The stock market is always changing, but few companies have captured the attention and imagination of investors like Xiaomi Corporation. Known for its innovative technology and rapid growth, Xiaomi has become a household name both in China and on the global stage. But the burning question on every investor's mind is: Is Xiaomi stock a buy? Today, we will dive into the fascinating world of Xiaomi stock and examine the characteristics that make it attractive to investors. So buckle up and get ready for an exciting ride as we dissect Xiaomi stock and determine if it is worth your investment.

I. Introduction

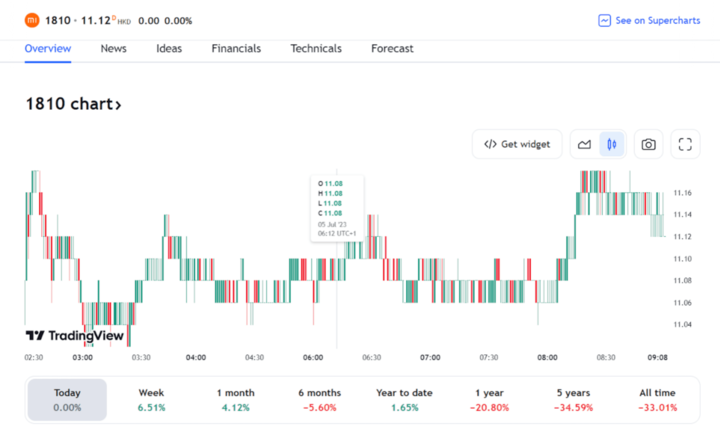

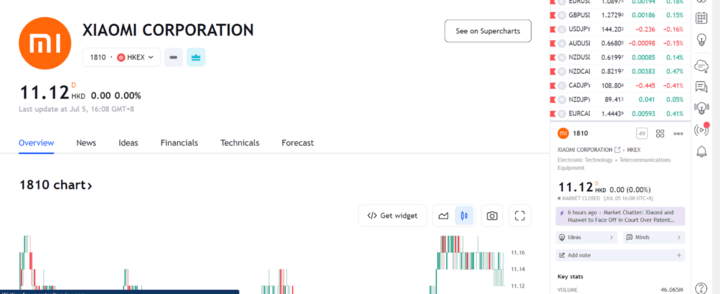

Investors and traders have been closely monitoring the share price movements of Xiaomi Corporation (1810.HK) on the Hong Kong Stock Exchange. With highs of HK$13.52 and lows of HK$10.84, these fluctuations present an intriguing opportunity for potential investors. The question that arises is whether Xiaomi's current trading price of HK$11.12 accurately reflects the true value of this large-cap company. Could it be undervalued and thus present an attractive buying opportunity?

Source: Istock

Recent Xiaomi Share Price Performance

Based on our valuation model, Xiaomi stock currently appears to be undervalued. It is currently trading around 17.89% below its intrinsic value, suggesting that the stock is attractively priced. Given that Xiaomi's current price is HK$11.22, there may be further upside potential if the price aligns with its true value. It is also important to note that Xiaomi stock has a high beta, indicating that its price movements may be more volatile compared to the broader market.

Xiaomi stock Growth Potential

When evaluating a stock, growth prospects play an important role. In the case of Xiaomi, earnings are expected to more than double over the next few years, signaling a promising future. The company is also ramping up production in India to regain market share and recently introduced wireless augmented reality glasses, demonstrating its commitment to innovation. These factors contribute to higher cash flow and, ultimately, a potentially higher stock valuation.

Key Xiaomi News and Developments

Xiaomi has been making headlines with its strategic moves and initiatives. For example, the company is demanding a payout from a supplier after early design drafts of an upcoming car model were leaked. Such developments show Xiaomi's determination to protect its intellectual property and ensure a competitive edge. Investors should take note of these recent events as they may impact the company's reputation and market position.

II. Overview of Xiaomi Corporation

Source: Istock

Founded: April 2010

Founder: Lei Jun

Headquarters: Beijing, China

Key milestones

2011: Xiaomi released its first smartphone, the Mi 1.

2014: Became the fourth largest smartphone manufacturer in the world.

2015: IPO on the Hong Kong Stock Exchange.

2016: Launched MIUI operating system.

2017: Became the world's third-largest smartphone maker.

2018: Launched the Mi TV.

2019: Launched the Mi electric scooter.

2020: Become the second largest smartphone manufacturer in the world.

Current Company Structure

Xiaomi is a diversified technology company with businesses in smartphones, smart homes, wearables, artificial intelligence, and other areas. The company is organized into three main segments:

Consumer Electronics: This segment includes smartphones, laptops, televisions, routers, and other consumer electronics products.

Internet Services: This segment includes the MIUI operating system, Mi Cloud service, and Mi Pay payment service.

Lifestyle Products: This segment includes electric scooters, air purifiers, and other smart home products.

CEO

Name: Lei Jun

Background: Lei Jun is the founder and CEO of Xiaomi. He is a serial entrepreneur who has founded several successful companies, including Kingsoft and UCWeb. Lei Jun graduated from Wuhan University of Technology.

III. Xiaomi Corp's Business Model and Products/Services

Source: Istock

A. How Xiaomi makes money

Xiaomi's business model revolves around low-cost manufacturing, online sales, and generating revenue from Internet services. By keeping manufacturing costs low and selling products primarily online, Xiaomi is able to offer high-quality products at competitive prices. In addition, the Company generates revenue from its internet services, such as the MIUI operating system, Mi Cloud and Mi Pay.

B. Main Products/Services

Xiaomi Company's main products/services include:

Source: Xiaomi

Smartphones: Xiaomi is known for its affordable and feature-rich smartphones.

Smart Home Products: Xiaomi offers a range of connected devices for the smart home, including air purifiers, water purifiers, and more.

Wearables: Xiaomi's wearable devices, such as smartwatches and fitness trackers, provide users with health and activity tracking capabilities.

Internet Services: Xiaomi provides internet services through its MIUI operating system, Mi Cloud storage, and Mi Pay payment service to millions of users worldwide.

IV. Xiaomi Corp.'s Financial Performance, Growth and Valuation Metrics

A. Analysis of Xiaomi Corp's Financial Statements

Xiaomi Market Cap

Xiaomi Corp continues to solidify its position as a major player in the market, as evidenced by its impressive market capitalization of $278.88 billion as of 2023.

The company's ability to generate profits is even more evident in the current year, with a net income of $7.86 billion in 2023, demonstrating its financial strength and efficiency.

Furthermore, Xiaomi's robust revenue growth remains steady, with a compound annual growth rate (CAGR) of 36% over the past five years, highlighting its consistent expansion and successful market penetration strategies.

One of the key factors contributing to Xiaomi's financial success is its gross profit margin, which stands at 17.45% in 2023. This demonstrates the company's savvy cost management and effective pricing strategies, allowing it to maintain a healthy profit margin.

In addition, Xiaomi Inc maintains a net profit margin of 2.73% in the same year, demonstrating its ability to efficiently convert revenue into profit, which enhances its overall financial stability.

The company's strong cash generation is evident from its cash flow from operations (CFFO) of $2.3 billion in 2023, which demonstrates Xiaomi's ability to generate cash flow from its core business. This liquidity is essential to sustain and expand the company's operations, which will drive further growth and innovation in the highly competitive market.

Let's check out more information about Xiaomi stock:

|

Metric |

Value |

Usefulness and Implications |

|

Closing Price (HKD) |

11.120 |

Represents the last traded price of Xiaomi stock. |

|

Turnover |

4.61 million |

Reflects the market activity and liquidity of the stock. |

|

Bid (Delayed) |

11.100 |

Shows the highest price at which buyers are willing to buy the stock. |

|

Short Selling Amount/Ratio (%) |

6.54 million / 12.793% |

Reflects the amount and ratio of short selling activity. |

|

Earnings per share (HKD) |

0.113 |

Represents the portion of profit allocated to each share |

|

Fund Flow |

16.6 million |

Represents the net amount of money flowing into or out of Xiaomi stock. |

|

Volume Ratio/Bibi |

0.544 / -17.782% |

Compares trading volume to average volume, indicating market interest. |

|

Average Turnover (3 months) |

5.90 million |

Represents the average number of shares traded per day. |

|

Market Value |

278.474 billion |

Represents the total market capitalization of Xiaomi. |

|

Shares per Lot |

200 |

Represents the number of shares required to form a trading lot. |

Over the past year, Xiaomi Corp's stock has shown a certain level of volatility and experienced fluctuations in its value. Here is a summary of its past performance based on different time periods:

1-month Period: During the last month, the stock price ranged between HKD 9.860 and HKD 11.220, with a positive change of 1.83%. This indicates a moderate upward trend in the stock's value in the short term.

2-month Period: Over a two-month period, the stock price fluctuated between HKD 9.860 and HKD 11.600, resulting in a slight decrease of 0.36%. The stock showed a relatively stable performance during this period.

3-month Period: In the last three months, Xiaomi Corp's stock showed more significant volatility, with the price ranging from HKD 9.860 to HKD 12.760. However, it experienced a decline of 7.18% during this period.

52-week Period: Looking at the stock's performance over the past year, the price fluctuated between HKD 8.310 and HKD 14.280. The stock experienced a total decline of 16.77% during this 52 week period.

B. Key Financial Ratios and Metrics

In the realm of financial performance, Xiaomi Corp stands out when compared to its largest industry peers, namely Apple and Samsung.

Revenue Growth (CAGR): Xiaomi has achieved an exceptional compound annual growth rate (CAGR) of 36% over the past few years, outpacing both Apple (10%) and Samsung (6%). This robust revenue growth demonstrates Xiaomi's ability to rapidly expand its market presence and attract a broader customer base, outpacing its competitors in terms of capturing market share.

Earnings Growth (CAGR): Xiaomi's earnings growth has been truly remarkable, with a CAGR of 60%. In comparison, Apple and Samsung have reported lower earnings growth rates of 15% and 10%, respectively. This impressive performance demonstrates Xiaomi's effective cost management strategies and operational efficiency, leading to higher profitability and overall financial strength.

Forward P/E Ratio: A Important valuation metric, the forward price-to-earnings (P/E) ratio provides insight into the market's expectations for a company's future earnings. Xiaomi currently has a forward P/E ratio of 34.5x, which is higher than Apple's ratio of 23.5x and Samsung's ratio of 15.5x. The higher forward P/E ratio suggests that investors are expecting stronger growth and profitability prospects for Xiaomi, which is driving up the company's stock valuation.

V. Xiaomi Stock Performance

A. Xiaomi Stock Trading Information

Xiaomi Ticker: Xiaomi Corporation is listed on the Hong Kong Stock Exchange (SEHK) under the ticker symbol 1810. It is traded on the primary market.

Country and Currency: Xiaomi is a China-based company and its shares are denominated in Hong Kong dollars (HKD).

Trading Hours: Xiaomi stock can be traded in two sessions during regular market hours. The morning session runs from 9:30 am to 12:00 pm HKT, followed by a break. The afternoon session resumes from 2:00 pm to 4:00 pm HKT. In addition, there is a pre-market session from 9:00 AM to 9:30 AM HKT and an after-market session from 4:00 PM to 4:30 PM HKT, providing extended trading opportunities.

Xiaomi Stock Splits: Xiaomi has never had a stock split. This means that the number of outstanding shares has not increased or decreased proportionately, and the original share structure has been maintained.

1810 Stock Dividends: Xiaomi has never paid any dividends to its shareholders. This indicates that the company has chosen to reinvest its profits back into the business rather than distribute them to shareholders as dividends.

Xiaomi's stock performance has been remarkable, with significant growth in recent years. As of July 4th, 2023, the stock is trading at HKD 11.12 per share, reflecting its upward trajectory. The key factors driving Xiaomi's stock price growth are the strong revenue and earnings growth that the company has experienced. Over the past 5 years, Xiaomi's revenue has grown at an impressive compound annual growth rate (CAGR) of 36%, indicating the campany's ability to capture market share and expand its business. In addition, the company's earnings have grown at an even higher CAGR of 60% over the same period, highlighting its strong profitability and financial performance. These positive fundamentals contribute to investor confidence and market demand for Xiaomi stock.

B. Overview of Xiaomi Stock Performance

Xiaomi stock price has fluctuated significantly over time. The 52-week high for the stock is HKD 14.28 per share, while the 52-week low is HKD 8.31 per share, representing a decline of 48.16% from its peak. Currently, the stock is trading at HKD 11.120 per share, showing stability with no change.

Looking at its historical performance, Xiaomi's stock has experienced a wide range of highs and lows. Over the past 5 years, the stock price has ranged from a high of HKD 13.80 per share to a low of HKD 2.40 per share, illustrating the volatility and potential for both growth and decline.

The rapid expansion of Xiaomi's revenue and earnings has been the primary driver of the company's rising stock price. Over the past 5 years, the company has achieved a 36% compound annual growth rate (CAGR) in revenue, highlighting its ability to capture market share and generate substantial sales.

Analysts have provided a favorable outlook with an average target price of HKD 14.00 per share. This suggests that the stock has the potential for further appreciation.

VI. Challenges and Opportunities

Source: Istock

While Xiaomi has experienced remarkable growth and success, it also faces several risks and challenges in the competitive technology market. One of the main risks is the intense competition from established players such as Apple and Samsung. These companies have well-established brands and significant market presence, which can pose a threat to Xiaomi's market share. However, Xiaomi has been able to carve out a niche for itself by offering high-quality products at affordable prices, catering to price-sensitive consumers. This competitive advantage has helped Xiaomi gain traction and build a loyal customer base.

In addition to competition, Xiaomi also faces risks related to changing market dynamics, technological advancements and the regulatory environment. The technology industry is highly dynamic, with rapid changes in consumer preferences and technological innovations. Xiaomi must remain agile and adapt quickly to emerging trends to maintain its competitive edge.

Despite the risks, Xiaomi has many opportunities for growth. The company has expanded its product portfolio beyond smartphones, venturing into areas such as smart home devices, wearables, and internet services. Xiaomi's focus on the Internet of Things (IoT) and ecosystem integration offers significant growth potential as more consumers adopt connected devices in their daily lives.

Xiaomi's future outlook appears promising. The company continues to innovate and invest in research and development to drive product advancements and maintain its competitive position. For example, in response to increased regulatory scrutiny and a desire to regain lost market share, Xiaomi Corp. is expanding its local sourcing efforts in India. The Chinese smartphone company aims to strengthen its position in the Indian market by sourcing more of its production within the country.

VII. Why Traders Should Consider Xiaomi Stock

A. Reasons Why Traders Should Consider Xiaomi Stock

Xiaomi has shown exceptional revenue and profit growth over the years, indicating high growth potential. The company's potential to generate attractive returns for traders is evidenced by compound annual growth rates (CAGRs) of 36% for revenue and 60% for profit over the past few years.

Xiaomi is known for its innovative product portfolio, especially in consumer electronics and smartphones. The company has captured a large portion of the market with its innovative products and low prices. Investors looking to gain exposure to a technology company with a diverse product line will find Xiaomi to be an attractive investment.

B. Key Resistance & Support Levels of Xiaomi Stock

Based on recent price action and technical indicators, the following are the key resistance and support levels for Xiaomi stock:

Xiaomi stock price Support Levels:

8.60 HKD

8.20 HKD

7.80 HKD

Xiaomi share price Resistance Levels:

14.00 HKD

14.40 HKD

14.80 HKD

These levels can serve as reference points for traders to identify potential entry and exit levels. A break below a support level may indicate further downside, while a break above a resistance level may indicate potential upside momentum.

C. Profit Strategies for Xiaomi Stock

When considering profit strategies for trading Xiaomi HK stock, traders can explore different approaches. Some strategies include:

Traders can use technical indicators and trend lines to track the movements of Xiaomi stock. By taking positions that are in line with the trend, traders hope to profit from sustained price movements in one direction.

The key resistance and support levels of Xiaomi Hong Kong stock must be monitored when using the breakout trading strategy. When a stock price breaks through a key technical level such as resistance or support, investors may decide to enter trades in hopes of profiting from the expected price movement.

Swing traders seek to profit from price swings that last from a few days to a week. They anticipate price reversals within a predetermined range and try to capitalize on the subsequent price movement.

VIII. Trade Xiaomi Stock CFD with VSTAR

When considering trading Xiaomi stock, traders can choose to use Contracts for Difference (CFDs) offered by reputable platforms such as VSTAR. Here are some of the benefits of trading Xiaomi stock CFDs with VSTAR:

Access to global markets: VSTAR offers access to a wide range of global markets, allowing traders to trade Xiaomi stock and other assets on various exchanges worldwide, including the Hong Kong Stock Exchange (SEHK).

Leveraged Trading: Trading Xiaomi stock CFDs on VSTAR allows traders to use leverage, which allows them to increase their exposure to price movements with a smaller initial investment. This can potentially increase profits but also increase risk, requiring careful risk management.

Trading flexibility: VSTAR offers flexible trading options, including both long (buy) and short (sell) positions, allowing traders to take advantage of both rising and falling markets. This flexibility allows traders to adapt to market conditions and implement different trading strategies.

Advanced trading tools: VSTAR provides traders with access to advanced trading tools, charting capabilities and real-time market data to help them make informed trading decisions. These tools can assist with technical analysis, risk management and trade execution.

IX. Conclusion

Xiaomi Corporation presents an interesting opportunity for traders due to its strong growth potential, innovative product portfolio and expanding global presence. The company has delivered impressive revenue and earnings growth over the years, demonstrating its ability to generate attractive returns. With its reputation for providing value-for-money products and successful expansion into international markets, Xiaomi remains a competitive player in the technology industry.

When considering Xiaomi stock, traders can monitor key technical levels such as support and resistance, which can serve as entry and exit points. In addition, using profit strategies such as trend following, breakout trading or swing trading can help traders capitalize on price movements and market trends.

FAQs

1. Can you buy Xiaomi stock?

Yes, Xiaomi stock is publicly traded on the Hong Kong Stock Exchange under the ticker 1810.HK. It can be purchased through brokers that provide access to the HKEX.

2. What is Xiaomi's stock symbol in the US?

Xiaomi does not currently have a US stock symbol, as it is only traded on the HKEX.

3. Is Xiaomi stock worth buying?

At around HKD 13 per share currently, Xiaomi could be a decent long-term buy as a leading smartphone maker expanding into other electronics and internet services. But it faces risks like supply chain issues and intense competition.

4. What is the prediction for Xiaomi stock?

Given China's economic uncertainty, the analysts average 12-month price target for Xiaomi is about HKD 15.5, implying moderate upside potential from current levels. However, targets range widely from HKD 10 to over HKD 22.