I. Introduction

Definition of Gas CFD Trading

Gas CFD (Contract for Difference) trading refers to the buying and selling of contracts that derive their value from the price movements of gas commodities without actually owning the physical gas itself. CFDs are financial derivatives that allow traders to speculate on the price fluctuations of underlying assets, in this case, gas.

In gas CFD trading, traders enter into an agreement with a broker to exchange the difference in the gas price between the opening and closing of the contract. If the gas price increases, the trader earns a profit, and if it decreases, the trader incurs a loss. Gas CFD trading provides an opportunity for investors to participate in the gas market without the need for physical storage or delivery of the commodity.

Explanation of Geopolitical Events and Their Impact on Gas CFD Trading

Source: uccholding.com

Geopolitical events play a significant role in shaping the gas market and, consequently, have a profound impact on gas CFD trading. Political tensions, conflicts, economic policies, and regulatory changes in gas-producing regions can all influence the supply, demand, and pricing dynamics of gas, thereby affecting gas CFD trading. Let's delve into a few examples to understand this relationship:

The Organization of the Petroleum Exporting Countries (OPEC) is a group of major oil- and gas-producing nations. When OPEC announces production cuts, it can affect gas prices globally. For instance, if OPEC decides to reduce oil production, gas prices may rise due to the interlinkage between oil and gas markets. Traders engaging in gas CFD trading need to closely monitor OPEC's decisions and adjust their strategies accordingly.

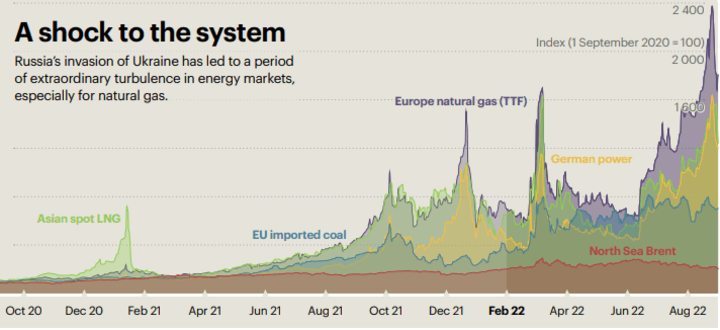

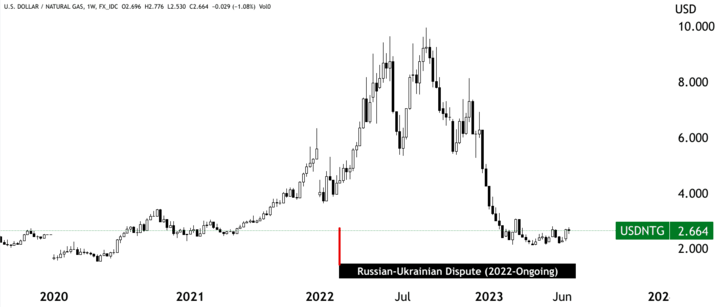

Gas is often transported through pipelines across different countries. Geopolitical conflicts or disputes over pipeline routes can disrupt gas supplies and lead to price volatility. For example, tensions between Russia and Ukraine have previously affected gas flows to Europe. Traders involved in gas CFD trading should be aware of such disputes, as they can impact market sentiment and price movements.

Source: assets.weforum.org

International trade agreements and sanctions can have a significant influence on gas CFD trading. For instance, if trade barriers are lifted between gas-exporting countries and importers, it can result in increased gas supply and potentially lower prices. Conversely, the imposition of sanctions on gas-producing nations can restrict supply and drive prices higher. Traders need to keep a close eye on geopolitical developments related to trade agreements and sanctions to make informed trading decisions.

II. Geopolitical Events That Affect Gas CFD Trading

Geopolitical events have a significant impact on gas CFD (Contract for Difference) trading, as they introduce uncertainties and risks that influence supply and demand dynamics in the gas market. These events can range from political instability in gas-producing countries to trade disputes between gas-producing nations.

Examples of Geopolitical Events that can impact the gas market:

Political instability in gas-producing countries

Political instability in gas-producing countries is one of the major geopolitical events that can affect gas CFD trading. When a gas-producing nation experiences political unrest, such as protests, regime changes, or civil wars, it can disrupt gas production and supply chains. For example, the Arab Spring in 2011 led to political instability in several Middle Eastern countries, including Egypt, Libya, and Syria. These events had a direct impact on gas production and supply, causing price volatility in the global gas market. Traders need to closely monitor political developments in gas-producing countries to anticipate potential disruptions and adjust their trading strategies accordingly.

Sanctions and embargoes on gas-producing countries

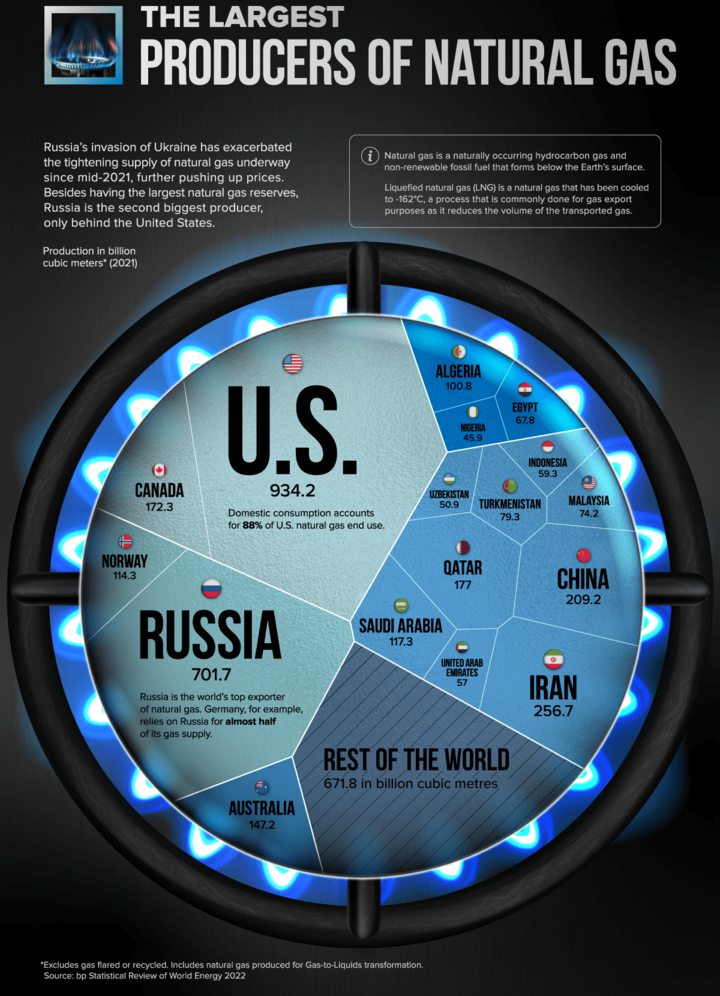

Sanctions and embargoes on gas-producing countries also have significant implications for gas CFD trading. Governments or international bodies may impose economic sanctions or trade embargoes on gas-producing nations due to various reasons, such as human rights violations, geopolitical tensions, or nuclear proliferation concerns. For instance, the imposition of sanctions on Russia in 2022 restricted its ability to export natural gas and limited its access to international markets. Such actions can lead to supply shortages, price fluctuations, and increased market risk for gas CFD traders.

Source: visualcapitalist.com

Wars and conflicts in gas-producing regions

Wars and conflicts in gas-producing regions have a direct impact on gas CFD trading as they disrupt production and transportation infrastructure. Regions like the Middle East, where a significant portion of global gas production is concentrated, have witnessed ongoing conflicts and tensions that affect the gas market. The Iraq War in 2003, for instance, temporarily disrupted gas production and caused volatility in gas prices. Traders closely monitor geopolitical tensions and conflicts, as any escalation or outbreak of violence can have immediate consequences for gas supply and prices.

Trade disputes between gas-producing countries

Trade disputes between gas-producing countries can also affect gas CFD trading. Disputes over pricing, market access, or political disagreements can lead to trade disruptions and affect gas flows. For example, Russia and Ukraine have been involved in numerous gas disputes over the years, impacting gas supplies to Europe. These trade disputes create uncertainties in the market and can lead to increased price volatility. Traders need to stay informed about trade negotiations and developments between gas-producing nations to anticipate potential disruptions and adjust their trading strategies accordingly.

III. How Geopolitical Events Affect Gas CFD Trading

Geopolitical events have a profound impact on gas CFD (Contract for Difference) trading, influencing various aspects of the market. These events can disrupt the supply and demand dynamics of gas contracts, lead to changes in gas prices and volatility, affect gas company stocks and indices, and influence investor sentiment and market psychology. Understanding the ways in which geopolitical events affect gas CFD trading is crucial for traders and investors to make informed decisions and manage their positions effectively.

Impact on supply and demand of gas contracts

One of the primary ways geopolitical events affect gas CFD trading is by impacting the supply and demand of gas contracts. Political instability, wars, conflicts, and trade disputes in gas-producing regions can disrupt gas production and transportation infrastructure, leading to supply shortages or interruptions. For example, if a conflict erupts in a major gas-producing region, such as the Middle East, it can result in the suspension or reduction of gas exports, thereby affecting the availability of gas contracts in the market. Such disruptions can have a direct impact on the trading volumes and liquidity of gas CFDs.

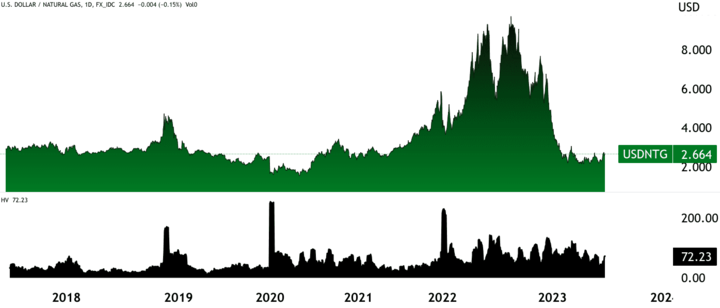

Changes in gas prices and volatility

Geopolitical events also influence gas prices and volatility. Any event that introduces uncertainties and risks into the gas market can lead to price fluctuations. For instance, the imposition of sanctions on a gas-producing country can restrict its ability to export gas, causing a decrease in supply and potentially driving up prices. Similarly, geopolitical tensions or conflicts can create concerns about future supply disruptions, leading to increased market volatility. Gas CFD traders closely monitor geopolitical developments and assess their potential impact on prices and volatility to identify trading opportunities.

Gas CFD prices and historical volatility (Source: tradingview.com)

Effect on gas company stocks and indices

The effect of geopolitical events extends beyond gas contracts to gas company stocks and indices. Gas-producing companies are directly affected by events such as political instability, sanctions, and trade disputes. Negative developments can lead to a decrease in stock prices and market capitalization, reflecting investors' concerns about the company's performance and future prospects. For example, when sanctions were imposed on Russian gas giant Gazprom, its stock price experienced significant declines. Traders who incorporate fundamental analysis into their trading strategies closely watch geopolitical events to assess their potential impact on gas company stocks and indices.

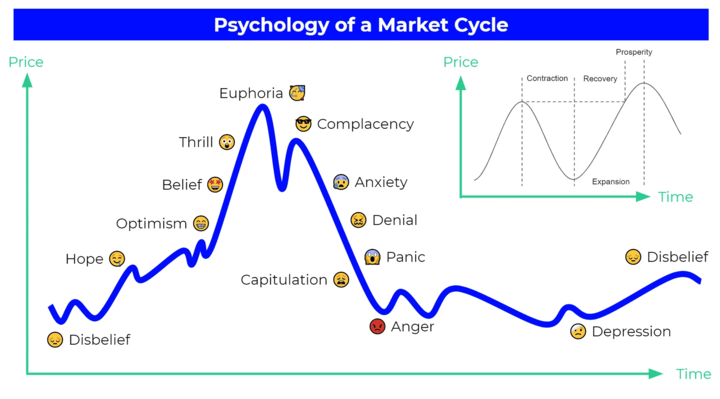

Influence on investor sentiment and market psychology

Geopolitical events also influence investor sentiment and market psychology in gas CFD trading. Uncertainty and risks introduced by these events can create a sense of fear, caution, or optimism among investors. For example, a geopolitical event that threatens gas supply can generate fear and prompt investors to sell gas contracts or take protective measures. Conversely, a resolution of a long-standing conflict or the lifting of sanctions can instill optimism and encourage investors to buy gas contracts. Investor sentiment and market psychology play a crucial role in shaping price trends and market behavior in gas CFD trading.

Source: patternswizard.com

IV. Strategies for Trading Gas CFDs During Geopolitical Events

Trading gas CFDs during geopolitical events requires careful planning and strategic approaches to navigate the uncertainties and risks introduced by these events. Traders can employ various strategies to effectively trade gas CFDs during such periods. These strategies include using fundamental analysis to monitor geopolitical events, implementing risk management strategies, utilizing technical analysis for entry and exit points, and diversifying the portfolio to reduce exposure to geopolitical risks.

Use of Fundamental Analysis to monitor geopolitical events and their impact on the gas market

Fundamental analysis plays a crucial role in monitoring geopolitical events and their impact on the gas market. Traders need to stay informed about political developments, conflicts, trade disputes, and sanctions that can affect gas supply and demand. By closely monitoring news and analyzing fundamental factors, traders can anticipate potential disruptions and adjust their trading strategies accordingly. For example, if there are indications of a potential conflict in a gas-producing region, traders may consider reducing their exposure to gas contracts or taking protective measures to mitigate risks.

Implementation of Risk Management strategies to minimize losses during volatile periods

Implementing risk management strategies is essential to minimizing losses during volatile periods influenced by geopolitical events. Volatility can significantly impact gas prices and increase the risk of unexpected market movements. Traders can use risk management tools such as setting stop-loss orders, implementing trailing stops, or using position-sizing techniques to limit potential losses. By managing risk effectively, traders can protect their capital and maintain stability in their trading activities, even during turbulent geopolitical events.

Utilization of Technical Analysis to identify potential entry and exit points

Technical analysis can be utilized to identify potential entry and exit points when trading gas CFDs during geopolitical events. Traders can analyze price charts, trend lines, and technical indicators to identify patterns or trends that may indicate favorable trading opportunities. Technical analysis can help traders make informed decisions based on historical price patterns and market behavior. For example, traders may use indicators such as moving averages or oscillators to identify potential reversal points or trend continuations during periods of heightened volatility.

Diversification of portfolio to reduce exposure to geopolitical risks

Diversifying the portfolio is another strategy that can reduce exposure to geopolitical risks when trading gas CFDs. By spreading investments across different assets or markets, traders can mitigate the impact of any adverse events affecting a specific region or gas-producing country. For instance, diversifying the portfolio to include other commodities or asset classes can help offset potential losses caused by disruptions in the gas market. By diversifying, traders can achieve a more balanced risk profile and potentially benefit from other market opportunities during geopolitical events.

V. Case Studies of Geopolitical Events and Their Impact on Gas CFD Trading

Geopolitical events have had significant impacts on the gas market, and analyzing case studies can provide valuable insights into the responses of traders and the outcomes of their trades. By examining past events, we can extract lessons that can be applied to future trading strategies.

Examples of past geopolitical events that affected the gas market:

Russian-Ukrainian Dispute (2022): The disputes between Russia and Ukraine over gas transit and pricing have historically resulted in disruptions to gas supplies to Europe. For instance, in 2022, Russia's gas supplies to Europe were halted, impacting the overall gas market.

Source: tradingview.com

Arab Spring and Middle East Unrest (2011): The political uprisings and conflicts in the Middle East, particularly during the Arab Spring in 2011, had a significant impact on gas trading. The unrest in countries like Libya, Egypt, and Syria disrupted gas production and exports, causing supply disruptions and price volatility.

Sanctions on Iran (2018): The imposition of international sanctions on Iran due to its nuclear program affected gas markets. As one of the world's largest natural gas producers, Iran's reduced export capabilities led to tighter supply conditions, influencing gas prices and trading strategies.

Source: tradingview.com

Analysis of how traders responded to these events and the outcomes of their trades

During these geopolitical events, traders reacted to the evolving market conditions and sought to capitalize on opportunities or mitigate risks. Their responses varied based on their risk appetite, market knowledge, and access to information. Here are some common trader responses and their outcomes:

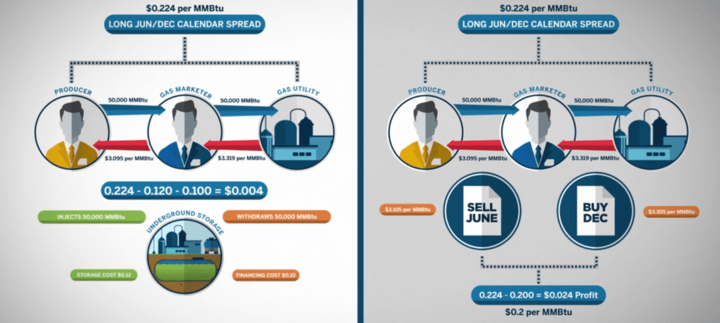

Hedging and Diversification: Traders employed hedging strategies, such as taking long or short positions in gas futures or options, to protect against price volatility resulting from geopolitical events. Diversification of portfolios across multiple gas-producing regions and supply sources also helped reduce risk exposure.

Speculation on Price Movements: Traders with a higher risk tolerance engage in speculative trading, attempting to profit from anticipated price movements resulting from geopolitical events. Some traders successfully predicted and capitalized on price spikes or drops, while others incurred losses due to unpredictable market reactions.

Monitoring Political Developments: Traders closely monitored political developments and geopolitical news to anticipate potential disruptions or opportunities in the gas market. Rapid responses to breaking news or policy changes allowed traders to adjust their positions and strategies accordingly.

The outcomes of these trades can also vary. Successful trades may yield substantial profits for traders who accurately anticipate the impact of geopolitical events on gas markets. Conversely, incorrect predictions or inadequate risk management can result in losses.

Lessons learned from these events and how they can be applied to future trading strategies

The case studies of past geopolitical events provide several valuable lessons for future gas CFD trading strategies:

Awareness of Political and Geopolitical Developments: Traders should stay informed about political events, conflicts, sanctions, and other geopolitical factors that can influence gas markets. Developing a comprehensive understanding of the geopolitical landscape allows for proactive decision-making.

Risk Management and Hedging: Effective risk management is crucial to mitigating the impact of geopolitical events. Traders should employ hedging techniques, such as futures contracts, options, or CFDs, to protect against price volatility and unexpected disruptions.

Natural Gas Risk Management Spreads & Storage (Source: CME Group)

Robust Monitoring Systems: Traders should establish robust monitoring systems to stay updated on geopolitical developments and their potential impact on gas markets. Utilizing real-time news feeds , geopolitical analysis tools, and market data can aid in making timely and informed trading decisions.

Diversification and Portfolio Optimization: Maintaining a diversified portfolio across various gas-producing regions and supply sources can help reduce risk exposure during geopolitical events. Traders should analyze and optimize their portfolios based on the changing geopolitical landscape and market conditions.

VI. Conclusion

Summary of the Impact of Geopolitical Events on Gas CFD Trading

Geopolitical events have a significant impact on gas CFD (Contract for Difference) trading, influencing supply and demand dynamics, gas prices and volatility, gas company stocks, investor sentiment, and market psychology. Political instability in gas-producing countries, sanctions and embargoes, wars and conflicts, and trade disputes can disrupt gas production and supply chains, leading to market uncertainties and risks.

The impact of geopolitical events on gas CFD trading is multifaceted. Political instability and conflicts in gas-producing regions can disrupt supply, leading to price volatility and potential shortages. Sanctions and embargoes on gas-producing countries can restrict their ability to export gas, impacting supply and prices. Trade disputes can create uncertainties in the market and affect gas flows.

Importance of staying informed and adapting to changing market conditions

Staying informed and adapting to changing market conditions are crucial for successful gas CFD trading during geopolitical events. Traders should closely monitor geopolitical developments, including political, economic (like VSTAR Economic Calendar), and social factors, to anticipate potential disruptions and adjust their trading strategies accordingly. Fundamental analysis is essential for assessing the impact of these events on the gas market, while technical analysis can help identify potential entry and exit points. Implementing risk management strategies, such as setting stop-loss orders and diversifying the portfolio, can help minimize losses and reduce exposure to geopolitical risks.

Final thoughts and recommendations for traders

In conclusion, traders involved in gas CFD trading need to understand the influence of geopolitical events on the market. By staying informed and monitoring developments, traders can adapt their strategies and make informed decisions. Geopolitical events introduce uncertainties and risks, but they also create opportunities for profit. By analyzing past events, traders can learn valuable lessons and apply them to future trading strategies. In light of these considerations, it is recommended that traders maintain a comprehensive understanding of geopolitical events, keep track of relevant news and analysis, and continuously evaluate their positions in the gas CFD market.