Welcome to an inside look at one of the world's most innovative and successful companies, Alphabet Inc. As the parent company of Google, this company has revolutionized the way people connect, search, and advertise online. In this article, we'll go over Alphabet's business model, financials, and stock performance, as well as potential risks and growth opportunities. So let's see what makes Alphabet a trillion-dollar tech giant.

Alphabet Inc.'s Overview

Founding of Alphabet

In August 2015, Google co-founders Larry Page and Sergey Brin founded a holding company that was aimed at restructuring Google. The new entity, which they named Alphabet Inc., would contain some of Google's subsidiaries and narrow the scope of its operations.

Alphabet consists of several companies, with Google being the largest of them. Google's focus is on internet-related products such as search, advertising, and cloud services.

The restructuring allowed each subsidiary to operate independently, resulting in more efficient management. In 2015, Sundar Pichai was appointed CEO of Google, while Larry Page became CEO of Alphabet. Later in 2019, Page and Brin announced their resignations from their respective roles, with Pichai taking on the position of CEO at Alphabet while retaining his position at Google.

Currently, Alphabet's market capitalization is over $1.5 trillion, with its headquarters located in Mountain View, California.

Key milestones in the company's history

Google's founding in 1998 was a major milestone in the history of the internet. The company quickly became a dominant player in the search engine industry and went public in 2004, raising $1.67 billion in an initial public offering (IPO). Google has continued to innovate and expand its services over the years, with key milestones including:

● 2016: Google's artificial intelligence program, AlphaGo, defeated a professional human player in the board game Go for the first time. This achievement demonstrated the power of AI and set the stage for further advancements in the field.

● 2017: Former executive Eric Schmidt revealed in a 2017 conference that the inspiration for Alphabet's structure came from Warren Buffett and his management structure of Berkshire Hathaway a decade ago.

● 2019: Larry Page and Sergey Brin stepped down from their roles as CEO and president, respectively. Sundar Pichai took over as CEO of both Alphabet and Google, consolidating the leadership of the two companies.

● 2020: Readers from 180 countries chose to support Alphabet financially more than 1.5 million times in 2020.

● 2021: Alphabet's revenue reached $261.6 billion, a 45% increase from the previous year. This growth was driven by strong performance in advertising, cloud computing, and other businesses.

Current company structure and leadership

Alphabet is the parent company of several subsidiaries, including Google, Waymo, and Verily. Google is divided into several business units, including Search, Ads, Cloud, and YouTube. Ruth Porat serves as the CFO for both Alphabet and Google. Sundar Pichai is the CEO of both companies, providing a unified vision and strategy for the organization.

Alphabet's Business Model and Products/Services

Business Model

As a potential investor or one who has already invested, it is important to understand the company's business model in depth. Though it is widely known that Google generates a significant portion of its revenue from advertising, you have to note that Google's business model is not solely reliant on this one revenue stream.

Firstly, Google's parent company, Alphabet, owns numerous other companies beyond Google, including Nest, Waymo, and Verily, each of which operates in a different sector. However, Google is by far the largest and most profitable subsidiary of Alphabet.

When it comes to Google's revenue streams, advertising is the main source of income. Google sells ads across its search engine as well as on its maps and video-sharing platform, YouTube. Additionally, Google also allows other websites and apps to show its ads through its AdSense program.

However, Google's revenue sources don't end there. The company also generates significant revenue through its cloud computing business, Google Cloud. In recent years, Google Cloud has been one of the company's fastest-growing business segments. Through Google Cloud, the company offers cloud storage, infrastructure, and computing services to businesses.

Google also generates revenue through its hardware products, which include smartphones, laptops, and smart home devices. While these products may not generate as much revenue as the advertising or cloud businesses, they do contribute to Google's overall revenue stream.

Main Products and Services

Google's search engine is one of its best-known products and allows users to search for information and web pages online.

Google Maps is a navigation and mapping service that provides users with directions, traffic updates, and information about businesses and landmarks.

YouTube is a video-sharing platform where users can upload, watch, and share videos.

Google Cloud is a cloud computing service that provides businesses with storage, computing power, and other tools and services in the cloud.

Google's hardware products include smartphones, smart speakers, and smart home devices, which are designed to integrate with Google's services and allow users to access them through voice commands or other means.

In recent years, Google has also made significant strides in artificial intelligence (AI) development, leveraging machine learning and natural language processing technologies to improve its products and services. Examples of Google's AI developments include Google Assistant, which uses natural language processing to understand voice commands, and Google Translate, which uses machine learning to provide accurate translations between languages. Additionally, Google's DeepMind subsidiary is dedicated to developing cutting-edge AI technologies for a range of applications, from healthcare to climate modeling.

Alphabet's Financials, Growth, and Valuation Metrics

Google's Financial Statements

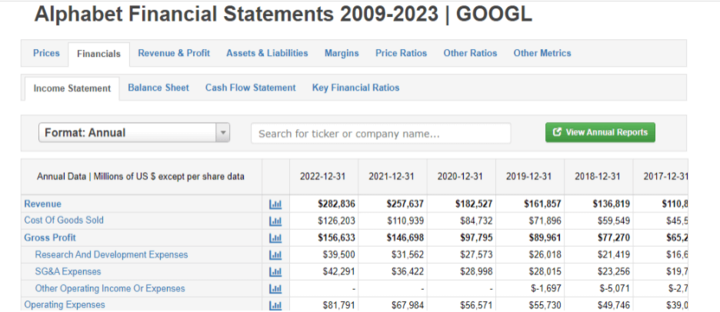

Revenue growth over the past 5 years:

Over the past five years, Google's revenue has shown strong and consistent growth. In 2018, Alphabet's annual revenue was $136.8 billion, which increased to $282.8 billion in 2022, representing a compound annual growth rate (CAGR) of 22.5%. This growth has been primarily driven by Google's advertising business, which generates a significant portion of its revenue. Google's advertising revenue grew from $94.4 billion in 2018 to $218.1 billion in 2022, representing a CAGR of 23.8%. Additionally, Google's cloud business has also shown promising growth, with revenue increasing from $4.1 billion in 2018 to $29.3 billion in 2022, representing a CAGR of 63.7%.

Profit margins:

Google has consistently maintained healthy profit margins over the past five years. In 2022, Alphabet's operating margin was 22.5%, which was a slight decrease from the previous year due to higher TAC and other costs. However, the net income margin increased to 20.8% in 2022, up from 18.9% in 2021, reflecting improved operating efficiency and lower income tax expenses.

Cash from operations (CFFO):

Google has consistently generated strong cash flows from operations over the past five years. In 2022, Alphabet generated $65.4 billion in CFFO, up from $50.9 billion in 2021, representing a growth rate of 28.4%. This strong cash flow generation has enabled Google to invest in growth opportunities, fund research and development activities, and return capital to shareholders through share buybacks and dividend payments.

Balance sheet strength and implications:

Google has a strong balance sheet with significant cash reserves, short-term investments, and low debt levels. In 2022, Alphabet's cash, cash equivalents, and marketable securities totaled $156.9 billion, which provides significant financial flexibility to invest in growth opportunities, pursue strategic acquisitions, and weather economic downturns. Additionally, Alphabet has low debt levels, with a total debt of $7.6 billion and a debt-to-equity ratio of 0.02, which provides further financial stability.

Key Financial Ratios and Metrics

Moving on to key financial ratios and metrics, it is important to compare Alphabet's revenue and earnings growth as well as forward P/E ratio to its largest tech peers to determine if Alphabet stock is under or overvalued based on growth potential. Alphabet's revenue growth over the past 5 years has been strong, with a CAGR of 19.8%. This growth has outpaced the revenue growth of its largest peers, including Microsoft and Amazon, which have had revenue CAGRs of 12.6% and 23.2%, respectively, over the same period.

In terms of earnings growth, Alphabet has had a CAGR of 16.3% over the past 5 years, which is slightly lower than Amazon's CAGR of 20.2%, but higher than Microsoft's CAGR of 13.3%.

Alphabet's forward P/E ratio of 25.5x is lower than Amazon's forward P/E of 61.7x and higher than Microsoft's forward P/E of 24.4x, suggesting that the market views Alphabet as moderately undervalued compared to its peers.

Alphabet Stock Performance

Google Trading Information

Primary Exchange & Ticker: Google was listed on the NASDAQ stock exchange on August 19, 2004, under the ticker symbol GOOGL.

Country & Currency: Alphabet Inc. is a US-based company, and its stock is traded in US dollars.

Trading Hours; Pre-market; After-market: The NASDAQ stock exchange is open from 9:30 AM to 4:00 PM Eastern Time. Pre-market trading begins at 4:00 AM and ends at 9:30 AM Eastern Time, while after-market trading runs from 4:00 PM to 8:00 PM Eastern Time.

Stock Splits: Since its initial public offering (IPO), Google has undergone two stock splits. The first was a two-for-one stock split in April 2014, and the second was also a two-for-one stock split in April 2015. As a result, one share of the original GOOGL stock was divided into four shares.

Dividends: The company does not currently pay dividends to its shareholders. The company's focus is on reinvesting its earnings in growth opportunities to drive long-term shareholder value.

Latest Developments Investors/Traders Should Note:

Google's recent announcement of a reduction in workforce of approximately 12,000 roles is likely to have a significant impact on the company's financials in the short term, with expected severance and related charges of $1.9 billion to $2.3 billion.

Another development is the advancement of Google's artificially intelligent (AI) language model 'Bard' to its next stage. This model has the potential to revolutionize the way computers understand and generate natural language, which could lead to significant advancements in various industries.

Lastly, Google's Q1 ad sales surge of 32%, which contributed to Alphabet's doubling of profits in the first quarter of 2023. This impressive performance reflects the strength of Alphabet's core advertising business and its ability to adapt to changes in consumer behavior and preferences. These developments are likely to have a positive impact on Alphabet's stock price in the near term.

Alphabet Stock Performance

Over the past five years, Alphabet's stock price has experienced significant growth, increasing by approximately 138%. The stock has consistently outperformed the S&P 500 index, which has grown by approximately 76% over the same period. Alphabet's revenue growth and earnings growth have been strong, with a 5-year compound annual growth rate (CAGR) of 18% and 26%, respectively.

Key Drivers of Alphabet Stock Price

The key drivers of Alphabet's stock price include revenue growth, earnings growth, and market sentiment. The consistent reporting of strong financial results has made revenue growth a significant driver of Alphabet's stock price in recent years. The primary source of Alphabet's revenue stems from advertising sales, which are primarily facilitated through its subsidiary, Google. The company has successfully sustained its position as a dominant force within the online advertising market.

The growth in earnings is a significant factor that drives the stock price of Alphabet. Alphabet has a robust history of generating profits, and stakeholders will be closely monitoring its capacity to sustain earnings growth in the future. Apart from its primary advertising business, Alphabet has made significant investments in cloud computing, artificial intelligence, and other nascent technologies. These regions signify substantial avenues for expansion for Alphabet.

Market sentiment is a significant driver of Alphabet's stock price. The sentiment of investors can be impacted by various factors, such as company news, macroeconomic patterns, and geopolitical events.

Future Prospects for Alphabet Stock

Looking ahead, Alphabet's strong financial position and continued investment in emerging technologies position the company for long-term growth. Its focus on innovation and its ability to monetize its vast data resources through advertising and other business lines provide a solid foundation for future earnings growth. However, Alphabet's stock price is not immune to market volatility, and investors should remain vigilant for potential risks such as regulatory changes or unexpected disruptions to the advertising market.

Risks and Opportunities

Potential risks facing Google

Competitive Risks

|

Main Competitors |

Threat |

|

TikTok |

Competition from TikTok poses a threat to Alphabet's YouTube platform, which relies heavily on advertising revenue. |

|

Apple |

Apple's Siri presents a competitive threat to Alphabet's Google Assistant in the voice assistant market. |

|

Amazon |

Amazon's Alexa is a rival to Google Assistant, and Amazon Web Services (AWS) presents a competitive threat to Google Cloud. |

|

NVIDIA |

NVIDIA's graphics processing units (GPUs) are used for machine learning and artificial intelligence, which presents a competitive threat to Alphabet's cloud and AI businesses. |

|

Microsoft |

Microsoft's Cortana presents a competitive threat to Google Assistant, and Microsoft Azure presents a competitive threat to Google Cloud. |

|

Adobe |

Adobe's Creative Cloud is a threat to Google's G Suite. |

Competitive Advantages

|

Competitive Advantages |

Explanation |

|

Search Dominance |

Google dominates the online search market, with over 90% market share. |

|

Strong Brand |

Alphabet's Google brand is one of the most recognizable and valuable brands in the world. |

|

Diversified Business Portfolio |

Alphabet has a diverse portfolio of businesses, including search, cloud, hardware, and autonomous vehicles. |

|

Advanced Artificial Intelligence Capabilities |

Alphabet has significant expertise in artificial intelligence and machine learning, which is a key differentiator in the technology industry. |

Other Risks

|

Other Risks |

Explanation |

|

Regulation |

Alphabet faces regulatory risks related to online privacy, data usage, and search and advertising practices. |

|

Global Economic Conditions |

Economic downturns or geopolitical events can impact advertising budgets and negatively affect Alphabet's revenue. |

|

Product Issues and Security Breaches |

Alphabet is challenged by risks related to product defects or security breaches, which can negatively impact consumer trust and harm the company's reputation. |

Opportunities For Growth And Expansion

Growth opportunities

Ecommerce and Payments: Google has been expanding into ecommerce and payments through Google Shopping and Google Pay. The company has a large user base and could leverage this to compete with established players like Amazon and PayPal.

Cloud Services: Google Cloud is rapidly growing and has been making significant investments to compete with Amazon Web Services and Microsoft Azure. Cloud services offer a large growth opportunity for Google, and they need to focus on it.

Voice Assistants: Google has a strong presence in the voice assistant space with Google Assistant, but there is still room for growth. The company needs to be steadfast to maintain its competitive edge.

Self-Driving Cars: Google's Waymo is a leader in the self-driving car space, and this technology has significant growth potential. Waymo has been expanding its services, and Google needs to continue to invest in this area to stay ahead of the competition.

Health Tech: Google has been investing in health tech through its subsidiary Verily. This area presents significant growth potential, and they must invest in it to compete with established players.

YouTube Advertising and Subscriptions: YouTube is one of the largest video-sharing platforms in the world, and Google has been investing heavily in advertising and subscriptions on the platform. This presents a significant growth opportunity for the company.

Future Outlook and Expansion

Despite the potential risks, Google is well-positioned for future growth and expansion. The company has a large user base and a strong brand, and it is investing heavily in innovation and new areas of growth. Google has a market cap of over $1 trillion and a forward P/E ratio of 29.9, which suggests that investors have confidence in the company's future prospects.

How to Invest In Alphabet Stock

There are three ways to invest in Alphabet stock, including holding its share, using options, or trading Contracts for Difference (CFDs). Here's a brief introduction and comparison of each way:

|

Investment Method |

Brief Description |

Benefits |

|

Hold its share |

Buying shares of Alphabet stock directly from a stock exchange and holding them in a brokerage account. |

Long-term investment, shareholder voting rights, potential dividends, and capital appreciation. |

|

Option |

Buying the right to buy or sell Alphabet stock at a set price within a specific time frame. |

Limited risk, customizable leverage, and flexibility. |

|

CFD |

Speculating on the price movement of Alphabet stock without owning the underlying asset. |

No ownership of the stock, access to leverage, ability to go long or short, and lower trading costs. |

Why Trade Alphabet Stock CFD With VSTAR

While each investment method has its benefits, trading Alphabet stock CFDs with VSTAR offers several advantages, including:

● Competitive pricing: VSTAR offers some of the most competitive spreads in the market, reducing your trading costs.

● Negative balance protection: VSTAR provides negative balance protection to ensure that you cannot lose more than your account balance, protecting you from unexpected market moves.

● Real-time trading opportunities: With VSTAR, you can trade Alphabet stock CFDs on popular markets in real-time, giving you the ability to take advantage of market movements as they happen.

It doesn’t matter if you're a novice or an experienced trader, VSTAR offers the tools and resources you need to make trading decisions. Sign up and start trading Alphabet stock CFDs with VSTAR today!

Conclusion

In conclusion, Alphabet, the parent company of Google, continues to be a dominant force in the tech industry, with a strong business model and a wide range of innovative products and services. Their focus on AI development has enabled them to stay ahead of the competition and explore new opportunities for growth and expansion. The company’s financials and key metrics are strong, and they remain committed to delivering value to our shareholders. There is confidence in the future prospects and therefore encourage investors to consider Alphabet stock as a valuable addition to their portfolio.