私たちの記事と市場分析を確認してください。これには、テクニカル分析、トレーディング戦略、外国為替、ゴールド、原油、ガス、株式、暗号通貨に関するテーマが含まれています。

VSTARアカウントに登録してリアルタイム更新を受け取る

私たちの最新で最も人気のある特集記事をお読みください。

Starbucks disclosed its quarterly revenue and earnings on Thursday, exceeding analysts' projections. The company attributed this success to the strong demand for premium beverages in the United States.

Wall Street projects an upward pressure on SBUX stock, after the upcoming quarterly earnings report release in January 2024.

Learn about mean reversion, trend following, hedging, leverage, and algorithmic strategies for trading XLM CFDs.

Learn about the top 6 best systems software stocks investors can purchase and useful tips for trading them.

Last Thursday, we saw a 12% decline in Tesla Stock (TSLA), eradicating $80 billion from the company's market value. The crash came as soon as the company warned investors about sluggish electric vehicle sales growth and increased competition from Chinese rivals.

Tron's performance in 2023 was marked by noteworthy achievements, most notably transactions worth billions of dollars.

Recently, crypto magnate and founder of blockchain Tron, Justin Sun, acknowledged his lunch meeting with Warren Buffett's profound influence on him as an investor and entrepreneur.

After an incredible rally to a seven-year high, the Tron price showed a counter impulsive pressure from the top, suggesting a possible trend reversal.

TSM stock price prediction implies huge upside potential. The chip stock presents a great profit opportunity for long-term investors and short-term traders.

On Wednesday, Uber Technologies (UBER) disclosed its initial-quarter financial results, which included a net loss that was not anticipated and revenue that marginally surpassed projections.

Decoding the financial triumphs, innovations, and market challenges of UnitedHealth (UNH) - a healthcare giant's journey in 2023 and beyond.

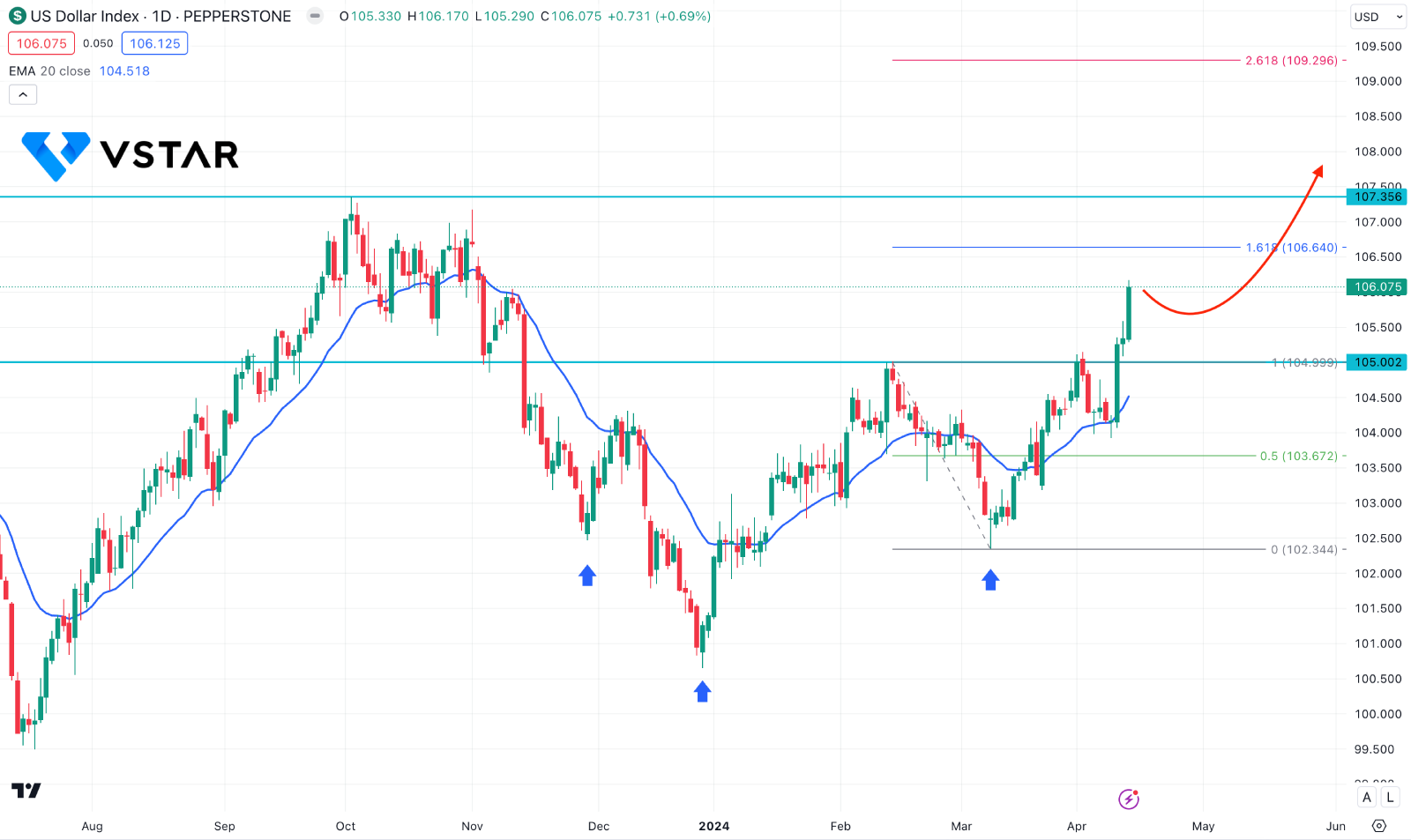

The US Dollar Index (USDX) reached a record high and is currently hovering near the 109.00 level with no sign of a recovery.

The US Dollar Index (USDX) recommenced its bearish trend, culminating in its most modest weekly close since July after the Fed’s December meeting.

The US dollar index maintained its position near its all-time lows since mid-January. Ahead of pivotal US inflation data anticipated later this week, investors refrained from dramatic action.

Last Friday marked the third consecutive day of strength for the US dollar, with the USD Index (USDX) surpassing 106.00, a level not observed since early November.

BoJ officials stated that the ongoing recovery of the US Dollar dampens investor optimism regarding the Bank of Japan's (BoJ) decision to end its ultra-loose policy following its December meeting.

As expected, the Bank of Canada (BOC) leaves the overnight rate unchanged at 5.0%. Is USDCAD a Buy now?

The Canadian Dollar (CAD) provided a corrective price action against the US Dollar (USD) for a prolonged time. Also, the near-term price action suggests indecision, which might result in a stable trend formation after a valid breakout.

Last Thursday marks the second consecutive day that the Canadian Dollar (CAD) has strengthened against the US Dollar (USD), propelled by an overall improvement in global risk appetite.

In the daily chart of USDCHF, the recent price extended the downside pressure and reached the multi-year low, indicating further loss in the coming days.

In contrast to the dollar's general stability, the Chinese yuan encountered pressure on Thursday after disclosing minutes from the Federal Reserve's recent policy meeting. The minutes indicated that there would be no immediate changes to the central bank's cautious posture regarding rate cuts.

The USDJPY is witnessing additional declines on Monday, as the Japanese Yen (JPY) gains more than a full percentage point against the US Dollar. Having declined from the 150.00 level, the pair is positioned to fall towards the 148.50 psychological area.

The USDJPY pair is approaching critical resistance, demonstrating resilience in the face of the ambiguity accompanying a week-long data dump.

After a brief downturn, the USDJPY pair rebounded, potentially putting to the test the foreign exchange intervention threats from the Ministry of Finance (MoF) and Bank of Japan (BoJ), in addition to the 155 resistance level.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

オーストラリア証券投資委員会ASIC (526187)

EUの金融商品市場指令(MiFiD II)に適応する

ポーランド財務省 VASP8762471601

モーリシャス金融サービス委員会FSC (GB21026599)

VS Group Limited. © VSTARの著作権は全て保留されています。

VSTARはVSグループのインターネット小売取引ブランドです。

本ウェブサイトはVSグループ会社によって運営されており、同社は世界の多くの国でライセンスを取得しています: •VSTAR Finance Pty Ltd (オーストラリア) •Vstar Limited (モーリシャス) •VSTAR Global LLC (セントビンセントおよびグレナディーン諸島)

VSTAR Finance Pty Ltdはオーストラリア証券投資委員会(ASIC)の承認を受けており、オーストラリア金融サービスライセンスAFSL 526187に基づいて金融サービスを提供しています。

欧州連合経済地域(MiFID II)では、MiFID IIにより、投資会社は他の加盟国および/または第三国において投資および補助的サービスを提供することが許可されています(前提として、投資会社の許可がそのようなサービスを含んでいることが必要です)。

VSTAR & SOHO MARKETS LTDは、EU金融商品市場指令に基づき、EU加盟国に金融投資および取引サービスを提供しています。これにはドイツ、フランス、イタリア、スペイン、ポルトガルなどが含まれます。

Vstar Limitedはモーリシャス共和国の法律に基づいて設立された投資会社で、モーリシャス金融サービス委員会(FSC)の規制を受けており、ライセンス番号はGB21026599です。

VSTAR Global LLCはセントビンセントおよびグレナディーン諸島に登録された国際商業会社で、登録番号は1310 LLC 2021です。

www.vstar.comを使用することにより、あなたは私たちのクッキーを使用してあなたの体験を向上させることに同意します。

地域制限:VSTAR.COMはトルコ、イラン、イラク、北朝鮮、及びアメリカ本土の住民にはサービスを提供していません。