Amazon is a Seattle-based tech company founded in 1994 by Jeff Bezos as an online bookstore. It's now one of the largest companies globally, valued at $1.8 trillion. The current CEO is Andy Jassy, succeeding Bezos in 2021. Key milestones include Amazon Prime (2005), Kindle e-reader (2007), and Whole Foods acquisition (2017). Amazon has diverse business segments, including AWS, Advertising, and Retail, and has expanded into healthcare and entertainment. Its net income was USD 33.5 billion in 2022.

Amazon's Business Model and Products/Services

Business Model

Amazon started as a bookstore and grew to offer various products and services. Its business model prioritizes convenience, selection, and low prices for customers. Amazon's online marketplace allows third-party sellers to sell products on the site, contributing to its vast selection without requiring inventory or storage investment. Amazon earns a commission on each sale, generating substantial revenue.

Amazon also operates a successful cloud computing business, Amazon Web Services (AWS), providing cloud-based services to companies of all sizes. The company leverages technology to provide customers with a wide range of products at affordable prices while prioritizing customer experience. This model has made it one of the world's most successful companies. In addition, Amazon’s artificial intelligence team (the deep engine science team) has developed a cloud-based service called Amazon Lex for automatic speech recognition and natural language understanding. This enables users to easily publish voice or text chatbots on mobile devices, applications and web apps.

Main Products and Services

Some of the leading products and services provided by Amazon include:

● Amazon.com: Amazon's flagship online retail store where customers can purchase various products, including electronics, books, clothing, and groceries.

● Amazon Prime: is a subscription-based service that offers free shipping, streaming video and music access, and other benefits.

● Amazon Web Services (AWS): A cloud computing platform that provides businesses with scalable computing resources and storage solutions.

● Kindle: A line of e-readers designed and marketed by Amazon, allowing users to purchase and download digital books, magazines, and newspapers.

● Amazon Fresh: A grocery delivery service that allows customers to order fresh produce, dairy products, meat, and other groceries for delivery to their doorstep.

● Amazon Music: A music streaming service that offers a wide range of songs and playlists.

● Amazon Alexa: A voice-controlled virtual assistant that can perform various tasks such as controlling smart home devices, answering questions, and playing music.

● Amazon Prime Video: A streaming service that provides access to a wide range of movies, TV shows, and original content.

Amazon's Financial Performance and Market Value

Amazon has demonstrated impressive growth and financial performance over the past five years. Below, we will analyze Amazon's financial statements and discuss critical metrics. By examining these metrics, you can gain a deeper understanding of Amazon's financial health and assess the company's ability to continue its success in the future.

Revenue Growth

Amazon's revenue has shown significant growth in recent years. In 2022, the annual revenue was $513.983 billion, a 9.4% increase from the annual revenue of 2021. Amazon’s revenue in the 1Q of 2023 was $127.358 billion, a 9.37% up from the 1Q of 2022.

Profit Margin

Profit margin is the metric to evaluate whether a company can turn revenue into profit. It is calculated using the formula NET INCOME/REVENUE. As of December 2022, Amazon had a profit margin of 0.19%, meaning 0.19% was the revenue Amazon retained after deducting expenses. As of March 2023, the profit margin is 2.49%.

Cash from Operations

Amazon has consistently generated strong cash flows from operations over the past five years. In 2022, the company generated $75.5 billion in cash from operations, a significant increase from the $30.7 billion generated in 2018.

Balance Sheet Strength and Implications

Amazon's balance sheet is strong, with significant cash and investments. As of 2022, the company had $99.5 billion in cash and cash equivalents and $98.6 billion in marketable securities.

The implications of Amazon's strong balance sheet are significant. The company is well positioned to continue investing in growth opportunities and pursuing strategic acquisitions. Additionally, a strong balance sheet provides a degree of financial stability, which can help to mitigate risks associated with economic downturns or market disruptions.

Amazon's Financial Performance: Key Ratios and Metrics

Amazon, a mega-cap company listed on Nasdaq, has shown remarkable sales growth and is highly valued. However, when using earnings-based valuation methods, Amazon earnings values often appear greatly inflated.

Forward P/E Ratio

The forward P/E ratio is a commonly used metric to value stocks, which is calculated by dividing the current stock price by the expected earnings per share for the next 12 months. The high valuation metrics of Amazon based on its potential for growth have caused its P/E ratio to appear inflated. However, it is essential to note that a high P/E ratio does not necessarily indicate an imminent stock market crash but may increase the stock's volatility.

In 2021, Amazon's P/E ratio was 25.93, expected to rise to 53.85 by 2023. For comparison, Apple's P/E ratio in 2022 was 21.27, and it is expected to remain relatively stable at 21.02 in 2023.

Sales Growth Rate

In 2022, Amazon’s annual revenue was $513.983 Billion, which was a staggering increase of 9.4% from the previous year. Taking a time frame from March 31, 2022, to March 31, 2023, Amazon’s revenue was $524.897 Billion.

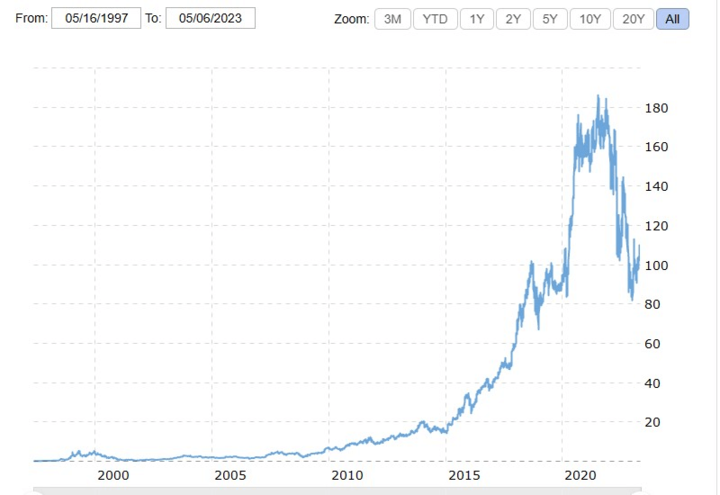

Amazon Stock Performance

Amazon is a publicly traded company on the NASDAQ with the ticker symbol AMZN. It is headquartered in the US and trades in US dollars. Regular trading hours are from 9:30 am to 4:00 pm ET, Monday through Friday. Pre-market trading runs from 4:00 am ET until the market opens, and after-market trading is from 4:00 pm to 8:00 pm ET. Since its listing on the NASDAQ on May 15, 1997, Amazon has undergone three 2-for-1 stock splits. The company has never paid dividends but reinvests earnings in growth and development. Amazon is expanding into new markets, such as healthcare and advertising, which could present new growth opportunities.

Over the past decade, Amazon stock price has experienced an incredible surge, driven by the company's strong financial performance, expanding product portfolio, and continued growth in new markets. For example, in April 2023, Amazon joined the booming field of generative artificial intelligence, which saw Amazon stock climb. Also, Amazon has continued to invest in healthcare by purchasing One Medical in February 2023 for $3.9 billion. The stock has consistently outperformed the broader market, with investors flocking to the company's shares to gain exposure to the rapidly growing e-commerce and cloud computing industries.

Factors that Impact the Value of Amazon's Shares

As a publicly-traded company, Amazon’s stock price fluctuates based on various factors. Here are some of the critical drivers of Amazon's stock price:

Revenue Growth: Investors are always looking for companies that can grow their revenue consistently and rapidly, and Amazon has been able to do just that. Amazon's revenue has grown at an average rate of over 30% per year for the past decade, which has helped to fuel its stock price growth.

Profitability: Amazon has historically been willing to invest heavily in growth initiatives by spending billions on internet satellites, self-driving cars known as robotaxis and logistics, which have sometimes come at the expense of profitability. However, in recent years, Amazon has consistently delivered profits, which has helped to boost its stock price.

Market Dominance: Amazon is the dominant player in several markets, including e-commerce, cloud computing, and digital advertising. Investors value companies that can establish themselves as market leaders, and the company's dominant position in these markets has helped to support its stock price.

Innovation: Amazon has a reputation for being an innovative company, and investors value companies that can introduce new products and services that disrupt existing markets. Amazon has been able to do this through initiatives like Amazon Web Services (AWS) and Amazon Prime, which have helped to drive revenue growth and be one of Amazon stock price support levels.

Economic Conditions:Amazon stock price is influenced by broader economic conditions. A strong economy generally supports higher stock prices, while a weak economy can lead to lower stock prices. Additionally, interest and currency exchange rate fluctuations can impact Amazon share price.

Future Prospects for Amazon Stock

Since the beginning of this year, 2023, the multi-billion dollar cooperation has made a 20% increase in interest rates; with this interest rate, the consensus among analysts as of April 25 is that Amazon stock by May 2023 will reach an estimated weighted average price of $106.80.

Gov Capital, an algorithm-based forecasting service, anticipates the stock will trade at $123.029 at the end of December 2023. However, Gov Capital's long-term Amazon stock forecast was much more optimistic, expecting the shares to be valued at $402.355 by the end of the first quarter of 2025 and potentially reaching $889.273 within five years.

Risks and Opportunities Facing Amazon

As one of the world's largest and most successful companies, Amazon faces several potential risks and opportunities that could impact its operations and financial performance. Here are some critical risks facing Amazon:

Competition risks

Amazon faces fierce competition from other online retailers, such as Walmart and Alibaba, as well as brick-and-mortar retailers that have expanded their online presence. Here are some key competitors that threaten Amazon, along with their competitive advantages:

● Walmart: Walmart is the largest brick-and-mortar retailer globally and has been expanding its online presence in recent years. The company has a strong distribution network and logistics capabilities, enabling it to offer customers fast and affordable shipping. It has a vast network of physical stores, which it can use for click-and-collect orders, making it a convenient option for customers who prefer to pick up their orders in-store. However, Amazon’s rapidly growing video and music streaming business, along with the Prime membership, gives a competitive advantage difficult for Walmart to overtake.

● Alibaba: The largest e-commerce company in China has a dominant presence in the Asia-Pacific region. The company has a diverse portfolio of businesses, including online marketplaces, cloud computing, and digital payments. Alibaba can leverage its massive scale and data analytics capabilities to provide personalized recommendations and a seamless customer experience. However, Amazon’s competitive advantage lies in innovations such as offering a 1-hour delivery service, electric products and digital media content such as Amazon Prime for streaming video content after a subscription.

● Microsoft and Google: Amazon Web Services (AWS) is the market leader in cloud computing but faces increasing competition from Microsoft Azure and Google Cloud Platform. Microsoft and Google have significant resources and expertise in enterprise software and cloud computing, which they can leverage to compete with AWS. Both companies have strong relationships with enterprise customers and can use their existing customer bases to promote their cloud offerings. However, Amazon Web Services offer more comprehensive services when compared to Google Cloud needed for running a business. Also, Amazon’s competitive advantage over Microsoft lies in providing more flexible licensing and license mobility, creating a secure private network in the cloud rather than using a virtual network like Microsoft Azure.

Regulatory risks

Amazon operates in many highly regulated industries, including e-commerce, cloud computing, and logistics. As such, it is subject to regulatory requirements and scrutiny from government agencies. Any changes in regulations or legal actions against the company could significantly impact its business.

Supply chain risks

Amazon's operations rely heavily on its supply chain, including suppliers, logistics providers, and delivery partners. Any disruption in the supply chain, such as a natural disaster or labor dispute, could impact the company's ability to fulfill customer orders.

Labor risks

Amazon has faced criticism over its treatment of workers, including allegations of poor working conditions and low pay. Any labor disputes or negative publicity related to these issues could impact the company's reputation and ability to attract and retain talent.

International risks

Amazon has expanded rapidly into international markets but faces challenges navigating local regulations, customs, and political and economic instability in some regions. Any difficulties in these areas could impact the company's growth and profitability.

Despite its already massive size, there are several growth opportunities that Amazon can pursue to continue expanding its business.

International Expansion

Amazon has already established a strong presence in several countries, but many untapped markets exist worldwide. Expanding into new international markets, particularly in emerging economies, could provide a significant growth opportunity for the company.

Cloud Computing

Amazon Web Services (AWS) is already the leading provider of cloud computing services, but there is still plenty of room for growth in this sector. As more and more businesses move their operations to the cloud, AWS can continue to capitalize on this trend and expand its market share.

Advertising

Amazon is already a significant player in the online advertising industry, with its advertising business growing rapidly in recent years. By leveraging its vast customer data and targeting capabilities, Amazon can continue to grow its advertising business and become an even more dominant force in the industry.

Healthcare

Amazon has made several forays into the healthcare industry in recent years, including the acquisition of PillPack and the launch of Amazon Pharmacy.

Physical Retail

While Amazon is primarily known for its online retail operations, the company has also been expanding into physical retail by acquiring Whole Foods and launching Amazon Go stores.

How to Invest in Amazon Stock

Investing in Amazon stock can be smart for those interested in the long-term growth potential of one of the world's most successful e-commerce companies. Here are three ways to do that:

Holding Amazon Stock

It involves buying shares through a brokerage and holding them in a personal account. Profits can be made through price appreciation or receiving Amazon dividends. For example, Investor A buys 100 shares at $3,000 per share and sells them five years later for $5,000 per share, earning a profit of $200,000 ($5,000 - $3,000) x 100.

Buying Amazon Options

Investors can buy AMZN stock options, giving them the right to buy or sell shares at a specific price within a set timeframe. For example, Investor B buys a call option for $500 with a strike price of $3,500 and an expiration date of six months. If the stock price increases to $4,000, Investor B can exercise the option, buying 100 shares at the strike price and selling them immediately for a profit of $50,000, minus the $500 option premium.

Trading Amazon CFDs

CFDs (Contracts for Difference) are financial derivative that allows traders to speculate on the price movements of an asset without owning it. Trading Amazon CFDs involves speculating on the stock's price movements without owning the underlying asset. For instance, Trader C believes that AMZN stock will increase in price and buys 1,000 CFDs of AMZN stock at $3,500 with a margin of 10%. The total value of the position is $3.5 million, and the margin required is $350,000. If the stock price increases to $4,000, Trader C can close the position, realizing a profit of $500,000 ($4,000 - $3,500) x 1,000 minus any fees or commissions charged by the CFD broker.

CFD trading allows investors to trade on margin, meaning that they can control a more significant amount of the underlying asset than they could with their capital. It allows investors to profit from falling prices by short-selling the asset and from the price movements of an asset without owning it, meaning they don't have to worry about holding or storing the asset.

Why Trade Amazon Stock CFD with VSTAR?

VSTAR is a suitable platform for trading Amazon CFDs due to various reasons. VSTAR offers competitive trading conditions for Amazon CFDs, such as tight spreads, low commissions, and flexible leverage options, helping traders to optimize their trading strategies and maximize potential profits.

VSTAR's user-friendly trading platform is easy to navigate and customize, providing advanced charting tools, technical indicators, and market analysis features that assist traders in making informed trading decisions. The broker is regulated and licensed by leading financial authorities like the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, ensuring the safety and security of traders' funds. Begin to trade with VSTAR today to experience these benefits and much more; sign up here and start trading today.

Conclusion

Amazon.com, Inc. (NASDAQ: AMZN) has established itself as one of the most influential ecommerce and cloud computing players. Its innovative business model, customer-centric approach, and relentless focus on expanding its product and service offerings have helped the company grow to unprecedented heights. With a vast array of businesses and revenue streams, Amazon is poised for continued success in the years to come. As investors weigh the risks and rewards of owning AMZN stock, they should consider the company's strong competitive position, impressive financial performance, and long-term growth potential.