Introduction

Protecting capital in Forex CFD trading is something that is paramount for your success. The most successful traders will typically focus on risk first, and reward second. The most important thing that a new trader can learn is how to manage risks in Forex CFD trading. In this article, we look at some of the best practices for Forex CFD trading with minimal risk.

Understanding Forex CFDs

To understand risk management techniques for Forex traders, you need to understand the market itself.

Definition of Forex CFDs

A Forex CFD (Contract for Difference) is a financial derivative that enables traders to speculate on currency pair price movements in the foreign exchange market. CFDs are contracts between a buyer and a seller in which the seller agrees to pay the buyer the difference between the asset's current price and its price when the contract is closed.

The asset being traded in Forex CFDs is a currency pair, and traders can take a long (buy) or short (sell) position on the currency pair without owning the underlying asset. As a result, traders can profit from both rising and falling currency prices.

Types of Forex CFDs Available

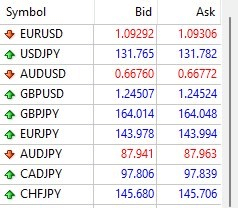

List of currency rates in MT5.

There are numerous Forex CFD markets available for traders to trade, with the following being some of the most commonly traded Forex CFD markets:

Major currency pairs are those that include the US dollar as one of the currencies. EUR/USD, USD/JPY, GBP/USD, and USD/CHF are the most frequently traded major currency pairs.

Minor currency pairs are those that do not include the US dollar as one of the currencies. EUR/GBP, GBP/JPY, and AUD/NZD are a few examples.

Exotic currency pairs are those that include currencies from emerging or less developed economies. USD/TRY, USD/ZAR, and USD/BRL are a few examples.

CFD trading on cryptocurrency pairs such as BTC/USD, ETH/USD, and LTC/USD is available from some brokers.

Currency pairs that do not involve the US dollar, such as EUR/GBP or EUR/JPY, are examples of cross-currency pairs.

It's important to note that the availability of Forex CFD markets varies depending on the broker and the trader's location. Traders should always consult their broker for a comprehensive list of Forex CFD markets.

Common Risks in Forex CFD Trading

There are a number of common risks in Forex CFD trading that you will have to pay attention to. Forex CFD risk management strategies will have to take into account the following.

Market Risk

In Forex CFD trading, market risk refers to the potential losses that a trader may face as the price of the underlying asset changes. In other words, it is the risk of loss resulting from adverse market price movements.

Forex CFD trading entails speculating on currency pair price movements, which can be influenced by a variety of factors such as economic indicators, geopolitical events, and central bank policies. These factors are frequently unpredictable and can result in abrupt and significant price movements, potentially resulting in losses for traders.

Market risk is a major concern for traders, and it is critical to effectively manage it. This can be accomplished through a variety of risk management strategies.

Counterparty Risk

In Forex CFD trading, counterparty risk refers to the risk that a trader may face if the counterparty with whom they are trading is unable to fulfill their financial obligations under the contract. In other words, it is the risk that the counterparty will fail to meet their obligation to pay the trader the difference between the contract's opening and closing prices.

Trading Forex CFDs entails entering into a contract with a counterparty, who is typically a broker or financial institution. The counterparty is in charge of settling trades and paying traders any profits or losses resulting from the trades.

However, the counterparty may fail to meet its obligations for a variety of reasons, including financial insolvency. This can result in substantial losses for the trader, especially if they have a large position or are using high leverage.

To reduce counterparty risk, traders should choose their broker carefully, ensuring that they are regulated and have a good reputation. It is also critical to monitor the counterparty's financial health and use risk management strategies such as diversification and position sizing to limit potential losses. Traders can also use custodial services to protect their funds and assets in the event of a counterparty default.

Liquidity Risk

In Forex CFD trading, liquidity risk refers to the risk that a trader will face if they are unable to execute a trade or close a position at the desired price due to a lack of market liquidity. In other words, it is the risk of not being able to quickly and fairly buy or sell an asset.

Forex CFD trading entails buying and selling currency pairs, with the price of these currency pairs determined by market supply and demand. If the market lacks liquidity, traders may find it difficult to execute their trades or may be forced to accept a lower price to exit their position.

Liquidity risk is especially prevalent during periods of high market volatility or when trading exotic currency pairs with low trading volumes. It can also be a concern for traders who trade with large positions or high leverage, as finding a counterparty willing to take the opposite side of the trade may be more difficult.

To reduce liquidity risk, traders should select currency pairs with high trading volumes and narrow bid-ask spreads. They should also keep an eye on market conditions and adjust their trading strategies accordingly, as well as consider risk management techniques like stop-loss orders and position sizing to limit potential losses. Traders can also work with brokers who have large liquidity pools to increase their chances of executing trades.

Leverage Risk

Leverage risk in Forex CFD trading refers to the possibility of magnified losses as a result of using leverage to open larger trading positions than would otherwise be possible with available trading capital. Leverage allows traders to control larger positions with less capital, but it also increases the risk of loss.

For example, if a trader uses 10:1 leverage, they can control a position ten times the size of their trading capital. While this has the potential to increase potential profits, it also means that any losses will be magnified by the same factor. If the market moves against the trader, they may lose more than their initial investment, which may result in a margin call or worse.

Leverage risk is especially important for traders who are new to Forex CFD trading because they may not fully understand the risks involved. It can also be a source of concern for traders who use excessive leverage or fail to implement proper risk management strategies.

Before employing leverage, traders should carefully consider their trading strategy and risk tolerance. They should also use risk management techniques like stop-loss orders and position sizing to limit potential losses and avoid over-leveraging. Furthermore, traders should monitor their positions on a regular basis and adjust their trading strategy as needed to reflect changing market conditions.

Risk Management Strategies in Forex CFD Trading

Risk management strategies are crucial to your success. The following tools and tips can help you keep your account as safe as possible.

Setting Stop Losses

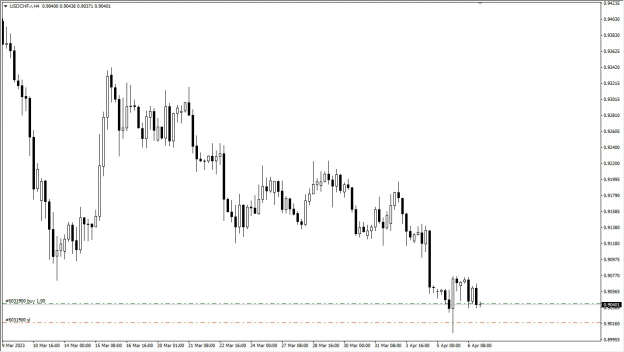

Chart w/ a stop loss order.

Using stop loss orders in Forex CFD trading is a must. This tells the broker when it is time to exit a position, in order to protect your account. If the market goes against you, there is a point in time when you must exit. This allows you to trade going forward.

Setting Take Profit Orders

Some traders will set take profit orders to exit a position in profit. The set the target, and the broker exits the position for them, crediting the trader’s account with the gains. By setting these targets, you can protect gains, but some traders prefer to “let winners run.”

Using Trailing Stops

Some traders will use trailing stops, which following the trade as it progresses. As the trade moves in your favor, the trailing stop loss order will follow along. This allows the trade to “breathe”, but also protects the trader along the way.

Hedging

Hedging refers to taking a position in order to protect from losses. Hedging strategies for Forex CFD trades can take several forms, but normally means opening an opposite trade. For example, a trader can open a short USD/JPY position in order to protect against losses in a long USD/JPY position. The idea is that when the market falls, the short position will credit the trader, mitigating the losses from the long position.

Diversification

Diversification is an important part of trading. For example, one of the biggest mistakes that traders make is that they become too concentrated in one asset, or correlated asset. An example would be to be short NZD/USD, AUD/USD, EUR/USD, and GBP/USD. The issue is the concentration of risk attached to the US dollar. If the markets were to all go higher, you would take four times the loss as the US dollar will typically move in the same direction against most currencies.

Position Sizing

Position sizing refers to the amount of money in the market. Using massive positions can cause great damage to your account, so therefore it is important to risk a limited amount of trading capital on each trade. The proper position size will be a combination of statistics and psychology.

Risk-to-Reward Ratio

One of the most important aspects of trading is risk-to-reward. If a trade risks 30 pips, then you should be aiming for more, and most professionals will tell you that it should be at least twice what you are risking. This allows for winners to be bigger than losses, therefore allowing a trader to be profitable without being perfect. Losses happen, so it is crucial to make sure the winners are bigger than the losers.

Risk Management Tools for Forex CFD Trading

Margin

Margin is the amount of money that a trader must deposit with their broker in order to open a trading position in Forex CFD trading. Margin is commonly expressed as a percentage of the total position value and is used to cover any potential losses that may occur while the position is open.

Leverage is frequently used in Forex CFD trading, which allows traders to control larger positions with less capital. The margin requirement varies by broker and position size, but it typically ranges from 1% to 5% of the total position value.

Stop Loss Orders

A stop-loss order is a risk management tool in Forex CFD trading that allows traders to set a predetermined price level below which their position will be automatically closed out if the market moves against them. It is a request to the broker to sell a position at a specific price level in order to limit potential losses.

A stop-loss order is essentially a minimum price at which a trader is willing to close their position. If the market moves against them and the price reaches the stop-loss level, the order is triggered, and the position is closed out automatically at the specified price.

Trailing Stop Orders

A trailing stop order in Forex CFD trading is a type of stop-loss order that allows traders to set a dynamic stop-loss level that adjusts automatically as the market price moves in the trader's favor. Trailing stop orders are designed to lock in profits while limiting potential losses by allowing the stop-loss level to move with the market price.

When a trailing stop order is placed, the stop-loss level is set at a certain percentage or dollar amount below the current market price. As the market price moves in the trader's favor, the stop-loss level also moves up or down, maintaining the same percentage or dollar amount below the current market price. This means that if the market price reverses and moves against the trader, the position will be automatically closed out at the new stop-loss level, helping to limit potential losses.

Guaranteed Stop Loss Orders

It is vital that you have guaranteed stop loss orders. This means that the broker will execute any stop loss orders that you place, regardless of momentum in the market. There have been times in the past that have been so volatile that traders have lost extraordinary amounts of money. Having a guaranteed stop loss order mitigates this issue.

Regulation and Licensing

The rules and guidelines that govern the operation of Forex brokers and the protection of traders' funds and investments are referred to as regulation and licensing in Forex. Forex trading is a global market, with different rules and regulations in each country and region. Most regulatory bodies, on the other hand, seek to protect traders from fraud and abuse by requiring brokers to meet certain standards and adhere to specific rules. You should never trade with a broker that is not regulated.

Negative Balance Protection

Some brokers provide negative balance protection in Forex trading, which protects traders from incurring losses that exceed their account balance. This means that if a trader's losses exceed their account balance due to a significant market move, the broker will automatically close out the trader's position to prevent the trader from owing the broker more money than they have in their account.

Negative balance protection is especially important in Forex trading due to the use of leverage, which can magnify a trade's potential losses. A sudden market move may cause a trader's losses to exceed their account balance in some cases, resulting in the trader owing the broker additional funds.

Brokers can provide traders with additional protection against this risk by offering negative balance protection, and traders can trade with greater peace of mind knowing that they cannot lose more than their account balance. It is important to note, however, that not all brokers provide negative balance protection, and traders should carefully review their broker's terms and conditions before opening an account to ensure that they understand the risks involved.

Margin Call Policies

Margin call policies are Forex brokers' rules that specify when a trader must deposit additional funds into their trading account in order to maintain the required margin level. When a trader's losses on open positions cause the account equity to fall below the required margin level, a margin call is issued.

When a margin call occurs, the broker typically notifies the trader and requires them to deposit additional funds into their account in order to restore the required margin level. If the trader fails to meet the margin call within a certain time frame, the broker may close out some or all of the trader's positions to prevent further losses.

Risk Disclosures

Make sure to read all risk disclosures, as it can explain to you some of the potential dangers of trading. It will also sometimes lead into the policies of the broker, so you know what to expect in various conditions.

Educational Resources

Educational resources are available at most reputable brokers, and freely available online. VStar offers plenty of eBooks that will explain the various ins and outs of the Forex markets. Make sure to have a solid educational background of markets.

VSTAR

By trading at VSTAR all of the above concerns are addressed. VSTAR offers negative balance protection, and over 1000 markets to choose from. Traders can not only trade Forex CFD markets, but also gain exposure to stocks, commodities, and indices through CFD offerings. Educational products are also available, and VSTAR is fully regulated in several markets, and has ample liquidity.

Developing a Forex CFD Trading Plan with Risk Management in Mind

Identifying and Setting Risk Tolerance Levels

Risk tolerance is different for different people, so therefore it is a personal decision to make. The main concern would be to understand what you are comfortable with when it comes to risk. The more comfortable a trader is, the more likely they will be to trade in a professional and profitable manner.

Defining Trading Goals and objectives

It’s important to define your trading goals and objectives before placing trades in a live environment. The simple answer of “to make money” is an esoteric response but doesn’t help with building a plan. Understanding realistic goals can lead to a more sustainable path.

Choosing a Trading Strategy

Forex CFD trading plan development is where you should start. Choosing a trading strategy involves finding some kind of system that allows for entry rules, position sizing, stop loss placement, and potential targeting. The trading strategy that you choose should also fit your personality, and backtest to show profit.

Backtesting a Trading Plan

Backtesting refers to determining how a trading system performs against historical market conditions. This allows the trader to understand how the system performs over time, allowing them to see if it is profitable, and how many losses could occur.

Keeping a Trading Journal

Most professional traders will keep a trading journal, in order to keep an eye on the potential ups and downs of their trading. It will often include not only set ups and charts, but also emotional state, as trading psychology plays a huge part in trading success and failure.

Conclusion

If you cannot include risk management in your trading, statistics suggest that you are likely to blow your account. The importance of risk management in Forex CFD trading cannot be overstated. The biggest concern is that you stay liquid and around to trade another day. The various aspects of risk management are all designed to keep you from taking on massive losses so that you can benefit from times when the markets are in your favor.

The benefits of following sound a risk management plan is longevity, and eventually, profitability. Even the best traders in the world have losses, and will only trade in reasonable amounts. The biggest friend of the trader is compound interest, and not trying to compound.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.