There are over 22,000 cryptocurrencies with Bitcoin being the oldest followed by Litecoin. Created in 2011 from a fork of the Bitcoin blockchain, Litecoin is very similar to Bitcoin and often referred to as the "Silver to Bitcoin's Gold." Charlie Lee created Litecoin to improve on the inadequacies of Bitcoin.

Litecoin can be described as an optimized version of Bitcoin in terms of faster transaction speed. This can be attributed to the adoption of the Scrypt hashing algorithm. In addition, the maximum supply of LTC is 84 million, which is about four times that of BTC.

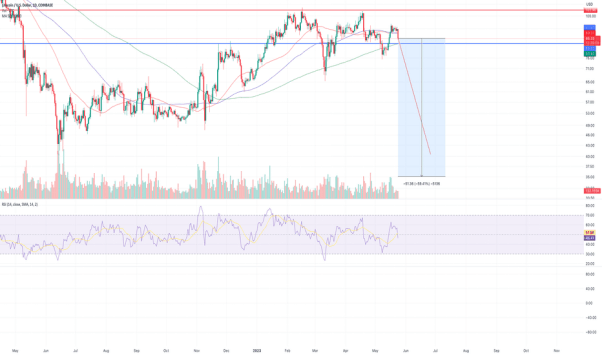

The popularity of Litecoin was steadily rising due to increasing acceptance. However, by 2013, LTC reached over $1 billion in market capitalization. Then in 2017, it reached an all-time high of about $375.

Are you interested in trading or investing in this high-utility token? Read on to explore useful tips for trading Litecoin!

Basic Concepts in Litecoin Trading

The cryptocurrency market has provided opportunities for traders to generate wealth from profits. However, many traders have lost their capital due to the volatile nature of LTC. Therefore, examining the basic aspects of Litecoin trading is critical to help you navigate the market.

a. Open an account on a top exchange

The first step to trading LTC is to open an account on a top exchange. Reputable exchanges that list LTC include Coinbase and Binance. They provide a user-friendly interface and various critical features.

After signing up, you need to register the account. Registration often requires your name, email address, residential address, and phone number. Once you have created the account, the exchange will need to verify your information. Therefore, you are required to provide an identification document. Some platforms require face verification for extra security.

Once verification is complete, your account becomes active, and you can start trading. However, you must first fund your trading account with USD or crypto to purchase LTC.

b. Store your LTC

It is critical to have a Litecoin wallet whether you are a newbie or a professional trader. A Litecoin wallet is an app that allows you to send, receive, and store LTC. Some exchanges offer in-built wallets, but you may consider more secure alternatives.

When choosing LTC wallets, consider those where you can own the Private Keys- this enhanced security feature can protect your assets. Suppose the exchange owns the Private Keys to your LTC wallet. If a cyber-attack occurs, your assets will be vulnerable to theft.

Other criteria for choosing a secure and reliable LTC wallet include ease of use, compatibility with various devices, and backup features.

Apart from exchange wallets, there are desktop wallets like Electrum-LTC or hardware wallets like Ledger and Trezor designed for optimal security. It is important to note that some of these LTC wallets are free while others are paid.

c. Develop a trading plan based on your goals.

Before trading LTC, you have to identify your goals and develop a trading plan. You need to answer questions like "will I buy and hold long term, trade on price fluctuations, or both?" A trading plan outlines trading objectives, risk management, entry and exit strategies. However, you must consider your risk tolerance and experience when making your trading plan.

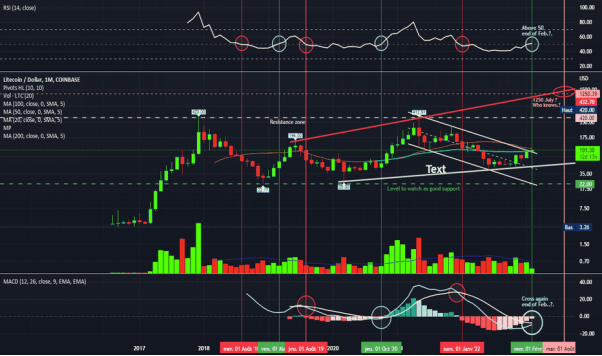

In addition, conducting a fundamental and technical analysis is critical to identify trends and spot potential profitable trading opportunities. Market analysis is critical because it helps you understand the dynamics of the market and factors that can influence the direction of price movement.

d. Start with a small amount

Start with a small amount and take profits and losses based on your targets. One fundamental rule is to avoid trading with money you cannot afford to lose. This strategy allows you to build your experience without risking significant capital. The volatile nature of LTC can cause significant price movement in a short time. Therefore, you can make either huge profits or losses within a few hours.

In addition, it is essential to set realistic profit targets and implement stop-loss orders to manage risk. Monitor the markets and LTC closely in case quick action is needed. It is important to stay updated on factors influencing LTC market value. As a result, you can make timely decisions to protect yourself from sudden unfavorable price movement.

e. Options for shorting or leveraged trading LTC

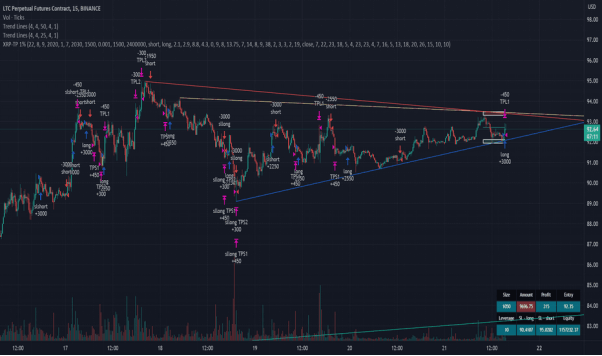

Trading LTC on exchanges by taking advantage of price movement is quite straightforward. However, you can choose shorting or leveraged trading options, which require caution. Some exchanges offer LTC margin trading and a few CFD brokers provide LTC CFDs.

Shorting involves betting on a decline in the price of LTC. On the other hand, leveraged trading allows traders to enter a position with only a percentage of the capital. For example, suppose you choose a leverage ratio of 1:5, and you deposit $1000.

With that deposit, you can control a position worth $5000, which can amplify your profit.

Leverage trading can be risky because your loss will also be amplified. Therefore, you need to implement tight risk management tools and orders to minimize risk.

Trading Litecoin CFDs

Trading CFDs is the use of derivatives to predict the price movement of LTC without owning it. Although it involves prediction, it requires analytical tools to make informed choices. This segment will explore the pros, cons, and strategies for successful Litecoin CFD trading.

i. Understanding CFDs

CFD stands for Contract for Difference- agreements in which the broker pays the trader the difference between the opening and closing prices. With LTC CFDs, you speculate on price movements without owning the actual LTC.

Before you can trade LTC CFDs, you need to create an account with a broker. However, be sure the broker offers Litecoin CFDs before making any moves. Trading LTC CFDs involves leveraging, which allows you to gain more exposure than your deposit. However, you must use margins cautiously as they could amplify gains or losses.

Another feature of CFD trading is it offers flexibility to go long or short. For example, suppose you predict a potential increase in LTC's market value. You can go long. On the other hand, you can go short when you speculate a decline in its market value.

ii. Pros of trading Litecoin CFDs

Trading Litecoin CFDs is an excellent choice for traders who want to profit from the market's volatility without actually owning the token. Here are some pros of trading Litecoin CFDs:

Short selling

One of the pros of trading Litecoin CFDs is it offers an excellent opportunity for short-term traders. You can short-sell LTC CFDs to profit from declining prices. As a result, you do not need to rely on Litecoin's long-term performance to make a profit.

In addition, CFDs do not have any shorting rules, so that they can be shorted at any time without additional costs. The flexibility of short-selling LTC CFDs allows traders to maximize small price fluctuations for profits.

Leverage

Leverage offers flexibility that cannot be seen in "traditional trading." Trading Litecoin CFDs provides leverage of 10x or higher. Therefore, with little profit, traders can make significant profits.

However, we recommend you trade with lower margins to manage risk. Higher leverage indicates higher risks. So, if the market moves against you, your loss is amplified. For example, the cost of controlling a position is $80,000. Using a 10x leverage, you are required to make an initial deposit of $8,000 to control the position.

No storage responsibilities

Trading LTC CFDs does not burden you with storage responsibilities. You do not have to worry about choosing the best Litecoin wallet. In addition, you also have no fear of all your Litecoins being stolen in case of a cyber-attack.

24/7 market

CFD markets operate 24/7, allowing you to trade Litecoin CFDs anytime. As a result, traders can take advantage of short-term market movements to maximize profit.

In addition, this continuous market allows traders to jump on short-term trends associated with daily price fluctuations. Therefore, traders can capitalize on volatility without restrictions on specific trading hours.

iii. Cons of trading Litecoin CFDs:

Trading Litecoin CFDs comes with benefits as well as risks. CFDs are risky if used irresponsibly. Here are some risks associated with LTC CFD trading:

Leverage

Leverage can pose a risk to traders as losses will be magnified if the market moves against you. Therefore, LTC CFD traders must use leverage cautiously and implement appropriate risk management strategies.

The initial deposit is only a percentage of the full position. Therefore, it is easy to fall into the trap of "excessive leverage." Traders must remember that the loss is calculated based on the full size of the position and not the deposit. As a result, even small price movements could result in significant losses.

Extra fees

Another risk of LTC CFD trading is extra fees such as spreads and commissions, which can eat into your profit. In addition, overnight fees may accumulate when keeping a CFD position active overnight. Many traders often forget about this fee, but they can erode your profit. Therefore, your trading plan must cater to fees associated with trading Litecoin CFDs.

You do not own the Litecoins

When trading Litecoins CFDs, you do not own the cryptocurrency. Therefore, you cannot benefit from any governance or staking reward associated with Litecoin. In addition, your funds may be at risk in situations when the broker may go insolvent. Therefore, choosing a reputable and regulated broker for trading LTC CFDs is critical.

iv. Choose a regulated CFD broker that offers LTC

To begin trading Litecoin CFDs, you must select a reputable CFD broker like VSTAR that offers LTC. After selecting a broker, you must create an account, which often requires providing personal information. Once you have verified the account, you can fund it via credit cards, debit cards, or bank transfers and start trading LTC CFDs.

Vstar is a reputable broker that provides institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

In addition, Vstar is regulated by CySEC- unregulated brokers often have a high commission, which can erode your profit. More so, Vstar caters to beginners by providing educational resources and a demo account for practice.

v. Develop a comprehensive trading plan

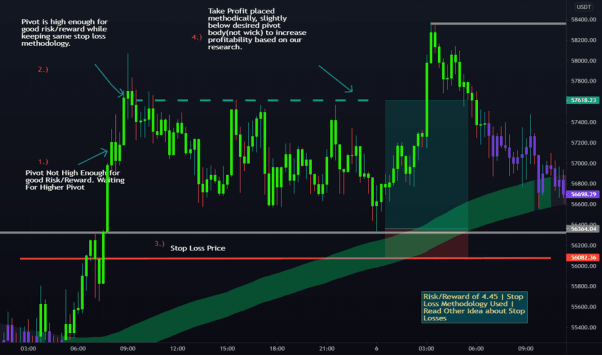

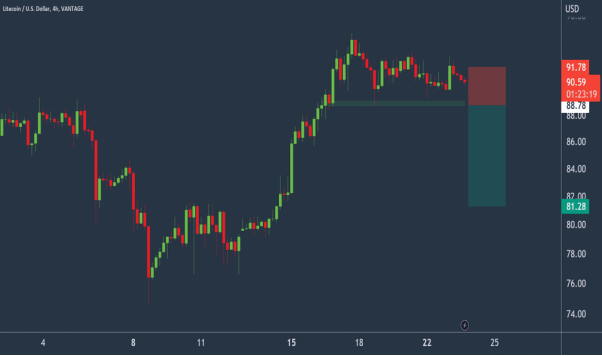

A trading plan is a blueprint that guides your trading activities. It includes entry and exit rules, stop loss/take profit levels, leverage, and position sizing based on your analysis and risk tolerance. Litecoin is volatile, so we recommend you start with demo trading to practice your plans. Fundamental and technical analysis can inform your trading plan. It is critical that you follow the outline of your trading plan, but you can modify it based on the current market condition.

Trading plans can help you determine entry and exit points to maximize profit and minimize risks. In addition, your plan should include a range of leverage for trading. This is to avoid "over-leveraging" and emotional trading.

Establish stop losses and take profit orders as part of risk management strategies. These orders automatically close your trading position when the price of Litecoin reaches a pre-set value.

vi. Monitor your positions closely

Careful monitoring of your positions is critical for LTC CFD trading. Leverage trading may be fast-paced, meaning trends can change rapidly. Therefore, you must be ready to make adjustments or close positions to minimize risk quickly.

Monitoring involves staying updated on trends and factors that can cause rapid Litecoin price movement. When you catch these signals early, you can adjust your trading goals to get the best of the situation.

You can set up a stop loss order, which automatically exits your position when the value of LTC has crashed to a pre-set level.

vii. LTC CFD trading fees

Fees like overnight financing rates, commissions, and spreads can affect profits. Ensure you understand the broker's full fee schedule before trading. Therefore, your trading plans must account for these fees to avoid issues with profit.

High leverage and long-term overnight positions can accumulate into a substantial overnight trading fee. This is added to your total trading cost and could reduce your profit.

viii. Strong discipline and risk management

Trading LTC CFDs requires strong discipline to protect you from the consequences of emotional trading. Due to the risk associated with leverage, it is critical you only risk capital you can afford to lose. Start with smaller positions, and as you build experience over time, you can trade larger positions.

The importance of risk management strategies cannot be overemphasized. Setting up appropriate stop-loss orders, taking profit orders, and monitoring support and resistance levels can protect your capital.

Summary

Litecoin is the second oldest cryptocurrency. Trading Litecoin CFDs provides an exciting opportunity for short-term traders. CFD trading has several advantages: leverage, short selling, no storage responsibilities, and a 24/7 market. However, associated risks include the potential for substantial loss, overnight trading fees, and broker risks.

The first step to trading LTC CFDs is to select a reputable and regulated broker like VSTAR. Trading without developing a plan is like entering a surfing competition without a surfboard. Monitor your positions and implement risk management strategies to minimize risk.

Visit Vstar today to begin building your Litecoin CFD trading with our demo accounts. Congratulations on reading to this point; you are well on your way to a successful LTC CFD training!