The global semiconductor industry revenue is forecast to double to $1 trillion by 2030. Excited about this opportunity, investors are on the lookout for the best ai stocks or chip stocks to buy.

There are many kinds of chips for different purposes. It turns out that chips that power artificial intelligence applications, or AI chips, are the most lucrative. Nvidia Corporation (NASDAQ: NVDA) and Intel Corporation (NASDAQ: INTC) are two semiconductor companies with deep interest in the AI chips business.

Source: Pixabay

If you have to select only one chip stock, would it be Nvidia or Intel stock?

This article explores the business model and financial results of Nvidia and Intel to help you to decide the right chip stock to buy. You’ll also find out how Nvidia and Intel stocks have performed and their stock price forecast.

Nvidia vs Intel: Stock Overview

About Nvidia Stock (NASDAQ: NVDA)

Founded in 1993, Nvidia is headquartered in Santa Clara, California. Nvidia co-founder Jensen Huang continues to lead the company as the CEO. Nvidia stock went public in January 1999 at an IPO price of $12.

Although it started as an underdog, Nvidia has become a major force in the global chip industry. Nvidia stock recently hit the $1 trillion valuation milestone, making it the world’s largest semiconductor company by market cap.

About Intel Stock (NASDAQ: INTC)

Founded in 1968 by a group led by Gordon Moore, Intel is headquartered in Santa Clara, California. Intel CEO Pat Gelsinger joined the company as a quality-control technician. Gelsinger left Intel for some time to go work for VMware. Intel stock went public in 1971 at an IPO price of $23.50. With a market cap of about $125 billion, Intel ranks among the world’s largest semiconductor companies.

Nvidia vs Intel: Business Model

From smartphones to computers to cars and power plants, the modern world runs on semiconductor chips. Nvidia and Intel are leading suppliers of chips for various applications. Although they compete for the chip market share, Nvidia and Intel approach the chip business differently.

Nvidia’s Business Model

Nvidia primarily makes a type of chip known as the graphics processing unit (GPU). GPU chips perform specialized functions in personal computers, gaming devices, and data centers. Nvidia is a fabless semiconductor company, meaning it doesn’t have its own chip production facilities. Instead, Nvidia outsources its chip manufacturing work to companies like Taiwan Semiconductor Manufacturing (NYSE: TSM) and Samsung.

Intel’s Business Model

Intel mainly makes a type of chip called the central processing unit (CPU). The CPU is the core chip in computing devices. Intel chips power personal computers, data centers, and various other devices.

Unlike the fabless Nvidia, Intel has its own chip manufacturing infrastructure. The company operates more than a dozen chip factories around the world. In addition to producing its own chips, Intel also accepts contract chip manufacturing orders. Nvidia is considering using Intel facilities to produce its chips.

Source: Pixabay

Nvidia vs Intel: Market Analysis

Although Nvidia and Intel target different primary market segments, their business interests overlap. While it dominates the GPU chip market, Nvidia is making inroads in the CPU chip market. Similarly, Intel dominates the CPU market and is making inroads in the GPU market.

GPU Market Share: AMD vs Intel vs Nvidia

● Nvidia: 88%

● AMD: 8%

● Intel: 4%

CPU Market Share: Intel vs AMD vs Nvidia

● Intel: 65%

● AMD: 34%

● Nvidia: <1%

The main difference between Nvidia and Intel is that Nvidia is fabless while Intel has an in-house chip manufacturing capability.

Intel vs Nvidia: AI Stocks Race

Source: Pixabay

The instant success of ChatGPT has stirred strong interest in artificial intelligence technology. From Meta Platforms (NASDAQ: META) to Alibaba (NYSE: BABA), virtually all the major technology companies are building some forms of AI products. For cloud computing providers like Amazon, Microsoft, Google, and Alibaba, they’re aggressively building AI capabilities in their data centers.

The AI race is fueling demand for powerful chips. It turns out that graphics chips are doing a great job in handling AI workloads. Consequently, Nvidia has taken an early strong lead in the AI chips race because of its dominance of the GPU market. While sales to the gaming market previously contributed the bulk of Nvidia’s revenue, the company now obtains most of its revenue from AI chip sales to the data center market.

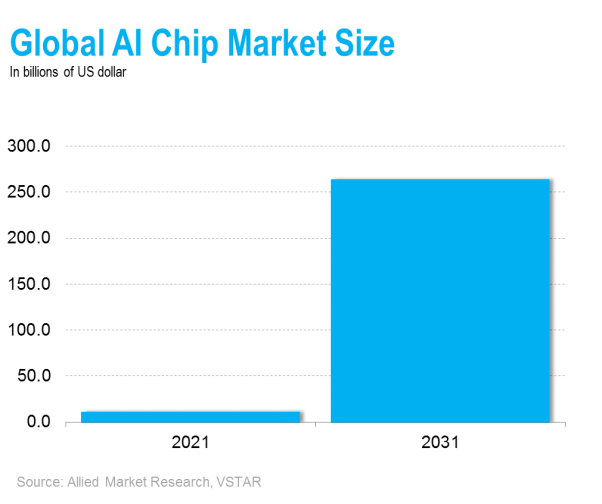

The global AI chip market size is forecast to hit $263.6 billion by 2031, from $11.2 billion in 2021.

After years of relying on CPU sales, Intel is shifting its focus to GPUs to take advantage of the booming AI chip demand. Intel initially attempted to sell chips that combine CPU and GPU capabilities. But that proved to be a hard sell, forcing the company to abandon the strategy to focus on standalone GPU chips for AI workloads.

Although Intel has fallen behind Nvidia in AI chip technology development, it hopes to have the best product for the market. Intel plans to launch its most advanced AI chip series, known as Falcon Shores, on the market in 2025. The company believes that its Falcon Shores chips will outperform Nvidia’s rival chips in handling AI applications.

Nvidia vs Intel: Financial Performance

Intel (NASDAQ: INTC) is a much larger company with annual revenue that is more than double that of Nvidia (NASDAQ: NVDA). But Nvidia has delivered better financial results than Intel in recent times, a sign of its strong advantage in the lucrative AI chip market. Let’s compare the companies’ financial performance on key areas:

1. Revenue

Nvidia’s Revenue

The company reported a 13% year-over-year revenue decline to $7.2 billion for its fiscal Q1 2024 ended April 30. Despite the dip from a year ago, the revenue exceeded the consensus expectation of $6.5 billion. Nvidia anticipates its revenue to grow more than 60% year-over-year to $11 billion in fiscal Q2 2024, well above the consensus expectation of $7.2 billion.

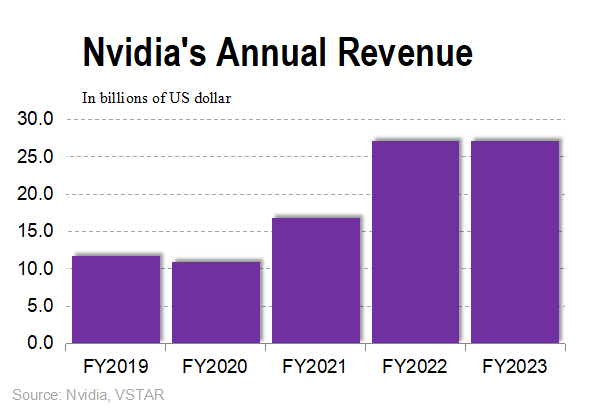

Nvidia’s revenue has increased at a compound annual growth rate of 18% over the past 5 years. The chart below illustrates the company’s annual revenue trend.

Intel’s Revenue

The company’s revenue declined 36% year-over-year to $11.7 billion in Q1 2023. Despite the drop, the revenue surpassed the consensus expectation of $11 billion. For Q2, Intel expects its topline to decline to ease to 20% to revenue of $12 billion, in line with the consensus expectation.

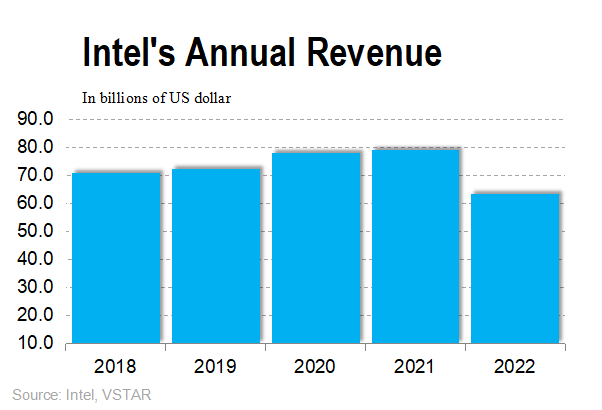

Following the steep decline in 2022, Intel’s revenue compound annual growth rate over the past 5 years has turned negative 2%. The chart below illustrates Intel’s annual revenue trend.

2. Net Income

Nvidia’s Net Income

The company’s profit for Q1 rose 26% year-over-year to $2 billion. That translated to EPS of $0.82, or $1.09 on an adjusted basis, which surpassed consensus expectation of $0.92.

Intel’s Net Income

The company reported Q1 loss of $2.8 billion, representing a 134% year-over-year decline. That translated into an adjusted loss per share of $0.04, which was better than consensus expectation of $0.15 loss per share. For Q2, Intel anticipates a loss per share of $0.04, though analysts expect EPS of $0.01.

3. Profit Margins

Nvidia’s Profit Margin

The GPU giant achieved a gross profit margin of about 65% in fiscal Q1 2024. The gross profit margin for fiscal 2023 was 57%. The company has maintained its annual gross profit margin at about 60% over the past 5 years. The high gross margin is a testament to Nvidia’s strong pricing power in the AI chip market where chips cost thousands of dollars.

Intel’s Profit Margins

Intel’s gross profit margin was 34% in Q1. The company’s gross margin was about 43% in 2022. Intel’s gross margin has been declining in recent years, a sign of pricing pressures in the company’s primary CPU market where AMD and Nvidia are seeking to take its market share.

4. Balance Sheet Strength

Nvidia’s Cash Position and Balance Sheet Condition

The company generated $2.9 billion in cash flow from operations in Q1. It ended the quarter with $15.3 billion in cash and short-term investments. Nvidia has more than $44 billion in assets against total liabilities of less than $20 billion. The company has an impressive debt-to-equity ratio of 0.49%.

Source: Pixabay

Intel’s Cash Position and Balance Sheet Condition

The company had negative cash flow from operations in Q1. Despite its steep loss and negative cash flow in Q1, Intel still stands on solid financial grounds. It finished the quarter with $27.5 billion in cash and short-term investments. The company has $185 billion in total assets against $84 billion in liabilities. Intel has a respectable debt-to-equity ratio of 0.51%.

Factors affecting Nvidia and Intel financial performance:

● Nvidia’s financial performance has benefited from strong demand for AI chips and high prices of the components.

● Intel’s financial performance has been hurt by lagging technology in the AI chip market and stiff competition in the CPU market.

Nvidia vs Intel: AI Stocks Analysis

Stock Trading Information

Nvidia: The stock trades on the Nasdaq exchange under the “NVDA” ticker symbol. About 50 million Nvidia shares are bought and sold in each trading session.

Intel: The stock is listed on the Nasdaq exchange under the “INTC” ticker symbol. About 45 million Intel shares are bought and sold in a trading session.

Intel vs Nvidia: Stock Price Performance

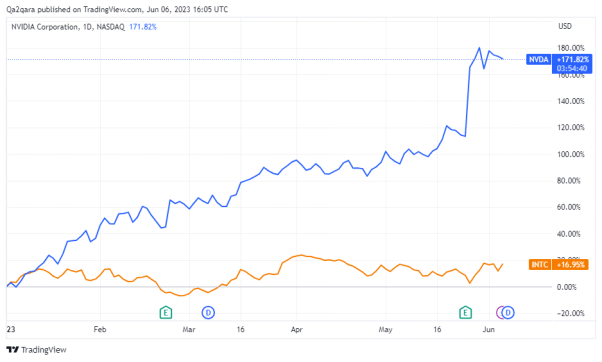

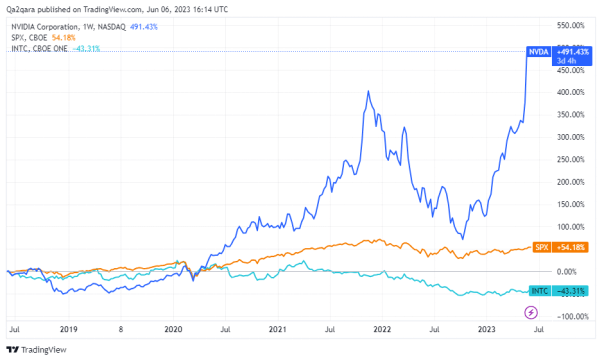

Nvidia (NASDAQ: NVDA) stock price has climbed more than 173% year-to-date, overshadowing Intel (NASDAQ: INTC) stock’s nearly 12% rise. Nvidia stock has more than doubled over the past year, while Intel stock has retreated 30% over that period.

Looking at the long-term returns, Nvidia stock has gained almost 500% over the past 5 years, while Intel stock price has pulled back 45% over that period. The S&P 500 index has advanced more than 50% over the past 5 years.

Nvidia vs Intel: AI Stocks Forecast

Nvidia Stock Forecast

After Nvidia’s sharp spike, you might wonder whether the stock has more room to rise. According to Wall Street analysts’ Nvidia stock price forecast, the chip stock still has a decent upside potential. The average NVDA stock price target of $450 implies a 15% upside. The peak NVDA stock price target of $600 suggests over 55% upside.

Intel Stock Forecast

Intel’s steep retreat might leave you wondering whether the stock will continue to slide or rebound. The Intel stock price forecast implies a modest upside potential. Wall Street’s average INTC stock price target of about $31 suggests a nearly 3% upside. The peak Intel stock price forecast of $39 implies a 30% upside.

These are some of the factors that affect Nvidia and Intel stock prices:

Financial results: Investors follow strong financial results. As a result, Nvidia’s impressive earnings results have been followed by a rise in NVDA stock price. Similarly, Intel’s anemic earnings have been followed by a tepid stock performance.

Chip technology: In the race to win over customers, semiconductor companies compete to build smaller, more powerful, and more energy-efficient chips. The stock market has rewarded Nvidia for its advanced chip technology and punished Intel’s lagging technology.

Economic conditions: Semiconductor demand is dependent on global economic conditions. In a booming economy, chip demand goes up, resulting in strong earnings that in turn influence chip stock price movements.

Is Nvidia or Intel Stock a Better Buy For 2023?

Source: Pixabay

Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC) both have strong balance sheets with substantial cash to support their chip technology development programs. They also have a large revenue opportunity considering that chips are included in nearly every modern product.

Intel has a firm grip on the large CPU market while Nvidia has a strong lead in the more lucrative GPU market. A major headache for these companies is that their customers can turn into competitors. Nvidia is particularly threatened as its customers such as Amazon, Microsoft, and Google consider designing their own AI chips.

These are additional factors you can consider to help you decide whether Nvidia or Intel stock is the better buy:

Dividend yield: If you’re investing for income, dividend yield is something you would want to consider when selecting chip stocks. Intel stock offers a dividend yield of 3.9%, better than Nvidia’s 0.04% and the sector average of 1%. The trouble is that Intel could be forced to rethink its dividend program if its losses persist and its cash balance continues to shrink.

Stock valuation: Nvidia stock trades at an annual forward PE ratio of 50x while Intel stock trades at a forward PE ratio of 71x. Intel stock comes out as overvalued on this basis.

Considering the semiconductor industry outlook, there is a reason to invest in both Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC) stocks. But if you only have to select one, Nvidia appears to be a better buy considering its more favorable stock valuation, strong hold on the lucrative AI chip market, and larger stock price upside potential.

How to Invest in Nvidia (NASDAQ: NVDA) Stock

You have several options to make money with ai stocks. Let’s examine the popular ways you can invest in Nvidia stock:

Holding Nvidia shares: This method involves buying and holding Nvidia shares in your portfolio. With this investing strategy, you get voting rights in the company and become eligible for dividends. But holding shares in a company requires a large starting capital and a wait for long gains.

Trading Nvidia stock CFD: This method allows you to profit from Nvidia stock price movements without actually owning the shares. You only need to predict whether the stock will go up or down over short periods such as an hour, a day, or week. You’re paid the difference between the closing and opening prices of the stock if your prediction turns out correct. Trading stock CFD requires minimal starting capital.

Trading Nvidia Stock CFD with VSTAR

If trading Nvidia stock CFD appeals to you, consider using VSTAR CFD trading platform. VSTAR allows you to start trading Nvidia stock CFD with as little as $50. It also offers leverage to boost your trade size. Additionally, VSTAR offers low trading fees and tight spreads to maximize your profit. Moreover, VSTAR supports fast order execution so you don’t miss an opportunity.

To start trading Nvidia stock with VSTAR, the first step is to open a VSTAR account. You only need your email address or phone number to open the account. Once the account is approved, you can fund it and start trading Nvidia CFD.

For those new to CFD trading, VSTAR offers a free demo account with up to $100,000 for your trading practice.

VSTAR is a fully licensed and regulated CFD trading platform. Consider signing up for a VSTAR account today to start trading stock CFDs.

Final Thoughts

Although the semiconductor market is expanding and generating more opportunities for chip companies, the AI chip market segment is shaping up to be the most lucrative. Nvidia (NASDAQ: NVDA) stock seems to be the best bet for investors seeking exposure to the AI chip market.