SoFi Technologies Inc (NASDAQ: SOFI) stock has soared on the back of the U.S. debt ceiling deal. But the stock is still down nearly 70% from its all-time high of $25. With that in mind, you might have questions like these: Should I invest in SOFI stock? Is SoFi stock a good investment? What is SoFi stock price prediction?

This article will help you decide whether SoFi stock is a buy or sell. It also looks at the potential impact of the debt ceiling deal on SoFi's business. Moreover, you're going to find out the SoFi stock price forecast and how to make quick money with SoFi stock as a trader.

What Does the Debt Ceiling Deal Have to Do with SoFi Stock?

In June, Congress agreed to raise America's borrowing limit. The U.S. was facing a historic default that, without the debt ceiling deal, would have caused a major economic catastrophe in the country and around the world.

The problems that could arise from America's default ranged from job losses to spikes in interest rates. In such a situation, SoFi could face a difficult business climate. For example, a sharp rise in interest rates could significantly increase the company's funding costs and squeeze its profit margins. The debt ceiling deal averted these problems and more for SoFi.

As part of the debt ceiling deal, the White House must end the long pause in student loan repayments in September. The government has suspended federal student loan repayments since March 2020 as part of its response to the Zika pandemic. But the pause has been a blow to SoFi's business, forcing the company to sue the government to overturn the pause.

Demand for SoFi's student loan refinancing service declined because of the government's pause on repayments and interest accrual. With the return of federal student loan repayments, SoFi could see an increase in demand for its lending services. This is one reason why many investors rushed to buy SoFi stock after the debt ceiling deal.

Source: SoFi

SoFi Technologies (NASDAQ: SOFI) Overview

What is SoFi

SoFi Technologies provides digital financial services. The company began by offering student loans, but its business has expanded to include other credit offerings and savings and investment services.

SoFi was founded in 2011 and is headquartered in San Francisco, California. SoFi founders Mike Cagney, James Finnigan, Dan Macklin, and Ian Brady came together in an effort to provide low-cost education loans.

SoFi CEO Anthony Noto was previously a senior executive at Twitter, where he worked alongside Square CEO Jack Dorsey. SoFi is among the few fintech providers with bank licenses that allow them to take customer deposits. SoFi Technologies went public in June 2021 through the SPAC method. Billionaire venture capitalist Chamath Palihapitiya spearheaded the SoFi SPAC IPO.

SoFi Technologies' Business Model and Products

Business Model

SoFi Technologies (NASDAQ: SOFI) offers lending, investing, saving, and budgeting services. How does SoFi make money? The company has multiple revenue streams. Its primary revenue source is interest on loans. The company's lending unit covers student loans, home loans, and personal loans.

SoFi's other revenue sources are fees for its investment service and transaction fees associated with its payment cards. Additionally, the company earns interest on its customer deposits and receives referral payments from partners such as insurance providers.

Source: SoFi

Main Products and Services

SoFi Technologies has positioned itself as a one-stop shop for online personal financial services. The company operates multiple service units to address the needs of its expanding customer base. These are SoFi's main products and services:

Lending: SoFi offers private student loans, personal loans, and mortgages. It also offers refinancing services across these credit areas. The company promotes no fees, low rates, and quick funding for its lending services.

Investing: SoFi supports investing in stocks, ETFs, and crypto. You can start investing with the SoFi Invest platform with as little as $5. The platform also supports retirement investing with options such as traditional IRA and Roth IRA.

Banking: SoFi offers a checking and savings account product with an associated debit card. The company pays interest on customers' checking and savings balances. Moreover, customers can earn cashback rewards when they pay for purchases with their SoFi debit card.

Insurance: SoFi offers homeowner insurance, auto insurance, and life insurance products through its SoFi Protect It partners with insurance providers such as Lemonade to offer these coverage products.

Budgeting tools: SoFi Insights offers budgeting tools and allows for spending tracking. The platform also supports credit score checks and alerts you to changes in your credit profile.

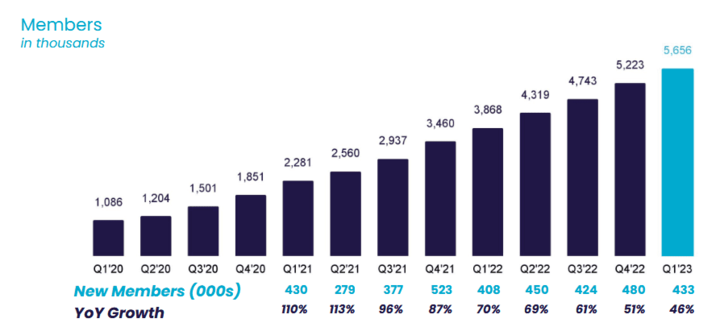

SoFi Technologies (NASDAQ: SOFI) calls its customers members. The company has attracted more than 5.6 million members across its service units. The chart below illustrates SoFi's membership growth over the past several years.

Source: SoFi

SoFi's Financial Performance

A look at SoFi's financials can help you determine whether the company has a promising future. Let's explore SoFi's financial performance and balance sheet condition to see where the company stands:

SoFi Market Cap

SoFi Technologies (SOFI) has a market cap of about $8 billion.

SoFi Earnings

SoFi Revenue

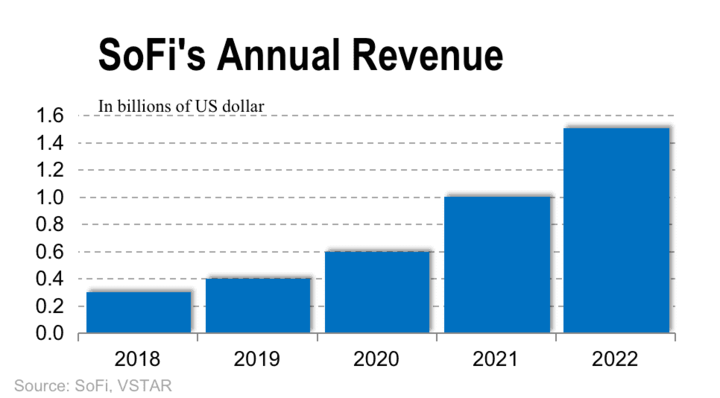

SoFi's revenue increased 46% year-over-year to $463.8 million in Q1 2023. The company expects revenue to grow as much as 35% to $480 million in Q2 2023. For the full year 2023, SoFi's revenue is expected to grow approximately 30% to nearly $2 billion. The company's revenue grew 55% in 2022. SoFi's revenue has grown at a compound annual growth rate of nearly 40% over the past 5 years.

The chart below shows SoFi's annual revenue trend.

Net Income

SoFi hasn't turned a profit yet, but its losses are shrinking. The company reported a loss of $34 million for Q1 2023, which narrowed from a loss of more than $110 million in Q1 2022. Similarly, the company's full-year 2022 loss of $320 million narrowed sharply from a loss of $484 million in 2021. SoFi is aiming to achieve quarterly profitability in 2023.

Profit Margins

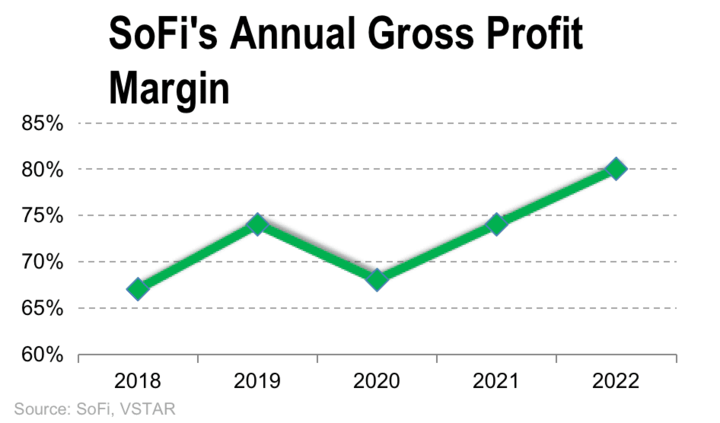

SoFi achieved a gross profit margin of 82% in Q1 2023, marking an improvement from a gross profit of 78% in Q1 2022. The company's gross profit for the full year 2022 jumped to over 80% from 74% in 2021. SoFi has maintained its annual gross margin above 67% over the past 5 years, as you can see in the chart below.

Although SoFi's primary focus has been on driving revenue growth, profitability is now coming into focus. Given its strong gross margins, tight control of operating expenses can put SoFi on a fast path to profitability.

Balance Sheet Strength

Although SoFi's business is still making losses, the company remains financially stable. It has ample cash and a solid balance sheet. The company ended Q1 2023 with $2.5 billion in cash and short-term investments. Its balance sheet shows $22.5 billion in total assets against only $17 billion in total liabilities.

SoFi Stock Analysis

SoFi Stock Trading Information

SoFi stock is listed on the Nasdaq exchange. The stock trades under the ticker symbol "SOFI".

Regular trading hours for SoFi Technologies (NASDAQ: SOFI) stock begin at 9:30 a.m. and end at 4 p.m. ET on weekdays. Investors who would like more time to trade SoFi stock can take advantage of extended trading hours. SoFi premarket trading starts at 6:30 a.m., and SoFi stock after hours trading extends until 8 p.m.

SoFi hasn't had any stock split since its IPO, and the company also doesn't pay dividends currently.

SoFi Technologies Stock Performance

SoFi stock hit the market at a SPAC IPO price of $10. The stock soared to its all-time high of $25 in February 2021. Although SoFi stock has retreated sharply from its peak, it has been climbing lately.

SoFi stock price has jumped more than 40% over the past month and soared more than 70% year-to-date. As you can see in the chart below, SoFi stock gains have overshadowed the gains in Square (SQ) stock and the S&P 500 Index.

SoFi Stock Forecast

SoFi stock's rapid spike on the back of the U.S. debt ceiling deal might have you wondering whether the stock will continue to rise or retreat.

SoFi Price Target: Following its recent rally, SOFI stock price has already surpassed Wall Street's average price target of $7. But the stock's peak price target of $10 suggests nearly 30% upside.

These are some of the key drivers of SoFi stock price:

Financial performance: Because much of SoFi's focus has been on driving topline growth, SoFi stock tends to rise when the company reports strong revenue growth and fall when revenue growth disappoints. As investors begin to crave profits, SoFi's profitability will likely continue to influence the stock in addition to revenue growth.

Interest rate changes: Rising interest rates can increase SoFi's borrowing costs and slow down its expansion plans. Consequently, the company can experience slow revenue growth and sink into deeper losses that can diminish investor appetite for SoFi stock.

Industry trends: The accelerating shift to digital financial services can can attract more investors to fintech stocks like SoFi. Conversely, a slowdown in the adoption of fintech products can hurt interest in SoFi stock.

SoFi news: SoFi stock tends to rise on announcements of acquisitions and product launches. The company's expansion into new markets also excites investors and moves the stock.

SoFi's Challenges and Opportunities

For SoFi Technologies (NASDAQ: SOFI), success in the fintech industry requires navigating challenges and taking advantage of opportunities. Let's explore the challenges facing SoFi and the opportunities available to the company.

SoFi's Risks and Challenges

Regulations: The financial sector is heavily regulated. Increased regulatory measures can increase SoFi's compliance costs and slow down its growth and expansion plans.

Technology failures: SoFi relies on third-party technology services for many of its operations. For example, some of its workloads run on Amazon's cloud platform. SoFi has no control over these third-party technology services, but their failure could cripple its operations.

Interest rate fluctuations: SoFi attracts customers to its bank account products with generous interest rates on deposits. As a result, low interest rates can make the account products less attractive, which can cause SoFi to lose access to cheap funding for its lending service.

Competition: With low barriers to entry into the fintech industry, competition is the biggest threat for SoFi. These are some of SoFi's major competitors and the threat they pose:

|

SoFi Competitor |

Threat |

|

Upstart (NASDAQ: UPST) |

SoFi's personal loan lending business faces stiff competition from Upstart. |

|

American Express (NYSE: AXP) |

SoFi competes with American Express and other big banks for checking and savings account customers. |

|

Square Block (NYSE: SQ) |

Square's CashApp platform competes with SoFi for investment and savings services. |

|

PNC Financial Services (NYSE: PNC) |

SoFi's student loans business faces tough competition from PNC Financial Services. Ascent and College Ave, as well as SoFi's other competitors in this space. |

SoFi Technologies' Competitive Advantages

Solid financial position: The company has significant cash on hand and low debt, giving it great financial flexibility as it fights to increase its market share.

Bank license: While many of SoFi's competitors rely on outside bank partners, the company has its own bank operation. Running its own bank, SoFi takes customer deposits that provide a cheap source of funding for its credit business.

Diversified business: Because SoFi offers a diverse array of fintech services its risks are spread out. For example, if the company's lending division isn't doing well, it can count on its investment, savings, and insurance operations to offset the weakness in that unit.

High-quality customers: SoFi targets customers with high credit scores and high household incomes for its lending services. These customers have a low risk of defaulting on their loans.

SoFi Technologies' Opportunities

Student loans lending: Amid the rising cost of attending college, there is a huge business opportunity for SoFi in providing student loans. A major obstacle to SoFi's education loan refinancing business is about to disappear as the federal student loan forbearance period ends.

Investing: More and more young people are turning to investment apps. As a result, SoFi has a tremendous growth opportunity in the investing space. The company offers both manual and automated investing options.

Banking: Operating a bank remains a high hurdle for most fintech providers. With its own bank license, SoFi has a head start in offering online banking services. Given that Americans typically use multiple banks, SoFi has a large room for growth in this space.

Upselling members: As its service portfolio expands, SoFi has the opportunity to direct its members to more of its services. By upselling its members, SoFi can make its platform more sticky and lower its customer acquisition costs.

SoFi estimates its market opportunity in the fintech services space at $2 trillion.

How to Profit from SoFi Stock as a Trader

SoFi Stock Profit Strategies

Long-term investing: The traditional way to profit from SoFi Technologies stock is to buy shares of the company. This strategy gives you voting rights and makes you eligible for potential dividends. However, you may have to wait many months or years to realize the desired return on your investment. In addition, a long-term investment strategy requires a large initial investment.

Short-term trading: Stocks can rise or fall more in a day or a week than they do on average over a year. Trading stock CFDs instead of owning stocks is a smart way to profit from short-term stock movements. With CFD trading, all you have to do is predict the direction of the stock's movement. As a result, CFD trading requires minimal initial capital.

SoFi Stock CFD Trading Strategies

Develop a trading plan: Decide whether you want to hold your SoFi stock CFD trading position for an hour, a day, a week, or months.

Set realistic goals: Determine your profit target and use limit and stop order features to manage your risks.

Trade prudently: The market can surprise you. It helps to avoid emotions-driven actions and excessive trading.

Trade SoFi Stock CFD With VSTAR

If you prefer pursuing short-term profits to long-term exposure, consider trading SoFi stock CFD with VSTAR. A fully licensed and regulated CFD trading platform, VSTAR offers low trading fees and tight spreads to maximize your profits.

The platform has a low initial deposit requirement of just $50 and offers generous leverage to boost your trading. In addition, VSTAR supports ultra-fast trade execution.

You can start trading SoFi stock CFD on VSTAR in minutes. It only takes a few steps to get started:

● Open a VSTAR CFD trading account - You will need an email address or mobile phone number.

● Fund the account - VSTAR supports the popular deposit methods, including digital wallets, credit cards, and bank transfers.

● Start trading - Once your VSTAR account is approved and funded, you can start trading SoFi stock CFD on the mobile app or website.

In addition to 24/7 human support to resolve any issues traders may have, VSTAR also offers a free demo account with up to $100,000 for new traders to practice their strategies.

Final Thoughts

SoFi Technologies (NASDAQ: SOFI) stock price has soared from its lows on the back of the debt ceiling deal. But the stock still has a long way to go to take its all-time high.

While Wall Street's SoFi stock forecast implies a modest upside, the stock can surprise investors to the upside given its improving fundamentals. For example, SoFi Technologies may finally turn a profit in 2023 after a string of losses. The end of the pause on federal student loans payments also bodes well for SoFi's education lending business.

FAQs

1. Who owns the most SoFi stock?

The largest individual shareholder is CEO Anthony Noto, who owns approximately 1.7% of SoFi stock. Major institutional shareholders include SoftBank and Silver Lake Partners.