Can USDJPY Extend Lower Following the Trade War & Middle East Crisis?

Amid muted US Dollar (USD) price action, the Japanese yen (JPY) continues its steady day-to-day rise and pulls the USD/JPY exchange rate to a three-week decrease.

Can USDJPY Move Higher as the USDX is at the Multi-Month High?

The Japanese yen (JPY) has been at its lowest point since the beginning of August, failing to make significant gains against its U.S. counterpart.

Can USDJPY Rebound as the Price Approached the Yearly Low?

For the second day in a row, the USD/JPY is losing ground, closing below the 143.00 level. In the wake of comments made by Bank of Japan (BoJ) trustee Junko Nagakawa, the Japanese Yen (JPY) is still strong.

USDJPY Showed A Counter Impulsive Bearish Pressure: A Trend Reversal Is Possible

The US Dollar Index (DXY) has declined to about 103.70. The Japanese Yen also showed a positive outlook, as the recent fundamental outlook indicated a possibility of reversal of the trend.

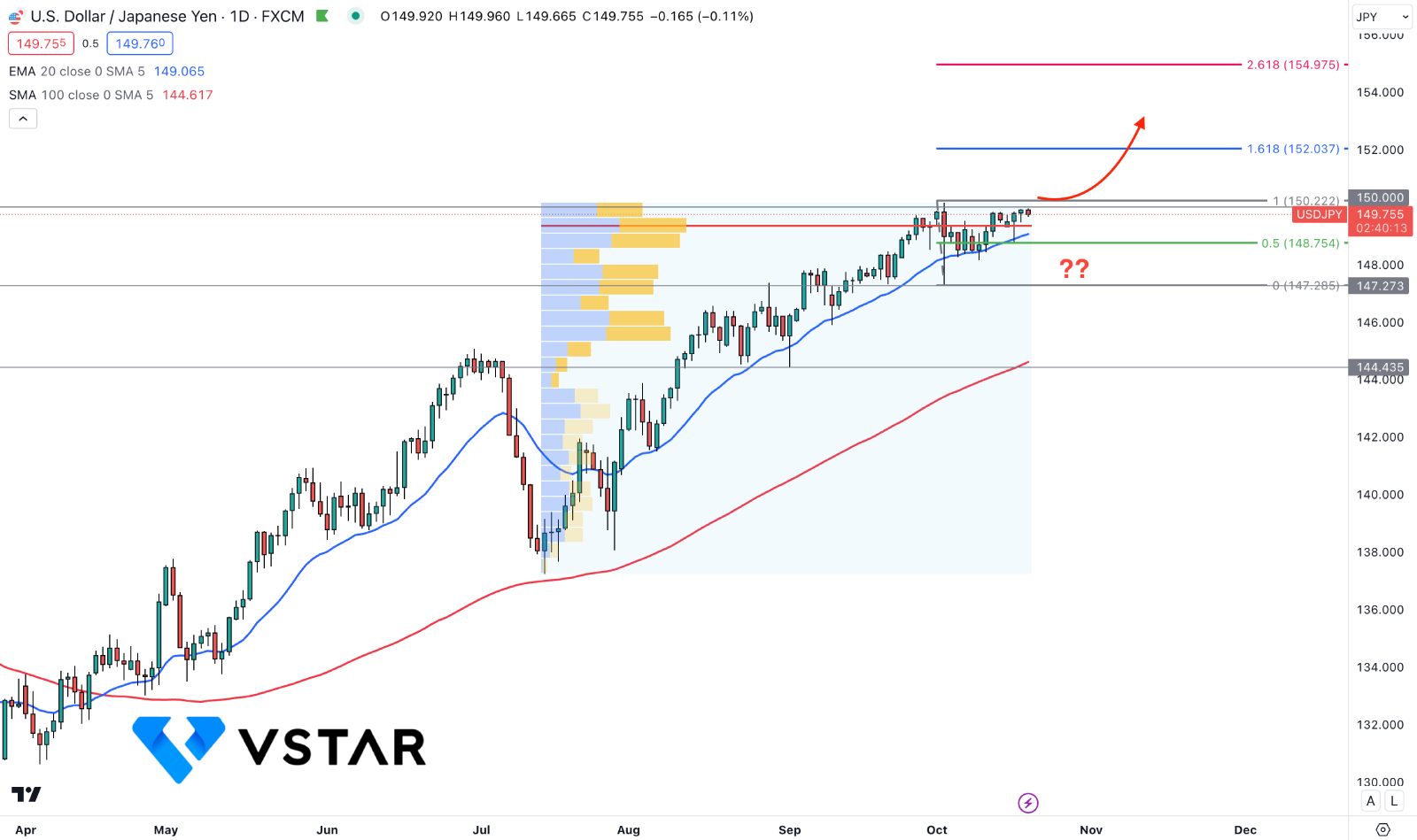

USDJPY Keeps Pushing Higher: How Long It Can Go?

After a brief downturn, the USDJPY pair rebounded, potentially putting to the test the foreign exchange intervention threats from the Ministry of Finance (MoF) and Bank of Japan (BoJ), in addition to the 155 resistance level.

USDJPY Reached The 12 Years High: Is This A Time For A Rebound?

The yen reached its lowest level since 1990 on Wednesday, prior to exhibiting a modest recovery following a meeting of Japan's highest-ranking monetary officials to discuss the currency's sharp depreciation and signal their preparedness for intervention.

USDJPY Hovers At The Critical Resistance: A Breakout Knocks

The USDJPY pair is approaching critical resistance, demonstrating resilience in the face of the ambiguity accompanying a week-long data dump.

Can USDJPY Revisit 150.00 Level After The BOJ Policy Meeting?

The Bank of Japan maintained its present monetary policy stance, as was widely anticipated. Nonetheless, the market's current emphasis is on a more sanguine projection for wages and inflation.

Can FOMC Meeting Take The USDJPY Price At The 150.00 Level?

BoJ officials stated that the ongoing recovery of the US Dollar dampens investor optimism regarding the Bank of Japan's (BoJ) decision to end its ultra-loose policy following its December meeting.

USDJPY Formed A Falling Wedge Breakout

The USDJPY is witnessing additional declines on Monday, as the Japanese Yen (JPY) gains more than a full percentage point against the US Dollar. Having declined from the 150.00 level, the pair is positioned to fall towards the 148.50 psychological area.

Japanese Yen's Descent: New Lows and BoJ's Intervention Dilemma

Analyzing rising bond yields, shifting monetary policy, and global economic impact on USD/JPY.

USDJPY Closed Sideways Despite The Powell's Neutral Tone

After reaching a new weekly high of 149.96, the USDJPY reversed course, falling 0.13 percent in response to dovish remarks by US Federal Reserve Chair Jerome Powell.

Will the bull market continue with Japanese stocks at record highs?

The Japanese stock market has hit more than 30-year highs this year. On Friday, the Nikkei 225 rose 0.41% to a near-January high at the close in Tokyo, Japan. With Japanese stocks at record highs, can the bull market continue?

Why is Japan not worried about yen depreciation?

The Japanese government, business community and economists are not overly concerned about the state of the yen because Japan's GDP growth continues to perform very well, even exceeding expectations.

Fundamental Analysis of the USD/JPY Currency Pair

The USD/JPY currency pair represents the exchange rate between the United States dollar (USD) and the Japanese yen (JPY). It is one of the most actively traded currency pairs in the foreign exchange (forex) market.