VSTAR에 관하여

할인 행사

우리는 고객에게 더 많은 가치를 창출하며, 활동을 통해 더 많은 거래 기회를 얻고 투자 수익을 높이는 데 최선을 다하고 있습니다. 최신 활동에 많은 관심 부탁드립니다!

우리의 기사와 시장 분석을 확인해 보세요. 여기에는 기술 분석, 거래 전략, 외환, 금, 원유, 가스, 주식 및 암호화폐 주제가 포함됩니다.

VSTAR 계정을 등록하여 실시간 업데이트를 받으세요.

최신 인기 전문가 기사를 읽어보세요.

Nike stock (NKE) closed the most recent trading session at $105.30, reflecting a marginal daily gain of 1.86%.

Nvidia Stock (NVDA) gained a substantial 9% increase after the company's quarterly earnings report, surpassing Wall Street's expectations. The NVDA stock price is steady near the 800.00 level, which may extend towards the 1000.00 mark soon.

On Wednesday, oil prices increased by roughly 2% to reach a two-week high, driven by a larger-than-anticipated decline in U.S. storage and escalating tensions in the Middle East.

Tuesday saw a decline of 10.4% in Oracle stock (ORCL), precipitated by a disappointing quarter of cloud sales and an unfavorable forecast.

Pfizer's global reach and diverse portfolio fuel growth, while COVID-19 dependency and revenue gaps pose challenges, stock is at multi year low.

In 2023, gold experienced a relatively subdued year, reaching a new peak while demonstrating a modest 10% growth. Surprisingly, the value of platinum, its close relative, has decreased by around 10% this year.

The Polkadot price showed a massive bull run in 2021 but went to the bottom after setting a new high in November 2021. However, the current price trades 98% higher than the yearly opening, which indicates more room to raise the price.

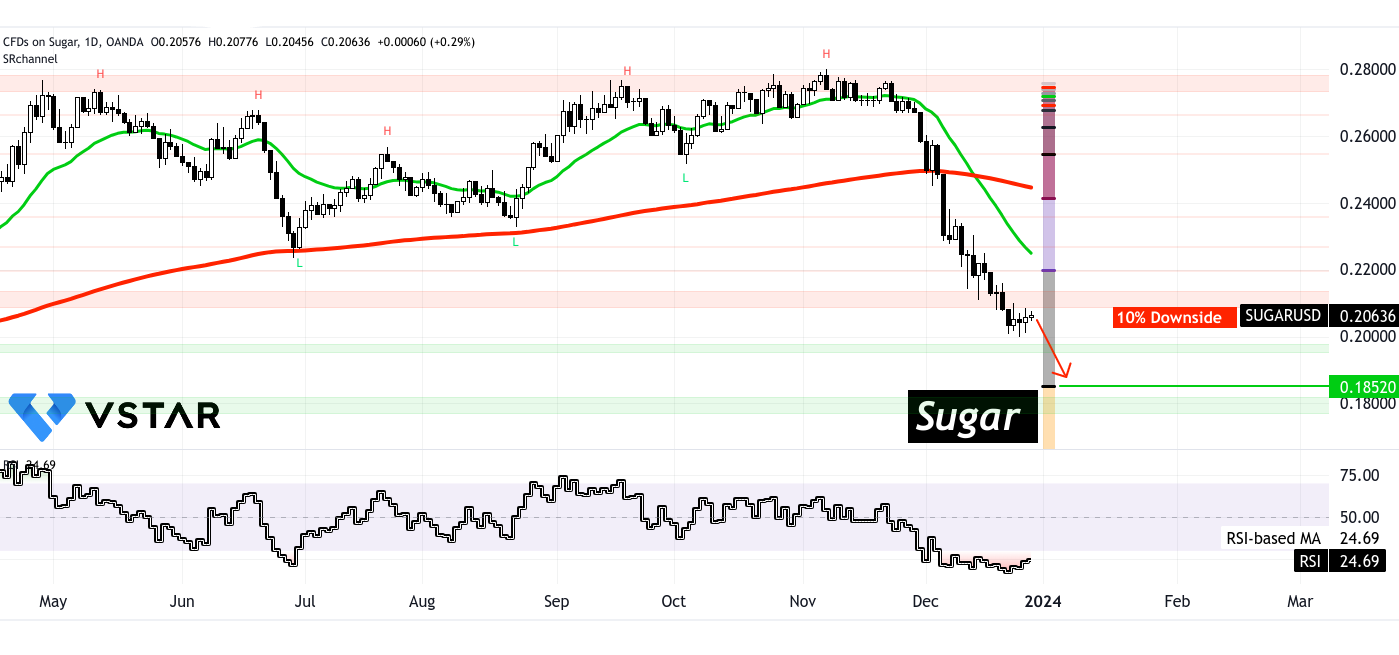

Analyzing the Consequences of Reduced Exports, Increased Imports, and Altered Stocks-to-Use Ratio on Sugar Prices and Market Stability in the US.

Ripple's XRP encountered difficulties in regaining the $0.60 threshold on Monday. However, the price action is optimistic for bulls without sufficient selling pressure.

The asset management firm, BlackRock, is reportedly not leaning to provide support for an XRP ETF. The consequence of this information increases in light of the ongoing SEC v. Ripple lawsuit in 2024.

In the past month, RTX stock has increased by 3.98%, lagging the 6.94 percent gain of the aerospace sector and the 5.28% increase of the S&P 500.

According to analysts, most of Silver's recent gains are anticipated to continue into the new year. Experts predict that the price of silver will surpass gold in 2025.

The price of silver peaked at the highest level in more than two months. The ascent in question was driven by expectations of impending rate cuts by the Federal Reserve within the year.

From Schlumberger’s robust financial performance to digital transformation and sustainability initiatives – setting the stage for sustained value growth.

The price of Solana (SOLUSD) has followed one of the most disappointing paths as volatility keeps gains at bay.

Solana (SOL) has exhibited selling pressure in the previous week after recovery from levels not seen in several years. When its primary supporter FTX, encountered setbacks, the token came under pressure.

The soybean market maintained its gains to begin the week. Also, the market structure and price pattern could signal an early investment opportunity in this commodity from the discounted price.

Exploring the S&P 500 market outlook technically and fundamentally for projecting investment moves in 2024.

Starbucks disclosed its quarterly revenue and earnings on Thursday, exceeding analysts' projections. The company attributed this success to the strong demand for premium beverages in the United States.

Wall Street projects an upward pressure on SBUX stock, after the upcoming quarterly earnings report release in January 2024.

Last Thursday, we saw a 12% decline in Tesla Stock (TSLA), eradicating $80 billion from the company's market value. The crash came as soon as the company warned investors about sluggish electric vehicle sales growth and increased competition from Chinese rivals.

Tron's performance in 2023 was marked by noteworthy achievements, most notably transactions worth billions of dollars.

Recently, crypto magnate and founder of blockchain Tron, Justin Sun, acknowledged his lunch meeting with Warren Buffett's profound influence on him as an investor and entrepreneur.

After an incredible rally to a seven-year high, the Tron price showed a counter impulsive pressure from the top, suggesting a possible trend reversal.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

호주 증권 및 투자 위원회 ASIC (526187)

EU 금융 도구 시장 지침 (MiFID II) 적합화

폴란드 재무부 VASP8762471601

모리셔스 금융 서비스 위원회 FSC (GB21026599)

VS Group Limited. © VSTAR 저작권 소유, 모든 권리 보유.

VSTAR은 VS 그룹 소속의 인터넷 소매 거래 브랜드입니다.

본 웹사이트는 VS 그룹 회사에 의해 운영되며, 이 회사는 여러 국가에서 라이센스 허가를 받았습니다: •VSTAR Finance Pty Ltd (호주) •Vstar Limited (모리셔스) •VSTAR Global LLC (세인트빈센트 그레나딘)

VSTAR Finance Pty Ltd는 호주 증권 투자 위원회(ASIC)의 승인을 받아, 호주 금융 서비스 라이센스 AFSL 526187에 따라 금융 서비스를 제공합니다.

유럽연합 경제 지역(MiFID II) MiFID II는 투자 회사가 다른 회원국 및/또는 제3국 내에서 투자 및 부수 서비스를 제공할 수 있도록 허용합니다(단, 해당 투자 회사의 허가가 이러한 서비스에 포함되어 있어야 합니다).

VSTAR & SOHO MARKETS LTD는 유럽연합 금융 도구 시장 지침에 따라 독일, 프랑스, 이탈리아, 스페인, 포르투갈 등을 포함한 유럽연합 회원국에 금융 투자 및 거래 서비스를 제공합니다.

Vstar Limited는 모리셔스 공화국 법에 따라 설립된 투자 회사이며, 모리셔스 금융 서비스 위원회(FSC)의 규제를 받으며, 라이센스 번호는 GB21026599입니다.

VSTAR Global LLC는 세인트빈센트 그레나딘에 등록된 국제 상업 회사이며, 등록 번호는 1310 LLC 2021입니다.

www.vstar.com을 사용함으로써, 귀하는 귀하의 경험을 향상시키기 위해 우리의 쿠키 사용에 동의합니다.

지역 제한: VSTAR.COM은 터키, 이란, 이라크, 북한 및 미국 본토의 주민에게 서비스를 제공하지 않습니다.