The basics of Forex Trading are simple - speculate on the exchange rate movement as correctly as possible. Then, exit trades at reasonable levels where you expect a trend reversal.

However, you may not always be successful due to different unfortunate mistakes.

Several Forex trading statistics claim that only 10-30% of traders are profitable. That means out of 10 traders, only one to three avoid multiple losses that blow their accounts.

Regardless of that fact's proof, it still seems challenging for new traders to be among the winning crowd.

Hence, continue reading this article to learn six of the most common errors Forex traders make and how it affects their goals. It also discusses ways to avoid them to help you become a profitable trader.

Incorrect Risk Management

Risk management is arguably the most critical aspect of Forex trading. Thus, it's rather unfortunate that many traders don't give it enough attention.

Without managing losses, trading is almost like gambling. You may "hit the jackpot" occasionally, but it can only take one losing trade to wipe out your account.

Risk management helps you control potential losses in a way that still ensures you remain profitable long-term.

You won't need to be the most skilled price movement analyst with the proper risk management strategies. Conversely, even the best price movement experts may never be profitable without them.

Common Risk Management Mistakes

Professionals consider Forex traders "risk managers" because that's all it takes to make steady profits.

It's almost impossible to prevent losing trades. However, by avoiding these risk management mistakes, you can control them in a way that guarantees profits in the long run:

Trading Without a Stop-Loss

Many traders, both experienced and beginners, trade without stop losses for these reasons:

● Fear of stop-outs

● Overconfidence

● The desire for more profits

● Lack of understanding

However, this is a very wrong approach to proper risk management for whatever reason.

You're opening your account to the highest possible risk when you don't set a stop-loss because the price can continue moving against you until the account balance hits zero.

Besides, just setting a stop loss isn't enough.

You must monitor the trade and keep adjusting the order to secure profits if the price moves in your direction. A trailing stop can be a helpful alternative.

Give room for price fluctuations but try to maximize your gains.

Failure To Understand Risk/Reward Ratios

The risk-reward ratio is an essential part of risk management.

It is the amount you're willing to lose for the amount you could gain in every trade.

For example, if you have a risk-reward ratio of 1:3, you're essentially saying it's okay to lose $10 when you could've gained $30 on a trade. In other words, you are looking for trading opportunities that could pay you $300 by only risking $100.

Based on this ratio, you can set a stop-loss and take-profit order at the respective levels on every trade.

In a real case scenario, assume you had the 1:3 risk-reward ratio on ten trades. You can lose 7 of them, win only 3, and still make a $200 net profit.

Setting The Wrong Position Size

Although your broker's maximum leverage will magnify your potential gains (and losses), you must learn how to set the correct position size on every trade.

Position size is the amount of FX pair units you invest in. You specify it as the number of "lots" on your trading platform.

To find the best position size per trade, divide your account risk by the trade size.

After estimating your ideal size per trade, divide it by the standard lot size (100,000 units) to know how to open new orders.

For example, if your position size is 10,000 units of EURUSD, you shouldn't take any trade beyond 0.1 lots on the currency pair.

Overtrading

Overtrading is another common Forex trading mistake that involves engaging in the market for too long.

It is typical among new traders for the following reasons:

● A desire for more profits, especially when you've had a series of winning trades

● Addiction to the markets due to excitement from regularly taking new trades

● Lack of patience and self-control

Overtrading always has negative consequences in the long run. If you're not careful, it won't only affect your trades but also your trading psychology.

You don't need to always be active in the market to be successful. Understand the most favorable, high-odds periods and capitalize on your risk management strategies instead.

Common Ways of Overtrading In Forex

Sadly, overtrading is one of those conditions that worsen over time. Traders will constantly desire to partake in every price rise or fall, even at high risk.

Therefore, try to discover any of the following in how you trade to solve it:

Multiple Trades At Once

Opening too many orders exposes you to more risk because it demands more attention to manage each one effectively. It is even worse when they are of different currency pairs requiring you to follow multiple charts.

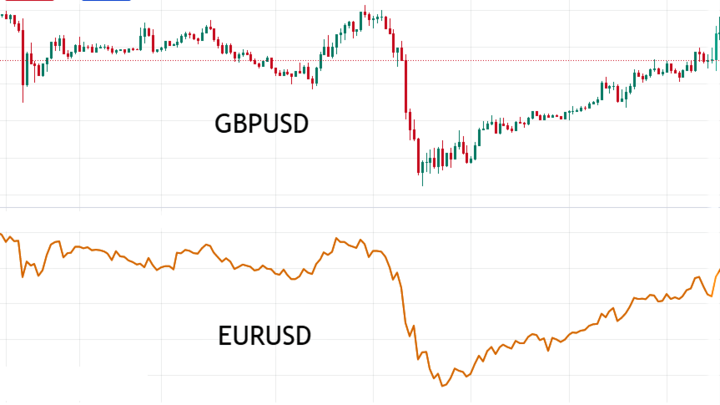

Instead, you can focus on currency pairs that generally move in the same direction and place the trades in one of them. The GBPUSD and EURUSD are examples of such.

If you expect an uptrend in both and prefer to open two buy orders, you can do that in one chart instead of both.

Another way to prevent multiple trades is by adding the position sizes together.

For example, instead of having five 0.1 lot trades on GBPUSD, you can open one 0.5 lot trade at the same reward-to-risk ratio.

Absence of a Solid Trading Strategy

A sound trading strategy already has rules that prevent overtrading. Hence, you're not following your trading plan if you still make this mistake.

Your trading strategy aligns with the goals you laid down before you began trading. Such objectives may be to make over 50% profit by the year's end.

Hence, you'd only need to make 1% of your account size daily.

With this mindset, you can't and don't need to overtrade to achieve the goal.

Trading Too Frequently

Sticking to your forex trading strategy, as discussed, prevents opening charts and trades too frequently. The best plans will have the following:

● The best conditions to trade, i.e., uptrend, downtrend, or ranging

● Your most preferred Forex trading session among London, New York, or Tokyo sessions

● The most favorable timeframes, e.g., M1, H1, D1, etc

All these conditions can't occur at the same time. Therefore, outline your preferred ones in your trading strategy.

Ensure you obey the rules strictly because frequent trading is another way to overtrade.

Emotional Trading

As the name implies, emotional trading means making decisions off your feelings. It could be from excitement, fear, or panic rather than reasonable thinking.

You will usually regret them later, especially if the decisions were against your trading plan.

On the contrary, the best Forex traders have precise rules that guide them to take market executions. They try to suppress every emotion whenever they are analyzing price.

If not, you'll be at risk of the following consequences:

● Wrong/late executions

● Lower profits

● Anxiety and stress

● Lost confidence

Forex trading should be precise with "yes" or "no" decisions. There must be no room for feelings in between.

Automating your strategy is one of the best ways to avoid emotional trading. It helps you stay off the charts while obeying the rules you were supposed to follow if you were active.

Common Emotional Trading Mistakes

As humans, it's normal to be emotional sometimes. Traders have different lifestyles and personalities that can affect their behaviors.

Regardless, whenever you sit in front of a Forex price chart to start trading, you must try to avoid the following:

Lack of Discipline

Before taking your first-ever Forex trade, you should have prepared a trading plan. It would guide you on what to expect before taking market executions.

Deviation from such trading strategy in any way is the lack of discipline.

It's okay to fine-tune the plan when necessary, but you must always obey its rules whenever you're ready to take or close trades.

No trading plan guarantees a 100% winning outcome. However, obeying it is better than trading irregularly.

If you feel like going against your trading plan, do it in a demo account where there is no risk of losing funds.

FOMO (Fear of Missing Out)

FOMO is quite common, even among experienced traders. It is anxiety or regret felt by believing you will potentially miss trading with a prolonged trend.

Hence, you'll quickly open a trade even when the price hasn't met the entry conditions in your trading plan.

Sometimes, you may be lucky enough to still profit from the price move. Other times, it can reverse and hit your stop loss.

It is like betting.

Try not to pursue any trend if it didn't meet your entry conditions. If you've missed a trade, be patient, and wait for the next opportunity.

Revenge Trading

Revenge trading is trading to recover losses or profits you would have gained from missed opportunities. Most times, it is at an increased risk.

It is a potentially harmful emotional behavior that could have terrible results.

If you ever feel this way, the best thing to do is to stay off the charts to clear your mind. Talk to a friend or mentor; enjoy some other hobbies; reassess your trading plan, or take a rest.

Lack of Knowledge

There are no two ways about it. If you lack proper trading knowledge, becoming a successful Forex trader will be difficult.

Many aspiring traders have refused intensive training due to how easy opening CFD accounts has become. They hardly learn basic facts, such as:

● Interpreting the current market nature

● Executing the appropriate market orders

● Utilizing trading platforms' charting tools

Such limited knowledge will expose you to poor decision-making, higher risks, and lower profits.

Before trading on a live account, take extensive Forex trading courses. Test and retest your skills in a demo account until you can create an effective trading plan.

Common Lack of Knowledge Mistakes

It's never advisable to begin Forex trading without previous knowledge about the market. If not, you may make the following mistakes, which could be costly:

Fail To Understand Market Conditions

There is always a way to interpret the market whenever you look at price charts. It may be in an uptrend, downtrend, or sideways trend across various timeframes.

However, failure to understand the price's current state makes it challenging to make the best decisions.

For example, the price may be in a long-term uptrend, visible on a higher timeframe chart. However, you may only observe a lower timeframe, which appears to be a downtrend.

Therefore, by opening sell market orders, you will be trading against the trend, which is generally not recommended.

Ignore Economic News and Data

Every financial market, including Forex, operates on the strength of countries' economies. Therefore, keeping up with related news reports that impact them is essential.

You can look at economic calendars for this. It will help you anticipate periods when the market could have a short-, intermediate-, or long-term change.

If you lack this knowledge, you may treat all the periods the same, which is a bad practice.

For example, during the Non-Farm Payroll (NFP) release, major currency pairs always feel the sudden impact of increased volatility. It'll be better to stay off trading for the period for reduced risk.

Use Irrelevant Trading Indicators

Today, there are hundreds of technical indicators available based on the following:

● Price trend, e.g., Moving averages

● Volume, e.g., On-Balance Volume (OBV)

● Volatility, e.g., Bollinger bands

● Momentum, e.g., Relative Strength Index (RSI)

However, not all are suitable for signaling potential entries. You must learn to filter the useful from the non-useful ones to find profitable trades.

You can also reasonably combine two or more for better signals. Back- and forward-test them several times to prove they can provide your desired outcome.

If not, you are at high risk of losing your capital on a live account.

Poor Record-Keeping

One of the ways to improve as a Forex trader is by regularly assessing your results. It helps you learn from your mistakes and remain on track to achieve your goals.

Here are more benefits of proper record-keeping:

● Better tax reporting when required

● Improved self-awareness and trading psychology

● Enhanced risk management rules

Even the most experienced traders occasionally reflect on their trading activities from records.

However, by keeping trading records, there is no way to evaluate your performance to improve. It's worse if you don't even have a trading journal.

You'd find yourself making the same errors every time, threatening your goal of becoming profitable.

Common Trading Journal Mistakes

As discussed, relying on past performances is one of the best ways to improve as a trader. Hence, ensure your journal is high-quality and free of the following mistakes:

Inadequate Entry and Exit Notes

Picking accurate trade entry and exit points makes you profitable in CFDs. Hence, your trading journal must contain sufficient records of them for improvement.

Assume you used the cross of two moving averages to open new buy market orders. Your winning percentage from the journal may have been around 50% after 50 trades.

However, adding an extra rule about entering such trades only when the trading volume is high may increase your chances to 60% from back-tests.

The discovery would be a big win.

Sadly, you may never know this if you didn't note your execution carefully in the journal.

Insufficient Stats Tracking Trade Outcomes

Any journal without the following statistics may be too poor to draw helpful trading conclusions from:

● Risk-to-reward ratio

● Maximum drawdown

● Win rate

● Average win/loss size

● Profit factor

They are not limited to these, especially when you plan to test a new plan on live accounts. However, ensure the figures are as understandable as possible to prevent confusion when assessing trades.

You'll always find brilliant ways to improve your trading skills backed by reliable data.

Failure To Assess Past Trade Behaviors

Unknown to most, your trading attitudes are just as important as the numbers in your journal.

What made you take a trade sooner or later than expected? How did you react to upcoming economic news? Did you feel sad for losing multiple consecutive days?

It may seem unnecessary, but this is a powerful way to improve your trading psychology.

As you are jotting the results from every trade, review your emotions and note how you felt for the following reasons:

● Minimizing or maximizing your position size

● Holding to the position for long or short

● Taking profits or losses

● Using stop orders

● Missing a long-term trend

Reflect on them later to learn how to improve.

Final Thoughts

You're not alone if you've struggled to sustain profits in Forex trading. Several beginners have lost their accounts for different reasons.

However, you stand a better chance of succeeding if you can avoid these popular mistakes:

● Poor risk management

● Overtrading

● Emotional trading

● Inadequate knowledge of the market

● Insufficient record-keeping

Test every strategy in a demo account to attain consistency and always stick to the rules under live trading conditions.

Moreover, you'll always become a better trader by regularly assessing your past results. Look for new ways to adjust them for the better.

You'll start enjoying long-term profits from Forex trading soon.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.