Trading USDNOK CFD with $50

Key Data

Previous Close

10.41354

Open

10.41414

Day’s Range

10.29652-10.45521

Contracts specifications

Contract Size

100000

Leverage

50x- 200x

Minimum Volume per Trade

100

Trading Hours

OFF

Company Profile

The USD/NOK currency pair represents the exchange rate between the United States Dollar (USD) and the Norwegian Krone (NOK). This pair is influenced by a variety of economic, political, and market factors. Here you will find a detailed introduction to the USD/NOK cross:

USD/NOK currency comparison:

1. Currency codes:

- USD (United States Dollar): The official currency of the United States and its territories.

- NOK (Norwegian Krone): The official currency of Norway.

2. Exchange Rate:

- The USD/NOK exchange rate indicates the amount of Norwegian Kroner required to purchase one United States Dollar. For example, if the exchange rate is 8.50, it means that 1 USD is equivalent to 8.50 NOK.

3. Economic fundamentals:

- Interest Rates: Interest rate differentials between the United States and Norway affect the USD/NOK exchange rate. Changes in the monetary policies of the Federal Reserve (Fed) and Norges Bank (the central bank of Norway) can influence the attractiveness.

- Economic indicators: GDP growth, inflation rates and employment data in both the United States and Norway play a crucial role. The economic performance of one region relative to the other can influence the direction of the USD/NOK pair.

4. Market Dynamics:

- Liquidity: The USD/NOK cross is generally well liquid, which allows for efficient execution of trades.

- Volatility: The USD/NOK may fluctuate, especially during times of economic releases, geopolitical events or changes in market sentiment.

5. Technical Analysis:

- Trend analysis: Traders use technical indicators, chart patterns and trendlines to identify trends in the USD/NOK pair.

- Support and Resistance Levels: Key price levels where the currency pair tends to stop and reverse are closely monitored for potential trading signals.

6. Other considerations:

- Oil Prices: Norway is a major exporter of oil. Changes in the price of oil can affect the Norwegian economy and consequently the NOK. As a result, the USD/NOK can be affected by movements in the oil markets.

- Global risk sentiment: Changes in global risk sentiment can affect the USD/NOK, as both currencies may react to changes in investor risk appetite.

7. Economic Diversification:

- Norway's economy is diversified: In addition to oil, Norway has a well-diversified economy. Developments in sectors such as shipping, fishing, and technology can also influence the USD/NOK cross.

In summary, the USD/NOK currency pair is influenced by a combination of economic fundamentals, interest rate differentials, market dynamics and factors specific to Norway's economic structure. Traders and investors use a variety of tools, including fundamental and technical analysis, to navigate the unique characteristics of this currency pair in the dynamic forex market.

Explore More Market Insights

USDJPY Keeps Pushing Higher: How Long It Can Go?After a brief downturn, the USDJPY pair rebounded, potentially putting to the test the foreign exchange intervention threats from the Ministry of Finance (MoF) and Bank of Japan (BoJ), in addition to the 155 resistance level.Read article

USDJPY Keeps Pushing Higher: How Long It Can Go?After a brief downturn, the USDJPY pair rebounded, potentially putting to the test the foreign exchange intervention threats from the Ministry of Finance (MoF) and Bank of Japan (BoJ), in addition to the 155 resistance level.Read article GBPUSD Looks Vulnerable Above The 1.2517 Key Support LevelGBPUSD bulls continue to be under pressure near the 1.2517 support level, suggesting a possible bearish breakout. Read article

GBPUSD Looks Vulnerable Above The 1.2517 Key Support LevelGBPUSD bulls continue to be under pressure near the 1.2517 support level, suggesting a possible bearish breakout. Read article USDJPY Reached The 12 Years High: Is This A Time For A Rebound?The yen reached its lowest level since 1990 on Wednesday, prior to exhibiting a modest recovery following a meeting of Japan's highest-ranking monetary officials to discuss the currency's sharp depreciation and signal their preparedness for intervention.Read article

USDJPY Reached The 12 Years High: Is This A Time For A Rebound?The yen reached its lowest level since 1990 on Wednesday, prior to exhibiting a modest recovery following a meeting of Japan's highest-ranking monetary officials to discuss the currency's sharp depreciation and signal their preparedness for intervention.Read article EURUSD Could Find Support From The Stronger US Dollar Index (DXY)The European Central Bank (ECB) established the conditions for a possible rate cut in June. On the other hand, the strong US Dollar Index (DXY) could work as a bearish factor in this instrument.Read article

EURUSD Could Find Support From The Stronger US Dollar Index (DXY)The European Central Bank (ECB) established the conditions for a possible rate cut in June. On the other hand, the strong US Dollar Index (DXY) could work as a bearish factor in this instrument.Read articleTrading Signals

is Pivot(10.4771)

Trade Strategythe downside prevails as long as 10.4771 is resistance

Alternative Strategyabove 10.4771, look for 10.5815 and 10.6437.

Commentsthe RSI is below its neutrality area at 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the price stands below its 20 and 50 period moving average (respectively at 10.4123 and 10.4224).

supports and Resistances

10.2436

10.1817

10.1197

10.3858 (Last)

10.4771

10.5815

10.6437

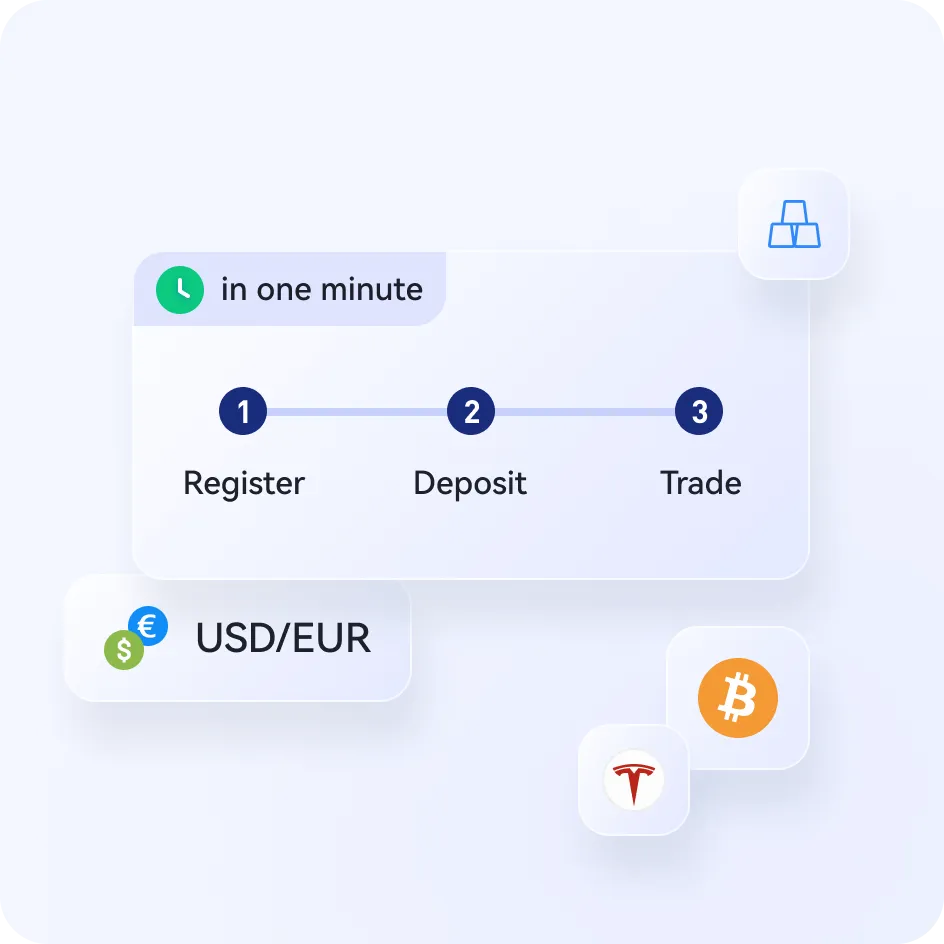

Trade USDNOK CFDs with VSTAR

- Ultra-low trading cost with tight spreads and 0 commission

- Top-tier deep liquidity to ensure extremely low slippage.

- Lighting-fast order execution within milliseconds

- Fully regulated with several licenses, trusted across 100+ national borders.