Who is Warren Buffett

Warren Buffett, often called the "Oracle of Omaha," is a legendary investor known for his successful financial ventures. As the Co-founder, Chairman, and CEO of Berkshire Hathaway, Buffett is respected for making wise investment decisions that have stood the test of time. Buffett's journey as a successful investor began in the mid-20th century. Born in 1930, he had an early interest in finance and investing, refining his skills under Benjamin Graham, a well-known value investor. Over time, Buffett developed a unique investment philosophy, focusing on long-term value, economic moats, and a deep understanding of businesses.

Image: Gettyimages

Berkshire Hathaway, led by Buffett, has become a major player in the investment world. The conglomerate's portfolio includes a variety of companies in insurance, energy, consumer goods, and technology. Key holdings such as Apple, Coca-Cola, and Bank of America highlight Buffett's belief in companies with enduring competitive advantages and solid growth potential.

When examining Berkshire Hathaway's holdings, you can observe how Buffett strategically diversifies, concentrating on companies with a strong market presence and potential for sustained growth. Now, explore specific stocks within Berkshire Hathaway's portfolio and uncover the reasoning behind Buffett's choices.

In recent years, Buffett has preferred businesses with consistent earnings, strong management, and competitive edges. This emphasis aligns with his commitment to long-term investments that withstand market fluctuations.

Understanding Warren Buffett's investment strategy provides valuable insights for both experienced and novice investors. His approach, characterized by patience, a long-term perspective, and a deep understanding of businesses, has positioned Berkshire Hathaway as a prominent player in the financial world.

What is Berkshire Hathaway

Image: Gettyimages

Berkshire Hathaway is more than just a company; it symbolizes lasting success and outstanding leadership. Leading this conglomerate are two remarkable individuals who have significantly influenced its path - Warren Buffett and Charlie Munger.

The success of Berkshire Hathaway is largely due to the leadership ideologies of Charlie Munger and Warren Buffett, not only to the company's wide range of assets. Because of their cooperative and morally grounded methods, Berkshire Hathaway has become a representation of long-term success in the dynamic world of finance.

Established in 1839 as a textile manufacturing company, Berkshire Hathaway went through a remarkable transformation guided by the visionary leadership of Warren Buffett. Today, it is a multinational conglomerate with a diverse portfolio covering insurance, energy, manufacturing, and consumer brands. The company's triumph is attributed to its diverse holdings and the strategic decisions made by its leadership.

Leadership under Warren Buffett and Charlie Munger

Image: Gettyimages

Berkshire Hathaway's success is greatly influenced by its collaborative leadership style, emphasizing synergy and complementarity. Warren Buffett, the prominent figurehead of Berkshire Hathaway, is widely recognized for his value investing philosophy and disciplined strategies. Buffett's long-time partner and Vice Chairman, Charlie Munger, added a distinct yet complementary perspective. The effective collaboration between these two leaders stands as a driving force behind the lasting success of Berkshire Hathaway.

Buffett and Munger's leadership foundation is long-term investing devotion, patience, and an emphasis on intrinsic value. This strategy has helped Berkshire Hathaway develop a culture that prioritizes careful decision-making above chasing after rapid, temporary profits.

Charlie Munger, vice chairman of Berkshire Hathaway and a longstanding business partner of Warren Buffett, died on November 28, 2023, at the age of 99. Berkshire's success was profoundly impacted by Munger's investment acumen and his collaboration with Warren Buffett; therefore, making this a momentous occasion for the company.

Holdings In Insurance, Railroads, Utilities, Manufacturing, Services, And Other Industries

When you think of Berkshire Hathaway, you see a massive financial company with a diversified holdings portfolio that includes manufacturing, utilities, railroads, insurance, and services, among other industries. The multinational corporation, led by the smart Warren Buffett, has a portfolio demonstrating its dedication to stability and long-term value through a strategic mix of companies.

Berkshire Hathaway's Holdings Across Industries

The size of its portfolio demonstrates Berkshire Hathaway's wide-ranging investing approach. To maintain a strong and well-rounded portfolio, the corporation systematically navigates a variety of industries, ranging from manufacturing to insurance to utility firms and beyond. This diversity provides stability and protection from risk in a volatile market.

Holdings from Berkshire Hathaway are an example of a well-balanced investment strategy, distributing wealth across several industries for long-term prosperity. Let's examine a few major sectors comprising Berkshire Hathaway's extensive range of businesses.

Insurance

The company's cash flow is bolstered by Berkshire Hathaway's substantial insurance industry interests, which include Geico and Berkshire Hathaway Reinsurance Group. As the company's main source of steady income and stability, the insurance division supports the whole.

Railroads

One example of Berkshire Hathaway's strategic investment in vital infrastructure is the company's ownership of BNSF Railway, one of North America's biggest freight train networks. This venture is the cornerstone of the conglomerate's diversified interests since railroads are essential to the movement of products throughout the continent. These holdings offer steady returns in addition to supporting the economy's core.

Manufacturing and Services

Precision Castparts and Berkshire Hathaway HomeServices, two of the company's manufacturing assets, are prime examples of its dedication to creating value in a variety of industries. These businesses support the overall adaptability and durability of the company.

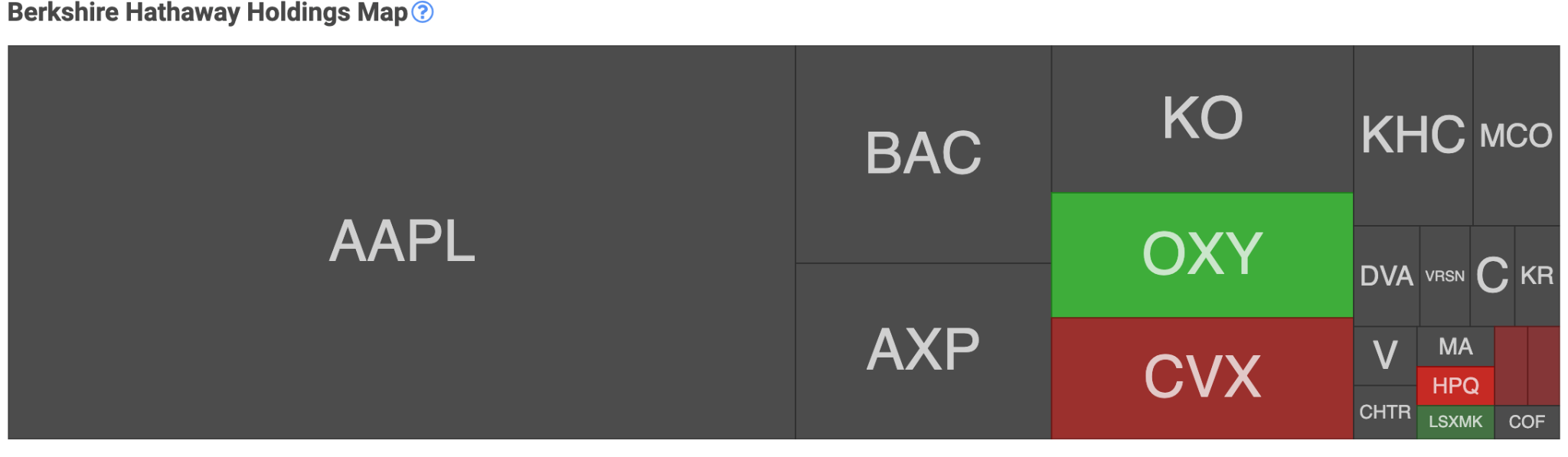

Top 7 Berkshire Hathaway Holdings

Apple Inc. (AAPL)

Berkshire Hathaway's significant investment in Apple, the tech giant, indicates Buffett's flexibility and understanding of the business's long-term worth in the ever-changing technology sector.

Based on a report, 50% of Berkshire's portfolio is on Apple Stock (AAPL), which indicates a strong bullish factor for this stock.

Bank of America (BAC)

- Market cap: $259.57 billion

- Dividend yield: 2.93%

- Price to earnings ratio: 10.79

- Basic EPS: $3.09

A major participant in the financial industry, Buffett's belief in the stability and long-term potential of well-established financial institutions is supported by Berkshire's stake in Bank of America.

American Express (AXP)

- Market cap: $132.66 billion

- Dividend yield: 1.32%

- Price to earnings ratio: 17.35

- Basic EPS: $3.09

Berkshire Hathaway's dedication to American Express highlights the company's faith in the financial services industry and the tenacity of the American Express brand.

The Coca-Cola Company (KO)

- Market cap: $261.09 billion

- Dividend yield: 3.05%

- Price to earnings ratio: 24.11

- Basic EPS: $2.49

Coca-Cola has long been a holding, demonstrating Buffett's preference for companies with enduring popular appeal and showing the value of traditional consumer items.

Chevron Corporation (CVX)

- Market cap: $277.16 billion

- Dividend yield: 4.10%

- Price to earnings ratio: 10.80

- Basic EPS: $13.51

Berkshire's strategic entry into the energy industry with its acquisition of Chevron is consistent with Buffett's idea of a diversified portfolio that includes exposure to key sectors.

Occidental Petroleum Corporation (OXY)

- Market cap: $50.95 billion

- Dividend yield: 1.24%

- Price to earnings ratio: 12.52

- Basic EPS: $4.96

Occidental Petroleum Corporation (OXY): Buffett's ability to recognize future possibilities in constantly shifting business sectors is proven through Berkshire Hathaway's investment in Occidental Petroleum, which represents an advantageous move into the oil and gas industry.

Kraft Heinz Company (KHC)

- Market cap: $46.21 billion

- Dividend yield: 4.25%

- Price to earnings ratio: 15.52

- Basic EPS: $2.44

The Kraft Heinz Company (KHC) is a manufacturer of consumer goods, and Berkshire's stake in the company reflects its commitment to a comprehensive and strong portfolio.

Berkshire Hathaway Market Cap And Financial Performance

In January 2024, Berkshire Hathaway's value stood at a whopping $798.04 billion, securing its place as the 8th most valuable company worldwide. On January 9th, 2024, both Yahoo Finance and CompaniesMarketCap reported a market cap of $798.41 billion for Berkshire Hathaway.

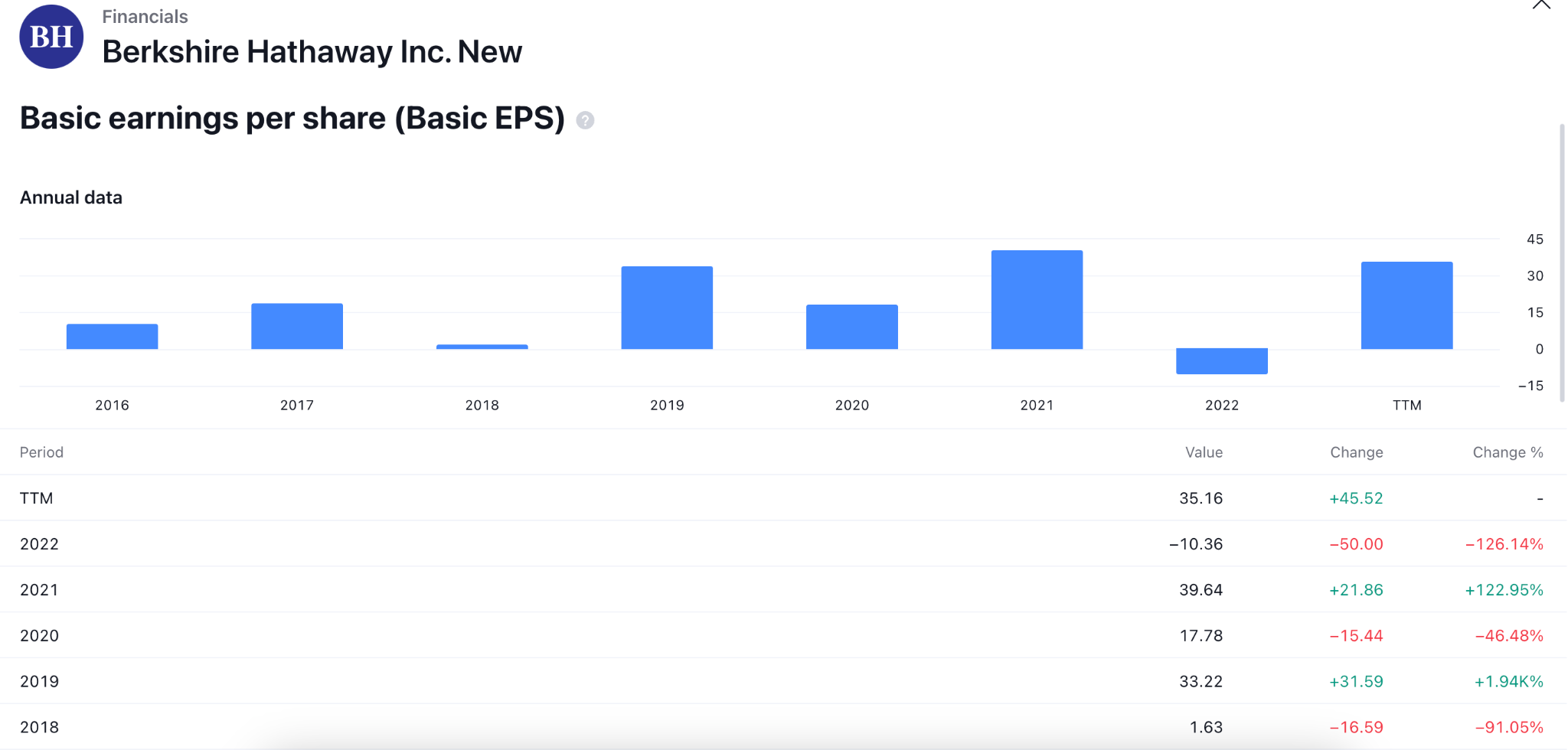

Looking at the earnings per share of the company, the recent reading suggests a higher instability. Therefore, for investors who agree to receive a stable dividend, this stock might not be a good option.

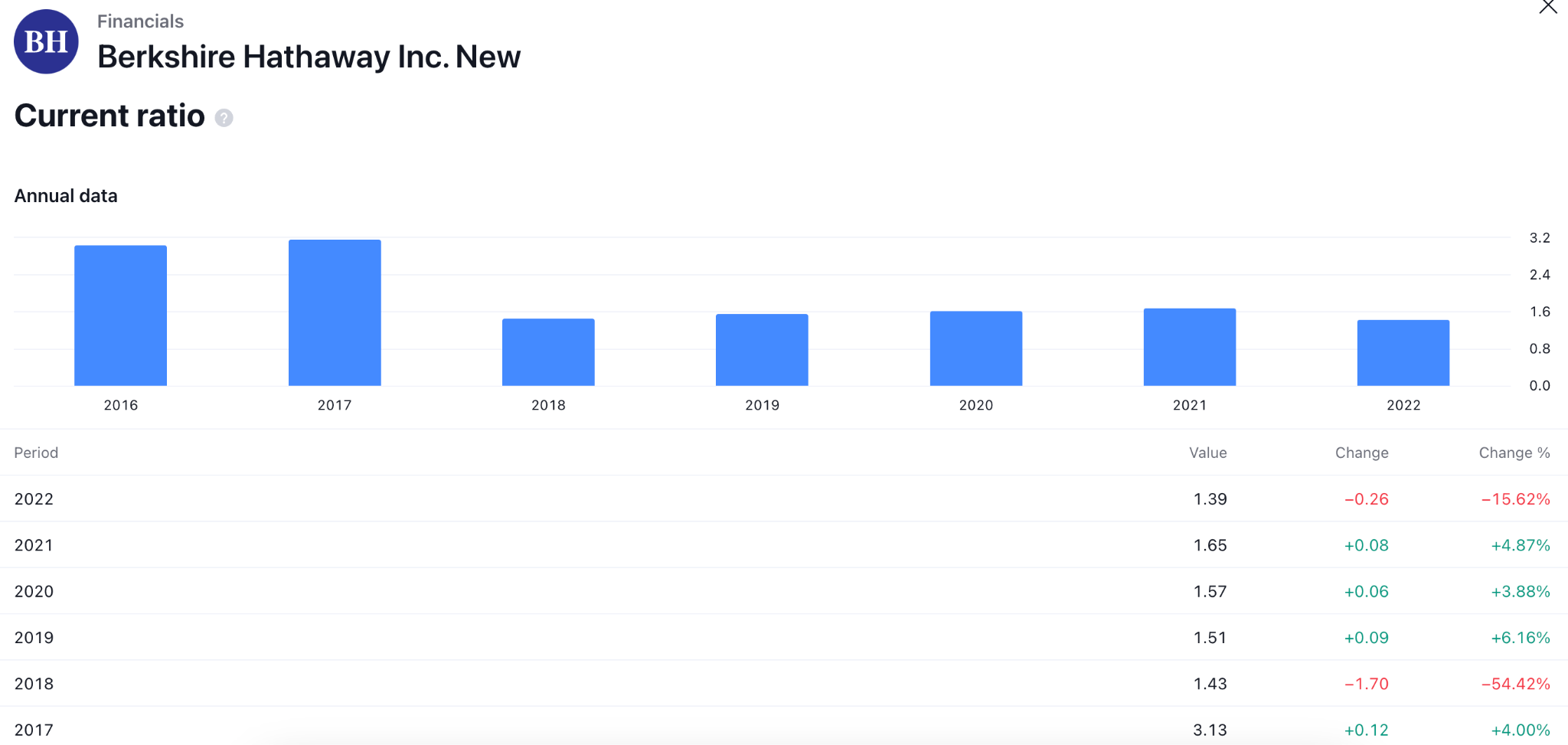

In the liquidity structure, the company looks stable as the recent reading remains above the 1.00 satisfactory level.

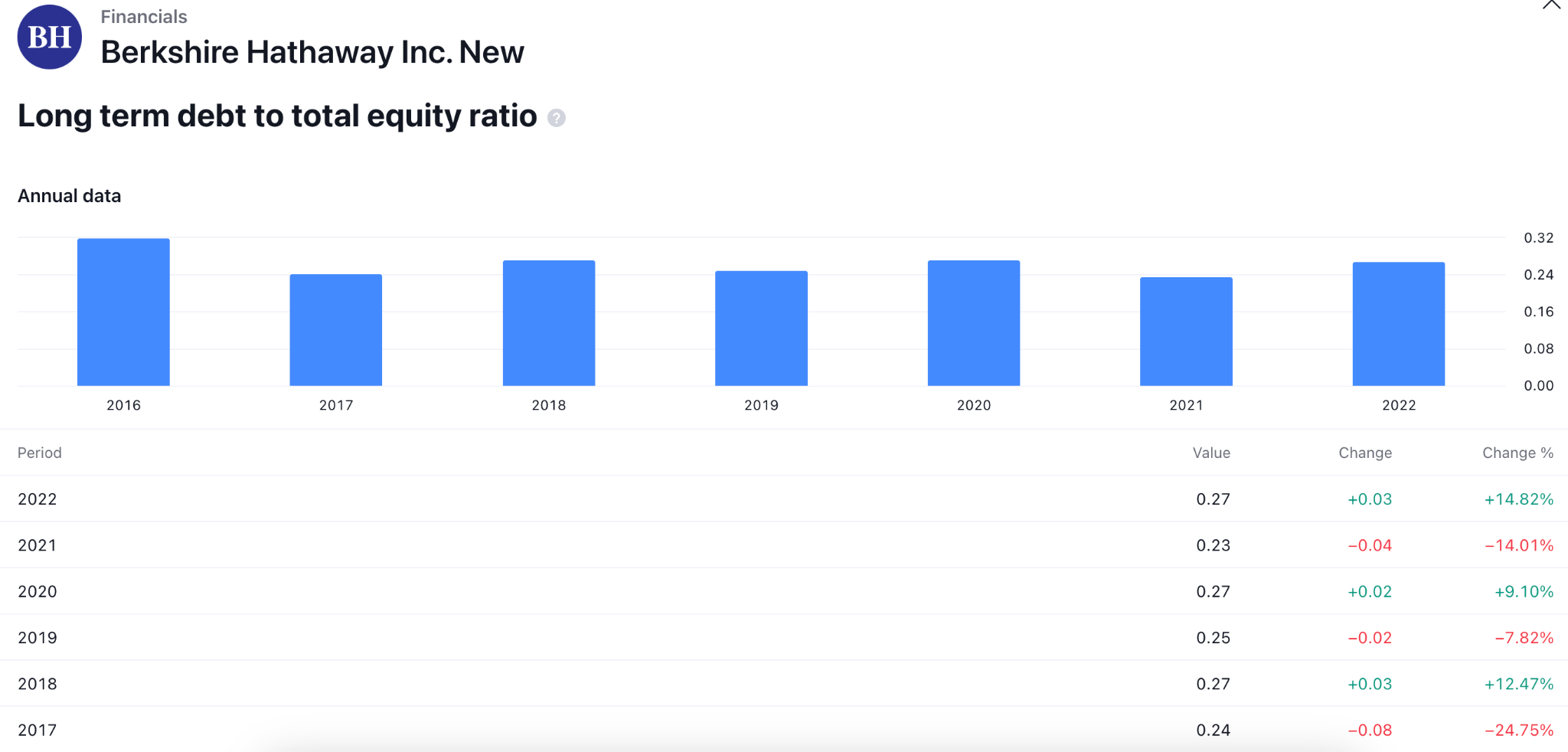

The long-term debt-to-equity ratio suggests a stable equity position with no significant fluctuations over the last 5 years:

Warren Buffett recently bestowed charitable intent on $866 million worth of Berkshire Hathaway stock. However, he reassured the public that this act in no way signifies a reevaluation of his dedication to the organization. This fulfills his prior commitment to philanthropy by donating 99 percent of his wealth during his lifetime.

A substantial insurance corporation, Alleghany Corporation, was recently acquired by Berkshire Hathaway for $11.6 billion. The incorporation of this acquisition into Berkshire's substantial insurance portfolio is anticipated to stimulate the company's expansion.

Berkshire Hathaway has been proactively allocating its substantial cash reserves through substantial investments in notable corporations such as Occidental Petroleum and HP Inc. However, it has recently divested a portion of its holdings, including HP Inc.

Despite the prevailing market volatility, the company's stock price has shown a sustained level of stability in 2023.

Berkshire Hathaway Stock Performance

Image: TradingView

Berkshire Hathaway Inc. (NYSE: BRK-B) concluded trading within a long-term bullish trend, as shown in the monthly time frame. The one-month return for Berkshire Hathaway Inc. (NYSE: BRK-B) stood at 3.00%, and its shares appreciated by 14.12% over the past 52 weeks.

Let's see the key performance of this stock in recent years:

- 2020: Berkshire Hathaway Stock (NYSE: BRK-B) formed a deeper discount of 30% but closed the year with a gain of less than 1%.

- 2021: A clear bull market since the beginning and closed the year with a 27% gain.

- 2022: Bulls continued pushing the price higher and peaked by 20% before closing the year with a 3.5% gain.

- 2023: After a deeper discount in 2022, the buying pressure continued and closed 2023 with a 12.27% gain.

Warren Buffett's Stock Investment Strategy

Image: Gettyimages

Warren Buffett's method of choosing stocks is a shining example of diligent, long-term value investing. By emphasizing intrinsic value, seeking out companies with market advantages, maintaining financial stability, and maintaining a margin of safety, Buffett has shown investors how to successfully navigate the complex dynamics of the stock market.

A. Core Principles of Value Investing

The foundation of Warren Buffett's investment theory is the idea of intrinsic value, or a company's actual value, as determined by its profitability, growth potential, and fundamentals. A more consistent and trustworthy indicator of a company's value is its intrinsic value, whereas market sentiment is prone to swings and unpredictability. By concentrating on intrinsic value, you may make well-informed financial selections that endure market changes.

The famous statement from Buffett is, "Our favorite holding period is forever." This shows his dedication to a long-term approach. Buffett advises investors to take a patient mindset and let their assets expand gradually, avoiding being controlled by temporary market noise. This approach supports the theory that high-quality businesses will increase in value over time.

Moreover, Buffett considers volatility as an opportunity rather than a threat, which is opposed to market panic. Good stocks frequently go on sale during market downturns, providing an opportunity to buy shares at a discount. Taking advantage of market swings, Buffett's technique acknowledges that a company's short-term losses are often not related to a drop in its long-term prospects.

B. Seek Companies with Competitive Advantages

Buffett looks for companies with strong economic moats or long-term competitive advantages. By protecting companies from rivalry, these moats ensure stability over time. Finding undervalued companies with strong moats puts them in a profitable long-term position.

C. Financial Strength and Stability

Companies that continuously generate high returns on invested capital are considered highly valuable by Buffett. This implies skillful and effective management, which is vital for long-term financial success.

Also, corporations with healthy free cash flow are less vulnerable to economic downturns and can put resources toward future expansion. Companies that produce significant free cash flow, which functions as a safety net in hard times, receive attention from Buffett.

D. Margin of Safety in Valuations

The idea of a margin of safety is at the heart of Warren Buffett's risk management approach. Hedging against unpredictable market volatility involves buying a stock at a price that is far lower than its actual worth.

Buying companies at a substantial discount to their inherent value is the rule of Buffett's methodical investing strategy. Investors are provided with a margin of safety and are protected from any market shrinks by this careful approach.

Buffett's technique is foreseeing potential risks and taking steps to mitigate them. Investors may improve the security of their portfolios and make smarter decisions by considering worst-case scenarios and negative risks.

It takes dedication and risk-taking to execute a margin of safety plan successfully. Buffett thinks that a stock's fundamental worth will far surpass its temporary undervaluation by the market. By exercising patience, investors may weather short-term market volatility and reap the rewards of excellent investments' long-term gains.

Warren Buffett Stocks: The Berkshire Hathaway Portfolio

Apple (AAPL)

Because of Apple's strong client base and excellent system, Warren Buffett consistently invests in the company. Berkshire Hathaway continues to purchase Apple, confirming Buffett's faith in the company's long-term success. Because he has faith in Apple's future, he has expanded his stake over time.

With 915,560,382 shares, Apple Inc. (AAPL) owns a sizable 5.9% stake in Berkshire Hathaway. At $184.78 per share, Apple's market worth is $169.18 billion. With 47.1% of Berkshire's whole portfolio made up of this, it shows a significant commitment.

In other words, Buffett's whole investing strategy is greatly impacted by his $169 billion stake (about 5.9% of Apple) in the firm. This reveals Buffett's confidence in Apple's influence on his investing decisions.

Coca-Cola (KO)

Due to his faith in the beverage sector, Warren Buffett, who is famous for making long-term commitments to companies he understands well, has an intense fondness for Coca-Cola. Buffett has shown his faith in Coca-Cola by including it consistently in his investing portfolio for a long period of time.

Currently, Berkshire Hathaway owns 400 million Coca-Cola (KO) shares or 9.3% of the business. With a price per share of $59.79, Berkshire's Coca-Cola assets are valued at $23.92 billion. 6.7% of Berkshire's total portfolio is made up of this investment, indicating a sizable amount that is allocated to Coca-Cola. Put more simply, Buffett's roughly $24 billion, 9.3% stake in Coca-Cola shows how confident he is in the beverage giant as part of his investing plan.

BYD

The 2008 investment made by Berkshire Hathaway, under the leadership of Warren Buffett, in the Chinese electric vehicle (EV) manufacturer BYD demonstrated Buffett's vision for the future of transportation. Berkshire has continued to work with BYD for more than ten years, proving Buffett's dedication to his progressive approach. Despite the recent decrease in holdings, this might result from regular portfolio modifications or purposeful shifts.

Berkshire owns 87.6 million BYD shares, or 8.0% of the business. With a share price of $26.96, Berkshire's BYD assets are valued at $2.36 billion, or 0.7% of the portfolio overall.

Mastercard (MA) & Visa (V)

Warren Buffett is fond of businesses that function similarly to toll booths, collecting a fee for each transaction, particularly in the expanding payment sector. Buffett's faith in Mastercard and Visa's business models is seen in their consistency. There haven't been any significant adjustments, indicating Buffett's confidence in the payment industry's future expansion.

However, 3.99 million shares, or 0.4% of Berkshire Hathaway's portfolio, are owned by Mastercard (MA). At $428.04 per share, Mastercard represents a $1.71 billion stake or 0.5% of the portfolio's total value. Comparably, Berkshire owns 8.30 million shares of Visa (V), or 0.4% of the company, at a price of $263.60 a share. With a $2.19 billion total worth, it makes up 0.6% of the portfolio.

Amazon (AMZN)

Because online shopping is becoming increasingly popular, Berkshire Hathaway is becoming more interested in Amazon. The fact that this acquisition is relatively new indicates that Buffett is adjusting to market developments. With 10 million shares, Amazon's holdings have increased significantly, indicating a high level of trust in the company's long-term performance.

Currently, 10 million shares, or 0.1% of Amazon (AMZN), are owned by Berkshire. At $155.10 a share, each Amazon share represents a $1.55 billion stake and adds 0.4% to the portfolio as a whole. This action displays Buffett's belief in Amazon's potential and fits with the trend of customer behavior shifting to a greater dependence on e-commerce.

Snowflake (SNOW)

Snowflake Inc. and Berkshire Hathaway's recent moves into the cloud computing space prove Buffett's ability to adjust to shifting market conditions. This new addition displays Berkshire's interest in modern technology. The initial investment of 6.13 million shares in Snowflake confirms cautious steps to entering the cloud software market.

Currently, 6.13 million shares, or 1.9% of Snowflake (SNOW), are held by Berkshire in its portfolio. At $198.9 a share, each Snowflake share represents a $1.22 billion position or 0.3% of the portfolio's total worth. This action highlights Berkshire's measured but remarkable entry into the cloud software space, in line with the business's plan to adjust to shifting market conditions and accept new technology.

What to Learn from Warren Buffett Portfolio

Warren Buffett's financial portfolio includes a wealth of knowledge and insightful strategic findings, not merely a collection of stocks. Understanding and using the concepts that influence Buffett's portfolio as you start your investing journey may significantly enhance how you deal with the constantly shifting area of finance.

We'll analyze four important takeaways from Warren Buffett's portfolio, which can help you improve and reshape your investing technique.

A. Focus On Market Leaders With Structural Competitive Advantages

The strength of investing in market leaders with underlying competitive benefits can be seen by Warren Buffett's portfolio. Market leaders tend to be companies that command a large market share and have overpowering positions in their respective sectors. Buffett seeks companies with economic moats - a defensive barrier against aggressive competition or long-term competitive advantages. These benefits could come from dominant brands, cost advantages, network effects, or legal restrictions.

However, investing in companies with these advantages provides some protection from market volatility. These companies can withstand economic performance downturns, manage changes in their sector, and continue to be profitable in the long run. You may put yourself in a position to make investments that will last over time by taking Buffett's advice and looking for companies with long-lasting competitive advantages.

B. Be Greedy When Others Are Fearful, And Prices Dislocate

Let's move on to the second lesson, which is the relevance of becoming greedy when others lack confidence and prices fluctuate. The saying, "Be greedy when others are fearful," popularized by Warren Buffett, perfectly expresses the ideals of contrarian investment. Stock prices could shift from their inherent values during periods of volatility in the market or when fear is widespread. Buffett considers such situations as chances to profit from failures in the market. He maintains patience and frequently takes advantage of opportunities to purchase high-quality businesses at a discount when others panic and sell.

This idea takes a change of a larger context. During market downturns, instead of falling into fear and discouragement, consider them as potential purchasing opportunities. Using this strategy takes self-control, a risk-taking mindset, and the capacity to separate oneself from short-term market noise. By adopting Buffett's approach, you put yourself in a position to take advantage of the instability of the market and maybe accumulate investments at better prices.

C. Take A Long-Term View And Allow Companies' Value To Compound

The third lesson emphasizes the benefit of having a long-term perspective and letting a company's worth grow. The concept that wealth increases exponentially over time, or growth, is at the core of Warren Buffett's investment philosophy. Buffett's investment portfolio is defined by its extended investment perspective, which permits compounding to do its magic. This implies hanging onto reliable investments over years and decades of market volatility and letting their value grow.

Over time, the compounding effect may transform even little investments into significant riches. Buffett's success has been based on his ability to patiently hang onto reputable companies that continually increase in value rather than trading often or seeking short-term gains. With your investment approach, you could replicate Buffett's long-term success by taking this patient, long-term view.

D. Stay Within Your Circle Of Competence And Know The Businesses

Let's now discuss the importance of knowing the companies you invest in and sticking within your expertise, which brings us to our final lesson. The famous advice given by Warren Buffett to investors is to "stay within your circle of competence." This means focusing on markets and companies that you know of. The concept appears in Buffett's portfolio, where he often invests in companies whose operations and economics he can understand with a high degree of confidence.

This idea underlines how important it is to conduct in-depth research and understand the fundamental strengths of the companies you invest in. You may lower your risk of making impulsive or speculative investments by sticking within your competency area and using your knowledge and experience to guide your selections. Buffett's success can be partly related to his ability to focus on areas he knows well.

Trade Warren Buffett Stocks or Berkshire Hathaway Stock CFD with VSTAR

Are you attracted by Warren Buffett's financial sense and wish to match the Oracle of Omaha's tactics with your portfolio? With VSTAR, trading Warren Buffett stocks and Berkshire Hathaway stock contracts for difference (CFD) is now simple.

Trading CFDs on Warren Buffett stocks or Berkshire Hathaway stock with VSTAR gives you a special chance to match your investing technique with one of the greatest investors ever. Let's explore how VSTAR might be your entry point for utilizing Warren Buffett's investing knowledge in your financial endeavors.

- Access to Warren Buffett Stock Portfolio: VSTAR allows you to trade CFDs on stocks held by Warren Buffett and inside Berkshire Hathaway's extensive portfolio. This implies that you may replicate Buffett's investment strategies to profit from the success of these popular stocks.

- Real-Time Trading: By allowing you to execute transactions instantly, VSTAR allows you to take advantage of market shifts as they occur. This is consistent with Buffett's approach of capturing opportunities and displaying flexibility in market conditions.

- Diversification: You may build a balanced portfolio by trading several Warren Buffett companies inside Berkshire Hathaway's broad assets. Buffett's approach depends extensively on diversification, which VSTAR helps with by offering a variety of CFDs on different companies.

Getting Started with Trading with VSTAR

- Sign up: You may open a trading account and register with VSTAR right now. The procedure is simple and fast and guarantees that you may start trading right away.

- Examine Buffett's Holdings: Browse the CFDs offering Warren Buffett stocks after logging in from among the many well-known businesses in Berkshire Hathaway's portfolio of your choice.

- Make Appropriate Selections: Use the easy-to-use interface of VSTAR to access charts, analytical tools, and real-time market data. This gives you the ability to make wise judgments that are consistent with Warren Buffett's core concept.

- Trade with Confidence: You may execute trades confidently since VSTAR provides a trustworthy and safe trading environment. VSTAR's platform supports investors of various experience levels, from beginners to seasoned professionals.

Conclusion

Analyzing the stocks owned by Warren Buffett's Berkshire Hathaway provides a tactical window into the financial expertise of the Omaha billionaire. You'll learn to stay within your area of expertise, take a long-term view, be opportunistic during market disruptions, and focus on industry leaders. Utilize ideas from Buffett to speed up your investment path.

Think about the skill of selecting quality over quantity, the enormous power of patience, and the compounding effect. By coordinating your approach with Buffett's timeless ideas, you may begin your road toward financial success step-by-step and create wealth.