In the era of economic uncertainty where the fear of recession and high inflation combined with a global chip shortage, has affected the tech industry, Qualcomm has managed to mitigate the effects of the headwinds.

However, the company’s structure and diversification weren't enough to completely stave off its short-term troubles and Apple's growth could also pose challenges to the company. In addition, global smartphone sales have slowed down making investors a bit skittish about investing. Here's what you need to know about Qualcomm and the company’s future growth.

Everything to Know about Qualcomm

QUALCOMM Incorporated is a wireless communications company that creates software, semiconductors, and other services relating to wireless communication. The company has been a major player in the tech industry since it was founded in 1985 by Irwin Jacobs and six others. When it started wireless communication was in its infancy and Qualcomm became a significant player in the industry soon after it launched its first satellite communications system in 1989.

Qualcomm continued to develop technologies that became the foundation for various 3G and 4G networks. It owns patents to crucial 5G and TD-SCDMA wireless technology with its CEO Cristiano Amon running operations. It is also one of the largest telecommunications and semiconductor companies in the world with its headquarters in San Diego California and incorporated in Delaware.

Qualcomm's Business Model and Products

Qualcomm’s main revenue sources happen to be its licensing business and semiconductor segment. Its most profitable and well-known semiconductors are its Snapdragon chipsets which are used to power smartphones and provide incredible performance. LG, Xiaomi, Sony, and One Plus are among the company’s top clients for its semiconductors. Qualcomm also sells cellular modems that offer connectivity to all known networks such as 2G, 3G, 4G, 5G, and CDMA.

As for the company’s licensing business called Qualcomm Technology Licensing, the company makes money by collecting fees for licensing its intellectual property portfolio which includes patents for its OFDMA, WCDMA, CDMA, and other technologies.

Main Products and Services

Qualcomm produces semiconductor chips that can be used in tablets, smartphones, and other electronic devices. These chipsets incorporate a range of technologies such as graphics, processors, and modems. Its best selling chips for smartphones and other electronic devices are the Snapdragon 8 Gen 1 and Snapdragon 778G. As for 5G technology, Qualcomm recently released the Snapdragon X75 and X35 5G modem which can be considered as one of the most advanced modems in the world today.

Financials and Growth

Review of Qualcomm’s financial statements

Qualcomm has a strong balance sheet that can handle its financial commitments such as debt repayment and dividend payouts. The chip designer currently has $8.2 billion in cash, cash equivalents, and short-term investments plus an operating cash flow of $10.1 billion. This also means QCOM is capable of increasing the dividend payout in the near future.

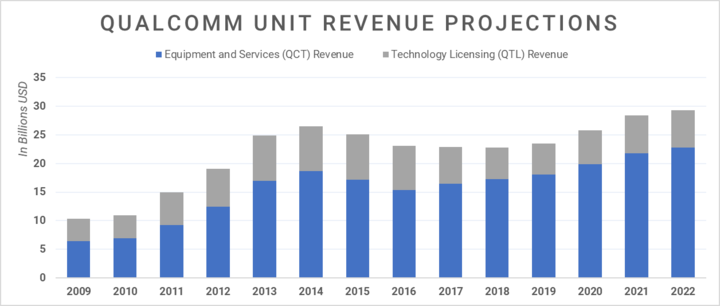

Although Qualcomm earnings have been down overall since last year, the company’s margins have been improving. Its net margin saw a 165% improvement from 11.06% in 2017 to 29.38% in 2022. Qualcomm’s current assets have also increased by 9.87% meaning that the company still has a strong structure for future growth. Its revenue has also grown steadily from $22.8 billion in 2017 to $44.2 billion in September 2022 with a 29.4% profit margin. However since the demand for smartphones has dropped, its revenue declined to $41 billion as of March this year also resulting in a decrease in its stock price. Qualcomm market cap was also affected as it now stands at $155.6 billion.

Key Financial ratios and metrics

Because of how diversified Qualcomm is, it faces strong competition in different segments. MediaTek and Samsung, which are its strongest competitors in the semiconductor market, made $18.7 billion and $245.7 billion in revenue in 2022 compared to Qualcomm’s $44.2 billion in revenue in 2022. All three companies also show attractive investment potential with Qualcomm’s P/E ratio of 13.53 measuring up favorably to that of Samsung and MediaTek which stands at 27.86 and 12.97 respectively.

However, Qualcomm remains significantly undervalued compared to its peers. It is still trading at 23.1% below its fair value of $134.95 and below the average Qualcomm stock price target of $133.71. It is not the only tech company affected by the global slowdown but its major segment - the smartphone sales was massively hit and it might take a while for the company to recover from the loss.

How is Qualcomm stock doing?

Trading Information

Primary Exchange & Ticker: NASDAQ: QCOM

Country & Currency: USA (USD)

Trading Hours: Pre-Market (4:00 - 9:30 am ET) and After Hours Market (4:00 - 8:00 pm ET)

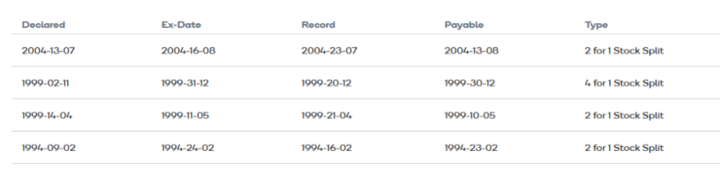

Stock splits: Qualcomm stock underwent 4 stock splits since 1991.

Qualcomm dividend: 0.80 USD

Qualcomm stock dividend yield: 3.02% annual dividend yield

Latest Developments Investors/Traders Should Note

FQ2'23 earnings report

The company’s earnings report for the second quarter of 2023 was in line with analysts' Qualcomm outlook but it still left investors with mixed feelings. Moreover, its forward guidance left some disappointed because it fell short of Wall Street estimates.

The management adjusted revenue for the third quarter to $8.5 billion, well below the consensus of $9.1 billion. Plus, the company’s adjusted midpoint EPS outlook of $1.8 surprised investors because it was well below analysts' estimates of $2.12.

Plans to acquire Autotalks

Qualcomm is making plans to acquire Autotalks, an Israeli semiconductor company. The acquisition will accelerate the adoption of its technologies for automotive to improve driver assistance systems and automated driving.

Overview of Qualcomm Stock Performance

Technology stocks in general have been affected by inflation and fears of a recession. This is largely the reason why Qualcomm stock has been down by over 23% since last year. Qualcomm's stock price fell by 6% in May after its latest earnings report left investors with mixed reactions.

At the start of fiscal 2023, investors were hopeful that Qualcomm would finally recover but the company’s declines only deepened in the first quarter. It expects the slowdown to worsen leading to a 19% to 26 year-on-year drop in revenue that is furthering the decline of the stock. The stock is currently trading at $104 and Qualcomm share price prediction for 2023 doesn't reflect much growth for the company this year.

Key Drivers of Qualcomm Stock Price

Automotive Business

Although the chip designer is dealing with the effects of the slowdown in smartphone sales as Qualcomm stock price prediction for the year doesn't reflect much growth for the company, its automotive business segment is thriving. The demand for different systems like vehicle telematics and ADAS (advanced driver-assistance systems) is a lucrative opportunity for the chip maker and it is barely starting to scratch the surface in an industry that is expected to generate $37 billion in revenue by 2026.

The IoT Business is growing

The Internet of Things (IoT) is gradually turning out to be the fastest-growing revenue stream for Qualcomm. The rapid growth of IoT as a revenue source for the chip maker is mostly due to an increased demand for handheld devices within the industrial sector of the IoT to use in logistics, robotics, and warehousing.

Analysis of Prospects for Qualcomm Stock

Qualcomm’s 12% YoY drop in revenue to $9.5 billion was expected since the smartphone sales which is their major segment fell in revenue by 18% YoY. This is a situation that the chip maker managed well since the fall in demand for smartphones due to inflation isn’t something that they can control. But there are no long-term worries in the handset segment for Qualcomm and it has managed to keep its market share relatively stable for the last 5 years.

Short-term Qualcomm stock support level: $105.64

So, with the automotive and IoT business rising fast, Qualcomm share price for 2023 is expected to be relatively stable but won't see much increase. Qualcomm outlook for 2024 is more positive as the smartphone slowdown starts to reverse and the company seeks new opportunities in other markets. Therefore based on the Qualcomm stock forecast by analysts, the price target for 2024 is $190 representing a 41% increase from the current price range.

Risks and Opportunities

There are certain risks and positive prospects that affect Qualcomm’s growth:

Opportunities

1. Strategic partnerships: Oualcomm has lucrative partnerships with some of the top names in the tech industry and automotive business. To continue to make innovative products and maintain its market share, the company also forms meaningful relationships with several universities and research institutions.

2. Better smartphone sales: Global smartphone sales remain weak despite the number of promotions and price cuts. But Qualcomm is expecting the weak sales to reverse in China by the second half of the year and gradually return to its pre-pandemic levels by 2024.

3. Growth in the automotive business: Automakers are starting to show more interest in using Qualcomm’s Snapdragon Digital Chassis product because it can assist with autonomous driving technology and in-car infotainment and cloud connectivity.

Risks

1. Losing Apple as a customer: So far, Apple has not succeeded in making its modems which is why it remains a customer of Qualcomm. However the threat of losing Apple as a customer remains and when the phone company does move away, it might take a sizable chunk of the company along with it.

2. ARM lawsuit against Qualcomm: ARM launched a lawsuit against Qualcomm for using its patents. If this suit succeeds, it threatens the chip designer’s expansion plans because those patents are needed to create more products and services for the data center market.

3. Increased competition: It is facing strong competition from other semiconductor and wireless communication companies. Intel Corporation, Broadcom Inc, and MediaTek are some of Qualcomm’s biggest competitors.

Opportunities for growth and expansion

Qualcomm’s expansion from wireless communication at the beginning to semiconductors and now automotive and IoT has been impressive. But the best part about it is, the diversification gives the company a lot of room to release new products and services.

More network providers are moving over to 5G technology and Qualcomm is well-positioned to benefit from the increased demand of the technology. Plus, Qualcomm is targeting its automotive market size to become $100 billion by 2030 and it has strong partnerships with other companies like Mercedes Benz Group AG to make it work.

Future Outlook and Expansion

Qualcomm’s bad stock performance and revenue fall in 2022 seems to be continuing in 2023 but the chip leader still has a solid structure for long-term growth. The weak smartphone sales were not much of a surprise to anyone even though it did affect Qualcomm’s overall revenue. However, if you focus on the smartphone slowdown alone, you might ignore clear growth areas for Qualcomm like the IoT applications and 5G.

So, is Qualcomm a buy or sell? The consensus estimates among Wall Street analysts along with signals from Qualcomm stock buy or sell indicators show that QCOM stock is a strong buy mostly based on its long-term fundamentals. It is already cutting costs to manage the short-term slowdown and has repurchased shares to boost its EPS. Qualcomm might struggle to make a comeback over the coming months but there is no sign that it has reached its bottom yet.

How to Invest in Qualcomm Stock

Right now, long-term investment is perhaps the best way to go when investing in Qualcomm since its near-term fundamentals are not good. You can hold it for as long as a year or more and you also benefit from its 3.02% annual dividend yield and reinvest it to grow your position.

But if you want to invest in something with higher profit potential, QCOM options are a solid investment method. The only downside is that it is riskier than investing in the stock itself because you are working with high volatility. The other short-term investment method is QCOM CFDs.

QCOM CFDs are financial derivatives like options because you do not have to own the underlying asset to invest in it. Here, you are profiting from the short-term fluctuations and can use leverage to place larger positions without having to risk your capital. For instance, if a CFD platform like VSTAR offers 1:10, you can put $100 into QCOM shares and be able to invest $1000. This helps you to increase your profits but you should be careful because it increases the risks you face as well.

Why Trade Qualcomm stock CFD with VSTAR

Trade Qualcomm stock CFD easily and conveniently under excellent trading conditions using VSTAR’s super-tight spreads, and fast order execution. You can start exploring the market for as low as $50 and protect your trades from losses by using VSTAR’s risk management tools and balance protection system.

Want a better trading experience? Sign up and start trading in seconds!

Conclusion

If you are interested in short-term outlook and growth, then Qualcomm might not be a suitable option for you since the company is still dealing with its near-term headwinds. But there is still a lot of room for growth as it capitalizes on other industries and meaning that there is still something to gain from the company long-term.

However, before investing, make sure to do some research of your own and also look into other tech stocks that might be a better fit for you.