Raytheon Technologies' Overview

On April 3, 2020, Raytheon Company and United Technologies merged to form Raytheon Technologies, with headquarters in Waltham, Massachusetts. This Fortune 500 corporation is currently led by Gregory J. Hayes as CEO. The company's market value was roughly $153 billion as of May 2023, and its net income for the fiscal year 2022 was close to $6 billion.

The company has achieved key milestones, such as creating ground-breaking radar systems and essential defense and aerospace contracts. It's also renowned for its significant mergers, like the most recent one with United Technologies in 2020 and the acquisition of Hughes Aircraft Company in 1997.

Four market-leading companies comprise Raytheon Technologies' present organizational structure: Collins Aerospace Systems, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense. The executive leadership team and the board of directors presided over by Gregory J. Hayes, run the business.

Raytheon Technologies' Business Model and Products/Services

Business Model

Raytheon Technologies is a new aerospace and defense leader with a broad business strategy prioritizing the commercial and defense markets. With a portfolio evenly split between commercial and government contracts thanks to the merging of United Technologies and Raytheon Company, the business can respond to shifting market conditions.

Main Products/Services

The main products offered by Raytheon are a variety of defense products, especially for government clients, including missiles, space systems, and cybersecurity solutions. It is renowned for its cutting-edge cybersecurity solutions and sophisticated missile defense systems.

Raytheon Technologies' Financials, Growth, and Valuation Metrics

Fundamental analysis involves understanding many key metrics on a company's balance sheet and the outlook for the future.

Review of Raytheon Technologies' Financial Statements

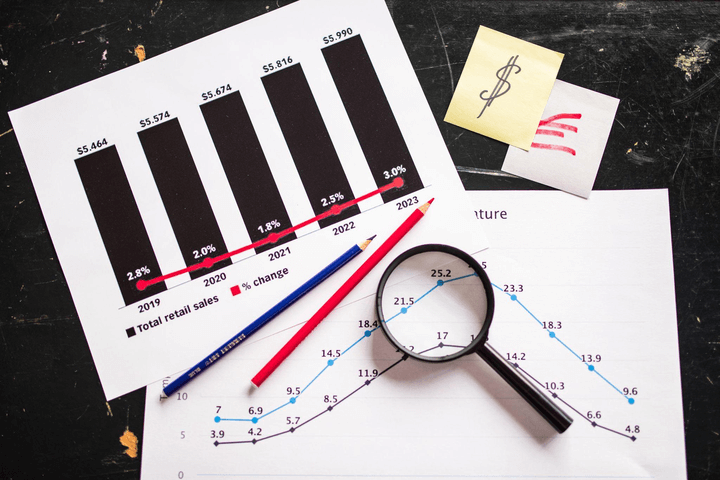

The Raytheon revenue has consistently increased over the last five years, highlighting its resiliency and potential for innovation. Due to its strong operational efficiency, its profit margins have stayed consistent. Substantial cash from operations (CFFO) provides enough money for ongoing corporate activities and investments. The company's balance statement points to a robust financial situation.

Raytheon has seen a 5-year gain of 26.75% in its stock price and a gain of 131.04% from the low made in 2020. (Covid low.)

RTX Earnings: With annual sales of $67 billion and a net income of over $1.5 billion quarterly, the company has substantial cash to weather any storm.

Raytheon Market Cap: As of October 2023, Raytheon Technologies has a market capitalization of $114.12 billion.

Key Financial Ratios and Metrics

Raytheon Technologies' revenue and earnings growth shows competitive market positioning compared to its biggest competitors, including Boeing (BA) and Lockheed Martin (LMT). However, the company's stock can be slightly undervalued based on its forward P/E ratio, indicating possible upside for investors.

Here is a quick summary of RTX:

2023's first quarter

· Sales of $17.2 billion increased by 10% from the previous year, including organic growth of 10%.

· With acquisition accounting adjustments of $0.25 and net significant and/or non-recurring charges of $0.97, GAAP EPS from continuing operations increased by 31% from the preceding year.

· $1.22 in adjusted EPS, an increase of 6% over the previous year

· $863 million operating cash outflow from ongoing operations; $1,383 million free cash outflow

· $180 billion in backlog for the company, of which $71 billion is for defense and $109 billion is for commercial.

· Achieved further RTX gross cost synergies of almost $50 million.

· Repurchased RTX shares worth $562 million.

· Forecast for the whole year 2023 is reiterated.

Full-year outlook

· $72.0 to $73.0 billion in sales

· EPS of $4.90 to $5.05 when adjusted.

· About $4.8 billion in free cash flow

· RTX shares worth $3 billion will be repurchased

RTX Stock (NYSE RTX) Performance

Raytheon has been a winner for some time, and as long as there is a sense of "never-ending conflict," RTX is likely to outperform many other companies.

RTX Stock Trading Information

What is RTX

Raytheon Technologies stock was listed on the New York Stock Exchange following the merger in 2020. It trades under the ticker symbol "RTX" in US dollars.

Regular trading hours are 9:30 AM to 4:00 PM Eastern Time, with pre-market and after-market sessions allowing extended trading.

Raytheon Stock Split

Raytheon Technologies has not announced any upcoming stock splits. The company last conducted a stock split in 2020.

RTX Dividend

RTX has consistently paid dividends.

Key Drivers of RTX Stock Price

Raytheon stock price or RTX stock forecast is primarily driven by defense spending trends, the company's financial performance, and geopolitical developments. The company continues to see demand based on various global conflicts, which is increasing.

Raytheon is also a satellite manufacturer, and as the race for control of the space around Earth heats up, Raytheon finds itself in an enviable position. The company is one of only a handful that produces satellites so the space race will be a positive driver.

Drones are also a big bullish catalyst for Raytheon Technologies stock price, as drones are being used extensively in Ukraine and will more likely than not continue to be used heavily in future conflicts. The company makes an entire line of drones that have various uses in battlefield conditions, search and rescue, and law enforcement.

Finally, there is also the war in cyberspace. With Chinese, Russian, and North Korean cyber-attacks becoming commonplace, the cybersecurity portion of Raytheon has received significant business from the US government over the last few years, a trend that is unlikely to end anytime soon.

Analysis of Future Prospects for RTX Stock

With solid growth in its defense and commercial sectors, RTX stock has promising prospects, particularly if defense spending remains robust. With the Biden administration increasing military budgets in the US, this should continue positively impacting the stock.

Another reason to be bullish on this company is the increasing tensions between Russia and the US and saber-rattling in the Taiwan Strait. As tensions increase between the Chinese and the Americans, it makes sense that military expenditures will continue to be significant.

Latest Raytheon News or Developments Investors / Traders Should Note

Being so heavily involved in the defense industry, Raytheon makes its money from arms sales. In other words, this company is very sensitive to geopolitics. For example, the war in Ukraine and the US supplying weapons to that country is reason to be bullish on the company. Furthermore, it is also worth noting military budgets and new purchases.

Traders will also pay particular attention to the Congressional debates on military budgets. Still, the last few years have seen a willingness by both parties in the US to spend heavily on the military, providing a market for the company's arms sales.

Risks and Opportunities

To trade any stock, you need to be able to weigh the risks and opportunities in the company. This is no different in RTX stock, and some of the following information can be used to understand what could be in store for the future.

Potential Risks Facing Raytheon Technologies

One of Raytheon Technologies' biggest threats is its fierce competition from rival aerospace and defense firms like Boeing and Lockheed Martin. As countries refocus their efforts following the pandemic, pressure on the defense budget may increase. The company's contracts and overall profitability may be impacted by geopolitical unpredictability.

Boeing, while normally considered a commercial aerospace company, also has customers in the form of the Department of Defense, NASA, and the Department of Homeland Security in the United States. Boeing's latest quarter produced $1.7 billion in sales, although the company took a $414,000 loss overall. Lockheed Martin had $15 billion in sales, with a $1.6 billion net income. Lockheed Martin is quite often the biggest competitor for military contracts for Raytheon, although the US government does tend to spread out contracts whenever necessary.

Raytheon has an advantage over its competitors because it has thousands of business lines with the government in America, meaning that no particular contract is likely to cause huge losses. Furthermore, the company is the sole producer of the large contracts that it does have, as is the case with the F-35 fighter and the B-21 bomber.

Opportunities for Growth and Expansion

Despite the dangers, Raytheon Technologies offers many prospects for development and growth. The rising demand for space and missile defense contracts presents considerable opportunities. Additionally, the corporation is expected to benefit from expanding global defense spending, lingering international conflicts, and the growing significance of cybersecurity.

How to Invest in RTX Stock

To invest the fortunes of Raytheon Technologies, there are three main ways the average retail trader can do so.

Hold the share: This classic investment strategy is purchasing and keeping the stock in a brokerage account.

Options: Buying the right to buy or sell a stock at a specified price before a specific date is an option. Options offer leverage but also involve time decay, which can work for or against you, depending on the situation.

Contract for Difference (CFD): Trading CFDs enables you to predict the direction of the RTX stock price without actually holding the underlying asset.

With CFDs, you can trade with leverage, sell short, and trade outside regular market hours, among other benefits. However, because of the possibility of quickly experiencing significant losses, they also carry their hazards and are inappropriate for all investors.

Why Trade RTX Stock CFD with VSTAR

VSTAR offers a robust trading platform with competitive spreads, reliable execution, and exceptional customer support. Trading military stocks like RTX Stock CFD with VSTAR allows investors to benefit from price movements without needing full capital outlay. The negative balance protection also benefits traders, as the system constantly monitors leverage and margin requirements.

Furthermore, it is essential to understand that VSTAR is highly licensed and regulated in various jurisdictions, allowing traders to feel safe depositing their funds.

How to Trade RTX Stock CFD with VSTAR

Visit the VSTAR website or download their mobile app to trade RTX Stock CFD. After creating and funding your account, you can look for RTX in the CFD trading category, decide whether to "Buy" or "Sell" based on your market prediction, set your trade size, and confirm the trade. Remember to set stop loss and take profit levels to control your risk.

Conclusion

Raytheon Technologies is a solid aerospace and defense industry player with a diverse portfolio and robust financials. Despite facing certain risks, the company also has significant growth opportunities. When investing in RTX stock, one should consider different methods and platforms. For instance, Trading defense stock RTX Stock CFD with VSTAR offers a flexible and potentially profitable way to speculate on the company's future performance. However, like any investment, it comes with its own risks, so due diligence and risk management are crucial.

In the current geopolitical environment, governments worldwide are expected to continue increasing military spending, especially NATO members, supplying Ukraine with large amounts of weapons for the last year in its struggle against Russia. This should continue to help the bottom line of Raytheon going forward.

FAQs

1. Is RTX a Buy or a Sell?

Most analysts rate RTX stock a Moderate Buy or Buy with upside potential.

2. Is RTX stock overvalued?

RTX stock does not appear to be significantly overvalued based on its forward P/E ratio relative to its defense/aerospace peers.

3. Has Raytheon stock split?

Yes, Raytheon conducted a 4-for-1 stock split in 2020.

4. What is Raytheon's dividend growth rate?

RTX's 5-year dividend growth rate is around 8%.

5. What is the 52-week high of Raytheon stock?

RTX's 52-week high is $106.02.

6. What does the future hold for RTX stock?

Analysts are bullish on RTX's future growth in the aerospace/defense markets. The consensus rating is a Moderate Buy with an average price target of about 12% above current levels.