Introduction

The foreign exchange or Forex market is a decentralized global market where anyone can buy, sell, trade, and speculate on different currencies. With an estimated $6 trillion in daily trading activity, it is the largest financial market in the world.

Currency exchange between nations takes place on the FX market. Some market participants are central banks, commercial banks, businesses, institutional investors, and small-time traders. Anyone with an online connection can access the market, which is open five days a week.

In Forex trading, currency pairs are bought and sold to make money from changes in exchange rates. The first currency in a currency pair is the base currency, while the second is the quote currency.

Several factors, including economic data release, geopolitical developments, and monetary policy decisions, impact the FX market. Traders employ various technical and fundamental analytical methods to examine these elements and decide how to trade.

For several reasons, it is crucial to comprehend the fundamentals of Forex trading. First, rather than depending on rumors or educated guesses, it supports traders in making well-informed trading decisions based on market patterns and statistics. Second, it lowers the risks of Forex trading by allowing traders to recognize prospective hazards and opportunities and implement the necessary precautions. Thirdly, it allows traders to enhance their knowledge and abilities by serving as a foundation for more complex trading techniques. Last but not least, having a firm grasp of the fundamentals of Forex trading increases traders' chances of success by empowering them to recognize lucrative trading opportunities and make wise choices.

Key concepts

There are some key concepts that you will need to know if you are going to begin a Forex trading career. To be successful, you will need to understand some currency trading basics.

Currency Pairs

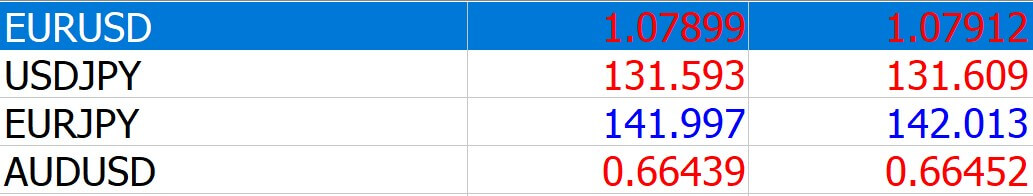

The two currencies traded against one another on the foreign exchange market are known as currency pairs. Currency pairs are always traded in Forex trading, with one currency being purchased and the other being sold simultaneously. The exchange rate between two currencies determines the value of a currency pair.

The base currency is the first currency in a quoted currency pair, while the quote currency is the second. For instance, the euro is the base currency, and the US dollar is the quote currency in the currency pair EUR/USD. The amount of US dollars needed to trade for one euro is represented by the value of this currency pair.

The Forex market has three categories of currency pairs: major currency pairs, minor currency pairs, and exotic currency pairs. Major currency pairs, which include the US dollar and other important currencies, including the euro, Japanese yen, British pound, Swiss franc, Canadian dollar, and Australian dollar, are the most frequently traded. Minor currency pairs do not include the US dollar but do include the major currencies. Exotic currency pairs combine a major currency with a lesser-known or emerging market counterpart.

Exchange Rates

The value of one currency represented in terms of another is called an exchange rate. It is, in other words, the rate at which one currency can be converted into another. Due to market volatility, exchange rates continually change and can greatly impact foreign investment and trade.

For illustration, let's say the euro to US dollar exchange rate is 1.2. This indicates that one US dollar may buy 1.2 euros. If a dealer wanted to purchase 100 euros, they would have to swap 120 dollars (100 euros multiplied by 1.2).

The Role of Supply and Demand in Forex Trading

The value of currencies in the foreign exchange market is determined by supply and demand, a key factor in Forex trading. According to the law of supply and demand, when a currency is in greater demand, its value will rise, and when its supply rises, its value will fall.

The demand for a currency in Forex trading is influenced by several economic variables, including interest rates, inflation, economic growth, and political stability. For instance, if a nation has high-interest rates, overseas investors may be more likely to invest there, raising the demand for that nation's currency. Similarly, if a nation's economy is expanding, there may be a rise in demand for its currency.

On the other hand, several variables, including monetary policy, governmental policies, and economic conditions, affect a currency's supply. For instance, if a central bank increases the money supply, the increased supply may cause the currency’s value to decline.

Leverage and Margin

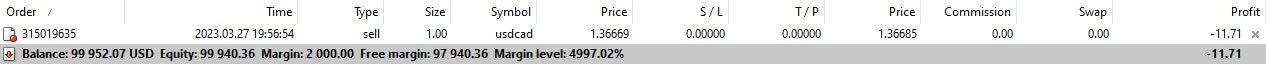

In Forex trading, the terms leverage and margin both refer to using borrowed money to raise the potential returns on investment.

Leverage is the amount of money a trader can borrow from a broker to open greater trading positions. Typically, leverage is described as a ratio, such as 50:1 or 100:1. For instance; a trader can manage a position worth $100,000 with just $1,000 of their own money when the leverage ratio is 100:1. With the aid of leverage, traders can profit from minute changes in price on the Forex market and potentially increase their return on investment. Yet, leverage greatly magnifies any possible losses if the trade goes against the trader.

Contrarily, the margin is the sum of money a trader must deposit with a broker to open a position employing leverage. Typically, the margin is shown as a percentage of the total deal value. To handle a position worth $100,000, for instance, a trader would need to deposit $1,000 with a 1% margin requirement.

In losses, the margin is collateral for the borrowed cash and lowers the broker's risk. If the trader loses money, the broker may issue a margin call, requiring the trader to deposit more money to keep their open position.

Risks and Benefits of Forex Trading

When you start trading Forex, you need to understand that there are both risks and benefits to trading currencies, as there are with any market.

Advantages of Forex Trading

Some of the most cited advantages of Forex trading include the market’s highly liquid nature. The ability to trade in an environment that allows for easy entry and exit of positions is paramount. The Forex trading hours are 24 hours daily, allowing anyone to participate. The Forex market also has a very low barrier to entry, which is part of what makes it so appealing.

Risks of Forex Trading

Like any market, the Forex market does come with risks. The volatile nature of the market can make trading it dangerous at times, and the leverage and margin risks also can be an issue. The ability to control large positions means that the wins can be accelerated, but losses can also. Furthermore, there have been unscrupulous actors in the past, and fraud was rife. The choice of broker is crucial in this sense.

How to Start Forex Trading

Once you have decided to start trading Forex, there are a few steps you need to take in order to get involved in the markets. Forex trading for beginners can seem daunting, but like anyone else, you have the same opportunity.

Types of Orders

Traders use multiple orders in the Forex markets, including buy orders, sell orders, stop-loss orders, and take-profit orders. The initial order to buy or sell a currency pair will then be followed by a stop-loss order, which tells the broker when you wish to exit the position in case of losses. This is done to protect your account. Take-profit orders are used to tell the broker when you wish to exit a trade and collect potential profits. Both are done automatically.

Choosing a Forex Broker

To access the Forex markets, traders need a broker that acts as an intermediary between various parties in the market. A trader’s broker choice is extremely important, as the safety of funds, execution of trades, and regulation all come into play.

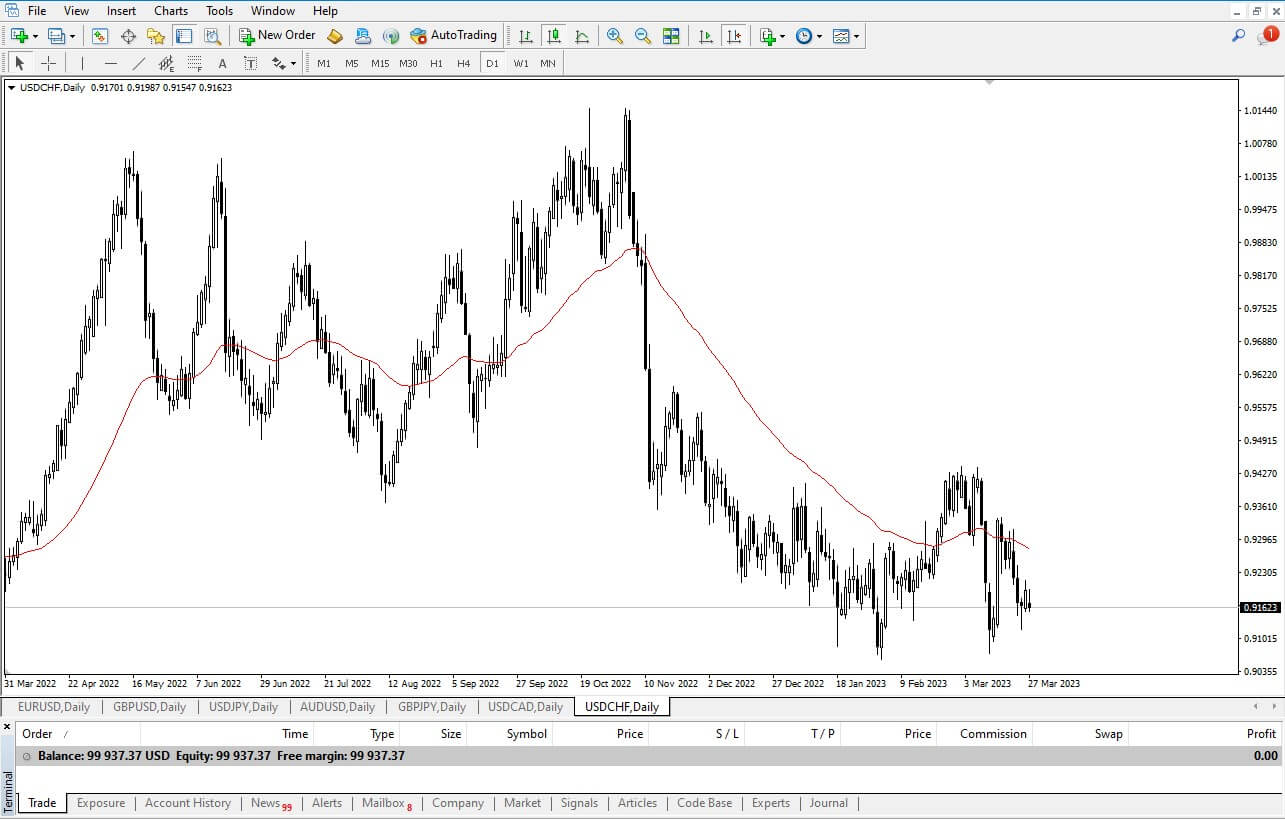

Understanding Trading Platforms

The Forex trading platform available is also important. The trader should be able to download a demo account to get familiar with the platform’s features. The last thing a trader wants to do is make mistakes entering or exiting a trade due to unfamiliarity with the platform. It should be noted that there is also a Forex trading app available for mobile phones as well.

Reading Forex Charts and Technical Analysis

Technical analysis, or “chart reading,” is important for Forex traders, as it can give hints about where buying and selling could occur in a currency pair. There are various indicators, candlestick formations, and forms of market structure that traders will use to make predictions on future prices based on past events.

Fundamental Analysis of Currency Pairs

Having a grasp on the fundamental factors that can move a currency is important. Interest rates, geopolitical concerns, GDP, employment, and many other things can move a currency. Learning about these factors is crucial.

Why Trade Forex with VSTAR?

If you are going to trade Forex, you will find VSTAR as a great solution to your brokerage needs. Some of the main reasons are listed below.

Fully Regulated

It is important to know that your broker is reliable and trustworthy. By being regulated, VSTAR has proven itself to be both. VSTAR is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC No. 409/22) and is a Cyprus Investor Compensation Fund member. VSTAR also operated under the European Regulatory Framework of MiFiD II.

Institutional Costs

VSTAR offers an institutional-level trading experience with the lowest trading fee. VSTAR offers 0 commission, and super tight trading spreads, allowing you to retain more profit. The deep liquidity offered also means that you will have reliable and super-fast order execution.

Tips for Success

Below are a handful of helpful tips to become successful in Forex trading. If you want to know how to invest in Forex, these following points are crucial to be aware of.

Develop a Workable Trading Plan

You should only put money to work once you have developed a reliable trading plan. This can be a plan you have read about somewhere or a mix of others’ work and your own. The trading system should have concise rules and be easy to implement. Furthermore, you should backtest it using historical market data to see how it typically performs.

Staying Disciplined and Patient

No matter how effective your trading plan is, if you cannot stay disciplined and patient, it is pointless to use a system. You must stay patient and stay disciplined. This is one of the biggest reasons for failure in retail trading.

Managing emotions

Understanding that emotions are one of the most difficult parts of trading can give you an idea of how to stay disciplined and patient. Most traders have a very hard time regulating their emotions when money is on the line, so it is paramount that you make sure to keep your emotions in check. In fact, most traders will say this is the biggest difference between profitable and losing traders.

Keeping Up with News and Events

It’s important to keep up with news and events, as they can greatly influence how the market moves. Furthermore, you should be aware when some bigger events are coming. For example, the last thing you want to do is put a big position in the market just a few minutes before a central bank interest rate decision. You must have a good economic calendar at your disposal.

Learning From Mistakes and Adapting to Changes

Never get too stuck in your routine. Make sure you adapt to changes in the market, as only some currencies will act the same as others. For example, something specific may be going on with a specific currency. More importantly, you need to make sure you learn from your mistakes. If you don’t do so, it can be expensive.

Conclusion

Forex basics

It is important to understand the basics of the Forex market. This includes the types of orders and the ability to understand technical and fundamental analysis. It also means understanding the risks and benefits of trading currencies, leverage, and margin. Ensure you are comfortable with all of the terms and unique characteristics of the Forex market.

Ongoing Education

Remember that markets are dynamic in nature and can be challenging. This is why ongoing education is crucial. Professional traders always continue learning and love the challenges of this endeavor. Ensure you do not rest on your laurels; always seek opportunities to strengthen your skills. Simply put, you do not learn Forex trading overnight, nor do you ever know “everything there is to know about it.”

FAQs

Can I start trading Forex with $50?

With some brokers, it is possible. However, you should understand that a small account is only a start, not something to build wealth on. That said, it is a great way to practice with a little “skin in the game.”

Is trading Forex profitable?

It can be. It depends on whether the trader in question has a solid and profitable system. It also will count on solid money management and sticking with the plan. Some traders make enormous profits trading Forex.

How many Forex accounts can I open?

You can open as many accounts as you want. It isn’t uncommon for a professional trader to have a different account for different trading systems. This is because some systems will perform better in some conditions while others will not. This helps even out the returns over time.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.