Overview of CFD Trading and Order Types

Contract For Difference (CFD) trading means exchanging the difference in a financial asset's value after some time. It involves two parties - a CFD broker and a trader, who can either be the "buyer" or the "seller."

For example, in Forex, CFD trading involves predicting a currency pair's future price movement. When you go long or short, you only profit or lose based on the exchange rate difference between the trade's entry and exit points.

The rate itself isn't too important because you don't actually own any of the currencies.

If the trade's opening price is lower than the closing price, you make some profit. However, if it is higher, it will be a loss.

Importance of Order Types in CFD Trading

To trade on Forex CFD brokers, you need to place orders. They are instructions that help you execute decisions in the market.

Orders are of various types with different uses, and here are some reasons why they are essential:

● Communication with the broker: CFD trading involves you and your broker. Therefore, there must be a means of communication between you both.

An order is a medium to instruct CFD brokers to perform executions. For example, you must place a market order to open new trades or close existing ones immediately.

● Manage risks: You are always open to risks while trading in the Forex market. However, you can reduce them with orders like stop loss or trailing stop.

● Less involvement in the market: Unlike market orders with immediate effect, limit orders are automatic for the future. When set, they allow traders to focus on other activities instead of staring at price charts constantly.

The price should trigger them when reached.

Understanding Market Orders and Executing Trades Quickly

A market order is an instruction to buy or sell a financial product immediately. It is the most basic order type and default choice in most trading platforms.

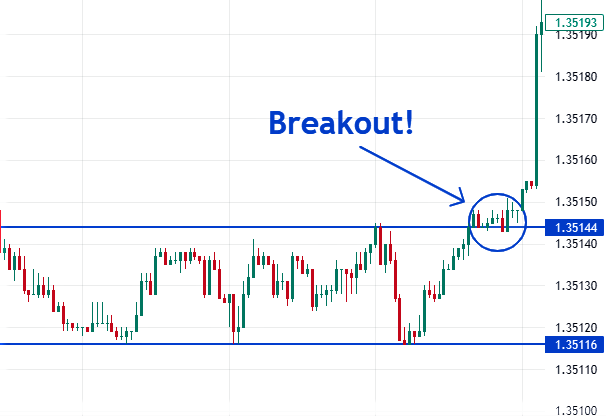

For example, if you are a forex breakout trader, you must place a buy market order as soon as the price moves outside the range, as seen below.

During volatile conditions, a CFD broker may delay slightly in executing market orders. However, it fills the order soonest at the best possible asking or selling price.

Advantages of Market Orders

Market orders have several benefits, including the following:

● Higher chances of executing trades: Since you're instructing your broker to make an execution immediately, there are higher chances for it to fill. It can secure profits and prevent losses as soon as possible.

● They are easy to use: As a beginner who doesn't want confusion, market orders are the best types to consider. It mostly involves clicking a few buttons most times to engage in trades.

Disadvantages of Market Orders

Despite the several benefits market orders provide, they have these disadvantages:

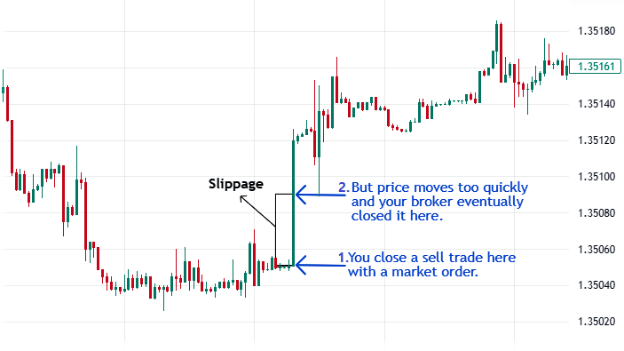

● Slippage: As discussed, CFD brokers may not execute market orders at your expected price level when the market is volatile. It is called slippage and can cause significant losses or reduced profits.

● Time-consuming: You must be actively observing the market at the time to open market orders. If not, it might be too late when the price moves quickly.

Mastering and Setting Limit Orders

Limit orders instruct your Forex CFD brokerage to buy or sell an asset at a specified price level.

The broker can only execute a buy order at the limit level, which must always be below the current price. Conversely, it will only activate a sell order at the limit price above.

After placing a limit order, it goes into the order book until the price moves there to trigger it.

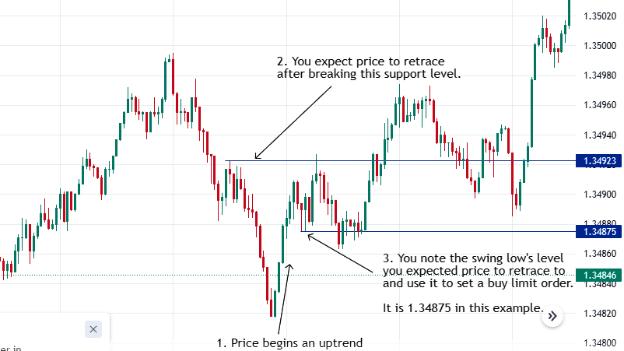

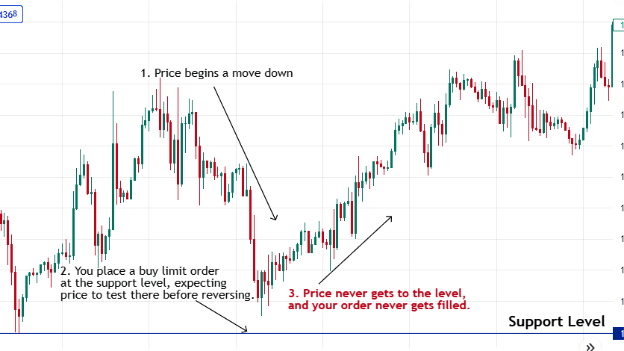

For example, you may expect the price to retrace (move down) into a significant level during a long-term uptrend.

Therefore, determine the price level you expect it to reach using a platform's charting tools like the horizontal line, as shown below.

You can then use it to set a buy limit order.

Advantages of Limit Orders

Limit orders may seem a bit complex for beginners. However, you can enjoy the following advantages when you understand it:

● Time-saving: Unlike market orders, limit orders are future automatic executions. Hence, there's no need to constantly stare at price charts after placing them.

● Better entry levels: Limit orders give you more control over your executions to define better entry levels. There will be no rush to enter the trades, especially when you've done your market analysis correctly.

The Disadvantage of Limit Orders

If you're interested in placing limit orders, beware of this disadvantage:

● Limit orders don't always fill: There is no guarantee that your broker will execute your limit order, especially when the price doesn't reach and pass the level. It becomes a missed opportunity and will remain unfilled in the order book.

On the other hand, you may have placed a quick market order if you were active when the price was near the level.

Minimizing Risks with Stop Loss Orders

A stop-loss order is another simple CFD trading order. It closes a trade when the price falls below a certain level.

The level will vary by trading plan, so you must always set this order to manage risks.

You can classify a stop loss as a market order if you manually close a trade when it is going against you. However, most traders place this order earlier for the CFD broker to execute it automatically when the price reaches there.

Follow these simple steps to set a stop-loss order:

1. Use the trading platform's tools to determine the maximum price level for your risk tolerance

2. Write down that price

3. Follow the platform's guide to set place the order on an existing or new trade

Advantages of Stop Loss Orders

Stop-loss orders are one of the most helpful orders every trader must learn how to use because of the following advantages:

● Minimized risks: The price can continue moving against you, increasing your loss without a stop-loss order. Instead, you can calculate and prepare the amount you're willing to risk, and this order will ensure it.

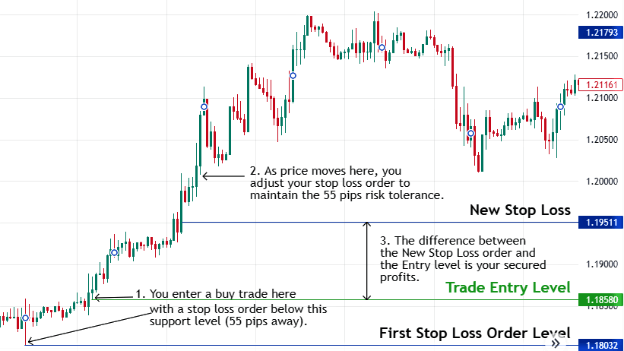

● Secures profits: Stop loss orders can also protect profit made after the price has moved some distance in your direction. You can enjoy this benefit by manually adjusting the order's price level beyond your entry point.

Disadvantages of Stop Loss Orders

Below are two main disadvantages of a stop-loss order:

● Trade may be closed too early: A minor price fluctuation can trigger your stop loss before the price moves in your direction eventually. Therefore, experts advise giving the price enough room to swing from your entry point.

● Slippage: Price may move too suddenly against you before your broker can execute your stop loss order. Hence, you'll have to bear the extra loss(es), which could be costly.

Slippages especially happen after a financial news report, so monitor economic calendars regularly.

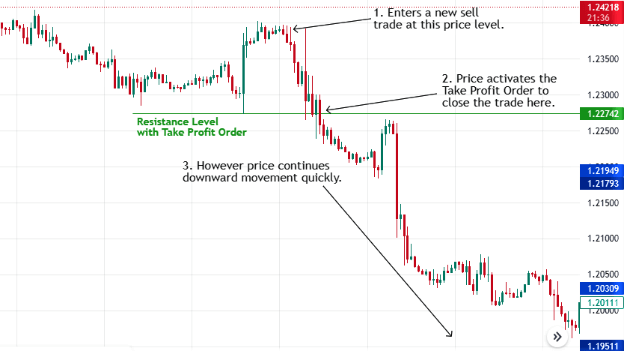

Locking In Profits With Take Profit Orders

As the name implies, take-profit orders help to secure your gains when the price reaches a certain level. The CFD broker will close your open trade at the best available price at or beyond that point.

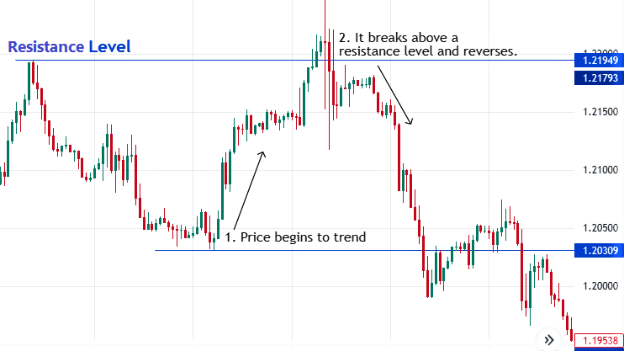

Setting these order types is an essential risk management strategy. If not, the trend can reverse and hit your stop-loss level.

For example, in the screenshot below, entering a trade between 1.20500 and 1.21500 levels would have been excellent. However, you should have set your take profit at the resistance level.

The price eventually swung beyond the point where it began the uptrend.

Like most other automatic order types, there is no guarantee that the price may fill it. Hence, it can result in a losing trade.

Advantages of Take Profit Orders

These are some of the benefits of setting a take-profit order in your trades:

● It locks your profits: As shared, the most significant advantage of a take-profit order is to ensure you are profitable. There is no guarantee that the price will continue moving in your preferred direction, so always protect any reasonable profits.

● Freedom to stay away from the market: By setting a take-profit order, you don't need to exit trades manually. Thus, you can sit out of the market for some time.

Disadvantages of Take Profit Orders

According to seasoned traders, below are some of the disadvantages of take-profit orders:

● Miss long-term trends: Price can activate your take-profit order too early and keep pushing in your favored direction. Some traders see this as lost profits, especially when they feel they could have left the trade open if they were monitoring it.

● Not suitable for long-term trading: Position traders are generally more open to large swings in price. Thus, placing a take-profit order reduces the chance of gaining from larger price swings.

Maximizing Profits with Trailing Stop Orders

Trailing stops are one of the most exciting orders because they move. They instruct the CFD broker to secure profits as an active trade continues trending in a favorable direction.

Hence, they keep following the price until it starts retracing. Then, they halt and act as a stop loss order to close the trade if the price continues in that opposite direction.

However, if the price doesn't cover enough opposite distance to trigger the trailing stop before moving again favorably, the trailing stop will start following the price too.

For example, assume you went long on a EURUSD uptrend. From observing prior price movement, you may notice that the price regularly retraces by 10 to 20 pips before continuing the trend.

Hence, you can place a trailing stop order of around 30 pips, giving the price enough room for pullbacks.

Setting it around 25 pips may be too tight, but it shouldn't exceed 40 to maximize your profits.

Therefore, after buying it at 1.4550, if the exchange rate moves to 1.4580, the stop order will also move from 1.4520 (its first level) to 1.4550.

If the price starts retracing at the new level, the 1.4550 trailing stop will remain static like a stop order.

Overall, the distance (in pips or percentages) between the price and trailing stop loss should concern you the most. Give enough room for reasonable price retracement but not too much to maximize profits.

Advantages of Trailing Stop Orders

These are some of the best benefits of a trailing stop order:

● Maximize profits: Your trading profits with a trailing stop order always increase when possible.

● Adjustable: Most brokers and trading platforms allow you to adjust your trailing stop order during the trade. It can be helpful, especially when you expect massive price retracements soon from economic reports.

The Disadvantage of Trailing Stop Order

Trailing stop orders have one major disadvantage, as follows:

● Early triggers: When the price is highly volatile, the fluctuations may activate your trailing stop when placed too close. You may regret setting it, especially if the price continues moving in your direction later.

Automating Trades with Contingent Orders

Contingent orders may seem complex to beginners. However, they simply instruct the broker to execute an action based on the outcome of another.

For example, it can be a simple take-profit order, which depends on you buying a financial asset first. A trade can automatically open with a buy or sell stop order before your take-profit order can work.

There can't be a take-profit order when there is no active trade.

In this example, the stop and take-profit orders are contingent or dependent.

Contingent orders are most valuable to traders who enjoy automating their trading strategy.

Below are some categories of them:

● One-Cancels-the-Other (OCO) order: In OCOs, when the price fills one out of two orders, your CFD broker automatically cancels the other.

● If-Then order: If-Then orders are like the take profit order example shared above. It instructs the broker of new executions to make if the price fills another order.

A trader can place a buy-stop order below the current price together with a take-profit. The take-profit order will only be active when the buy-stop order fills.

● If-Then-OCO order: If-Then-OCO Orders combine OCO and If-then orders. It involves placing three trades, at least.

The execution of the second order will depend on the execution first order. And the execution of the third order will depend on the execution of the second.

Advantages of Contingent Orders

Contingent orders instruct your CFD broker with clear rules set earlier. Thus, they provide the following benefits:

● Automated trading: Almost every automatic trading plan uses some set of contingent orders. It's a great way to stay away from the chart and still be actively making profits if you have a great strategy.

● Minimized risks: You can set stop-loss or trailing-stop loss to be contingent upon another order. Hence, it will reduce your losses when executed.

Disadvantages of Contingent Orders

Placing contingent orders has the following setbacks:

● The first order may never fill: Your contingent orders will never be active if the one it depends on isn't triggered.

● They can be too complex: When using contingent orders, you must be precise with what you want. Any confusion causing misunderstanding can open your trading account to more risks.

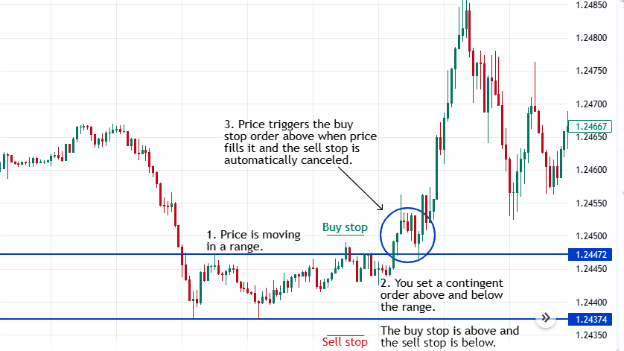

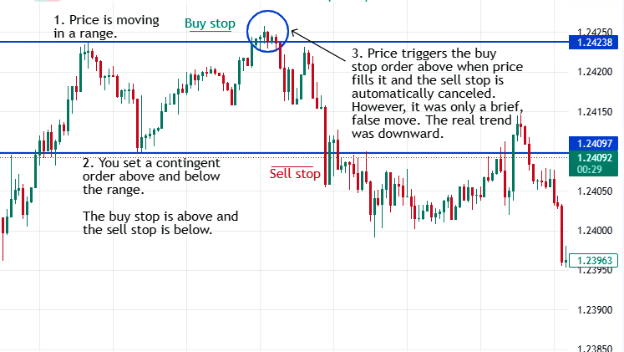

Managing Trades With OCO (One-Cancels-the-Other) Orders

As discussed, a One-Cancels-the-Other (OCO) Order is a type of contingent order. They involve two individual orders, where the execution of one cancels the other.

Therefore, it allows traders to place two orders at once. However, only one of them will be active under specific conditions.

For example, in a ranging market, a trader may be uncertain whether the price will break out above or below. You can set a contingent order of a buy stop and sell stop both ways.

Price breaks out above the range will trigger the buy stop and automatically cancel the sell stop. Conversely, a movement below will execute the sell stop and withdraw the buy stop.

Advantages of OCO Orders

Some benefits of OCO orders include the following:

● More customized orders: Without OCO orders, you must set each order manually and cancel one when price movement activates the other. The consequences could be costly if you don't actively monitor the market for this.

● Reduced risks: Your risk exposure reduces since one of your orders cancels when your CFD broker activates the other. If not, a fluctuating price can trigger both before you have time to exit the other manually.

Disadvantages of OCO Orders

While OCO orders can be helpful in many ways, there are still some drawbacks you must consider. Some of them are below:

● Acceptance: OCO orders can be highly complex, so not all CFD brokers support them. If you are interested in OCOs, research well to be sure your brokerage and trading platform allows them.

● Missed opportunities: Once your broker executes one of the OCO orders, it cancels the other. However, the price may have only retraced in the opposite trend briefly.

Unfortunately, it becomes a lost trade and missed opportunity.

Understanding GTC (Good 'Til Canceled) Orders

A Good 'Til Canceled (GTC) Order is an order that remains active until the price fills it or you cancel it. GTCs can also expire between 30 to 90 days, depending on your broker.

For example, if an asset trades at a high price, you can set a GTC order to buy it when it moves lower to a limit level. Use charting tools to discover your most favorable limit level before placing the order.

In this case, the GTC order will act like a buy limit active for several days to weeks.

Remember to always stick to your risk management plan, regardless.

Advantages of GTC Orders

The automation of GTC orders gives traders the following benefits:

● Flexibility: GTC orders allow you to set trades at specific points and leave them for some time. You won't need to monitor the market closely every day.

● Control over trades: By setting GTC orders, you become less anxious over price fluctuations, giving you a sense of control. It helps you make sound decisions that align with your trading plan.

Disadvantages of GTC Orders

Despite the exciting uses of GTC orders, they also have the following drawbacks:

● Acceptance: Some well-known brokers do not accept GTC orders for several reasons. Therefore, you must ensure your favorite brokerage does if you want to use them.

● Market volatility: A volatile market may fill a GTC order too early or too late. You might suffer some significant loss if you don't regularly check them.

Conclusion

As a trader, orders are significant because they help you execute trades on CFD brokers. There are several types, including:

● Market orders

● Limit orders

● Stop loss orders

● Contingent orders

● GTC orders

Most are automatic and help you secure profits or minimize losses. However, not all of them are suitable for every trader.

A long-term trader may prefer GTC orders because they remain active for several days. Regardless, a scalper will use market orders to enter and exit trades quickly within a trading day.

You must understand them to select the right one(s) based on your trading plan.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.