The Nikkei 225 is a significant financial index that serves as a key barometer of the strength and vitality of the Asian markets and the economy of Japan. It consists of 225 significant firms listed on the Tokyo Stock Exchange and gives investors and market experts an overview of the performance of the Japanese economy across different sectors.

What is the Nikkei 225?

Japan's top stock index is the Nikkei 225, sometimes known as the Nikkei Stock Average or just the Nikkei. It was founded in 1950 and has 225 big businesses listed on the Tokyo Stock Exchange. Although it primarily favors manufacturing and technology businesses, which are the main engines of the Japanese economy, the index encompasses a wide spectrum of industries.

The Nikkei is a Price-Weighted Index

The Nikkei 225 is a price-weighted index, which implies that the value of the index is more heavily influenced by the performance of the firms with higher share prices. This contrasts with market capitalization-weighted indices, which base each company's effect on the sum of its market values. As the performance of a few expensive stocks disproportionately impacts the index, the price-weighting method can occasionally produce a skewed portrayal of the market.

Sectors Covered

The Nikkei 225 index includes a wide range of industries in the Japanese economy, but it is significantly biased toward businesses in the industrial and technology sectors. These sectors have long served as the engine driving Japan's economic expansion, and their dominance in the index reflects this. The index includes other industries like consumer goods, healthcare, and financial services.

A Global Bellwether: The Nikkei 225

The Nikkei 225 is an important gauge for the health of the Japanese economy and the larger Asian markets as it is a well-known index for Japan, the third-largest economy in the world. The index's swings can reveal important information about market patterns, investor sentiment, and economic trends. Additionally, portfolios of investments centered on Japanese equities sometimes use the Nikkei 225 as a benchmark.

Fundamental Analysis of the Nikkei 225

The fundamental analysis of the Nikkei 225 involves evaluating the financial health and market performance of the 225 largest Japanese companies listed on the Tokyo Stock Exchange. The Nikkei 225 serves as a major stock market index, a key gauge of market strength in Japan, and a significant Asian equity benchmark with global consultation. It is also considered the equivalent of the Dow Jones Industrial Average (DJIA) Index in the United States.

It is crucial to analyze earnings from the biggest companies on the Nikkei 225, including companies like Toyota, Softbank, Sony, etc. Strong performance from the biggest players and strong guidance can be a major boost for the index. Pay the most attention to the biggest firms, as the index is a weighted average, so some companies are much more influential than others.

Global news can also impact the Nikkei, just like any other index. As Japan is one of the great economies in the world, such news as US-China relations and geopolitical conflicts will likely affect the market.

As of late, the Japanese government and major businesses have undergone pro-growth reforms, which should be helpful for the Nikkei over the longer term, but this is a longer-term project, and results won’t happen overnight.

Technical Analysis of JPN225 (Nikkei 225)

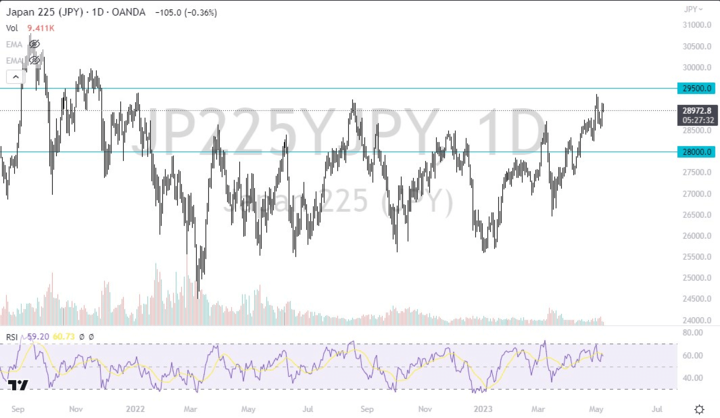

Currently, the Nikkei 225 looks bullish, as Asian equities generally have been doing fairly well. The ¥29,500 level is an area that offers overhead resistance, perhaps extending to the ¥30,000 level. Any significant move above that level could open up buying pressure, as the market will have turned around its entire attitude.

It’s worth noting that the Relative Strength Index is not overbought, even though there has been such a big move to the upside. This shows that the rally may very well be sustainable, and it does look at this point that the ¥28,000 level underneath offers a bit of a “floor in the market” for the Nikkei. Trading volumes have been relatively steady, with the most recent spike in volume happening at the ¥26,500 level, a major swing below that led to the recent rally.

When looking beyond this “30,000-foot view” of the Nikkei 225, you must pay attention to trading patterns and potential technical setups. There is a potential trendline from the rally higher, so traders may be paying close attention to it. Furthermore, it’s also worth paying attention to the value of the Japanese yen, as the Bank of Japan and the Japanese government continue to stimulate the economy. A cheap Japanese Yen helps the major firms in Japan with exports, a major driver of the Japanese economy.

Trading Strategies for the JPN225

Broadly speaking, investors can use a handful of trading strategies to take advantage of price movement in the Nikkei 225. Some of them include:

• Trend following: Going long or short is based on the dominant short-term trend. Use stop losses in case of reversals and look for continuation indications to continue the trend.

• Trading in the range: Watch for times when the JPN225 oscillates back and forth between support and resistance. Sell at resistance and buy at support.

• Breakout trading: Buy or sell JPN225 when it departs from ranges or chart patterns. Signals based on volumes and fundamentals should be confirmed. In case of fake breakouts, control the danger.

• Reversal trading: Trading reversals is riskier but aims to profit from turning points. Look for head and shoulders patterns, double tops and bottoms, and changes in the momentum indicators. Stop loss limits must be strict.

• News and events trading: Trading volatility around significant news events, such as elections, natural catastrophes, and central bank pronouncements, is known as events trading. As the influence frequently wanes quickly, be prepared to grab winnings promptly.

• Hedging: By holding short index positions, investors can protect their portfolios from market declines. But because markets change, this needs ongoing management.

How to trade JPN225 – ETFs, options, CFDs, and spread betting

Exchange-traded funds (ETFs) that track the Nikkei 225 Index are an option for traders seeking direct exposure to the index. Many ETFs allow for shorting and give leverage, enabling traders to profit from rising and declining markets. Due to their ease of purchase and sale on exchanges, these ETFs are a well-liked and practical option for exposure to the Japanese market.

More sophisticated trading tactics, like straddles, strangles, and calendar spreads, are available with Nikkei 225 options and futures. To correctly manage the risks associated with these instruments, a higher level of experience is needed. Contracts for difference (CFDs) and spread bets are options for individuals looking for simple access and leverage. With tight spreads, these products let traders go long or short. To better limit risks, start with lesser leverage and exercise caution when dealing with volatile moves against positions.

It's important to remember that margin needs, commissions, and overnight funding expenses vary greatly amongst brokers. To choose the best broker for trading the Nikkei 225 Index, traders should carefully examine these variables based on their demands and frequency of trading.

Trading JPN225 CFDs

Contracts for Difference, or CFDs, provide an easy way to predict the price changes of the JPN225 index without getting the underlying stocks. Trading with registered CFD brokers is necessary to guarantee a safe and dependable trading experience.

Using leverage and going long or short with CFDs allows traders to earn bigger returns while potentially increasing risk. To protect your investments, look for brokers who offer flexible margin and risk management tools and at least 2-5x leverage.

Low spreads, fees, and commissions are essential considerations for frequent index traders. To choose the top CFD broker that best suits your requirements and trading style, compare them. Use a demo account to get acquainted with the broker's platform, interface, and tools before investing real money because these features can significantly impact your risk management and trading decisions.

Use leverage with utmost caution when trading a volatile index like the JPN225. Leverage can increase profits, but it can also quickly magnify losses. Start with a maximum leverage of 2 to 5 times and increase it progressively as you acquire experience.

For all transactions, use stop-loss orders to reduce the danger of loss. However, be ready to regularly watch your holdings because unexpected index movements could trigger stops. If manual exits are necessary to protect your capital, think about them.

Watch for trade opportunities around index catalysts like Bank of Japan pronouncements or calamities. The effect of these events frequently wears off fast, so prepare escape strategies in advance.

Use technical analysis to help you enter and exit momentum, swing trades, and spot longer-term patterns in the JPN225 index's broader fundamentals. Limit your total CFD exposure to 5% of your capital at any given moment to control risk. You should also dedicate at most 2% of your capital to any trade. To further reduce risk and take advantage of various market opportunities, diversify your assets among multiple worldwide indices.

Conclusion

The Nikkei 225 is an important financial indicator that measures the health and vitality of the Japanese economy and the Asian markets. It has 225 notable companies listed on the Tokyo Stock Exchange, mostly in the manufacturing and technology sectors. The price-weighted index has a strong tilt in favor of companies in the industrial and technological sectors. The index's fluctuations can provide insight into market trends, investor mood, and broader societal issues. Investors can use various trading techniques to profit from price changes in the Nikkei 225, including trend following, trading in the range, breakout trading, reversal trading, and news and events trading. ETFs, options, CFDs, and spread betting are options for traders seeking direct exposure to the index. It's essential to carefully manage risks associated with these instruments and choose a suitable broker based on the trading frequency and requirements.