私たちの記事と市場分析を確認してください。これには、テクニカル分析、トレーディング戦略、外国為替、ゴールド、原油、ガス、株式、暗号通貨に関するテーマが含まれています。

VSTARアカウントに登録してリアルタイム更新を受け取る

私たちの最新で最も人気のある特集記事をお読みください。

UAL Stock lost 10.66% value in a day when the U.S. aviation regulator extended the indefinite grounding of Boeing 737 MAX 9 aircraft.

Decentraland has recently experienced a substantial marketplace upgrade to enhance accessibility. This improvement facilitates cross-blockchain transactions, facilitating the integration of Polygon and Ethereum to optimize gaming interactions.

Plug Power is partnering with Amazon.com to power more than 225 forklifts at the site with an electrolyzer system that will produce low-carbon hydrogen.

In recent days, the wale’s accumulation in Uniswap (UNI) suggests an ongoing development of the v4 Uniswap project, which might enhance the system.

Shopify stock (SHOP) experienced a 5.93% surge in its share price during the previous week, surpassing the 0.13% growth in the industry average.

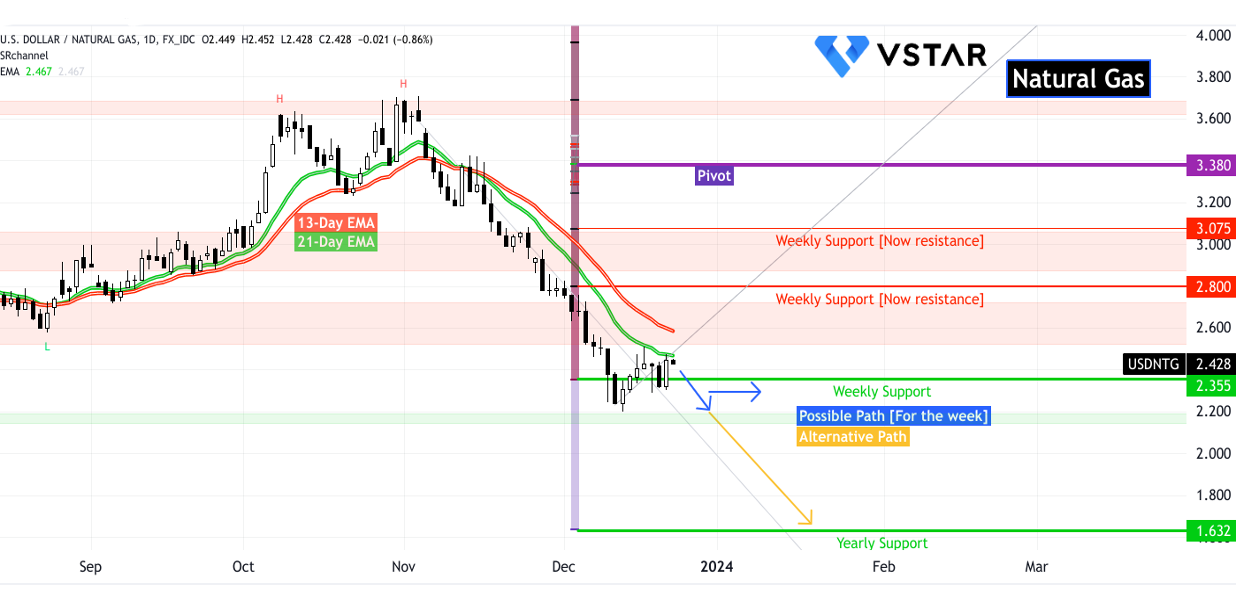

Analyzing storage dynamics, market trends, supply-demand equilibrium, and global influences on pricing for Natural Gas CFDs.

Cardano, a Layer-1 blockchain token, is positioned to sustain its recent upward pressure this week. A considerable price increase of approximately 20% was observed for the altcoin on the Binance exchange in the initial week of November.

Since September, an upward trend has been visible in the Chainlink price, culminating in an impressive 60% increase over the previous thirty days. The price has decreased by 2% daily, giving a chance of an imminent further decline.

Chainlink released the second iteration of its staking program for LINK holders on November 28. A considerable proportion of version 1 stakers promptly converted their assets to the upgraded iteration within 24 hours of the release. This led to a substantial outflow of LINK tokens from exchanges.

The Solana (SOL) cryptocurrency grabbed institutional investors’ attention, as the price of a single SOLUSD coin has increased by a remarkable 70% over the past month.

Dogecoin price showed a string selling pressure at the crucial Fibonacci Extension level, which could result in a bearish reversal.

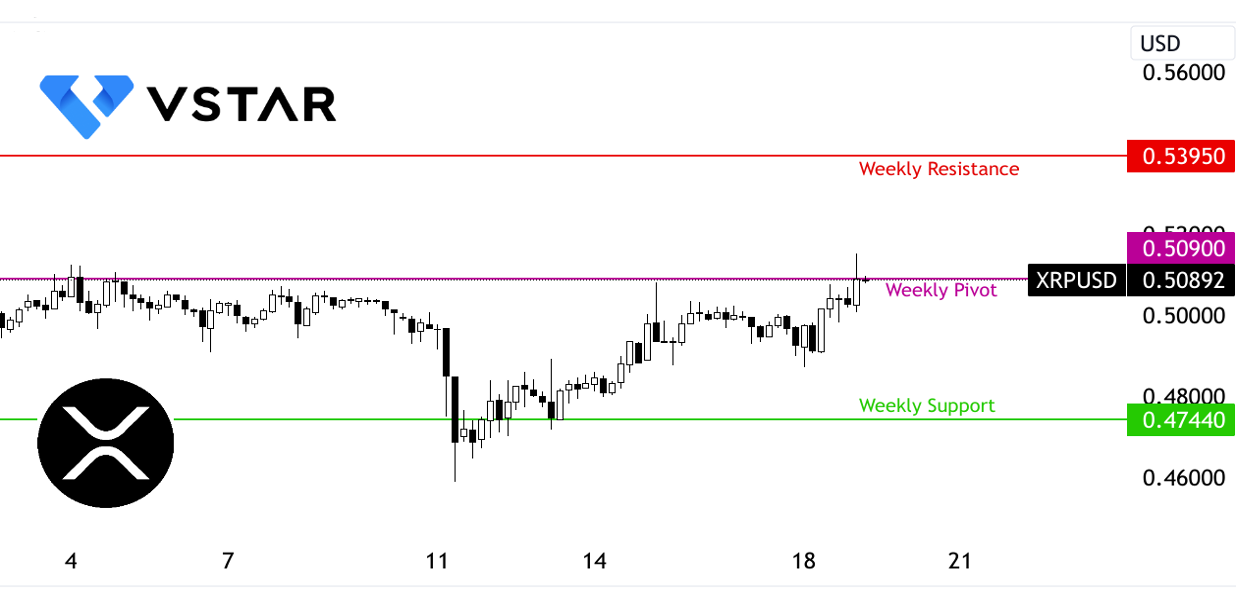

Ripple's removal from the approved-tokens list by NYDFS can create downside pressure.

Ethereum price soared above $2,100 on Friday, the question is whether the bullish momentum will enable ETH price to exceed $2,500 and establish a fresh peak in 2023.

Litecoin (LTC) encountered a substantial setback after a week of steady expansion, giving rise to apprehensions regarding its future prospects. Compared to Bitcoin, LTC's value has sunk by 55% over the last five months.

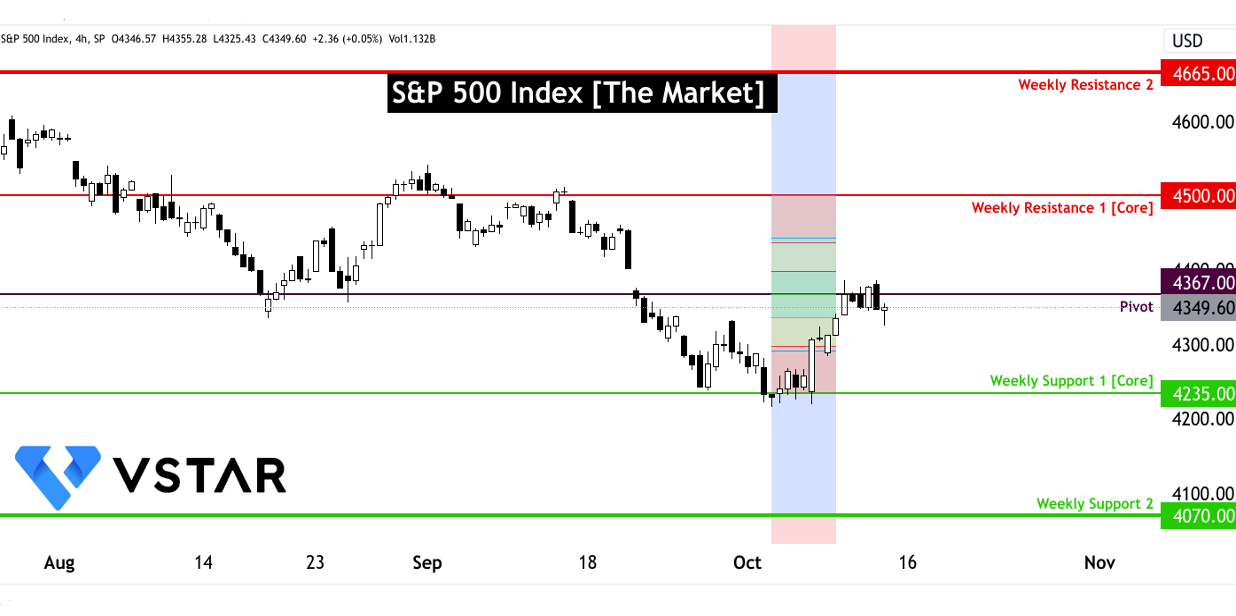

On Tuesday, the tech-heavy Nasdaq and the benchmark S&P 500 posted their largest daily percentage gains over six months. It was bolstered by consumer price data that was weaker than anticipated.

The current selling pressure came after the 2.4% loss in a week for the S&P 500. The current price hovers at the critical trading range of 4180 to 4200 area.

Inflation, interest rates, and market sentiment - deciphering the path forward for SP500 investors after September 2023 US inflation (CPI) report.

On Thursday, Bitcoin (BTC) showed substantial volatility, with a short squeeze. The price of Bitcoin experienced a significant 8% surge, surpassing psychological milestones of $36,000.00 and $37,000.00 en route to an intra-day high of over $38,400.

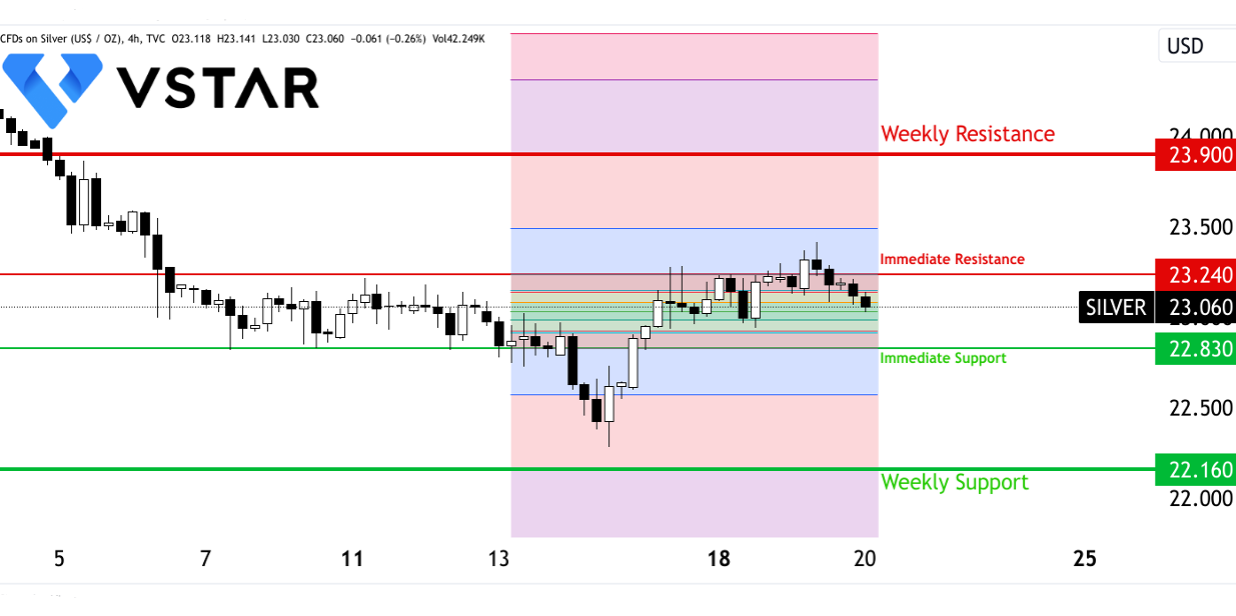

In U.S. trading on Thursday, Silver and gold prices increased marginally, expanding on this week's gains fueled by more moderate U.S. inflation data.

The upcoming FOMC meeting holds specific and numerical implications for the silver market.

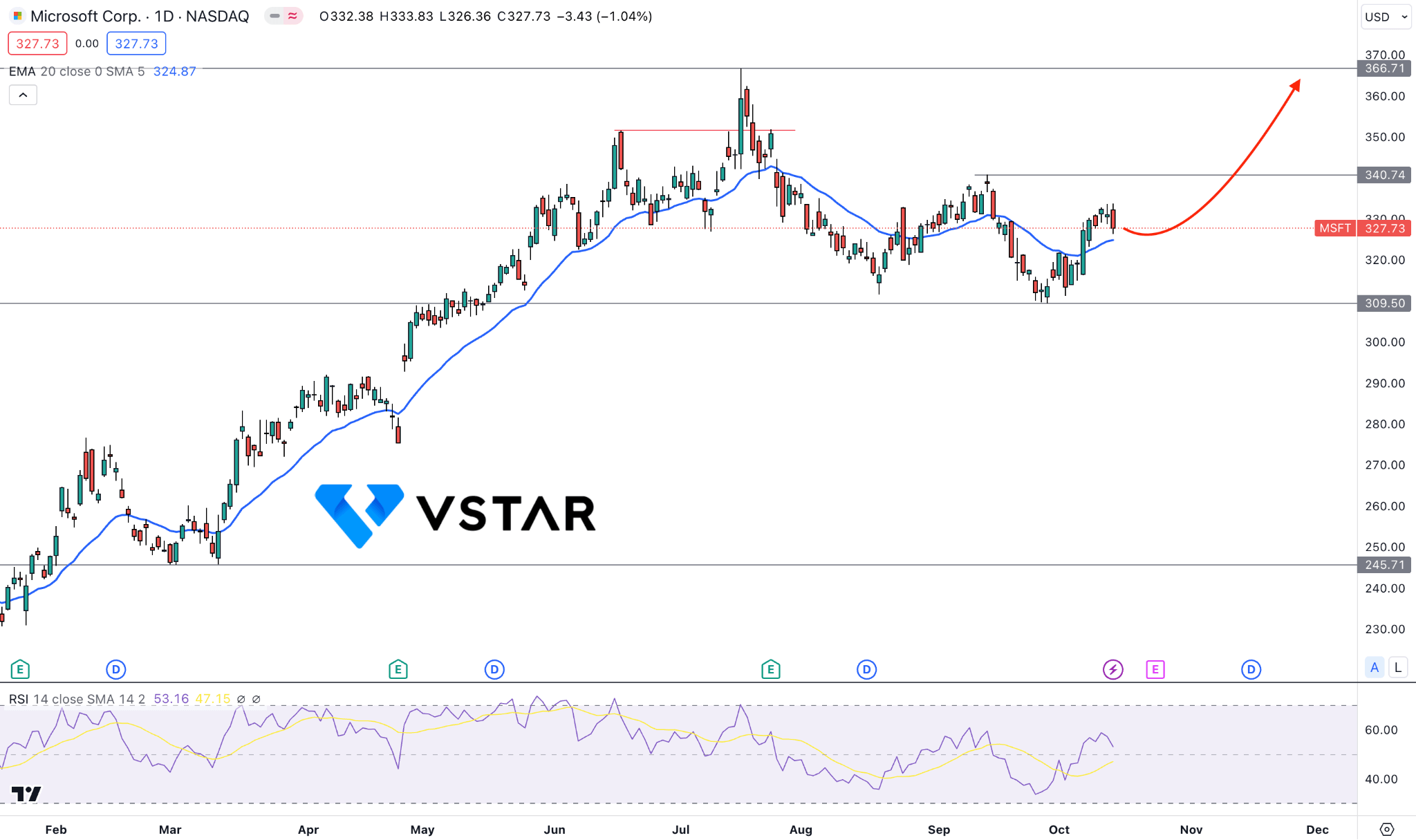

In a monumental transaction worth $69 billion, Microsoft acquired Activision Blizzard, making it the largest acquisition in the video game industry's history.

Amazon (NASDAQ: AMZN) has strategically positioned itself to benefit in the long term by actively addressing environmental concerns and investing in innovative carbon removal technologies.

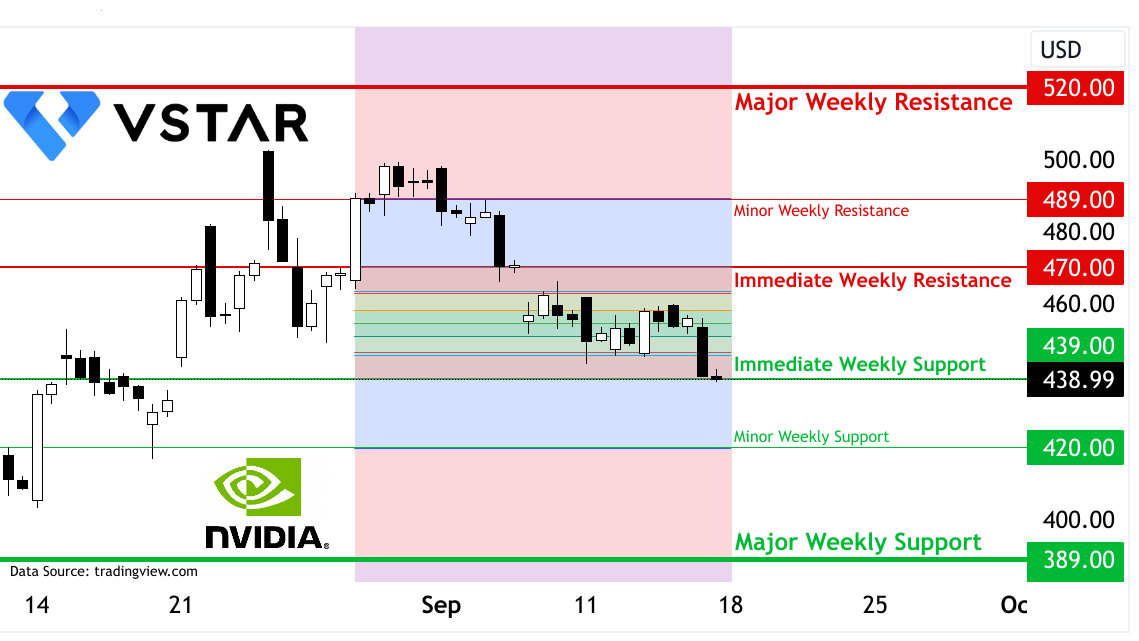

NVIDIA (NASDAQ: NVDA) has demonstrated significant potential for fundamental benefits through its recent innovations in AI hardware and software, as showcased by its exceptional performance in the MLPerf Inference Benchmarks.

Exploring the immediate impact and long-term implications for Nvidia's financial health and growth prospects in the face of export restrictions to China.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

オーストラリア証券投資委員会ASIC (526187)

EUの金融商品市場指令(MiFiD II)に適応する

ポーランド財務省 VASP8762471601

モーリシャス金融サービス委員会FSC (GB21026599)

VS Group Limited. © VSTARの著作権は全て保留されています。

VSTARはVSグループのインターネット小売取引ブランドです。

本ウェブサイトはVSグループ会社によって運営されており、同社は世界の多くの国でライセンスを取得しています: •VSTAR Finance Pty Ltd (オーストラリア) •Vstar Limited (モーリシャス) •VSTAR Global LLC (セントビンセントおよびグレナディーン諸島)

VSTAR Finance Pty Ltdはオーストラリア証券投資委員会(ASIC)の承認を受けており、オーストラリア金融サービスライセンスAFSL 526187に基づいて金融サービスを提供しています。

欧州連合経済地域(MiFID II)では、MiFID IIにより、投資会社は他の加盟国および/または第三国において投資および補助的サービスを提供することが許可されています(前提として、投資会社の許可がそのようなサービスを含んでいることが必要です)。

VSTAR & SOHO MARKETS LTDは、EU金融商品市場指令に基づき、EU加盟国に金融投資および取引サービスを提供しています。これにはドイツ、フランス、イタリア、スペイン、ポルトガルなどが含まれます。

Vstar Limitedはモーリシャス共和国の法律に基づいて設立された投資会社で、モーリシャス金融サービス委員会(FSC)の規制を受けており、ライセンス番号はGB21026599です。

VSTAR Global LLCはセントビンセントおよびグレナディーン諸島に登録された国際商業会社で、登録番号は1310 LLC 2021です。

www.vstar.comを使用することにより、あなたは私たちのクッキーを使用してあなたの体験を向上させることに同意します。

地域制限:VSTAR.COMはトルコ、イラン、イラク、北朝鮮、及びアメリカ本土の住民にはサービスを提供していません。