorgan vẫn vượt quá mong đợi và thu nhập của công ty này được dự đoán sẽ tăng 18,5% trong năm nay. JPMorgan Chase & Co cũng tập trung vào việc mở rộng các sản phẩm và dịch vụ của mình để đảm bảo rằng công ty tiếp tục duy trì tính thích hợp.

Tương lai của JPM sẽ ra sao?

Khi các ngân hàng trực tuyến, ứng dụng ngân hàng di động và công nghệ tiếp tục phát triển, JPMorgan đang đổ nguồn lực để mở rộng phạm vi tiếp cận của mình. Ngân hàng trực tuyến Chase của họ sẽ được mở rộng sang các nước Châu Âu như Anh và Đức trước cuối năm nay. Nhưng JPMorgan không chỉ tập trung vào Chase Bank. Công ty đã đầu tư đáng kể vào các ngân hàng trực tuyến sinh lợi khác như ngân hàng kỹ thuật số C6 của Brazil và gần đây đã tăng tỷ lệ sở hữu từ 40% lên 46%. Đồng thời, hãng có kế hoạch đổ 1 tỷ USD trở lên mỗi năm vào AI để cung cấp dịch vụ tốt hơn và nâng cao trải nghiệm của khách hàng.

Nguồn: BP Money

Mặc dù JPMorgan đang mở rộng phạm vi tiếp cận trực tuyến một cách đáng kể nhưng họ vẫn ưu tiên các chi nhánh bán lẻ để phục vụ khách hàng địa phương. Vì vậy, trong vòng hai đến ba năm tới, khoảng 130 chi nhánh sẽ được mở trên khắp Hoa Kỳ và sẽ tiếp tục mở rộng ở Trung Quốc, nơi được coi là một trong những cơ hội lớn nhất ở nước ngoài.

Tại sao nhà giao dịch nên xem xét cổ phiếu JPM

JPMorgan Chase & Co. chứng minh rằng trong ngành ngân hàng người giàu càng trở nên giàu hơn. Báo cáo thu nhập quý 2 năm 2023 của họ là sự thể hiện khả năng phục hồi tài chính và dự kiến họ sẽ tiếp tục phát huy hiệu suất mạnh mẽ vào năm 2022 bất chấp tình trạng bất ổn tài chính trong năm nay. Việc mua lại First Republic gần đây cũng thúc đẩy tâm lý của các nhà đầu tư về hiệu suất của JPMorgan trong năm 2023 và trong những năm tới. Thỏa thuận này đã cho thấy tác động tích cực khi JPMorgan thu được 2,7 tỷ USD từ giao dịch mua giá hời và đạt doanh thu gần 4 tỷ USD.

Ngoài ra, cổ phiếu JPM ít biến động hơn so với gần 75% cổ phiếu ngân hàng Mỹ trong 3 tháng qua và hiện bị định giá thấp dựa trên các số liệu chính và bảng cân đối kế toán.

Chiến lược giao dịch cổ phiếu JPM

- Giao dịch CFD: Các nhà giao dịch không muốn sở hữu trực tiếp cổ phiếu JPM có thể chuyển sang CFD như một cách để kiếm lợi nhuận. Giao dịch CFD cho phép bạn suy đoán về biến động giá của cổ phiếu bằng cách ký kết hợp đồng CFD với nhà môi giới. Ví dụ: nếu bạn dự đoán rằng cổ phiếu JPM sẽ đạt 200 USD vào cuối năm, bạn có thể mở một vị thế CFD mua và sau đó bán khi nó đạt đến mục tiêu giá.

- Giao dịch theo xu hướng: Giao dịch theo xu hướng là một cách đơn giản nhưng hiệu quả để giao dịch cổ phiếu JPM. Chiến lược giao dịch này dựa trên kỳ vọng rằng xu hướng sẽ tiếp tục di chuyển theo hướng đã dự đoán. Cổ phiếu JPM hiện đang trong xu hướng tăng và dự kiến sẽ duy trì xu hướng này cho năm 2023. Trong trường hợp này, bạn có thể mở một vị thế mua và xem giá trị tài sản của mình tăng lên. Tuy nhiên, nếu bạn tin rằng giá cổ phiếu sẽ giảm, bạn có thể bán tài sản của mình. Nhưng thị trường không thể đoán trước được và cần phải sử dụng các chỉ báo kỹ thuật để xác nhận xu hướng trước khi đưa ra bất kỳ quyết định nào.

Nguồn: Investment U

- Giao dịch thuật toán: Giao dịch thuật toán còn được gọi là giao dịch algo hoặc Robot giao dịch chứng khoán, sử dụng các chương trình máy tính để thực hiện giao dịch. Máy tính hoạt động dựa trên một bộ mã hoặc thuật toán do nhà giao dịch đưa ra chủ yếu để nắm bắt các biến động giá nhỏ. Ngoài ra, các thuật toán giao dịch này có thể được sử dụng để tìm các điều kiện kỹ thuật hoặc cơ bản nhất định để áp dụng trong chiến lược giao dịch của họ.

Giao dịch CFD cổ phiếu JPM với VSTAR

Khởi đầu thuận lợi trên thị trường CFD bằng cách giao dịch CFD cổ phiếu JPM với VSTAR. Được xây dựng cho cả nhà giao dịch tổ chức và tư nhân, VSTAR cung cấp khả năng khớp lệnh nhanh như chớp với chi phí giao dịch thấp để tối đa hóa lợi nhuận của bạn và mang lại cho bạn lợi thế ngay khi bạn bắt đầu giao dịch.

Với nội dung giáo dục, podcast và công cụ giao dịch, các nhà giao dịch được cung cấp nguồn lực để xây dựng kiến thức của mình và tập trung duy nhất vào việc trở thành những nhà giao dịch giỏi hơn.

Kết luận

JPMorgan Chase & Co đã khẳng định mình là một thế lực trong ngành dịch vụ tài chính và nhiều năm quản lý rủi ro đã được đền đáp khi công ty vẫn ổn định trước những bất ổn tài chính trong năm nay. Khi công nghệ được cải thiện, tiềm năng phát triển của JPMorgan cũng tăng theo và họ liên tục mở rộng sang các thị trường mới nổi để phục vụ nhiều khách hàng hơn.

Sức mạnh tài chính, danh tiếng thương hiệu, khả năng sinh lời và danh mục đa dạng khiến họ trở thành một khoản đầu tư tốt và là khoản đầu tư mà bạn có thể muốn cân nhắc thêm vào danh mục đầu tư của mình.