Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third-party interference. In addition, Ethereum is a public blockchain-based distributed computing platform featuring smart contract functionality.

Furthermore, it provides a decentralized virtual machine, the Ethereum Virtual Machine (EVM), which can execute scripts using an international network of public nodes. The native cryptocurrency of the Ethereum blockchain is “ETH”. This is used to pay for transaction fees and computational services on the network.

Market Capitalization

When it comes to market capitalization, Ethereum is second only to Bitcoin. As of April 10th, 2023, the market capitalization of Ethereum stood at around $632 billion, with a price of $4,675 per token. This is a significant increase from its market capitalization of around $20 billion in 2017, highlighting the growth and potential of the cryptocurrency market.

So, what does Ethereum's market capitalization mean for traders?

For one, it shows there is a lot of interest in Ethereum and that it is a major player in the crypto space. This can give traders confidence when buying or selling ETH. Additionally, a large market cap can also make a cryptocurrency more stable, which can be attractive to risk-averse traders.

Trading Volume

Ethereum has established itself as one of the most popular cryptocurrencies, with over $200 billion in market capitalization. As of March 2023, the daily trading volume of Ethereum stands at around $50 billion, making it the second most traded cryptocurrency after Bitcoin.

Compared to other cryptocurrencies, Ethereum's trading volume is significantly higher. For instance, the trading volume of the third most popular cryptocurrency, Binance Coin (BNB), is around $10 billion. This indicates that Ethereum's market is more liquid and active than other cryptocurrencies.

So, what does this mean for traders?

Understanding the trading volume is essential for traders as it provides them with valuable insights into the market. Additionally, high trading volumes can provide traders with more opportunities for arbitrage. Arbitrage is a trading strategy where traders take advantage of price differences between different exchanges to make a profit. Higher trading volumes can make it easier to identify these price differences and execute profitable trades.

Moreover, a high trading volume also means that traders can easily buy and sell Ethereum without affecting the price significantly. This is because there are enough buyers and sellers to ensure the price remains stable. Therefore, if the trading volume is low, it may be a good time to sell Ethereum, as it indicates a lack of interest in the market.

Price History

Ethereum's price history is a story of extreme volatility. In its early days, Ethereum's price was less than $1. However, in just a few months, the price surged to $15, a more than 1500% rise. The year 2017 was remarkable for Ethereum, as the price went from $8 in January to a staggering $1,389 by December, an increase of more than 17,000%.

This was mainly due to the booming Initial Coin Offering (ICO) market, where Ethereum was the preferred choice for fundraising. However, this meteoric rise was short-lived, as the price started to decline in 2018. By the end of the year, the price had plummeted to $83, a drop of more than 90% from its all-time high. The following years saw a gradual recovery, and the price reached an all-time high of $4,362 in May 2021, before experiencing a slight correction.

Analysis of trends in Ethereum's price history:

One of the key trends in Ethereum's price history is the correlation with Bitcoin's price. Ethereum's price closely follows Bitcoin's price movements, and this correlation has increased over the years. Another trend is the impact of major events such as the ICO boom and regulatory actions. The ICO boom in 2017 had a significant effect on Ethereum's price, as it was the preferred choice for fundraising. Regulatory measures, such as the SEC's decision to classify some ICOs as securities, negatively affected Ethereum's price.

Discussion of the significance of Ethereum's price history for traders:

Ethereum's price history is significant for traders as it provides valuable insights into the cryptocurrency's behavior and volatility. By studying the trends and patterns, traders can make informed decisions on when to buy or sell Ethereum. Traders can also use Ethereum's price history to identify potential support and resistance levels, which can help set stop-loss orders and profit targets.

Furthermore, Ethereum's price history can also help traders develop trading strategies. For instance, some traders use technical analysis to identify short-term price movements, while others use fundamental analysis to identify long-term trends. Traders can also use Ethereum's price history to identify potential risks and opportunities, such as major events or market cycles.

Technical Analysis

Technical analysis is a technique that traders use to analyze Ethereum's price movements. By studying past price patterns, traders can identify trends and predict the future price of Ethereum.

There are a variety of technical indicators that traders use to analyze Ethereum's price movements. Some of the most popular indicators include- moving averages, support and resistance levels, and Fibonacci retracements.

❖ Moving averages are a technical indicator that show the average price of Ethereum over a period of time. The most common time periods used are 50 days, 100 days, and 200 days. Traders use moving averages to identify trends and momentum. For example: The chart below shows Ethereum's price movement along with the 50-day and 200-day moving averages.

❖ Support and resistance levels are another technical indicator that traders use to predict future prices. Support levels are prices where Ethereum has found buyers in the past and is likely to find buyers again in the future. Resistance levels are prices where Ethereum has found sellers in the past and is likely to find sellers again in the future.

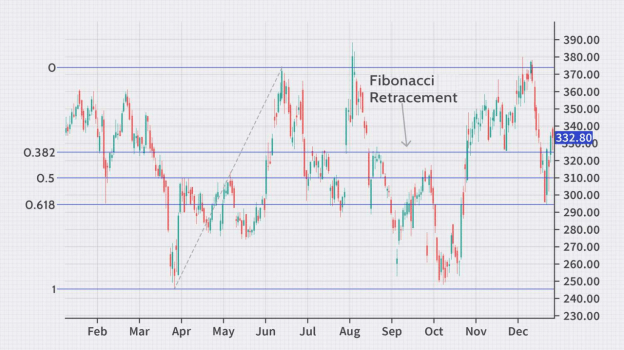

❖ Fibonacci retracements are a technical indicator that uses mathematical ratios to predict support and resistance levels. Fibonacci retracements are based on the Fibonacci sequence, which is a series of numbers that starts with 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc. The most important Fibonacci ratio for trading purposes is 61.8%. The chart below shows Ethereum's price movement along with the Fibonacci retracement levels.

Fundamental Analysis

When it comes to Ethereum trading, it is essential to understand the fundamental factors that can affect the price of ETH. These include things like technology, adoption rate, and market demand. Let us take a closer look at each of these factors:

● Technology: The technology behind Ethereum is constantly evolving. This can affect the price of ETH in both positive and negative ways. For example, if a new use case for Ethereum is discovered, this could lead to an increase in price. On the other hand, if there are technical issues with Ethereum, this could lead to a decrease in price.

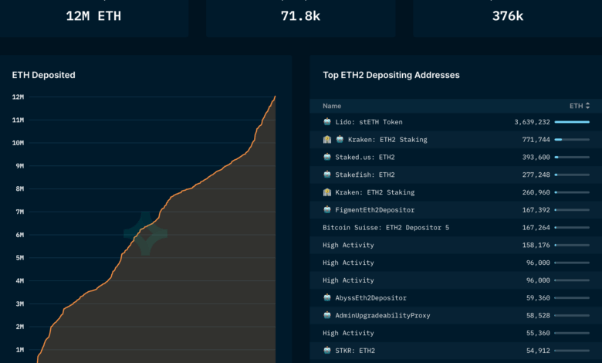

● Adoption rate: The more people that use Ethereum, the higher the demand for ETH will be. This increased demand can lead to a higher price for ETH. Conversely, if the adoption rate of Ethereum decreases, this could lead to a lower ETH price.

● Market demand: The overall demand for cryptocurrencies can affect the price of ETH. In general, if there is high demand for cryptocurrencies, it will likely lead to a higher ETH price. However, if there is a low demand for cryptocurrencies across the board, this could put downward pressure on the price of ETH.

One of the critical aspects that every trader should understand when it comes to Ethereum trading is the fundamental factors that can influence its price movements. Here are some of the key fundamental factors that every Ethereum trader should know:

● Network Activity: The more people using the network and creating smart contracts, the more valuable Ethereum becomes.

● Developer Activity: The more developers build on the platform, the more likely Ethereum will grow in value.

● Regulatory Developments: As with any cryptocurrency, regulatory developments can significantly affect the price of Ethereum. For example, if a major country were to ban the use of cryptocurrencies, it could lead to a significant drop in the price of Ethereum.

How to Trade Ethereum

If you want to trade Ethereum, you have three main options: spot trading, options trading, and CFD trading. Each option has its advantages and disadvantages, so choosing the right one for your needs is important. Here are some profitable ethereum trading tips:

Spot Trading

Spot trading is the most straightforward way to trade Ethereum. You simply buy or sell ETH for the current market price. This method is best for short-term traders who want to take advantage of quick changes in the market.

For instance, let's say you want to buy Ethereum, which is currently trading at $2,500. You buy one Ethereum coin and hold it in your cryptocurrency wallet. After a few months, the price of Ethereum increases to $3,000, and you decide to sell your Ethereum coin. You made a profit of $500.

Options Trading

Options trading gives you more flexibility than spot trading. With options, you can bet on the direction of the market (up or down), but you don't have to commit to a specific price. This method is best for traders who want to speculate on the direction of the market without having to commit to a specific price.

Practical application of this is let's say you believe that Ethereum's price will increase in the next two weeks. You buy a call option at a strike price of $3,000, which expires in two weeks. If Ethereum's price increases above $3,000 before the option expires, you can exercise the option and make a profit. If Ethereum's price stays below $3,000, you can let the option expire, and you will only lose the premium you paid for the option.

CFD Trading

CFD trading is a more complex way for Ethereum trading pairs. With CFDs, you trade based on the difference between the current price and the price at contract expiration. This method is best for traders who are comfortable with complex financial instruments and are looking for leverage to amplify their returns.

For instance, you buy a CFD contract for 10 Ethereum coins at a price of $2,500 per coin, with a leverage of 5:1. If Ethereum's price increases to $3,000 per coin, you will make a profit of $5,000 (10 x ($3,000 - $2,500) x 5).

No matter which method you choose, you can develop a strategy that fits your goals and risk tolerance.

Trading Strategies For Ethereum

Let’s discuss key trading strategies for Ethereum, including day trading, swing trading, and position trading.

Day Trading

Day trading involves buying and selling Ethereum within a single trading day. Day traders aim to profit from short-term price movements and close their positions before the end of the trading day.

Application:

Let's say you want to day trade Ethereum. You buy Ethereum at $2,500 in the morning and sell it at $2,550 in the afternoon. You made a profit of $50.

Swing Trading

Swing trading involves holding Ethereum for a few days to a few weeks to take advantage of medium-term price movements. Swing traders aim to profit from price swings and usually hold their positions for a longer time than day traders.

Application:

Let's say you want to swing trade Ethereum. You buy Ethereum at $2,500 and hold it for two weeks. After two weeks, the price of Ethereum increases to $3,000, and you sell it. You made a profit of $500.

Position Trading

Position trading involves holding Ethereum for an extended period, usually several months to several years. Position traders aim to profit from long-term price movements and usually base their trading decisions on fundamental analysis.

Application:

Let's say you want to position trade Ethereum. You buy Ethereum at $2,500 and hold it for a year. After a year, the price of Ethereum increases to $5,000, and you sell it. You made a profit of $2,500.

Trade ETH CFDs with VSTAR

VSTAR is a secure and reliable platform for trading ETH CDFs. VSTAR's CFD trading platform offers lightning-fast execution and low trading costs, including tight spreads, which can help traders maximize their profits. Secondly, VSTAR is fully regulated by the Cyprus Securities and Exchange Commission (CYCEC), which provides traders with an added layer of security and confidence in their trading activities. Suppose the goal is to trade with confidence and maximize gains, whether as a beginner or professional. Then Vstar is the platform for you!

News and Events

To trade Ethereum profitably, it is crucial to stay up-to-date on all the latest news and events related to the coin. By doing so, traders can make more informed decisions about when to buy or sell Ethereum and be aware of any potential price movements that may occur due to news or events.

There are some ways to stay informed about Ethereum news and events;

● One way is to follow cryptocurrency news outlets such as CoinDesk or Cointelegraph. These outlets often provide timely updates on any major developments related to Ethereum or other cryptocurrencies.

● Another way to stay informed is to follow Ethereum-focused social media accounts such as @Ethereum on Twitter. Also, you can get updated news via VSTAR news as they sometimes provide trending trading tips.

● Finally, traders can also join online communities dedicated to discussing Ethereum trading. These communities provide a platform for users to share information and ideas and can be an invaluable resource for staying up-to-date on all things related to Ethereum trading.

Risk Management

Risk management is an essential aspect of any type of trading, including Ethereum trading. As a trader, it's crucial to have a plan in place to manage the risks associated with Ethereum trading and the potential losses that may occur. Let’s consider some strategies for managing risk when trading ethereum:

❖ Diversification: One of the most critical strategies for managing risk in Ethereum trading is diversification. This involves investing in a variety of different cryptocurrencies to reduce the overall risk of a trader's portfolio. By spreading out their investments, traders can minimize the impact of any potential losses in any one particular cryptocurrency.

❖ Use Of Stop-loss: Another critical aspect of risk management in Ethereum trading is setting stop-loss orders. Stop-loss orders allow traders to set a specific price at which they will sell their Ethereum if the price drops below a certain level. This helps to limit potential losses and protect a trader's capital. Stop-loss orders should be set at a reasonable level and take into account the volatility of Ethereum.

❖ Technical Analysis Tools: Technical analysis involves ethereum chart analysis and other data to identify trends and patterns in the market. This can help traders decide when to enter or exit trades. Technical analysis tools can include moving averages, trend lines, and momentum indicators.

Conclusion

Finally, mastering Ethereum trading requires excellent comprehension of the technology behind Ethereum, market analysis, technical analysis, trading strategies, risk management, and trading tools. With its growing adoption and increasing use cases, Ethereum has significant potential for trading, and its future prospects look promising. However, traders must be cautious and manage risk exposure to make informed investment decisions. Invest Now!

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.