VSTAR에 관하여

할인 행사

우리는 고객에게 더 많은 가치를 창출하며, 활동을 통해 더 많은 거래 기회를 얻고 투자 수익을 높이는 데 최선을 다하고 있습니다. 최신 활동에 많은 관심 부탁드립니다!

우리의 기사와 시장 분석을 확인해 보세요. 여기에는 기술 분석, 거래 전략, 외환, 금, 원유, 가스, 주식 및 암호화폐 주제가 포함됩니다.

VSTAR 계정을 등록하여 실시간 업데이트를 받으세요.

최신 인기 전문가 기사를 읽어보세요.

Exploring AMD's tech innovations in adaptive computing across Automotive, Edge computing, and AI, reinforcing its rapid market valuation growth potential.

Tether Treasury has issued an additional one billion USDT on the Tron network. Since November 3, a cumulative sum of 6 billion USDT tokens have been minted on the Tron and Ethereum networks as part of this expansion.

After being dissatisfied with the Reserve Bank of Australia's (RBA) choice to adopt a neutral position, Australian traders will now redirect their attention towards the country's employment report and the wage price index this week.

The AUD USD price moved down despite the cash rate hike by the RBA. The sentiment came as the bank provided a dovish statement saying that it could be the last hike before tightening.

The AUDCAD would be the most awaited currency pair for this week as both central banks are expected to release monetary policy reports.

On Tuesday, the Australian Dollar (AUD) removed early gains against the Canadian Dollar (CAD) as the latter attempted to recoup recent losses.

Examining the key fundamental factors, growth initiatives, and risks, that shape AutoZone's progress towards sustained value creation.

Bitcoin Cash (BCH) got attention from the Cardano founder, which could be a potential long-term opportunity.

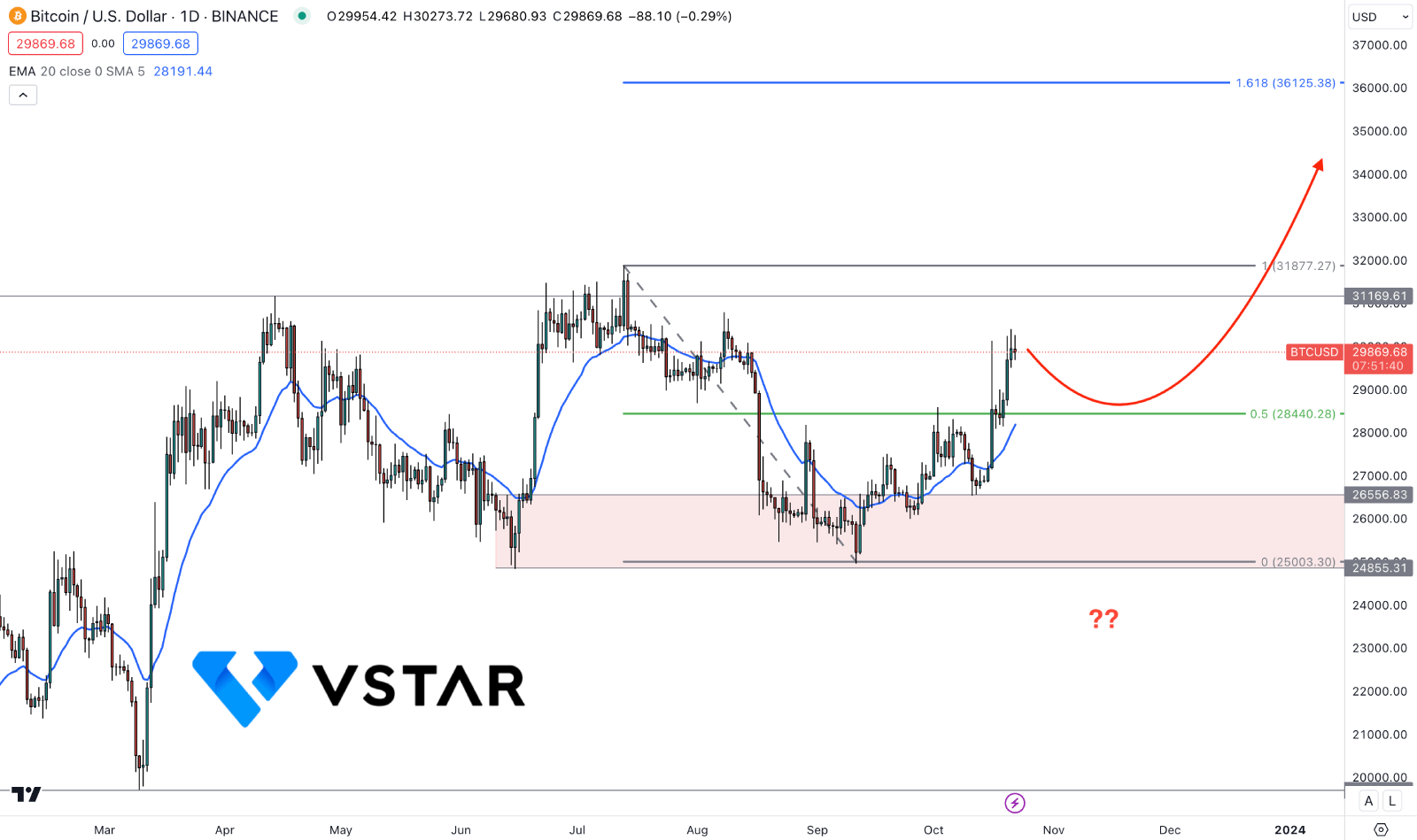

Analyzing Bitcoin's 2024 price prospects: regulatory evolution, expert projections, and market dynamics.

Amid the intense momentum surrounding all-time highs (ATHs), the continued accumulation endeavors of Bitcoin whales have come to the forefront, with Bitcoin's ascent to a 27-month high surpassing $63,000.

Recently, the SEC approved ten other applications and declared the registration statement for BlackRock's spot Bitcoin ETF effective.

Discover Bitcoin's upcoming price movements, vital institutional investments, and their potential impact, exploring the significance of BlackRock's Bitcoin ETF accumulation, Bill Ackman's speculative scenarios, and the evolving regulatory landscape.

Learn about BlackRock's recent price performance, strategic acquisitions, fundamental strengths, and weaknesses, alongside industry projections and valuation metrics.

Boeing’s Dubai Order Is A Bullish Case: On Monday, Emirates Airlines, the largest operator of Boeing 777 aircraft globally, disclosed a substantial order worth $52 billion.

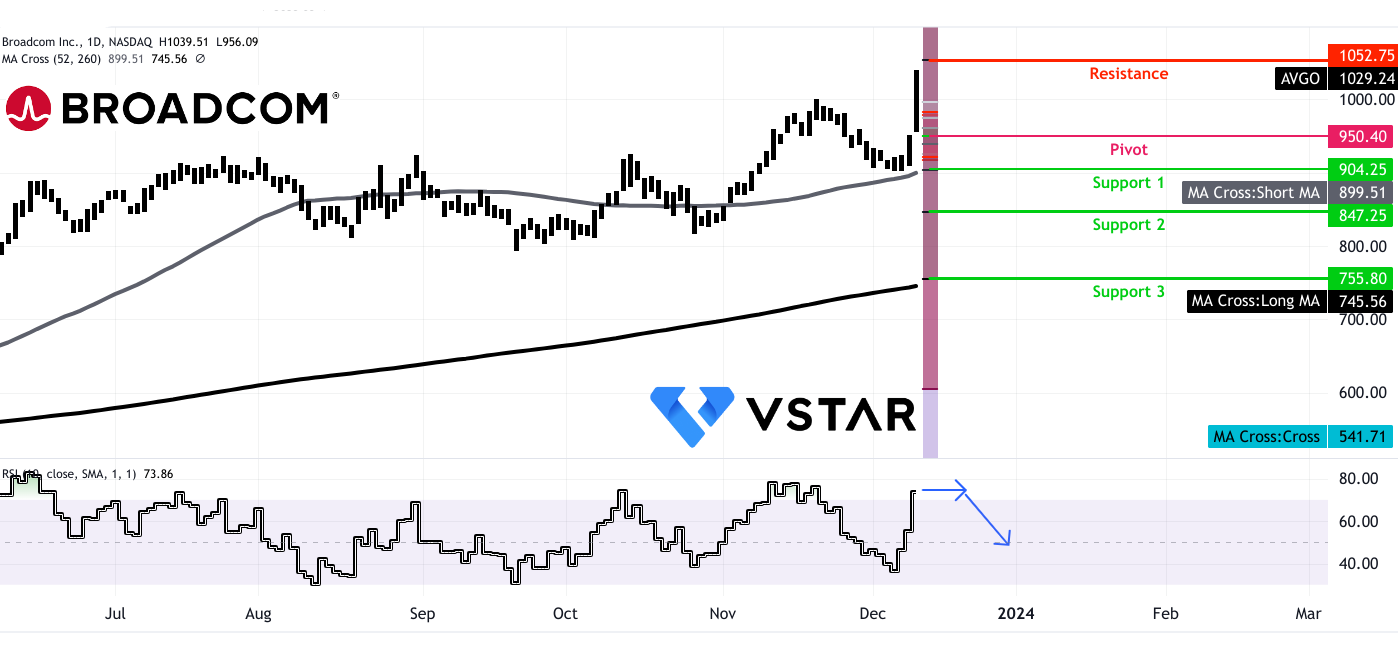

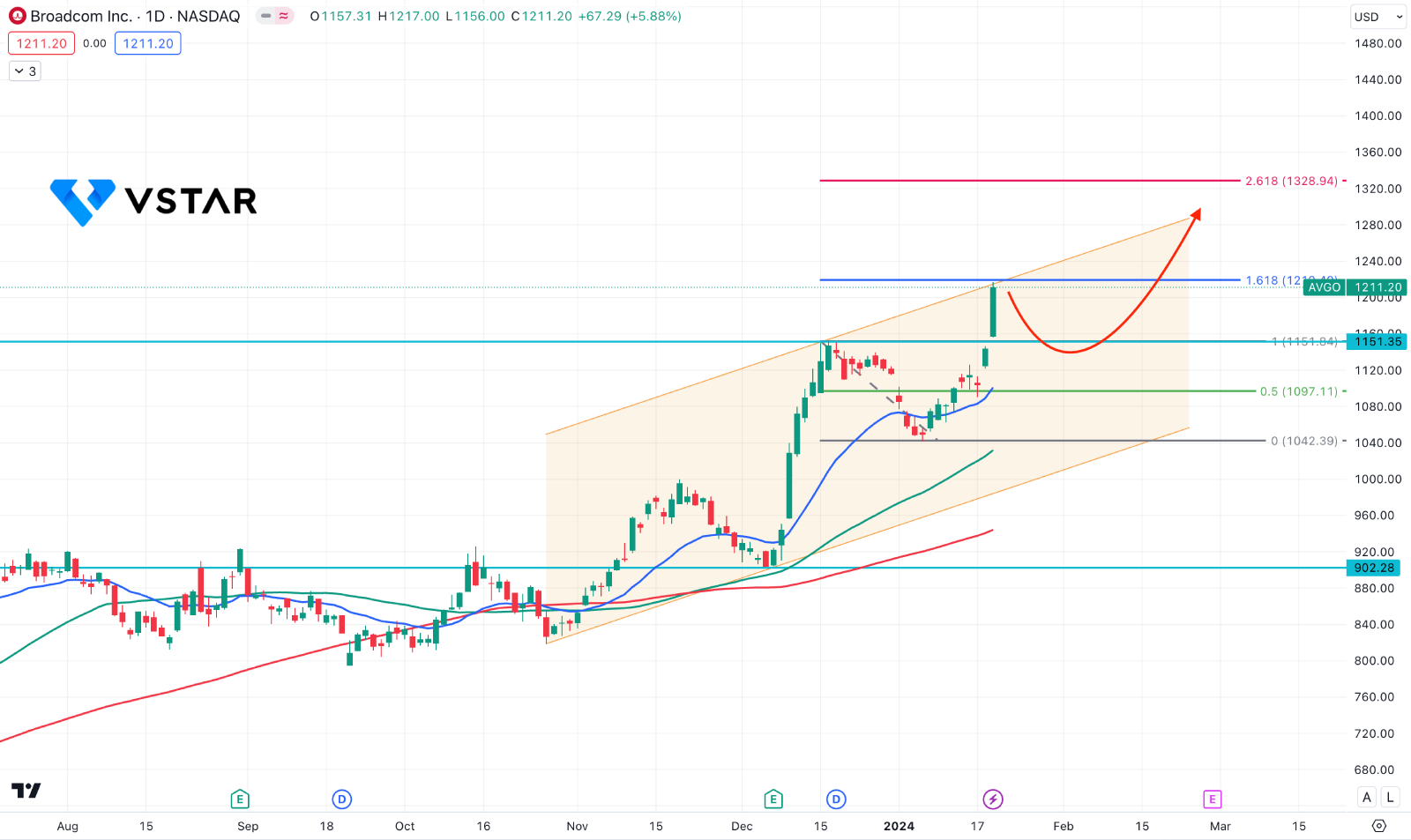

Exploring Broadcom's revenue surge, strategic segments, financial strength, and anticipated 40% year-on-year revenue rise in fiscal 2024.

To strengthen its November completion $69 billion acquisition of VMware, Broadcom has implemented new invoicing models and streamlined product bundles.

Affirm Holdings Stock (AFRM) has traded sideways in recent days, and the upcoming earnings report could be a trend-breaking event for this stock.

While technical indicators show bullish pressure in the BTCUSD price, on-chain metrics indicate a consolidation.

Over the previous five years, Boeing has led investors through a turbulent ordeal. The company initially encountered challenges about its 737 MAX, which resulted in an 18-month grounding. Subsequently, it encountered a sales decline caused by the pandemic.

As the current economic releases from Japan have no indication of changes, the long-term bullish trend in the CADJPY pair could remain intact.

In recent times, Cardano (ADA) supporters have exhibited reduced activity during unfavorable market conditions, whereas certain investors consistently take advantage of marginal price increases.

Dell Technologies (DELL) is expected to release its fiscal year 2025 third-quarter results on November 26. As the share price is under ongoing buying pressure, investors might take advantage of the recent base formation and grab a long opportunity.

Ethereum (ETH) has traded sideways in recent days, which could signal a possible trend trading opportunity after a breakout.

The FTSE 100 of Britain maintained its impressive ascent on Monday, propelled by a succession of favorable corporate updates.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

호주 증권 및 투자 위원회 ASIC (526187)

EU 금융 도구 시장 지침 (MiFID II) 적합화

폴란드 재무부 VASP8762471601

모리셔스 금융 서비스 위원회 FSC (GB21026599)

VS Group Limited. © VSTAR 저작권 소유, 모든 권리 보유.

VSTAR은 VS 그룹 소속의 인터넷 소매 거래 브랜드입니다.

본 웹사이트는 VS 그룹 회사에 의해 운영되며, 이 회사는 여러 국가에서 라이센스 허가를 받았습니다: •VSTAR Finance Pty Ltd (호주) •Vstar Limited (모리셔스) •VSTAR Global LLC (세인트빈센트 그레나딘)

VSTAR Finance Pty Ltd는 호주 증권 투자 위원회(ASIC)의 승인을 받아, 호주 금융 서비스 라이센스 AFSL 526187에 따라 금융 서비스를 제공합니다.

유럽연합 경제 지역(MiFID II) MiFID II는 투자 회사가 다른 회원국 및/또는 제3국 내에서 투자 및 부수 서비스를 제공할 수 있도록 허용합니다(단, 해당 투자 회사의 허가가 이러한 서비스에 포함되어 있어야 합니다).

VSTAR & SOHO MARKETS LTD는 유럽연합 금융 도구 시장 지침에 따라 독일, 프랑스, 이탈리아, 스페인, 포르투갈 등을 포함한 유럽연합 회원국에 금융 투자 및 거래 서비스를 제공합니다.

Vstar Limited는 모리셔스 공화국 법에 따라 설립된 투자 회사이며, 모리셔스 금융 서비스 위원회(FSC)의 규제를 받으며, 라이센스 번호는 GB21026599입니다.

VSTAR Global LLC는 세인트빈센트 그레나딘에 등록된 국제 상업 회사이며, 등록 번호는 1310 LLC 2021입니다.

www.vstar.com을 사용함으로써, 귀하는 귀하의 경험을 향상시키기 위해 우리의 쿠키 사용에 동의합니다.

지역 제한: VSTAR.COM은 터키, 이란, 이라크, 북한 및 미국 본토의 주민에게 서비스를 제공하지 않습니다.