As the cryptocurrency industry continues to captivate investors, understanding how to profit from market downturns becomes essential. One of the ways of maximizing your potential profits is by selling short Ethereum (ETH) with Contracts for Difference (CFDs). Short selling Ethereum (ETH) using Contracts for Difference (CFDs) is an effective strategy for traders looking to profit from a potential decline in the price of ETH.

Short selling ETH with CFDs empowers you to take advantage of price declines, potentially multiplying your gains even in a bearish market. More so, while delving into the world of contract specifications, we will unveil the crucial details you need to know, from leverage and margin requirements to lot sizes and trading hours. Understanding these specifications will enable you to make informed trading decisions while managing your risk.

This comprehensive Ethereum trading guide is designed to help you learn how to analyze the ETH market, identify key indicators, and stay informed about news and events that can affect its price. In addition, it will guide you through the process of opening a CFD trading account and provide useful tips on selecting the right broker.

In the next section, we shall explore the process of market analysis for selling short ETH with CFDs. Let us dive in!

Analyze the ETH market

Before considering selling short Ethereum (ETH) using Contracts for Difference (CFDs), it's crucial to conduct a comprehensive analysis of the market. By monitoring price action, key indicators, and relevant news and events, you can identify potential opportunities for bearish trades. Here are the essential steps to follow:

a. Monitor price action and signs

To analyze the ETH market with less risks, monitor price action and identify signs of bullish momentum slowing or bearish reversal. Things to look out for, include:

Trendline Break: Keep an eye on the trendlines that define ETH's price movements. A break below an established uptrend line could indicate a shift in market sentiment and the potential start of a downtrend.

Failed Rally: Watch for instances where ETH attempts to rally but fails to break through significant resistance levels. This can suggest a lack of buying interest and the potential for a reversal in price.

Double Top: A double top pattern occurs when ETH reaches a high price level, retraces, and then fails to surpass the previous high. This pattern can signal a reversal and the potential for a downtrend.

b. Look out for indicators

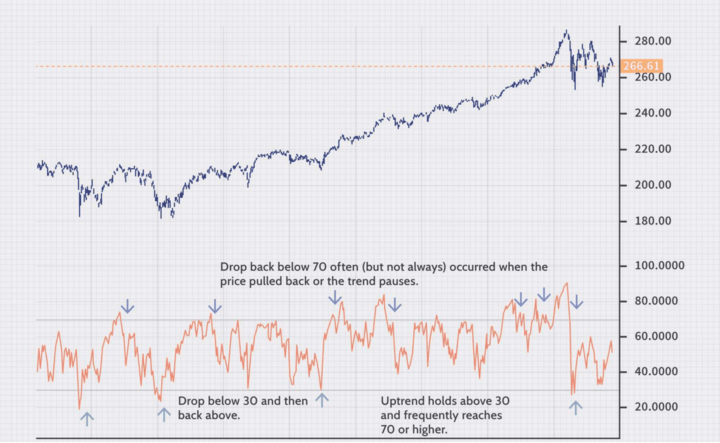

Indicators are part of the essentials that aid a profitable trade. Track key indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) for overbought readings:

RSI: The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI reading above 70 is generally considered overbought, indicating a potential reversal or a period of price consolidation.

MACD: The MACD is a trend-following momentum indicator that can help identify potential trend reversals. Look for a bearish crossover, where the MACD line crosses below the signal line, as it may signal a potential downturn in price.

c. Follow news and event updates

Keeping up on latest ETH news and events that can negatively affect ETH's Price has proven effective in ETH price analysis. Priorities should be on news that focuses on subjects like:

Ethereum Network Vulnerabilities: Stay updated on any news regarding vulnerabilities or security issues within the Ethereum network. Exploitable weaknesses or network failures can significantly influence market confidence and lead to a decline in ETH's value.

New Competing Altcoins: Keep an eye on emerging altcoins that pose a potential threat to Ethereum's dominance. If a new altcoin gains significant traction or introduces innovative features, it may divert investment away from ETH and exert downward pressure on its price.

By critically analyzing these factors, you can gain a better understanding of the market sentiment surrounding ETH and identify potential opportunities for selling short it with CFDs.

Open a CFD Trading Account and Fund your Account

Once you have analyzed the ETH market and decided to proceed with short selling Ethereum using CFDs, the next step is to open a CFD trading account and fund it. Here is a guide on how to do that:

i. Open an account with a CFD broker:

To begin short selling ETH using CFDs after conducting an analysis, the initial step involves opening an account with a CFD broker that offers ETH CFDs, such as VSTAR. It is important to compare various brokers based on their reputation, regulations, interface, trading fees, and customer support to determine the most suitable option.

Once a broker has been carefully selected, the next step entails providing personal information and completing the necessary account verification process. To initiate trading ETH CFDs, funds can be deposited into the account through bank transfers, debit cards, or credit cards.

Vstar is a reputatble broker that delivers a institutional level trading experience. This includes the advantage of having the lowest trading costs, resulting in tight spreads and swift execution of trades.

Additionally, VSTAR is regulated by CySEC, which is crucial since unregulated brokers often impose high commissions that can eat into your profits. Moreover, Vstar offers a demo account for beginners to practice trading strategies, helping to mitigate potential losses during actual trading.

ii. Deposit funds into your trading account:

Once you have chosen a CFD broker, you'll need to deposit funds into your trading account. Most brokers offer multiple funding options, including:

Wire Transfer: You can transfer funds from your bank account to your trading account using a wire transfer. This method may take a few days for the funds to be credited.

E-wallets: Some brokers accept popular e-wallets like PayPal, Skrill, or Neteller for instant deposits. Check with your broker to see which e-wallet options they support.

Credit/Debit Cards: Many brokers accept major credit and debit cards for instant deposits. Simply provide your card details and follow the instructions provided by the broker.

Once your account is funded, you are ready to start trading ETH with CFDs.

Review the Contract Specifications for ETH/USD or ETH/BTC CFDs

Before trading ETH/USD or ETH/BTC CFDs, it is essential to review the contract specifications provided by your CFD broker. These specifications outline important details such as margin requirements, leverage, lot sizes, trading hours, and financing charges. Understanding these specifications is crucial for effective trading. Here is a guide on what to consider:

a. Check margin requirements, leverage, lot sizes, and trading hours:

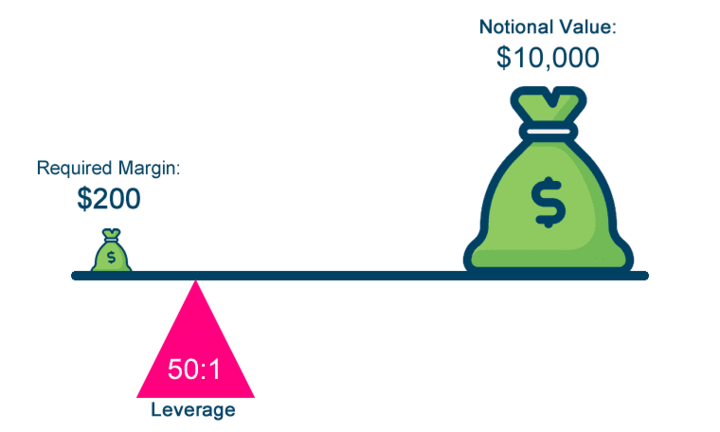

Margin Requirements: Margin refers to the percentage of the total trade value that you need to deposit as collateral to open a CFD position. Check the margin requirements, as they determine the amount of capital required for each trade. Higher leverage levels may require smaller margin percentages but involve greater risk.

Leverage: Leverage allows you to trade with a larger position size than your account balance. It amplifies potential profits but also increases potential losses. Review the leverage options offered and understand the associated risks. Leverage is typically represented as a ratio (e.g., 1:10 or 1:50), indicating how much larger your position can be compared to your account balance.

Lot Sizes: CFDs are typically traded in lot sizes, which represent standardized contract sizes. Check the lot sizes offered for ETH/USD or ETH/BTC CFDs. Lot sizes can vary between brokers and may affect the minimum and maximum trade sizes you can execute.

Trading Hours: Different CFD brokers may have varying trading hours for ETH/USD or ETH/BTC CFDs. Ensure that you are aware of the trading hours to plan your trading activities effectively. Cryptocurrency markets operate 24/7, but CFD trading may have limitations based on the broker's availability.

b. Understand how financing charges are calculated if holding positions overnight:

Financing Charges: When holding CFD positions overnight, brokers typically apply financing charges, also known as overnight financing or swap fees. These charges are based on the interest rate differential between the two currencies in the CFD pair (e.g., ETH and USD or ETH and BTC).

Financing Calculation: Financing charges can be positive or negative, depending on the direction of your position (long or short) and prevailing interest rates. The charges are calculated based on the notional value of your position and the applicable interest rate differentials. It's important to review your broker's financing calculation method to understand how these charges will impact your positions.

Financing Rates: Brokers may provide information about the financing rates or swap rates for ETH/USD or ETH/BTC CFDs. These rates can vary and are typically expressed as an annual percentage rate (APR) or a daily rate. It's advisable to check the financing rates and consider them in your trading strategy if you plan to hold positions overnight.

Place your Short Sell Order

After conducting thorough market analysis, opening a CFD trading account, and reviewing contract specifications, it's time to place your short sell order for ETH CFDs. Follow these steps to execute your trade effectively:

Study the latest ETH price chart and determine a good entry point for your short position by:

● Analyzing the most recent ETH price chart, considering both technical and fundamental factors.

● Identifying the key resistance levels, trendlines, or other technical indicators that suggest a potential downtrend or bearish reversal.

● Looking for a suitable entry point based on your analysis. This could be a specific price level, a trendline break, or a bearish pattern confirmation.

Place a sell order for the number of CFD contracts you want to open based on your maximum risk tolerance:

Complete this by following these steps:

● Log in to your trading account and navigate to the trading platform provided by your CFD broker.

● Locate the ETH/USD or ETH/BTC trading pair and select "Sell" or "Short" to initiate the order.

● Specify the number of CFD contracts you want to open based on your risk tolerance and the available trading size options provided by your broker.

● Set the appropriate order type, such as a limit order or a market order, based on your desired execution method.

Your order will be executed once the bid price reaches your limit sell price, establishing your CFD short position:

However, note that:

● When placing a limit sell order, set the price at which you want the order to be executed. This should be based on your analysis and the desired entry point.

● Alternatively, you can place a market sell order, which will be executed at the prevailing market price at the time of order placement.

● Monitor the order status in your trading platform to confirm its execution.

● Once the order is executed, your CFD short position is established, and you can track the profit or loss as the ETH price moves.

It is important to remember that market conditions can change rapidly, so it is advisable to set appropriate stop-loss orders to manage your risk.

Monitor your Open Position and the ETH Market

Once you have placed your short sell order for ETH CFDs, it's important to actively monitor your open position and the overall ETH market to make informed decisions. Here is a guide on how to effectively monitor your position:

a. Monitor your profit and loss (P&L) in your brokerage account:

Continuously monitor your brokerage account or trading platform to track the profit and loss (P&L) of your open position in real-time as the ETH price declines. More so, ensure you stay updated on the gains made from your short position, and evaluate any notable P&L changes to align them with your initial analysis.

b. Adjust your stop loss to lock in profits in case of a price reversal:

To safeguard your profits, it is advisable to make adjustments to your stop-loss order as the price moves in your favor. Lower your stop-loss to a level that would still secure a satisfactory profit even if the price were to reverse and trigger the stop-loss order. Doing this effectively limits potential losses and preserves your existing gains.

c. Close the trade if your target profit is reached or if there are signals of a trend reversal:

Once the ETH price hits your target profit level, it is recommended to close the trade and lock in your desired gains, staying true to your predetermined trading plan. Additionally, maintain a vigilant watch over the market, paying attention to potential signs of a trend reversal or significant market events that could influence ETH's price. If there are clear indications of a trend reversal or adverse market conditions, it would be prudent to close the trade and reassess your position accordingly.

Remember, monitoring the market and your open position is crucial to successful trading.

Close out your CFD Position

When you decide to close your CFD position, whether it's at a profit or a loss, there are specific steps you need to follow. Here is a guide on how to close out your CFD position effectively:

❖ If closing the trade at a profit, place a buy order to buy back the same number of contracts you sold:

To close your CFD position, access your trading account and navigate to the platform provided by your CFD broker. Locate the ETH/USD or ETH/BTC trading pair and choose the "Buy" or "Close" option to initiate the order.

Specify the quantity of CFD contracts you wish to repurchase, which should match the number you initially sold when opening the position. Finally, select the suitable order type, such as a limit order or market order, depending on your preferred execution method.

❖ If closing at a loss, you will still need to buy back the contracts to realize the loss:

Follow the same steps as highlighted above for closing a profitable trade. When closing a losing trade, it is critical to accept the loss and focus on risk management. Cutting losses is an essential part of successful trading.

❖ Your broker will then debit or credit your account with the loss or profit based on the buy and sell prices of your trade:

After the execution of the buy order, your CFD position will be officially closed. The resulting profit or loss from the trade will be determined by the variance between the sell price and the buy price. Your broker will then debit or credit your trading account accordingly, reflecting the calculated profit or loss from the closed trade.

Conclusion

In summary, when analyzing the ethereum market for signs of a potential short trade, it is important to consider several factors like- monitor price action, track key indicators, follow news and events, and optimize technical analysis strategies.

Short selling Ethereum (ETH) with Contracts for Difference (CFDs) can be an effective strategy for traders looking to profit from potential price declines. However, it requires careful analysis, risk management, and a comprehensive understanding of the market and CFD trading.

Visit Vstar today to begin the process of short selling ETH with CFDs. You can implement your trading strategy with the demo account before investing your capital. More so, our customer support is available to provide round the clock assistance when you need it.