The world of data has been revolutionized since the inception and launch of Snowflake Inc. Unknown to many, the Warren Buffett-backed data warehouse has been through thick and thin, but is still standing tall. This thorough assessment of this cloud computing company will arm you with the proper knowledge of financials, stock analysis, and other information sufficient to make a decision to invest in its stock (NYSE: SNOW). The SNOW stock has experienced a major downturn in the past few years, but is currently on an uptrend with a stock price of 180.79, coupled with the recent expansion with Microsoft, which is exploring groundbreaking possibilities with AI, data governance, and more. You might ask, why should I invest in this stock? That's what we're going to show you in this article.

Snowflake News - Snowflake's Dynamic Collaboration with Microsoft Sets the Stage for Limitless Possibilities

Snowflake's expanded partnership with Microsoft is significant for investors considering Snowflake stock. The collaboration allows Snowflake to tap into Microsoft's trusted platform and leverage its cloud technologies and AI capabilities. This positions Snowflake to further enhance its offerings and strengthen its competitive advantage in the data cloud industry.

By integrating with Microsoft's generative AI and LLM services, Snowflake gains access to the latest AI models and frameworks, enabling joint customers to leverage cutting-edge technology and increase developer productivity. This expanded partnership also fosters joint go-to-market strategies, enabling Snowflake to reach a broader customer base and drive revenue growth.

The partnership with Microsoft is a testament to Snowflake's ability to forge strategic alliances with industry leaders, opening new avenues for growth and innovation.

Snowflake Inc's Overview

What is Snowflake

Snowflake Inc. is a data cloud company founded on July 23, 2012 by Benoît Dageville, Thierry Cruanes, and Marcin Żukowski. The company is headquartered in Bozeman, Montana, USA. After two years in stealth mode, Snowflake went public in October 2014. It is listed on the New York Stock Exchange (NYSE: SNOW) as a Class A stock and is a component of the Russell 1000 Index.

A prominent player in the cloud data warehousing market, Snowflake's ownership is divided among its top 25 shareholders, who collectively own 51.02% of the company. Notable shareholders include The Vanguard Group, Altimeter Capital Management, Sequoia Capital Operations, and Capital Research and Management Company.

Snowflake's leadership team consists of key executives who also hold significant ownership interests in the company. Frank Slootman, Chairman & CEO, and Michael Scarpelli, Chief Financial Officer, each own 0.27% of the Company. Christopher Degnan, the Chief Revenue Officer, owns 0.23%, while co-founder and CTO, Thierry Cruanes, holds a substantial 1.6% stake.

The company has achieved several milestones since its inception and establishment. In particular, Snowflake secured successful financing rounds and investments from prominent venture capital firms. The company was recognized for introducing an innovative data cloud platform that revolutionized data management and analytics. As a result, Snowflake experienced rapid growth, attracting a diverse customer base of large enterprises worldwide. The company reached another significant milestone with a successful initial public offering (IPO), one of the largest technology IPOs in recent history.

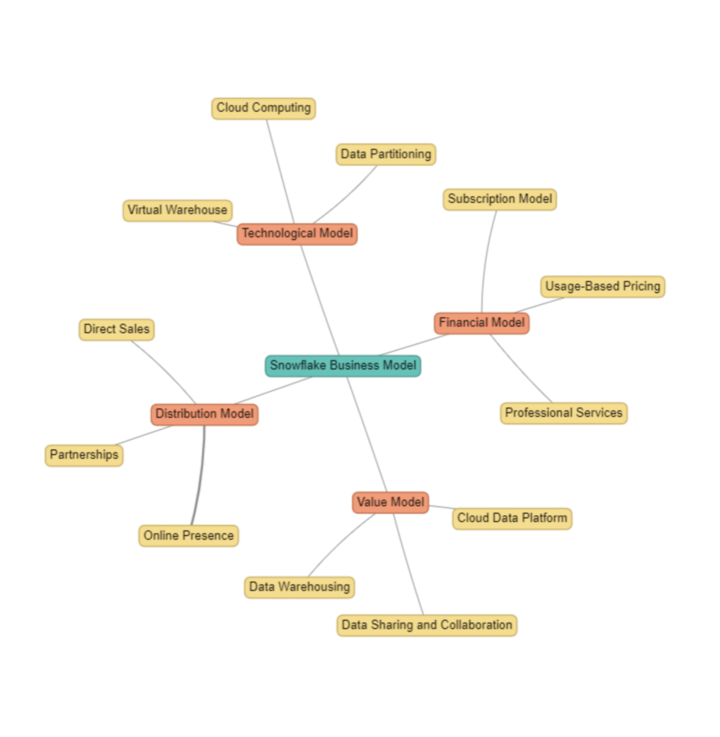

Snowflake Inc's Business Model and Products

Image Source: fourweekmba.com

How Snowflake makes money

The composition of Snowflake's revenue showed that the majority, approximately 94%, was generated from its products and software. Specifically, the product segment accounted for $1.93 billion in revenue, while professional services contributed approximately $127 million, or approximately 6% of total revenue.

Snowflake Inc. generates revenue through a subscription-based model. Customers pay for the storage, compute, and data transfer resources they consume on Snowflake's cloud data platform. The company's pay-as-you-go pricing model allows customers to pay only for the resources they use, providing cost optimization and flexibility.

Snowflake Cost

Snowflake's cost structure in 2023 is heavily weighted toward its product business, which not only generates the majority of the company's revenue, but also contributes to its gross margins. Of the $2 billion in revenue reported that year, Snowflake incurred $717 million in cost of sales, resulting in gross profit of $1.35 billion.

Image Source: Unsplash

Main Products and Services

Snowflake's flagship product is its Cloud Data Platform, a fully managed cloud data warehouse. The platform provides data storage and processing capabilities, data transmission, and strong data security protocols. This system is designed to manage large amounts of information and facilitate rapid data processing.

In addition, Snowflake provides an online store where customers can discover and purchase data and applications developed by third parties. This platform provides users with a variety of information sets and tools to enhance their data solutions.

Over time, Snowflake's platform has expanded to accommodate a wide range of use cases. Today, customers have the flexibility to use the platform for multiple purposes, including data engineering, data lakes, data warehousing, data science, data applications, and data exchange. They can choose to use specific components of the platform for their specific needs or adopt it as a comprehensive end-to-end solution. This adaptability and versatility makes the Snowflake platform suitable for a wide range of data-related needs and enables customers to effectively optimize their data management and analysis processes.

Snowflake Inc's Financials, Growth, and Valuation Metrics

Image Source: Istock

Review of Snowflake Inc's financial statements

Snowflake Market Cap

As of August 2023, Snowflake has a market capitalization of around $50.62 billion.

SNOW Earnings

Snowflake's financial results for fiscal year 2023 showed impressive growth and positive momentum. On May 24, 2023, Snowflake announced its earnings results for the quarter. The company reported earnings per share (EPS) of $0.15, easily beating the consensus estimate of $0.078.

One of the most notable achievements was the generation of positive non-GAAP free cash flow on an annual basis. This is a testament to the efficiency and profitability of their operations. They ended the year with GAAP net cash provided by operating activities of $545.6 million and non-GAAP free cash flow of $496.5 million, reflecting their commitment to financial stability and prudent management of resources.

Snowflake Revenue

The company prides itself on customer satisfaction, and the numbers speak for themselves. Their net revenue retention rate reached an impressive 158% in the fourth quarter of fiscal 2023, highlighting the strong loyalty and continued investment of their existing customer base. With a Net Promoter Score (NPS) of 72, well above the software industry average, it is clear that their customers recognize the value and impact of the Snowflake Data Cloud.

Return on equity (ROE) of -15.95% reflects Snowflake's net loss and early stage of growth.

In addition, Snowflake's financial performance improved year-over-year in April 2023. The company reported revenues of $623.6 million, reflecting a significant year-over-year growth of 47.64%. While net income remained negative at -$225.63 million, it showed a 36.09% improvement over the same period last year.

Snowflake's net profit margin also saw a positive shift to -36.18% year over year. This improvement of 7.82% indicates progress in managing costs and optimizing operational efficiency. In addition, operating income showed a positive trend with a 42.42% decrease in losses to -$266.14 million.

Furthermore, the net change in cash and cash equivalents in April 2023 was -$285.89 million, a significant improvement of 1192.28% compared to the previous year.

Key financial ratios and metrics

Image Source: Istock

Snowflake Valuation

Snowflake's valuation metrics show that the company trades at a premium relative to its peers and the industry. With a P/E ratio of 41.6, Snowflake's stock is relatively more expensive than companies like Datadog (DDOG) and Okta (OKTA), suggesting that investors are willing to pay a higher price for each dollar of Snowflake's earnings. Similarly, the P/S ratio of 18.7 suggests that the market is valuing Snowflake's revenue at a higher multiple than its peers.

The price-to-earnings ratio of 11.5 further supports Snowflake's higher valuation relative to its book value. This implies that investors are willing to pay a premium for Snowflake's tangible assets relative to its peers. In addition, the EV/EBITDA ratio of 55.5 indicates a higher valuation multiple for Snowflake's earnings before interest, taxes, depreciation, and amortization compared to its industry peers.

SNOW Stock Performance Analysis

SNOW Stock trading information

IPO Time: Snowflake made its initial public offering (IPO) on September 16, 2020, entering the stock market with great anticipation.

What is SNOW: Snowflake's shares are listed on the New York Stock Exchange (NYSE) under the ticker symbol SNOW. This allows investors to easily identify and track the company's stock.

Country & Currency: Snowflake operates in the United States, and its stock is traded in U.S. dollars (USD). This is consistent with the currency of the country in which the company is headquartered.

Trading hours: Snowflake's stock can be traded during regular NYSE market hours. These hours typically run from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays, excluding holidays. During these hours, investors are actively buying and selling Snowflake stock.

Pre-market and After-market: For those who prefer to trade outside of regular market hours, pre-market and after-market sessions are available. Pre-market trading for Snowflake share begins as early as 4:00 a.m. ET, allowing investors to make trades before the market officially opens. After-market trading extends until 8:00 p.m. ET, allowing investors to continue trading after the regular market closes. It's important to note, however, that these sessions often see lower trading volumes and may exhibit higher volatility due to reduced market participation.

SNOW Stock splits: Snowflake has not undergone any stock splits since its IPO. This means that the number of shares outstanding has remained constant, without any adjustments to the stock price. Investors who hold Snowflake shares have not experienced a change in the quantity or value of their holdings due to stock splits.

SNOW Stock Dividends: Currently, Snowflake does not pay dividends to its shareholders. Instead, the company chooses to reinvest its earnings back into the business to support growth and expansion initiatives. Investors in Snowflake rely on the potential appreciation of the stock price as the primary source of return on their investment.

SNOW Stock Price Performance since its IPO

Image Source: Istock

Snowflake stock price has experienced various highs and lows since its initial public offering (IPO). Over the past 12 months, the stock reached a low of $119.27 and a high of $205.66. As of the latest available data, the current stock price stands at $180.79.

In terms of shareholder returns, SNOW has seen a slight decline of $3.43 per share, representing a decrease of 1.86%. However, it's important to note that stock prices can be subject to fluctuations and daily market movements.

When comparing SNOW's performance to the broader market and the U.S. IT industry, the stock has outperformed both. Over the past 7 days, SNOW has returned 6.6%, compared to 4.4% for the U.S. IT sector and 2.7% for the overall U.S. market. Over the past year, SNOW has generated a solid 23.4% return, outperforming the 15.1% return of the U.S. IT industry and the U.S. market.

Analyzing the price volatility, SNOW stock price has remained relatively stable compared to other US stocks over the past 3 months. It typically moves within a range of +/- 9% per week. Furthermore, SNOW has maintained a consistent weekly volatility of 9% over the past year.

SNOW Stock Forecast

When looking at the trend analysis of Snowflake stock price, it is worth noting that the stock has been showing positive momentum. There is a key resistance level at $213.54, and the stock appears to be heading towards this point with strong momentum. Breaking through this resistance level could potentially signal further upward movement in the stock's price.

Snowflake Stock Forecast

In terms of analyst recommendations at WallStreet, there is a consensus among 32 analysts covering Snowflake. Out of these analysts, 25 rate the stock as a Buy, 6 rate it as a Hold, and 1 rate it as a Sell. This indicates a generally positive sentiment among analysts regarding Snowflake's stock.

Taking a look at price targets from major analysts, the average price target for Snowflake is $188.89, representing a potential upside of 4.48% from the current price. The highest price target among the analysts is $235.00, while the lowest price target is $105.00. These price targets suggest a range of expectations for the stock's performance.

Looking at the sentiment of bloggers, there seems to be a more bullish sentiment towards Snowflake with a sentiment rating of 77%. This indicates a positive sentiment among bloggers following the stock.

Risks and Opportunities

Competitive Landscape

Image Source: Istock

In the competitive landscape, Snowflake faces strong competition from industry giants such as Amazon, Microsoft, and Google Cloud. These companies have established their presence in the cloud computing and data analytics market by offering their own data management and analytics tools. For example, Amazon Web Services (AWS) provides Amazon Redshift, Microsoft offers Azure Synapse Analytics, and Google Cloud provides BigQuery.

However, Snowflake possesses unique competitive advantages that set it apart from its competitors. Its architecture, which combines shared disk and shared-nothing database structures, allows for efficient data storage and processing. Snowflake's platform excels at tasks such as compiling, viewing, analyzing, and sharing massive amounts of data in a user-friendly manner. Its commitment to continuous product innovation and leveraging customer feedback enables Snowflake to deliver cutting-edge solutions that meet evolving market needs.

Risk Assessment

Image Source: Istock

Snowflake faces certain risks that could impact its operations and growth prospects. Market volatility is a significant concern, as fluctuations in customer preferences and competitive dynamics can affect Snowflake's performance. Additionally, the company must address risks related to data security and privacy, given the increasing threats of data breaches and cybersecurity incidents. Compliance with strict data protection regulations is crucial to maintain customer trust and protect sensitive information.

Another challenge for Snowflake is talent acquisition and retention in the highly competitive data industry. The company needs to attract and retain top talent to drive innovation, enhance its offerings, and maintain a competitive edge.

Growth Opportunities and Drivers

Snowflake has various growth opportunities and drivers that can drive its expansion in the market. Product innovation remains a key driver, as Snowflake continues to invest in advanced technologies and incorporate customer feedback to enhance its solutions. Additionally, the company can explore market expansion by targeting untapped domestic and international markets. Snowflake's platform has the potential to gain traction in industries that are undergoing digital transformation and have a high demand for data analytics.

Strategic partnerships with technology providers, cloud platforms, and industry leaders present another avenue for growth. By forging collaborations, Snowflake can leverage synergies, expand its customer reach, and access new business opportunities. Furthermore, the overall industry trends, including the increasing demand for data analytics, cloud adoption, and digital transformation, create a favorable environment for Snowflake's growth.

Future Outlook and Expansion

Image Source: Istock

Looking ahead, Snowflake expects positive financial projections, including revenue growth, improved profitability, and strong cash flow generation. These projections are based on market trends, customer adoption and retention, and the company's strategic initiatives. Snowflake's expansion plans include geographic expansion into new regions, leveraging local partnerships to establish a global presence and capitalize on emerging market opportunities.

In addition, Snowflake may consider more strategic mergers and acquisitions to enhance its product portfolio and strengthen its competitive position. These initiatives align with Snowflake's growth strategy and allow the company to tap into new technologies and markets, further solidifying its position in the industry.

Why Traders Should Consider SNOW Stock

Image Source: Istock

Market Leadership

Snowflake is a leader in cloud-based data warehousing and analytics, providing scalable and secure solutions to enterprises of all sizes. The company has established a strong reputation for its performance, reliability, and ease of use, making it an attractive choice for businesses looking to leverage data analytics capabilities.

Disruptive Technology

Snowflake's architecture and design offer unique advantages over traditional data warehouse solutions. Its cloud-native platform allows for seamless scalability, real-time data processing, and efficient storage utilization, enabling organizations to derive valuable insights from their data quickly and cost-effectively.

Strong Financial Performance

Snowflake has demonstrated impressive financial performance, with robust revenue growth and narrowing losses. Its subscription-based business model provides a recurring revenue stream and offers long-term stability and predictability.

Trading Strategies for SNOW Stock

If you are interested in trading Snowflake stock, here are some trading strategies that you can consider:

Long-term Investment Strategy

For traders who have a long-term perspective and believe in Snowflake's growth potential, a long-term investment strategy can be adopted. This strategy involves buying Snowflake shares with the intention of holding them for an extended period. Consider factors such as Snowflake's strong financial performance, the market demand for cloud data analytics, and potential future expansions to inform your decision.

Short-term Trading Strategy

Short-term traders can use technical analysis to identify trading opportunities in Snowflake stock. Monitor price charts and look for patterns or indicators that signal potential buying or selling opportunities. For example, a bullish technical pattern such as a break above resistance or a crossover of a moving average may indicate a buying opportunity, while a bearish pattern such as a break below support or a crossover of a moving average to the downside may indicate a selling opportunity.

Dollar-Cost Averaging Strategy

Implement a dollar-cost averaging (DCA) strategy to spread your investment over time. With this strategy, you regularly invest a fixed amount of money in Snowflake stock at predetermined intervals, regardless of the stock price. This approach helps to mitigate the impact of market volatility and reduces the risk of investing a significant amount at an unfavorable time.

Stop Loss Strategy

To manage risk, consider using a stop-loss order. This strategy involves setting a predetermined price at which you will automatically sell your Snowflake shares if the market moves against your position. By placing a stop-loss order, you can limit potential losses and protect your investment from significant downturns in the stock price.

CFD trading

This is also known as Contract for Difference trading, is a popular form of derivative trading that allows investors to speculate on the price movements of various financial assets without owning the underlying asset itself. CFDs are contracts between a trader and a broker, where they agree to exchange the difference in the price of an asset from the time the contract is opened to the time it is closed.

Trade Snowflake Stock CFD with VSTAR

If you prefer to trade Snowflake stock through Contracts for Difference (CFDs), you should consider using a reputable CFD provider like VSTAR.

VSTAR offers a regulated institutional-level trading platform for CFD trading, providing access to real-time market data, competitive spreads, leverage options, and a user-friendly trading app. It's important to conduct thorough research and choose a CFD provider that aligns with your trading goals and risk tolerance.

Conclusion

In conclusion, Snowflake (SNOW) stock should be seriously considered as a strong buy. The company's strategic partnerships and alliances are positioning it for future growth and success. Analyst projections further support the belief that Snowflake stock is undervalued and presents a favorable buying opportunity. Traders should take advantage of the current undervaluation and buy SNOW stock before it experiences the anticipated bull run. To get started on this exciting investment journey, download VSTAR today and seize the potential gains awaiting you with Snowflake stock.

FAQs

1. What does Snowflake do?

Snowflake provides a cloud-based data platform that enables customers to consolidate data into a single source to drive business insights.

2. Is SNOW a good stock to buy now?

SNOW stock has performed well recently, but it still trades at a high valuation. It could continue to grow with the cloud data market, but the stock price is vulnerable to market downturns.

3. What is the future price of SNOW stock?

Analysts predict that SNOW stock could reach $200-300 per share by the end of 2023. However, estimates vary widely.

4. What is the SNOW stock price forecast for 2023?

In 2023, if growth continues as expected, the SNOW stock price could potentially trade between $250-350 per share. However, macroeconomic issues could significantly impact the price.

5. What is the SNOW stock price forecast for 2025?

Looking ahead to 2025, if Snowflake can maintain strong revenue growth and profitability, analysts estimate that the stock price could reach $350-500. But predicting prices that far out has a high degree of uncertainty.