Blockchain Technology has three main concepts: decentralization, scalability, and security. However, scalability has become more and more important for the whole industry during the development of blockchain. And the birth of Solana has elevated the scalability of blockchain to a new level.

This guide will examine Solana, its native token SOL, SOL tokenomics, and strategies for successfully trading SOL. Let us dive in!

What is Solana?

Solana is a high-performance blockchain network supporting fast, secure, scalable decentralized apps and marketplaces. The network was launched in 2017 by Anatoly Yakovenko, featuring a new permissionless and high-speed layer-1 blockchain.

In simpler terms, the vision was to create a blockchain platform with incredible scalability but with low costs. As a result, over 710,000 transactions per second can be processed on the Solana network.

Solana's native cryptocurrency: SOL

The native token of the Solana platform is SOL. Therefore, SOL powers the Solana blockchain and is useful for various operations. Launched in 2020, SOL quickly became one of the top 10 cryptocurrencies due to its market capitalization.

Solana's native token is used to pay for transactions and transfer value through staking. In addition, investors can receive SOL as a reward for various activities on the network. SOL is a unique token because it provides governance rights to holders- they can vote in critical matters that may affect the future of the network.

Although the market value of SOL recently dropped, its price was about $20.93 in April 2023, with a market cap of $8.5 billion.

Solana uses an innovative hybrid consensus model

One of Solana's unique features is the use of proof-of-history and proof-of-stake that can handle over 50,000 transactions per second. This mechanism uses hashed timestamps to verify transactions as they occur. Proof-of-history verifies the order and time between events. Solana blockchain relies on its own local clock, which works outside the knowledge of other participants' clocks on the platform.

However, every node in the network relies on the recorded passage of time in the ledger to ensure transparency. This innovative hybrid consensus model provides greater scalability, which optimizes usability.

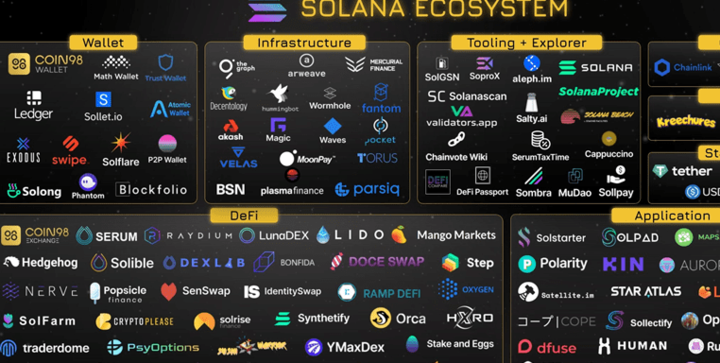

Solana's ecosystem is rapidly expanding

Solana's ecosystem is rapidly expanding and has proven to be an attractive platform for DeFi apps. More so, Solana hosts various dApps spanning sectors, including gaming, payments, borrowing, and more.

One intriguing factor about the Solana ecosystem is that developers can access the software code from the Lab's GitHub. As a result, project development on the platform is easy and completed within a short time.

Serum, a high-speed, non-custodial DEX, is a popular engine hosted on the Solana ecosystem. Raydium is another popular DeFi protocol built on Solana. Other projects on the Solana ecosystem include Oxygen, Mango Markets, PsyOptions, Audius Project, and more.

SOL Tokenomics

Tokenomics is a fundamental concept you have to understand before trading SOL. It describes the major factors that influence the market value of a crypto asset. Therefore, SOL tokenomics can provide insights into supply, demand, distribution, and long-term sustainability. Here are some factors that affect SOL tokenomics:

a. Supply

SOL has a maximum supply of 488 million tokens. However, the creators designed the ecosystem so that all the tokens are not immediately available. As of early 2021, only about half the total supply is in circulation. This design aims to control the token's distribution and ensure the Solana ecosystem's sustainability.

b. Inflation

SOL is an inflationary token meaning it does not have a fixed total token supply. The initial inflation rate of SOL was about 8% annually. Inflation will continue decreasing over time until the token attains a stable long-term inflation rate. Moreso, the inflation rate will reduce by 15% each year until 2031(about 1.5%), when some form of stability has been achieved.

c. Earning SOL as a reward

Solana's validators and stakers earn SOL block rewards and transaction fees. These validators verify transactions and add them to the blockchain. Validators are an integral part of the Solana ecosystem.

Staking on the other hand, it involves holding SOL for a long time, thereby contributing to the sustainability of the ecosystem. Therefore, validators and staking contribute to making Solana the best-performing blockchain ecosystem.

d. Distribution

Solana has a vested schedule of SOL releases to fund the ongoing development of the ecosystem. These releases are part of the proceeds from the founding sale. As the years progress, a certain amount of SOL will be released into circulation.

This design aims to maintain a steady and controlled influx of tokens to avoid sudden price movements, which may negatively affect their value. Most of the remaining SOL tokens are projected to be in circulation within ten years.

Why Trade or Invest in SOL?

Solana is a high-performance platform. SOL has the potential for significant growth and adoption. Therefore, SOL presents unique trading opportunities. Let us explore other reasons why trading or investing in SOL is an excellent idea.

i. Potential for high growth:

Solana is a leading blockchain project with the potential for major growth in value and adoption if it becomes more widely used. The blockchain industry is constantly evolving, and Solana is one of those leading platforms.

Therefore, an increase in the adoption of Solana's unique technology can lead to a rise in demand. As a result, the market value of SOL could appreciate significantly over the long run.

ii. Earnings from staking:

An attractive feature of the Solana ecosystem is the staking reward. Staking is a way SOL holders can contribute to the security and growth of the ecosystem.

The network rewards your participation by giving you some SOL tokens. Currently, staking SOL can yield about 7-10% interest per year. Therefore, this is an alternative to earning yearly passive income. However, the annual returns may vary depending on various factors that affect the stability of the Solana ecosystem.

iii. Increase in mainstream interest:

Mainstream interests can lead to higher trading volumes, liquidity, and positive market sentiments. Several projects, like Mercurial Finance, Orca, Star Atlas, and Ren, are some of the top projects on Solana in 2023.

As more developers adopt Solana, it optimizes the network's visibility. Therefore, as Solana gains more interest and adoption from exchanges, institutional investors, and the public, demand for SOL may rise and positively affect its price.

iv. Use case potential:

The growth of the Solana ecosystem plays a critical role in driving the market value of SOL. As more dApps and marketplaces are built on the network, SOL's use cases and utility will increase.

Whether it includes gaming, payments, or borrowing, the integration of SOL supports the fundamental value of the token. Therefore, the growing use cases and utility of SOL tokens can drive price gains as well as the expansion of the ecosystem.

Trading and Investing in SOL

SOL is an exciting opportunity for traders and investors to participate in the revolutionary blockchain network. SOL has gained lots of attention from traders and investors due to its impressive performance. This section will explore useful strategies to trade and invest in SOL to make a profit.

a. Buy SOL on exchanges:

You can purchase SOL tokens on exchanges like Binance and Bitfinex. The first step is to open an account on the exchange platform. These platforms offer SOL trading pairs like SOL/USD, SOL/BUSD, and SOL/USTD. However, you may need to provide personal information and upload identification documents to verify the account. Once the account has been verified, you can deposit funds via credit card, debit card, or bank transfer. Afterward, you can go to the dashboard and place buy orders for the amount of SOL tokens you want.

b. Stake your SOL:

For a long-term investment, staking SOL in the Solana network allows you to earn passive yield while maintaining exposure to SOL's potential price growth. You can stake through some exchanges or set up a staking wallet. The next step is to create a stake account by following the instructions on the wallet. Afterward, you need to select a validator- Solana provides information on validators' performances but will not make recommendations. Finally, delegate your stake to your preferred validator.

c. Develop a trading plan:

For active trading, it is critical to have a well-defined trading plan. The plan outlines your strategies for entering or exit positions and risk management controls.

In addition, trading SOL requires fundamental market and sentiment analysis. The analysis involves using indicators, charts, patterns, and signals to understand market trends and make better trading decisions.

Furthermore, set profit targets, place stop loss orders, and consistently monitor market movement to manage risks. Avoid making decisions based on impulse because they can expose you to risk.

d. Consider diversification:

Diversification is a critical investment strategy that helps to spread risks across various crypto assets. Therefore, your capital is spread among these assets protecting you from the impact of any single asset's poor performance. Although SOL has the potential for massive growth, diversification of your trading portfolio is recommended. Therefore, allocating only a small portion of your portfolio to a speculative asset like SOL can help you manage risks. The advantage of diversification is it offers a balanced investment portfolio.

e. Stay up to date with Solana updates:

Factors like news, partnership announcement, upgrades, and product releases influence the market movement of SOL. You can get updates by checking Solana's website and social media accounts and being a member of communities on Reddit or Facebook. Therefore, when trading SOL, it is critical to closely follow Solana's news and updates to determine how it may affect the token's price. In addition, look out for fundamental factors that affect growth, such as adoption and hype cycles, that may trigger short-term price movements.

f. Manage your risk:

Trading SOL, like any other crypto asset, comes with risks due to the volatile nature of the market. As a result, risk management practices are critical to trading SOL. Set stop loss and take profit orders to limit the potential loss and protect profit.

In addition, use leverage with caution when trading SOL. FOMO (fear of missing out) can push traders to over-leverage their positions. In this case, the trader will be left in tears if the market goes against their predictions.

Therefore, consider your risk tolerance and implement risk management practices to avoid impulse trading, which may have fatal consequences.

SOL CFD Trading

CFD- Contract for Difference trading is a method of speculating on the price of SOL without actually owning it. Traders can go long if they think SOL's price will increase or short when they predict a downtrend. However, whether you profit or lose depends on the outcome of your predictions. Here is a guide to trading SOL CFDs:

❖ Trade SOL CFDs on broker platforms:

Some CFD brokers offer SOL CFDs that allow you to trade SOL on leverage without owning the underlying SOL tokens. However, you must be careful when choosing a broker. When choosing a CFD broker, looking out for regulated brokers is critical to ensure transparency and fund security. In addition, look out for brokers with tight spreads, flexible leverage, and risk management tools.

VSTAR is a reliable and reputable broker that provides institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

In addition, Vstar is regulated by CySEC, which is essential when choosing a broker. Some crypto exchange platforms are often unregulated and have a high commission, which can negatively affect your profit. Furthermore, Vstar offers a demo account for beginners to practice trading strategies to mitigate loss during actual trading.

Opening an account with VSTAR takes about five minutes. Once you fund your account, you are ready to start trading SOL CFDs.

❖ Higher leverage means higher risk:

CFD trading involves leverage, which allows you to enter a market position with a small deposit. However, the potential loss or gains will be calculated based on the position's full size and not the deposit.

Although higher leverage may seem appealing, it comes with higher risks. Therefore, it is critical to trade SOL CFDs with caution because while it can amplify your gains, it also significantly amplifies your losses.

We recommend that beginners only trade with low leverage until they gain experience. Considering volatility, avoid using more than 1:5 leverage to avoid excessive risk.

❖ Develop a SOL CFD trading plan:

Another critical aspect of trading SOL CFDs is to create a trading plan. The plan should be based on the results of fundamental and technical analysis of the Solana ecosystem. Factors like social media hype, news, upgrades, and partnerships can influence the price of SOL.

A good trading plan considers your investment goals, risk tolerance, and trading experience. Therefore, it protects you from "impulse trading." In addition, your trading plan is incomplete without risk management strategies. Due to the high risk associated with SOL CFD trading, controlling risks and maximizing profit are essential.

Take profit and stop loss orders are two risk management tools that can help you minimize loss. A stop order automatically closes your market position when the price of SOL falls to a pre-set level. Alternatively, a take profit order automatically exits your position after getting a certain profit.

❖ Monitor your positions closely:

Volatility is unpredictable when trading SOL CFDs. Therefore, it is critical to monitor your trades closely. Monitor BTC price movements, general crypto market trends, and any relevant news that may affect your trading position.

When you open CFD positions, pay attention to the market movement and make quick adjustments based on your trading plan. Monitoring your position can help you minimize losses and lock in profits when target levels are reached.

Additionally, your trading experiences and performances can improve with careful monitoring. Monitoring provides opportunities for traders to quickly adjust their stop loss or take profit orders while taking advantage of market volatility.

❖ Additional fees:

When trading SOL CFDs, there are additional fees you should consider. The common fees include deposit fees, withdrawal fees, and processing fees. However, other fees like overnight trading fees and trading commissions should be considered when making your trading plan. CFD brokers may charge financing fees for keeping a position open overnight. Other fees include currency conversion fees and inactivity fees. These fees can add significantly to your costs if not properly managed. Traders must pay attention to these additional fees as they can erode potential profit.

Summary

Solana is a high-performance ecosystem that aims to provide solutions to the blockchain trilemma. The network stands out because it can handle high transaction volumes at high speed and support numerous applications.

Understanding SOL's tokenomics is critical before investing or trading the token. Its inflationary nature and scheduled token release ensure the long-term sustainability of the Solana ecosystem.

The potential for high growth, earnings from staking, increase in mainstream interest and use case potential of SOL are compelling reasons to invest in the Solana ecosystem. However, trading SOL requires research, developing a trading plan, and implementing risk management strategies.

Do you want to be part of the innovative and solution-providing Solana ecosystem? Visit VSTAR today for SOL CFD trading!