VSTAR에 관하여

할인 행사

우리는 고객에게 더 많은 가치를 창출하며, 활동을 통해 더 많은 거래 기회를 얻고 투자 수익을 높이는 데 최선을 다하고 있습니다. 최신 활동에 많은 관심 부탁드립니다!

우리의 기사와 시장 분석을 확인해 보세요. 여기에는 기술 분석, 거래 전략, 외환, 금, 원유, 가스, 주식 및 암호화폐 주제가 포함됩니다.

VSTAR 계정을 등록하여 실시간 업데이트를 받으세요.

최신 인기 전문가 기사를 읽어보세요.

On Wednesday, Uber Technologies (UBER) disclosed its initial-quarter financial results, which included a net loss that was not anticipated and revenue that marginally surpassed projections.

Decoding the financial triumphs, innovations, and market challenges of UnitedHealth (UNH) - a healthcare giant's journey in 2023 and beyond.

The US Dollar Index (USDX) reached a record high and is currently hovering near the 109.00 level with no sign of a recovery.

The US Dollar Index (USDX) recommenced its bearish trend, culminating in its most modest weekly close since July after the Fed’s December meeting.

The US dollar index maintained its position near its all-time lows since mid-January. Ahead of pivotal US inflation data anticipated later this week, investors refrained from dramatic action.

Last Friday marked the third consecutive day of strength for the US dollar, with the USD Index (USDX) surpassing 106.00, a level not observed since early November.

BoJ officials stated that the ongoing recovery of the US Dollar dampens investor optimism regarding the Bank of Japan's (BoJ) decision to end its ultra-loose policy following its December meeting.

As expected, the Bank of Canada (BOC) leaves the overnight rate unchanged at 5.0%. Is USDCAD a Buy now?

The Canadian Dollar (CAD) provided a corrective price action against the US Dollar (USD) for a prolonged time. Also, the near-term price action suggests indecision, which might result in a stable trend formation after a valid breakout.

Last Thursday marks the second consecutive day that the Canadian Dollar (CAD) has strengthened against the US Dollar (USD), propelled by an overall improvement in global risk appetite.

In the daily chart of USDCHF, the recent price extended the downside pressure and reached the multi-year low, indicating further loss in the coming days.

In contrast to the dollar's general stability, the Chinese yuan encountered pressure on Thursday after disclosing minutes from the Federal Reserve's recent policy meeting. The minutes indicated that there would be no immediate changes to the central bank's cautious posture regarding rate cuts.

The USDJPY is witnessing additional declines on Monday, as the Japanese Yen (JPY) gains more than a full percentage point against the US Dollar. Having declined from the 150.00 level, the pair is positioned to fall towards the 148.50 psychological area.

The USDJPY pair is approaching critical resistance, demonstrating resilience in the face of the ambiguity accompanying a week-long data dump.

After a brief downturn, the USDJPY pair rebounded, potentially putting to the test the foreign exchange intervention threats from the Ministry of Finance (MoF) and Bank of Japan (BoJ), in addition to the 155 resistance level.

Vertex Pharmaceuticals Incorporated (VRTX) disclosed strong financial performance for the first quarter of 2024, suggesting advancements in its research and development pipeline.

After VF Corporation's Q3 earnings report, VFC stock moved 14% down but closed the day with an indecision formation with a 9% loss.

Exploring Walgreens' adaptive strategies in a transformative retail landscape.

Front-month wheat futures increased by double digits at the start of the week. Prices for front-month spring wheat also saw notable gains, finishing the day up between 7 and 9 ½ cents.

Deciphering the complex dynamics of Wheat markets: unveiling global trends, supply glut, and price volatility impacting Futures and CFDs in the face of increased supplies, shifting production, and reduced demand forecasts.

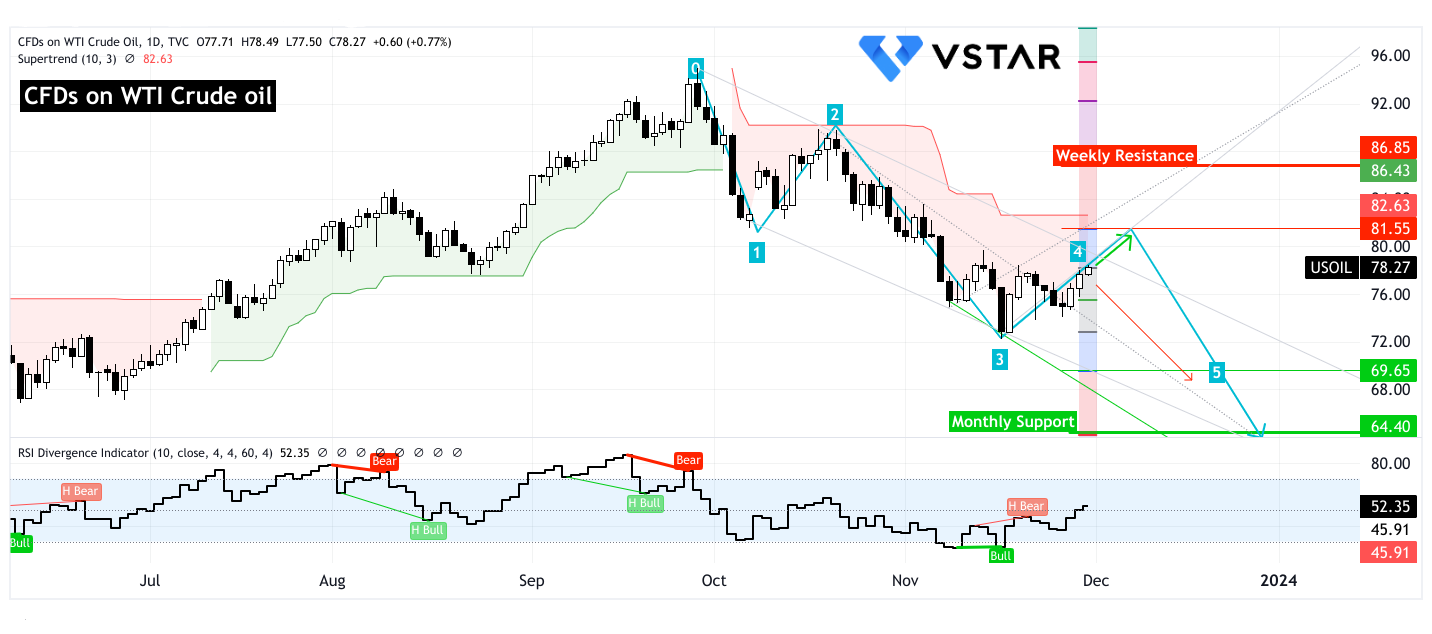

Exploring Refinery Inputs, Production Fluctuations, Import Trends, and Inventory Discrepancies: Implications for WTI Crude Oil CFDs and Market Dynamics.

Explore the crude oil supply, demand, and price fluctuations to navigate the complexities of CFD trading.

Geopolitical tensions in the Middle East, supply trends influenced by OPEC+, and US economic data will continue to be key drivers of oil prices.

Crude oil prices moved 2% higher on Tuesday, driven by the expectation of supply cuts by OPEC+, Kazakh oil production cuts, and a weakening U.S. dollar.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

호주 증권 및 투자 위원회 ASIC (526187)

EU 금융 도구 시장 지침 (MiFID II) 적합화

폴란드 재무부 VASP8762471601

모리셔스 금융 서비스 위원회 FSC (GB21026599)

VS Group Limited. © VSTAR 저작권 소유, 모든 권리 보유.

VSTAR은 VS 그룹 소속의 인터넷 소매 거래 브랜드입니다.

본 웹사이트는 VS 그룹 회사에 의해 운영되며, 이 회사는 여러 국가에서 라이센스 허가를 받았습니다: •VSTAR Finance Pty Ltd (호주) •Vstar Limited (모리셔스) •VSTAR Global LLC (세인트빈센트 그레나딘)

VSTAR Finance Pty Ltd는 호주 증권 투자 위원회(ASIC)의 승인을 받아, 호주 금융 서비스 라이센스 AFSL 526187에 따라 금융 서비스를 제공합니다.

유럽연합 경제 지역(MiFID II) MiFID II는 투자 회사가 다른 회원국 및/또는 제3국 내에서 투자 및 부수 서비스를 제공할 수 있도록 허용합니다(단, 해당 투자 회사의 허가가 이러한 서비스에 포함되어 있어야 합니다).

VSTAR & SOHO MARKETS LTD는 유럽연합 금융 도구 시장 지침에 따라 독일, 프랑스, 이탈리아, 스페인, 포르투갈 등을 포함한 유럽연합 회원국에 금융 투자 및 거래 서비스를 제공합니다.

Vstar Limited는 모리셔스 공화국 법에 따라 설립된 투자 회사이며, 모리셔스 금융 서비스 위원회(FSC)의 규제를 받으며, 라이센스 번호는 GB21026599입니다.

VSTAR Global LLC는 세인트빈센트 그레나딘에 등록된 국제 상업 회사이며, 등록 번호는 1310 LLC 2021입니다.

www.vstar.com을 사용함으로써, 귀하는 귀하의 경험을 향상시키기 위해 우리의 쿠키 사용에 동의합니다.

지역 제한: VSTAR.COM은 터키, 이란, 이라크, 북한 및 미국 본토의 주민에게 서비스를 제공하지 않습니다.