If you're interested in trading the EUR/CHF currency pair, you might need a good knowledge of the fundamental analysis. It is the process of evaluating economic, financial, and other qualitative and quantitative factors that can influence the value of a currency.

The EUR/CHF currency pair is the exchange rate between the euro, the official currency of the European Union, and the Swiss franc, the currency of Switzerland. This pair is one of the most widely traded in the forex market, as both currencies are considered safe-haven assets and are heavily used in international trade.

Fundamental analysis is crucial in evaluating the economic conditions of the Eurozone and Switzerland, which can significantly impact the value of their currencies. This analysis typically involves examining economic indicators such as GDP growth rates, inflation, employment data, and central bank policies.

For example, if the European Central Bank (ECB) announces a reduction in interest rates, this could lead to a decrease in the value of the euro against the Swiss franc. Similarly, if the Swiss National Bank (SNB) announces measures to control inflation, this could lead to an increase in the value of the Swiss franc.

Fundamental analysis is an essential tool for traders looking to trade the EUR/CHF currency pair. By staying informed about economic indicators and central bank policies, you can make more informed trading decisions and potentially improve your chances of success.

In this article, we'll take a look at the fundamental analysis of the EUR/CHF currency pair. The Euro (EUR) and Swiss franc (CHF) are two major currencies in the forex market, and understanding their fundamentals can help you to make informed trading decisions.

Macroeconomic Overview - Eurozone

To understand the fundamentals of the EUR/CHF currency pair, it is essential to analyze the macroeconomic environment of the Eurozone. The Eurozone is a monetary union of 19 European countries that share the euro currency.

Here are some key indicators that affect the performance of the euro:

A. Economic Indicators Review

In recent years, the Eurozone's GDP growth rate has improved, with a 1.5% growth in 2021 and a forecasted 4.5% growth in 2022, according to the European Commission. The unemployment rate has also decreased, reaching 7.5% in 2021, while inflation has risen, averaging 2.2% in 2021 due to higher energy and commodity prices.

Additionally, business and consumer confidence indicators have improved, with the European Commission's economic sentiment index standing at 117.2 in March 2022.

When it comes to managing risks associated with trading the EUR/CHF pair, traders should also pay attention to political and economic developments in Switzerland. In 2021, the Swiss National Bank maintained its negative interest rate policy and intervened in the foreign exchange market to limit the appreciation of the Swiss franc. The Swiss economy has also been recovering, with a GDP growth of 3.4% in 2021 and forecasted growth of 2.8% in 2022, according to the Swiss National Bank.

In 2023, the outlook for the Eurozone and Switzerland remains positive, with the European Commission forecasting GDP growth of 1.8% and 2.2%, respectively. However, as with any investment, there are risks associated with trading EUR/CHF, and it is important for traders to manage those risks effectively through strategies such as stop-loss orders, position sizing, diversification, and technical and fundamental analysis.

B. Monetary Policy

The European Central Bank (ECB) is responsible for the monetary policy of the Eurozone. The ECB has maintained a loose monetary policy stance, with its key interest rate at 0% and a negative deposit rate of -0.5%. The market expects the ECB to maintain its low-interest rate policy in the near future.

C. Political Climate

The European Union (EU) is a political union of 27 European countries, including the Eurozone countries. The EU has been implementing policies aimed at promoting economic growth and stability in the region.

On the other hand, the Brexit decision has had a negative impact on the Eurozone's economy due to the uncertainty surrounding the UK's future relationship with the EU. The Eurozone is expected to face some challenges as it navigates this transition.

Macroeconomic Overview - Switzerland

When it comes to analyzing the EUR/CHF currency pair, it's also crucial to have a solid understanding of the macroeconomic factors that impact the Swiss economy.

A. Economic Indicators Review

Switzerland has a stable economy with a low unemployment rate, which is currently at 2.7% (as of March 2023). Its GDP growth rate has been steady, hovering around 2% for the past few years. Inflation rates have been relatively low in Switzerland, with an average annual rate of 0.5% over the past five years.

However, it's important to keep an eye on any changes in inflation rates, as they can impact the country's monetary policy. Business and consumer confidence levels in Switzerland have remained high, indicating a positive outlook for the economy.

B. Monetary Policy

The Swiss National Bank (SNB) plays a crucial role in Switzerland's monetary policy. The SNB has kept interest rates at historic lows in recent years, which has helped to support the economy. While the SNB has indicated that it may raise interest rates in the future, the timing of any rate hikes is uncertain. Any change in interest rates can impact the value of the Swiss franc and, therefore, the EUR/CHF currency pair.

C. Political Climate

Switzerland has a stable political climate, and its government has implemented policies to support economic growth and stability. As a small, open economy, Switzerland is vulnerable to geopolitical risks, such as trade disputes and political instability in neighboring countries. Any such risks can impact the country's economy and the value of the Swiss franc.

Analysis of the EUR/CHF Currency Pair

The EUR/CHF currency pair is an important one to watch for investors and traders alike. We'll take a look at the relevant economic indicators, factors supporting a bullish or bearish stance, and potential risks to the currency pair.

A. Relevant Economic Indicators

There are several relevant economic indicators to consider. Firstly, the correlation between the eurozone and Swiss economies should be examined. The Swiss economy is highly dependent on the eurozone, as Switzerland exports a significant portion of its goods to the EU. Therefore, any significant changes in the eurozone economy can impact the CHF's value.

GDP growth, inflation rates, and interest rates also have a significant impact on the currency pair. Higher GDP growth typically results in an appreciation of the currency, while higher inflation rates can lead to depreciation. Interest rates can also have a significant impact, as higher interest rates tend to lead to an appreciation of the currency.

B. Factors Supporting a Bullish or Bearish Stance

Several factors can support a bullish or bearish stance on the currency pair. The European Central Bank's monetary policy can impact the currency pair, as it can influence the value of the euro. The Swiss National Bank's monetary policy can also impact the CHF's value.

Additionally, the safe-haven status of the Swiss franc can also impact the currency pair, as investors tend to flock to safe-haven currencies during times of economic uncertainty.

C. Potential Risks to the Currency Pair

Potential risks to the currency pair include sudden changes in global economic fundamentals, unexpected changes in the eurozone or Swiss monetary policies, and political instability in the eurozone or Switzerland. These risks can cause significant fluctuations in the value of the currency pair.

Trading Strategies for EUR/CHF

One potential trading strategy for the EUR/CHF currency pair is to use a combination of fundamental and technical analysis. Fundamental factors such as economic data, political events, and central bank policies can all impact the exchange rate. For example, if the Swiss National Bank (SNB) were to increase interest rates, this could potentially strengthen the Swiss franc and weaken the euro.

In addition to fundamental analysis, technical indicators such as moving averages and Bollinger Bands can be used to identify potential entry and exit points based on historical price and volume data. For example, a trader might look for a bullish trend in the EUR/CHF pair using a combination of technical indicators and then enter a long position when the price is near a key support level.

It's important to note that no trading strategy is foolproof, and traders should always be prepared to manage risk and adapt to changing market conditions. It's also important to have a solid understanding of the underlying fundamentals of the EUR/CHF pair and the broader market dynamics at play.

However, you can use the VSTAR trading platform to do the technical analysis as it provides many technical tools and indicators for their traders. VSTAR is an online trading platform that can help you execute your trades quickly and easily.

A. Technical Analysis

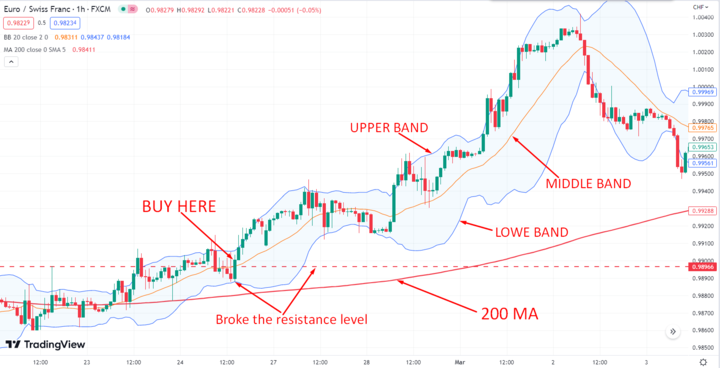

Technical analysis involves using charts and indicators to identify trends and patterns in the market. Some popular indicators include moving averages and Bollinger Bands. By analyzing these charts, you can identify potential entry and exit points for your trades.

The above chart shows the price is residing above the 200 moving average line, which means the trend is bullish. So, when the price broke above the resistance line with an impulsive bullish candle, after touching the Bollinger Band lower band.

You can enter a buy trade, by putting the stop-loss below the Bollinger Band lower band. However, you can take the profit, when the price touches the Bollinger Band upper band. Otherwise, you can ride the trend until the price breaks below the 200 moving average indicator line.

B. Risk Management

EUR/CHF is a popular currency pair traded in the foreign exchange market. As with any investment, there are risks associated with trading EUR/CHF, and it is important to manage those risks effectively.

Here are some risk management strategies that traders can use when trading the EUR/CHF pair:

- Stop-loss orders:One of the most important risk management tools available to traders is the stop-loss order. A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price level. This can help limit losses if the trade doesn't go as expected.

- Position sizing:Another important aspect of risk management is position sizing. Traders should determine the appropriate position size for each trade based on their risk tolerance and the size of their trading account. A general rule of thumb is to risk no more than 1-2% of your account on any given trade.

- Diversification:Diversifying your portfolio by trading multiple currency pairs can help spread risk and reduce exposure to any one particular currency pair. This can be especially important when trading a volatile currency pair like EUR/CHF.

- Fundamental analysis:Traders should also stay up-to-date on economic and political developments in the eurozone and Switzerland, as these can have a significant impact on the EUR/CHF exchange rate. This can be done through fundamental analysis, which involves analyzing economic indicators and news releases to predict future price movements.

C. News Trading

News trading involves following economic events and data releases and trading based on market reactions to this news. This strategy can be particularly effective for the EUR/CHF pair, as both currencies are heavily influenced by events in the Eurozone.

The above chart shows that when the CHF positive interest rate was released, the bears pushed the price downside quite impulsively. So, in this situation, you can enter a trade when the price retraces at least 50% of the impulsive candle. However, you can take the profit, when the price touches the 200 moving average line.

If you choose to trade the EUR/CHF pair on VSTAR, you'll benefit from a user-friendly platform that works quickly and easily. You can also take advantage of VSTAR's educational resources and analysis tools to help you develop and refine your trading strategy. Thus, you'll be well-equipped to make informed trading decisions and maximize your profits.

Conclusion

After conducting a fundamental analysis of the EUR/CHF currency pair, we can conclude that it is currently in a bearish trend. The euro has been weakened by the COVID-19 pandemic and the economic slowdown in the Eurozone, while the Swiss franc remains strong due to its safe-haven status. Additionally, the recent political uncertainties in the Eurozone, such as Brexit and the Italian political crisis, have further weakened the euro.

Based on our analysis, we recommend a cautious approach to trading the EUR/CHF currency pair. The current bearish trend may continue in the short term, but it is essential to monitor any significant changes in economic and political factors that may affect the currency pair's direction. We advise traders to consider using risk management tools such as stop-loss orders and position sizing to minimize potential losses.

Overall, trading the EUR/CHF currency pair requires a thorough understanding of the fundamental factors that impact the currencies' value. It is crucial to stay up-to-date with current economic and political developments that can significantly impact the currency pair. Combining fundamental analysis with effective trading strategies and risk management techniques can help traders navigate the markets and make informed decisions. With the right approach and VSTAR technology, traders can potentially profit from trading the EUR/CHF currency pair while managing their risk effectively.