私たちの記事と市場分析を確認してください。これには、テクニカル分析、トレーディング戦略、外国為替、ゴールド、原油、ガス、株式、暗号通貨に関するテーマが含まれています。

VSTARアカウントに登録してリアルタイム更新を受け取る

私たちの最新で最も人気のある特集記事をお読みください。

After being dissatisfied with the Reserve Bank of Australia's (RBA) choice to adopt a neutral position, Australian traders will now redirect their attention towards the country's employment report and the wage price index this week.

The AUD USD price moved down despite the cash rate hike by the RBA. The sentiment came as the bank provided a dovish statement saying that it could be the last hike before tightening.

The AUDCAD would be the most awaited currency pair for this week as both central banks are expected to release monetary policy reports.

On Tuesday, the Australian Dollar (AUD) removed early gains against the Canadian Dollar (CAD) as the latter attempted to recoup recent losses.

Examining the key fundamental factors, growth initiatives, and risks, that shape AutoZone's progress towards sustained value creation.

Bitcoin Cash (BCH) got attention from the Cardano founder, which could be a potential long-term opportunity.

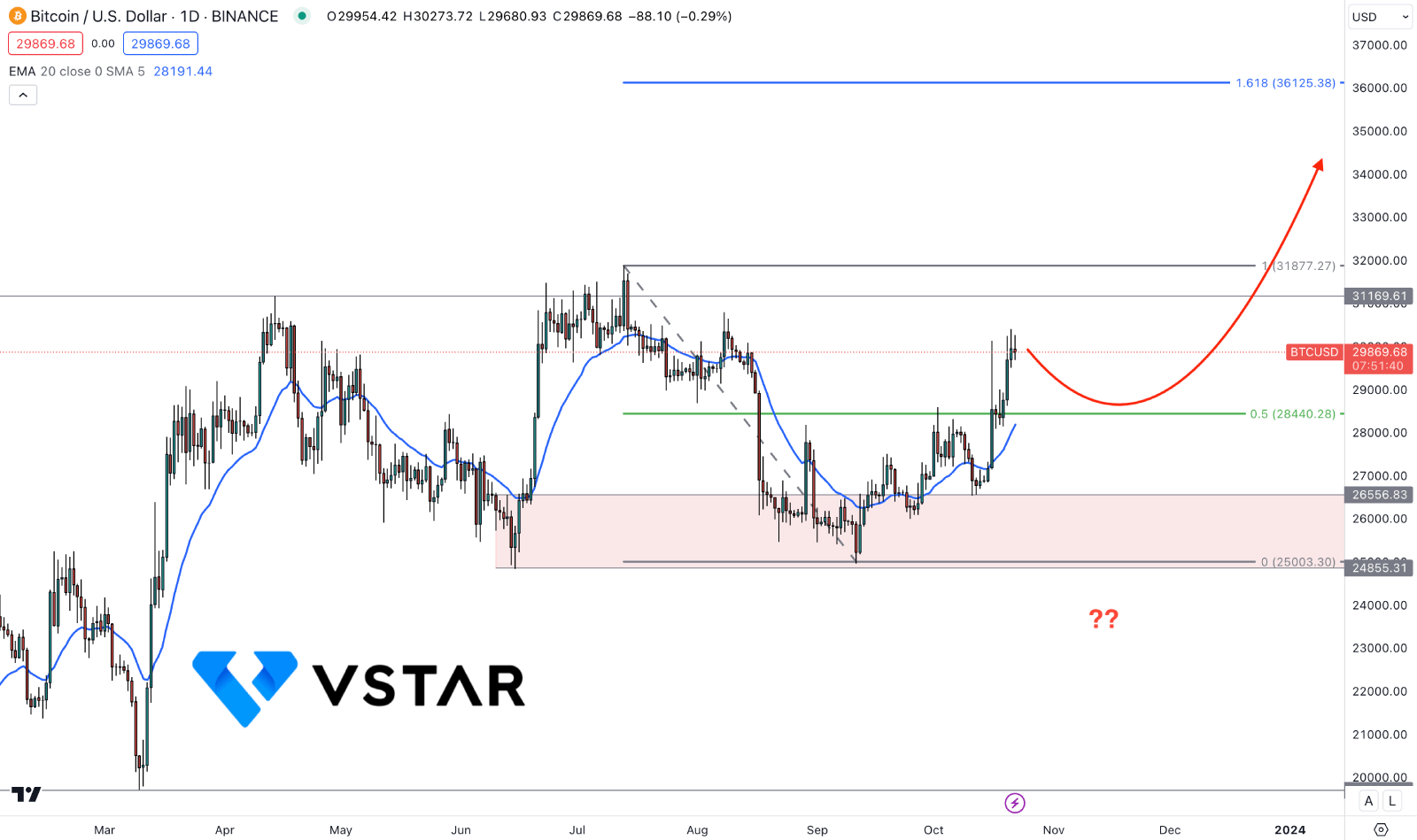

Analyzing Bitcoin's 2024 price prospects: regulatory evolution, expert projections, and market dynamics.

Amid the intense momentum surrounding all-time highs (ATHs), the continued accumulation endeavors of Bitcoin whales have come to the forefront, with Bitcoin's ascent to a 27-month high surpassing $63,000.

Recently, the SEC approved ten other applications and declared the registration statement for BlackRock's spot Bitcoin ETF effective.

Discover Bitcoin's upcoming price movements, vital institutional investments, and their potential impact, exploring the significance of BlackRock's Bitcoin ETF accumulation, Bill Ackman's speculative scenarios, and the evolving regulatory landscape.

Learn about BlackRock's recent price performance, strategic acquisitions, fundamental strengths, and weaknesses, alongside industry projections and valuation metrics.

Boeing’s Dubai Order Is A Bullish Case: On Monday, Emirates Airlines, the largest operator of Boeing 777 aircraft globally, disclosed a substantial order worth $52 billion.

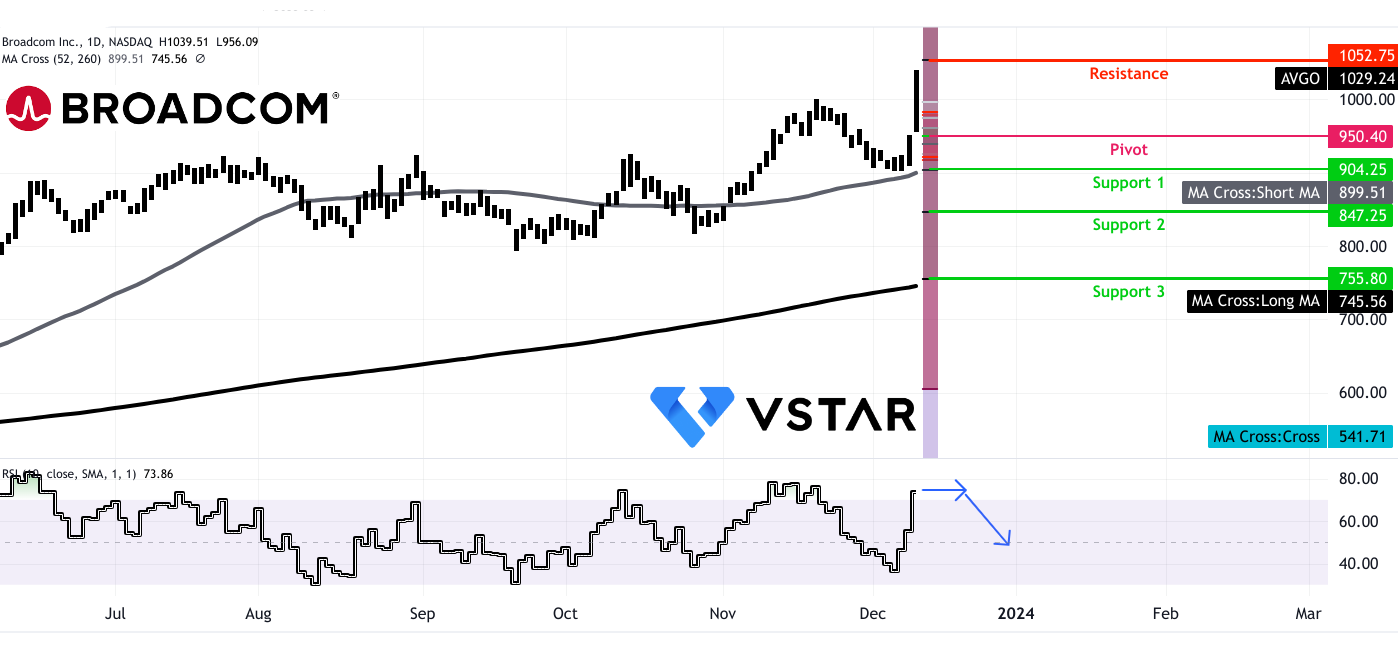

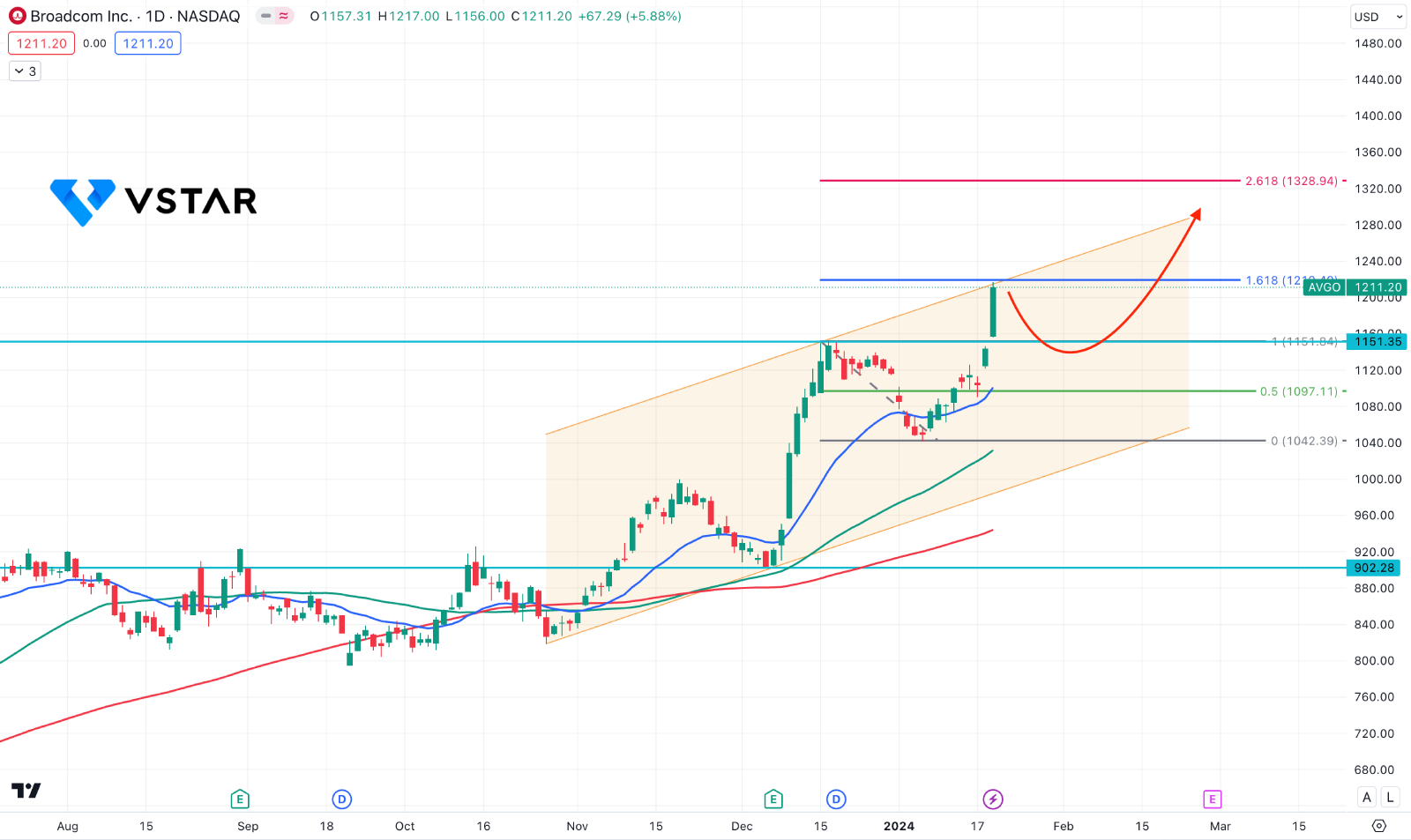

Exploring Broadcom's revenue surge, strategic segments, financial strength, and anticipated 40% year-on-year revenue rise in fiscal 2024.

To strengthen its November completion $69 billion acquisition of VMware, Broadcom has implemented new invoicing models and streamlined product bundles.

Affirm Holdings Stock (AFRM) has traded sideways in recent days, and the upcoming earnings report could be a trend-breaking event for this stock.

While technical indicators show bullish pressure in the BTCUSD price, on-chain metrics indicate a consolidation.

Over the previous five years, Boeing has led investors through a turbulent ordeal. The company initially encountered challenges about its 737 MAX, which resulted in an 18-month grounding. Subsequently, it encountered a sales decline caused by the pandemic.

As the current economic releases from Japan have no indication of changes, the long-term bullish trend in the CADJPY pair could remain intact.

In recent times, Cardano (ADA) supporters have exhibited reduced activity during unfavorable market conditions, whereas certain investors consistently take advantage of marginal price increases.

Dell Technologies (DELL) is expected to release its fiscal year 2025 third-quarter results on November 26. As the share price is under ongoing buying pressure, investors might take advantage of the recent base formation and grab a long opportunity.

Ethereum (ETH) has traded sideways in recent days, which could signal a possible trend trading opportunity after a breakout.

The FTSE 100 of Britain maintained its impressive ascent on Monday, propelled by a succession of favorable corporate updates.

Following the hawkish posture adopted by the Bank of England, pound traders are now focusing on the forthcoming November UK inflation data. And GBPJPY Bulls Await For the UK CPI.

The GBPUSD pair shows a neutral momentum from the technical perspective, while the broader market remains bullish.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

オーストラリア証券投資委員会ASIC (526187)

EUの金融商品市場指令(MiFiD II)に適応する

ポーランド財務省 VASP8762471601

モーリシャス金融サービス委員会FSC (GB21026599)

VS Group Limited. © VSTARの著作権は全て保留されています。

VSTARはVSグループのインターネット小売取引ブランドです。

本ウェブサイトはVSグループ会社によって運営されており、同社は世界の多くの国でライセンスを取得しています: •VSTAR Finance Pty Ltd (オーストラリア) •Vstar Limited (モーリシャス) •VSTAR Global LLC (セントビンセントおよびグレナディーン諸島)

VSTAR Finance Pty Ltdはオーストラリア証券投資委員会(ASIC)の承認を受けており、オーストラリア金融サービスライセンスAFSL 526187に基づいて金融サービスを提供しています。

欧州連合経済地域(MiFID II)では、MiFID IIにより、投資会社は他の加盟国および/または第三国において投資および補助的サービスを提供することが許可されています(前提として、投資会社の許可がそのようなサービスを含んでいることが必要です)。

VSTAR & SOHO MARKETS LTDは、EU金融商品市場指令に基づき、EU加盟国に金融投資および取引サービスを提供しています。これにはドイツ、フランス、イタリア、スペイン、ポルトガルなどが含まれます。

Vstar Limitedはモーリシャス共和国の法律に基づいて設立された投資会社で、モーリシャス金融サービス委員会(FSC)の規制を受けており、ライセンス番号はGB21026599です。

VSTAR Global LLCはセントビンセントおよびグレナディーン諸島に登録された国際商業会社で、登録番号は1310 LLC 2021です。

www.vstar.comを使用することにより、あなたは私たちのクッキーを使用してあなたの体験を向上させることに同意します。

地域制限:VSTAR.COMはトルコ、イラン、イラク、北朝鮮、及びアメリカ本土の住民にはサービスを提供していません。