VSTAR에 관하여

할인 행사

우리는 고객에게 더 많은 가치를 창출하며, 활동을 통해 더 많은 거래 기회를 얻고 투자 수익을 높이는 데 최선을 다하고 있습니다. 최신 활동에 많은 관심 부탁드립니다!

우리의 기사와 시장 분석을 확인해 보세요. 여기에는 기술 분석, 거래 전략, 외환, 금, 원유, 가스, 주식 및 암호화폐 주제가 포함됩니다.

VSTAR 계정을 등록하여 실시간 업데이트를 받으세요.

최신 인기 전문가 기사를 읽어보세요.

Litecoin (LTC) encountered a substantial setback after a week of steady expansion, giving rise to apprehensions regarding its future prospects. Compared to Bitcoin, LTC's value has sunk by 55% over the last five months.

Understanding the basic concepts of Litecoin trading as well as strategies for LTC CFD trading.

Litecoin (LTC) is an open-source peer-to-peer (P2P) cryptocurrency network that allows users to send payments worldwide.

Discover the secrets to trading Litecoin CFDs including opportunities, developing trading plan and risk management strategies.

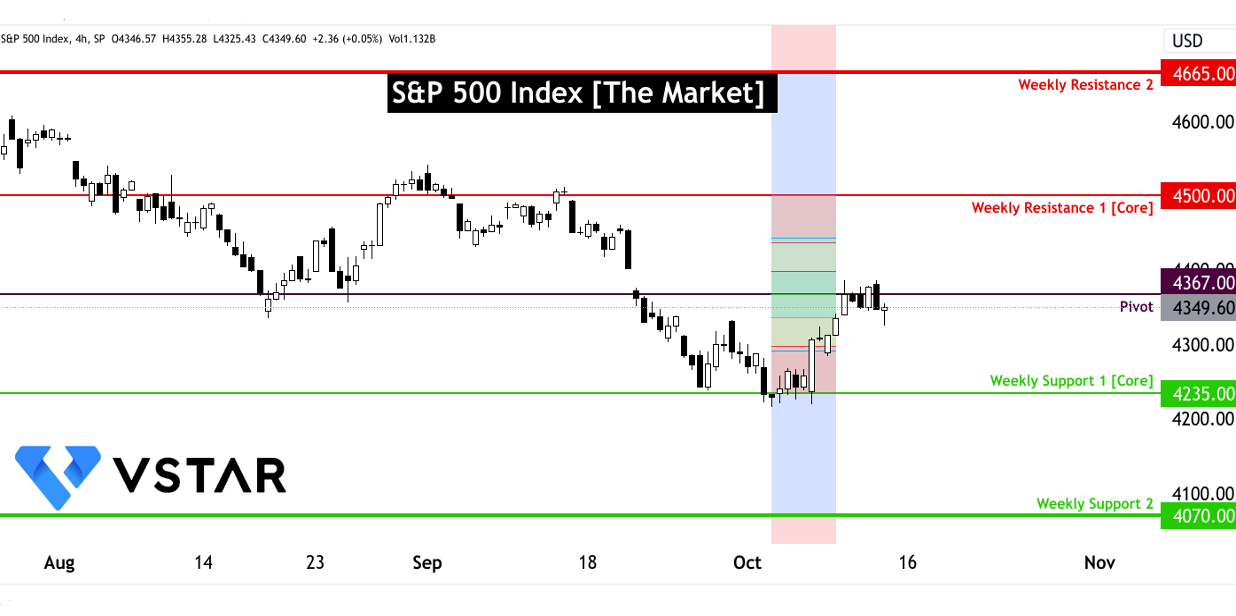

On Tuesday, the tech-heavy Nasdaq and the benchmark S&P 500 posted their largest daily percentage gains over six months. It was bolstered by consumer price data that was weaker than anticipated.

The current selling pressure came after the 2.4% loss in a week for the S&P 500. The current price hovers at the critical trading range of 4180 to 4200 area.

Inflation, interest rates, and market sentiment - deciphering the path forward for SP500 investors after September 2023 US inflation (CPI) report.

Investing in the S&P 500 can be profitable. To learn how to invest in the S&P 500, check out this guide on how to buy S&P 500.

Ethereum is one of the blockchains and distributed platforms that has made a substantial impact in the crypto market, whereby it stands as the world’s second-largest blockchain network. It’s also well-known for its native cryptocurrency, Ether (ETH). Ethereum is an idea conceptualized in 2013 by Vitalik Buterin, the co-founder of Bitcoin Magazine at the time. However, it was launched in 2015.

Exploring Bitcoin’s price trends over the years, analysing factors that influence market value, and the future of Bitcoin investment.

Examining macro fundamentals, adoption trends, and price catalysts propelling the price of BTC.

On Thursday, Bitcoin (BTC) showed substantial volatility, with a short squeeze. The price of Bitcoin experienced a significant 8% surge, surpassing psychological milestones of $36,000.00 and $37,000.00 en route to an intra-day high of over $38,400.

Examining technical indicator tools for Bitcoin trading as well as developing excellent trading strategies to protect profit and minimize risk.

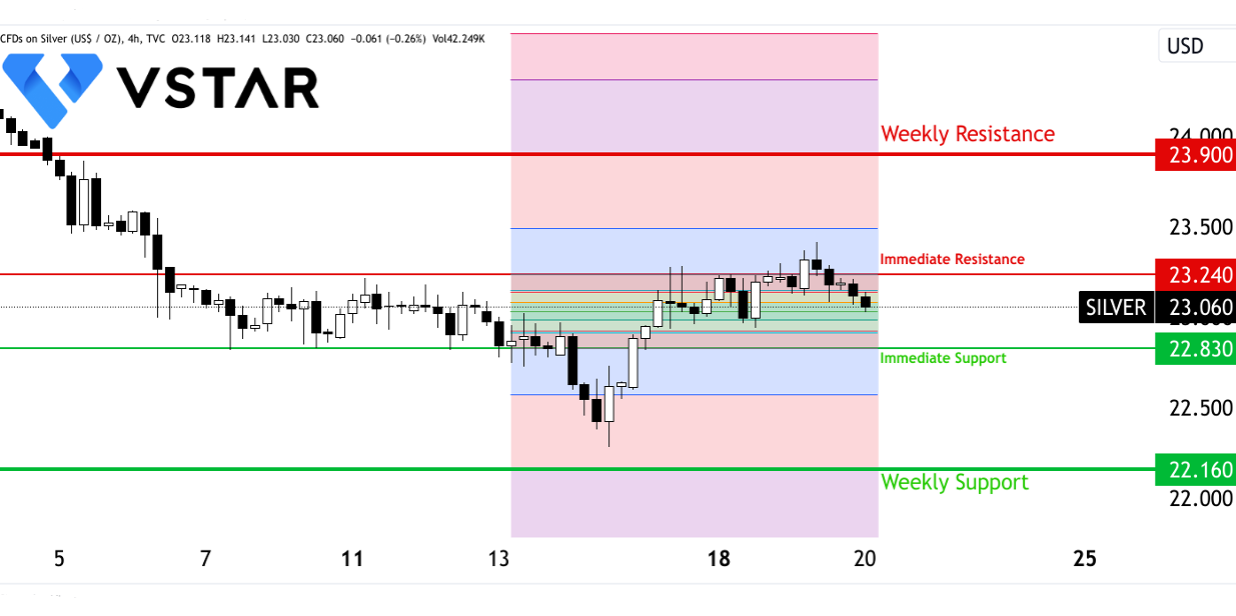

Gold CFDs provide investors with a flexible and accessible way to trade the price movements of gold without physically owning the metal. Other precious metals, like silver, palladium, and platinum, offer intriguing investment opportunities beyond the allure of gold.

In U.S. trading on Thursday, Silver and gold prices increased marginally, expanding on this week's gains fueled by more moderate U.S. inflation data.

The upcoming FOMC meeting holds specific and numerical implications for the silver market.

Comprehensive oil price forecast for 2023, 2025, 2030 and beyond, analyzing market trends, geopolitical factors, and supply-demand dynamics. Get insights and predictions for the future of oil prices.

Learn about oil trading platforms for CFDs, major oil CFD platforms, key features of oil CFD platforms.

In gas Contract for Difference (CFD) trading, technical analysis plays a crucial role in making informed trading decisions.

Gas CFD trading, which stands for Contracts for Difference, is a popular method for speculating on the price movements of natural gas without owning the underlying asset. Fundamental analysis plays a crucial role in Gas CFD trading as it helps traders make informed decisions based on the intrinsic value of the gas market.

By understanding the factors that affect trading costs and implementing strategies to minimize them, traders can improve their profitability in Gas CFD trading.

Gas CFD (Contract for Difference) trading refers to the buying and selling of contracts that derive their value from the price movements of gas commodities without actually owning the physical gas itself.

Gas CFDs (contracts for difference) allow traders to speculate on the price movements of natural gas without owning the underlying asset. In a CFD, traders initiate an agreement with a broker to exchange the difference in natural gas prices between the opening and closing of the contract.

Oil trading plays a vital role in global financial markets, facilitating the exchange of this precious commodity on various platforms. Contracts for Difference (CFDs) have emerged as a popular financial instrument for oil trading, allowing investors to speculate on oil price movements without owning the physical asset.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

호주 증권 및 투자 위원회 ASIC (526187)

EU 금융 도구 시장 지침 (MiFID II) 적합화

폴란드 재무부 VASP8762471601

모리셔스 금융 서비스 위원회 FSC (GB21026599)

VS Group Limited. © VSTAR 저작권 소유, 모든 권리 보유.

VSTAR은 VS 그룹 소속의 인터넷 소매 거래 브랜드입니다.

본 웹사이트는 VS 그룹 회사에 의해 운영되며, 이 회사는 여러 국가에서 라이센스 허가를 받았습니다: •VSTAR Finance Pty Ltd (호주) •Vstar Limited (모리셔스) •VSTAR Global LLC (세인트빈센트 그레나딘)

VSTAR Finance Pty Ltd는 호주 증권 투자 위원회(ASIC)의 승인을 받아, 호주 금융 서비스 라이센스 AFSL 526187에 따라 금융 서비스를 제공합니다.

유럽연합 경제 지역(MiFID II) MiFID II는 투자 회사가 다른 회원국 및/또는 제3국 내에서 투자 및 부수 서비스를 제공할 수 있도록 허용합니다(단, 해당 투자 회사의 허가가 이러한 서비스에 포함되어 있어야 합니다).

VSTAR & SOHO MARKETS LTD는 유럽연합 금융 도구 시장 지침에 따라 독일, 프랑스, 이탈리아, 스페인, 포르투갈 등을 포함한 유럽연합 회원국에 금융 투자 및 거래 서비스를 제공합니다.

Vstar Limited는 모리셔스 공화국 법에 따라 설립된 투자 회사이며, 모리셔스 금융 서비스 위원회(FSC)의 규제를 받으며, 라이센스 번호는 GB21026599입니다.

VSTAR Global LLC는 세인트빈센트 그레나딘에 등록된 국제 상업 회사이며, 등록 번호는 1310 LLC 2021입니다.

www.vstar.com을 사용함으로써, 귀하는 귀하의 경험을 향상시키기 위해 우리의 쿠키 사용에 동의합니다.

지역 제한: VSTAR.COM은 터키, 이란, 이라크, 북한 및 미국 본토의 주민에게 서비스를 제공하지 않습니다.