The NASDAQ 100 is a stock market index that comprises the 100 largest non-financial companies listed on the NASDAQ stock exchange. It is widely used as a benchmark for the performance of technology and growth-oriented stocks, and its largest components are typically high-growth technology companies.

Why traders focus on the NASDAQ 100

The NASDAQ 100 is a focus for traders for several reasons. The 100 biggest, most traded firms listed on the NASDAQ stock exchange make up the NASDAQ 100, a stock market index. Traders can invest in the index to receive exposure to a wide range of industries, including technology, healthcare, and consumer goods. These firms are regarded as having strong growth potential.

The possibility for large gains is one of the key benefits of investing in the NASDAQ 100. Since the companies in the index are typically high-growth businesses, their stock prices may rise significantly over time, providing investors with sizable returns. Additionally, trading in the NASDAQ 100 can benefit from index investing, such as diversification, allowing the trader to reduce risk.

High Volatility

The NASDAQ 100 can fluctuate based on various factors, including economic and geopolitical events, company news, and investor sentiment. High-growth technology companies, a significant component of the NASDAQ 100, can be particularly sensitive to changes in investor sentiment, which can contribute to volatility. The high volatility of the NASDAQ 100 means that investors can realize gains much quicker than many other assets. However, it also means that losses can be quick as well.

The volatility of the NASDAQ 100 is measured by the Nasdaq-100 Volatility Index (VOLQ), which is calculated based on the values of certain listed options on the index. The NASDAQ 100 can fluctuate based on various factors, including economic and geopolitical events, company news, and investor sentiment.

Momentum

The NASDAQ 100 is quite strong regarding momentum trading, as the companies that make up the index quite often are at the forefront of growth and can be very strong moving stocks in good times and drastically falling stocks in bad.

Exposure to Key Sectors

The NASDAQ 100 index gives investors access to several important economic sectors, including technology, healthcare, consumer products, and more. The index comprises the top 100 non-financial companies with the highest market capitalizations listed on the NASDAQ stock exchange.

The NASDAQ 100 features several of the world's biggest and most innovative technology companies, making the sector exceptionally well-represented. These businesses are renowned for creating innovative goods and services and promoting innovation in the technology industry. Healthcare, consumer goods, and industry are additional significant industries that are included in the index.

Options and Futures

The NASDAQ 100 has many derivatives that you can trade. This includes options, futures, and CFDs. These allow you to use leverage, making it particularly attractive to short-term traders. However, some longer-term traders use other products, such as EFTs, to take advantage of the overall momentum of the index from a long-term perspective.

Global Relevance

The NASDAQ 100 is widely followed by traders and investors around the world. The index allows people to gauge where some of the most innovative companies in the world are heading from an economic standpoint. It also allows traders to understand how the market risk appetite is functioning.

Options and Futures Available on NASDAQ 100

The NASDAQ 100, popular with traders and investors alike, can be traded via futures, options, CFDs, and ETFs. Some of the most popular vehicles include:

NASDAQ 100 Options

An example of a financial instrument is a NASDAQ 100 option, which gives the holder the option—but not the obligation—to purchase or sell the NASDAQ 100 index at a defined price and time. The 100 biggest non-financial companies listed on the NASDAQ stock exchange comprise the market capitalization-weighted NASDAQ 100 index.

There is no possibility of compelled delivery because the NASDAQ 100 index options are issued in the conventional AM-Settled Monthly & PM-Settled Daily Expires and have cash settlements rather than equities as the underlying asset.

Investors employ NASDAQ 100 options for various reasons, including yield improvement, risk hedging, and portfolio protection against market corrections. Institutional and ordinary investors alike use these options.

E-Mini NASDAQ 100 Futures

The E-Mini NASDAQ 100 contract is a futures contract that enables investors to obtain exposure to the NASDAQ 100 Index, which monitors 100 large-cap businesses across key industry groupings and is a modified capitalization-weighted index. The contract is one of the most affordable ways to get market exposure to the NASDAQ 100 Index and is provided by the Chicago Mercantile Exchange (CME) Group. The E-Mini NASDAQ 100 futures contract has a minimum tick of 0.25 index points and is priced at $20 times the value of the NASDAQ 100 Index.

NASDAQ 100 ETFs

Exchange-traded funds that track the performance of the NASDAQ 100 index are known as NASDAQ 100 ETFs. The 100 largest non-financial firms listed on the NASDAQ stock exchange are included in the NASDAQ 100 Index, a market capitalization-weighted index.

Invesco NASDAQ 100 ETF and Invesco QQQ Trust are the two biggest ETFs available for trading that significantly target the NASDAQ 100, excluding inverse and leveraged ETFs, which either add leverage for short-term traders or a way to bet against the index for bears.

The NASDAQ 100 index's chosen firms are primarily from industries including hardware and software, telecommunications, retail, and biotechnology, including all the big US technology corporations.

3x Leverage NASDAQ 100 ETFs

A 3-times leverage NASDAQ 100 ETF is an exchange-traded fund that offers investors three times the daily return of the NASDAQ 100 Index by utilizing financial derivatives, such as futures or swaps. These ETFs are intended for investors looking to profit from short-term price changes in the NASDAQ 100 Index because they fall within the larger category of leveraged ETFs that employ leverage to increase profits.

According to NASDAQ, Leveraged ETFs use various investment strategies, including swaps, futures, and other derivatives. They provide multiple exposures to the daily performance of the underlying index, such as 2x or 3x. These ETFs are made for investors who wish to profit from swift price changes, and they are intended to be used by short-term traders looking to get in and out of the markets quickly.

The Direxion Daily Semiconductor Bull 3X Shares ETF, which aims to produce three times the daily performance of the PHLX Semiconductor Sector Index, is one example of a 3x leverage ETF that targets the technology sector. With the help of this ETF, investors will be able to gain leveraged exposure to the semiconductor segment of the technology market.

Leveraged ETFs carry a higher level of risk than non-leveraged ETFs, and their returns over longer time periods may diverge dramatically from the underlying index. Furthermore, because leveraged ETFs are made for short-term trading, they might not be appropriate for all investors.

CFDs Based on the NASDAQ 100

One of the most flexible ways to benefit from movement in the NASDAQ 100 Index is to get involved in the CFD markets.

What is a NASDAQ 100 CFD?

A NASDAQ 100 CFD is a Contract for Difference that allows investors to speculate on the price movements of the NASDAQ 100 index without owning the underlying assets. According to Investopedia, a CFD is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes.

Some of the main features of CFDs:

· You can go long or short on margin to amplify your returns. This leads to large gains, but losing more than your initial investment is possible.

· A CFD tracks the underlying index directly. Unlike some leveraged ETFs, there is a 1:1 correlation between the CFD and the index, without the distortions that futures and options can cause over time.

· There is no expiration date as you have in futures and options.

· It takes only a percentage of the total value of your trade as a margin. The leverage is typically higher and, therefore, can make trading CFDs more efficient for deploying capital.

· Stop loss and profit orders are available. While the ETF and futures markets can have these, they don’t exist in the options market. (At least not directly.)

· You can speculate on price moves of the index without the expense of options or futures, which can be somewhat prohibitive for smaller retail traders.

NASDAQ 100 Strategies Popular with Traders

While there are unlimited ways to trade the NASDAQ 100 Index, the different ways can be generally classified into these categories.

Trend following

A chart of the NASDAQ 100, using a trend line and 50 day EMA for trend following.

Trend following is a trading strategy that involves buying an asset when its price trend is increasing and selling when its trend is decreasing, expecting the price movements to continue. This strategy is applied to the NASDAQ 100 by traders who aim to profit from the long-term trends of the index's underlying assets.

According to Wikipedia, trend following involves using different techniques, calculations, and timeframes to determine the market's general direction and generate trade signals. These techniques may include analyzing moving averages, chart patterns, and technical indicators to identify trends in the market.

Breakout trading

Breakout trading is a strategy that involves buying or selling an asset when its price moves above or below a significant support or resistance level. This strategy is applied to the NASDAQ 100 Index by traders who aim to profit from the sudden price movements of its underlying assets.

Breakout traders identify important areas or data points in the market and use them as triggers for trades if the price moves through them. These areas may include trendlines, moving averages, or other technical indicators that indicate significant price levels. The strategy involves buying or selling the asset when the price breaks through the identified level and attempting to profit from the subsequent price movement in the same direction.

Reversal trading

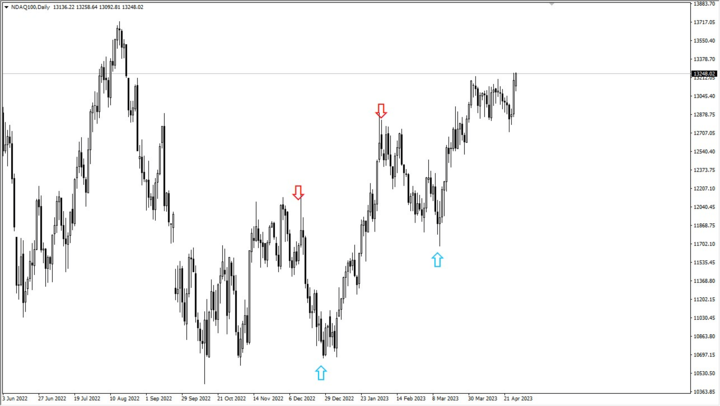

A couple of reversal trades in the NASDAQ 100.

Reversal trading is a tactic trader employ to spot probable reversals in a price trend in the NASDAQ 100 Index. This method predicts when a trend will likely change direction and profit from the ensuing price swings.

A price trend reversal occurs when it shifts from an upward to a downward trend or vice versa. Before the trend turns, traders attempt to exit trend-aligned positions and enter new positions that follow the new trend. To spot probable market reversals, reversal traders employ technical analysis techniques like moving averages, momentum indicators, and chart patterns. These traders hope to make money from the price movements that occur after the reversal takes place.

Options strategies

To trade the NASDAQ 100 index, several options and methods can be applied. For the NASDAQ 100, the bull put spread, covered call, and iron condor is common options strategies.

The bull put spread method allows an investor to profit only to the extent of the credit received, regardless of whether the level of the NASDAQ-100 Index (NDX) remains neutral or increases. To create net credit with this approach, a put option with a higher strike price is sold, and a put option with a lower strike price is purchased. The options expire worthless, and the investor keeps the net credit if the underlying asset's value stays above the higher strike price. A price decline below the lower strike price will result in losses for the trader.

In the covered call strategy, an investor holds a long position in an asset while selling call options on the same asset to make money. Investors who are somewhat to moderately optimistic about the underlying asset can employ this method. The investor keeps the premium earned from selling the call option if the underlying asset's value stays below the call option's strike price. However, the investor might be forced to sell the asset at the strike price if the price of the underlying asset increases above the strike price.

The iron condor is a different well-liked options strategy for the NASDAQ 100. In this strategy, a put option with a lower strike price and a call option with a higher strike price are both sold along with a call option with a higher strike price, while a put option with an even lower strike price and a call option with an even higher strike price are simultaneously purchased. This method aims to reduce risk by defining a range of profit and loss while generating money from the premiums obtained from selling the options. The options expire worthless, and the investor keeps the premiums paid if the underlying asset's price stays within this range. The investor suffers losses, though, if the price fluctuates outside of the range.

Earnings seasons

Once a quarter, the companies in the NASDAQ 100 Index will report earnings. This is typically a couple of weeks that can see increased volatility, allowing traders to take advantage of price fluctuations in a short-term manner.

Derivative hedging

One of the most basic uses for derivatives in the NASDAQ 100 Index is to hedge against a longer-term position that a trader may hold. For example, they take a short position in the futures, CFD, or options markets to protect against a pullback in the index that would cause losses in their ETF holding.

How to Analyze the NASDAQ 100 as a Trader

While the analysis of an index can be done in infinite ways, there are a few highlights that you should pay attention to determine the most likely movements in the NASDAQ 100.

· Use technical analysis to plot and recognize key support and resistance levels in the market. This could offer potential reversal points, longer-term trends, etc.

· Following earning reports and sentiment around the major index companies, such as Apple, Google, Facebook, Tesla, etc.

· Track the performance of sectors such as biotech, cloud computing, fintech, and e-commerce and how the companies are performing. A sudden change in one of these areas could signal a change in trend or confirm the one the market is currently in.

· Pay close attention to major economic announcements. This would include announcements like Non-Farm Payrolls, US GDP, other major economies’ GDPs, US Retail Sales, Michigan Consumer Sentiment, and more.

· Read transcripts of earnings calls from the major companies and movers on this NASDAQ 100 Index. This can give you an idea of future trends, hiring, investment in innovation, and new products coming to market.

· Use trend analysis of index-tracking ETFs to make trades based on the signals they compose.

Conclusion

The NASDAQ 100 is one of the world’s most important indices to follow. It is tied to innovation, technology, and many subsectors involving fintech, health, communications, and more. It is one of the more volatile indices traders can trade in the United States, so it has been very attractive to both short-term traders and investors.

There are a lot of different ways to benefit from the index. ETFs, futures, options, and CFDs all offer the ability to take advantage of the strengths or weaknesses of this market. The market can trend for long periods and for much longer periods than one might expect. However, the volatility can make it difficult to trade at times. Either way, this is a major market that you can use to increase alpha in your portfolio.

To take advantage of CFD markets, you must open an account with a trusted CFD broker like VSTAR. VSTAR is heavily licensed and regulated through CySec and other major regulatory bodies globally. Furthermore, VSTAR allows you to trade other markets, such as commodities and currencies, making diversification much easier.