As a market leader in the gaming industry, Unity Software experienced a massive boom when its IPO came out in 2020 and benefited from increased consumer demand during the pandemic. But from 2022 still now, the company has been hit with a multitude of issues like high interest rates, post-pandemic slump, inflation, and losses in one of its most important business segments.

Although Unity is at its lowest valuation since going public, the company is focused on fixing operational issues and maintaining the company’s potential upside long-term. So, does this make Unity Software stock a good buy or do you need to look elsewhere?

Unity Background

Founded in 2004 by David Helgason, Joachim Ante, and Nicholas Francis in Denmark, Unity Software Inc is a video game software development company responsible for creating the Unity game engine- a software platform for building video games. Now based in San Francisco, United States, Unity Software market cap stands at $10.02 billion and the company ended 2022 with a net income of -921 million.

Unity technologies created one of the first engines to support the 2007 release of the iPhone and continued to be the main platform for creating games for a few years after it was founded. As Unity expanded its platform to support virtual reality and artificial intelligence, the use of Unity software expanded beyond games in 2010. Today, it is used in the automotive industry for design and virtual world car testing and also used in various movies. In 2014, one of its founders David Helgason officially stepped down as CEO with John Riccitiello as the new CEO while Helgason remained as the executive vice-president.

Business Model and Products

Unity Software Inc makes it easier for developers to create 2D/3D products such as video games. Creators on the platform use it for a wide range of applications such as online and augmented reality product configurators, autonomous driving simulation, workplace safety training, AR/VR experiences, and other industrial applications. In addition, Unity provides built-in tools and features, graphical components, and cross-platform operability to create futuristic metaverse games.

Unity generates a bulk of its revenue through partnerships, subscriptions, and direct sale of additional tools and software. Their subscription plans for developers and creators are in three levels- Plus, Pro, and Enterprise in order to cater to different needs.

The second way Unity makes money is through post-game creation. Once a game developer or creator has created a game or any other application, it provides services like Unity Ads to allow users to operate and monetize apps created on the platform. Then the revenue is shared between the company and developers only when the game succeeds.

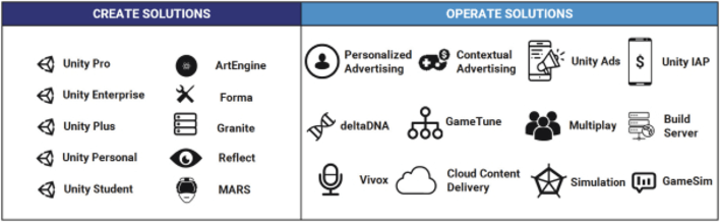

Products and Services

Unity Software offers a suite of 3D products and services that can be used to make custom applications. Its products are divided into two categories: Create Solutions and Operate Solutions.

Unity Financials and Growth

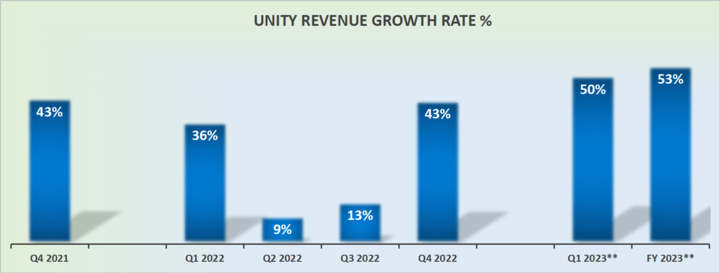

After its IPO in 2020, Unity Software revenue has been improving as the company recorded $1.39 billion in revenue at the end of 2022- a 25% increase from 2021. The Q4 2022 was also Unity’s first profitable non-GAAP quarter when its revenue grew to $451 million. The Q4 2022 earnings of Unity software indicated a 42.77% increase year-over-year and the company’s management is expecting revenue to increase between 47% and 58% year-over-year in 2023 as annual revenue grows to $2.20 billion. However, the company’s other fundamentals are not as strong as its revenue performance:

● Profit margins: -66.2% in December 2022

● Cash from Operations: - $59.43 million

● Free Cash Flow: -$116.57 million

Unity Software earnings growth for the past 5 years is -41.1% compared to the industry's 20.3% growth. But despite the company not being profitable, analysts still predict revenue to grow by 19.36% per year because they expect the company's strong performance to continue. The company also has sufficient cash for the next three years with its long-term assets valued at $5.4 billion.

Key Financial Ratios and Metrics

Unity has a market cap of $10.02 billion giving it a price-to-sales ratio of 19.4% which is almost 2 to 3 times lower than its major competitors Roblox, and Epic Games, Meta, and Microsoft. By generating $1.4 billion in revenue for the year 2022, Unity is also behind Roblox and Nintendo that generate $2.2 billion and $13.7 billion annually respectively. The company price/earnings ratio for 2022 was also in the negative at -11.97 making it significantly better than Roblox P/E ratio of -22.61.

So is Unity Software undervalued?

Unity’s revenue appears to be growing quickly enough for it to achieve a 50% year-on-year growth in Q1 2023. However, this acceleration is mostly due to Unity’s acquisition of IronSource which Unity paid more than 40% of its market cap for. It is also important to remember that Unity spent $1.5 billion of its market cap during Q4 2022 to buy back its shares at $35.10 after the stock price had nearly fallen to an all time low. Plus, Unity’s fair value is estimated to be $23.16 compared to the current share price of $28.46 indicating that the company is slightly overvalued.

Stock Performance

Trading Information

Primary Exchange and Ticker: NYSE: U

Country and Currency: USA(USD)

Trading Hour: Pre-market (4:00 - 9:30 am ET) After Hours Market (4:00pm - 8:00pm)

Unity Software Dividend: N/A

Unity Software stock Dividend Yield: N/A

Stock Split: N/A

Overview of Unity Software stock performance

Since Unity launched its IPO in 2020, U stock has lost more than 80% of its value. As at the time of writing, Unity software stock was trading at $28.46 - down from its all-time high of $196.65 in November 2021. At first the company’s impressive growth rate supported predictions of a bullish stock growth but it later faced unexpected obstacles. First, the rapid growth of the gaming market cooled down after experiencing highs during the pandemic. The company also got tough competition from other game development engines like Epic Games Unreal Engine.

Advertisers also reduced their marketing budget on Unity and the platform was forced to remove its advertising algorithm altogether after Apple's privacy oriented update allowed users to opt out of data tracking features. As a result of the headwinds the company faced, its revenue rose by only 25% in 2022 as opposed to the company’s guidance of 47%-58% which affected investors confidence and in turn reduced the value of Unity Software share price. Another thing weighing down Unity stock is the company’s increasing operating losses and no profits.

Although Unity still has a significant long-term upside potential and has resolved most of the issues that caused the share price fall in 2022, investors still have their doubts about the profitability of the company especially during a time of economic uncertainty.

Latest Developments Investors should note

Employee Layoffs

From 2022 till date Unity has conducted three rounds of layoffs and dismissed 14% of its staff. In this latest round, Unity announced that it plans to cut 8% of its workforce or about 600 jobs. The video game software developer announced that these layoffs will help the company restructure certain teams and position itself for long-term profitable growth.

Q4 2022 Earnings Call Transcript

The company announced its Q4 2022 earnings which marked its first profitable quarter. Plus for the full year, Unity brought in $1.39 billion in revenue, surpassing its own expectations of $1.385 billion for the year. While this was an impressive achievement for the company, it surprised investors by lowering its guidance for Q1 2023 revenues to between $470 million to $480 million compared to analyst estimates of $524.21 million. For the full year, Unity expects to bring in $2.05 billion to $2.20 billion as revenue compared to analyst estimates of $2.17 billion. Plus, one other thing that investors are keeping in mind is that Unity reported non-GAAP profitability and is not yet profitable according to the generally accepted accounting principles (GAAP).

Key Drivers of Unity’s Stock Price

IronSource Acquisition

2022 was quite a year for Unity Software for a lot of reasons but one line of business posed the most problems for Unity. Under its brand called Unity Grow, the company discovered an issue with its digital ads pinpointer tool and its revenue from game ads took a massive hit. But after merging with IronSource, Unity has gotten a lot of positive attention as customers expect that the merger of the two companies will give developers more tools for developing digital products. The acquisition led analysts to increase Unity Software stock price target to an average of $40 by the end of the year.

Mobile Gaming Industry

The mobile gaming industry isn’t going away and won’t stop growing anytime soon. As the market grows, developers will need more tools to create, operate, and monetize mobile games. For instance, revenues for mobile games is expected to reach $92 billion this year and ad spending alone on mobile games is predicted to reach $110 billion by 2025. So, there is still plenty of room for Unity to grow and compete substantially. The company is also actively taking steps to move away from its operational issues and position itself for the growth of the metaverse and digital modeling.

What does the Future Hold for Unity Software Stock?

Unity Software share price was highly inflated due to the company’s involvement in metaverse. But after the hype died down, its price went down and hasn’t recovered much since. For the long-term Unity might be a buy but its short-term fundamentals are affecting investors confidence in it. Unity software outlook is not very positive as investors do not expect it to maintain 20% growth rate in 2023 but this is subject to the success of its IronSource merger.

Unity Software stock buy or sell signals indicate that the company is a strong buy based on its long-term upside. So, if Unity software is able to sustain rapid long-term growth, Unity Software stock price prediction could fall between $40 to $67.

Risk and Opportunities

Here are some major risks and benefits of buying Unity:

● It has a solid position in the gaming industry: It is one of the first companies to solve issues relating to game development as has its early mover advantage.

● It is growing faster than the gaming market: By expanding its platform to provide services for non-gaming applications such as AR/VR and metaverse, Unity will continue to progress faster than the gaming industry.

● Unity is working to reduce non-GAAP losses: The company’s efforts are paying off as it recorded its first non-GAAP profitable quarter and will continue to improve its margins.

Risks

● Presence of strong competition: Unity Software has to deal with other companies providing sound game engines like Unreal Engine as well as Cocos2d-x. In the VR/AR and Metaverse space, the company also has to deal with well-established competition like Roblox, Meta,Nvidia, andAdobe. These companies are eating away at Unity’s market share by providing tools that can rival it.

● Macroeconomic factors: Economic factors such as the Ukraine war and China’s crackdown on the gaming industry could affect Unity Software.

● Its valuation: Unity is facing post-pandemic slowdown, Apple tightening its privacy policies among other issues, Unity Software share price could crash depending on how its management navigates these issues.

So, is Unity Software a buy or sell? Unity’s strengths justify its position in the market but its short-term risks increase the volatility of the stock making it a very risky short-term buy. But Unity Software share price prediction remains positive because the consensus analysts estimate still expects a 51.20% increase from $28.28 by the end of the year.

Future Outlook and Expansion

Competition is growing but Unity is still the leading game development platform and used to make over 50% of games worldwide. Unity is also solidifying its place as a major player in VR/AR and will benefit greatly from the growth of Metaverse- an industry with an estimated growth rate of 47.6% with a value of $1.5 trillion by 2029.

Unity is also making good profits from its Create Solutions segment as well as its two new segments called Artistry and Digital Twins that will help Unity establish itself more in the gaming industry. In addition, Unity Software is poised to profit from the rise of remote working and has made acquisitions to help with creative work and collaboration easier.

How to Invest in Unity Software Stock

There are three major means of investing in Unity Software stock: long-term hold, options trading, and CFD trading.

Long-term investors typically hold on to the asset for 12 months or more to recover their capital and profit. Unlike CFD and options, long-term hold requires you to purchase the asset and hold it until you are ready to sell. Options is a financial derivative that gives you the chance to trade the underlying asset and you can choose whether or not to exercise the power to buy the asset at the expiration date. CFD trading on the other hand, is another derivative instrument like options but it works a little differently.

When you trade CFDs, you are essentially trading the price difference between the opening and closing price of a stock by making correct predictions of price movement. Although options and CFDs are different forms of investment, they can be used to hedge a portfolio against risk which cannot be done through long-term investing. However, CFD trading has several key advantages over options trading and long-term hold.

CFD is often recommended to beginners because of its simplicity and it is quite easy to access. It is suitable for traders that want to make profit fast and do not want to implement a lot of strategies. On the other hand, options and long-term hold are more suitable for expert and low-risk traders who have the patience to conduct extensive research and effective strategies for investing. Since CFD trading works by predicting price movement, investors can profit from both bull and bear markets as long as they can buy and sell at the right time. Generally high volatility in a market could keep you away from investing long-term but the volatility provides lucrative opportunities with trading CFDs.

Why Trade Unity Software Stock CFD with VSTAR

VSTAR provides a convenient and secure way to trade Unity Software Stock CFD and other major stock CFDs with no fear. You have access to over 1000 markets and can catch trading opportunities and benefit from the potential price movements using its user-friendly trading platform and tools.

Trade Unity stock CFDs with zero commission and deep liquidity using VSTAR. Sign up and start trading today!

Conclusion

Unity Software has established a name for itself in the tech industry and gaming market by providing certain tools and technology that makes it easier for game developers and other creators to create 2D/3D applications. But the company is battling to stay profitable after its stock lost nearly 80% in value and its expensive valuation worked against it in a bear market scenario.

However, Wall Street investors are still confident in the management, direction and services of the company as it is benefiting from industries beyond gaming with 2.8 billion active users. Unity still has an important role to play in the tech industry but before investing in the stock, make sure to do extensive research of your own and ensure that it suits your investing style and investment horizon.