VSTAR에 관하여

할인 행사

우리는 고객에게 더 많은 가치를 창출하며, 활동을 통해 더 많은 거래 기회를 얻고 투자 수익을 높이는 데 최선을 다하고 있습니다. 최신 활동에 많은 관심 부탁드립니다!

우리의 기사와 시장 분석을 확인해 보세요. 여기에는 기술 분석, 거래 전략, 외환, 금, 원유, 가스, 주식 및 암호화폐 주제가 포함됩니다.

VSTAR 계정을 등록하여 실시간 업데이트를 받으세요.

최신 인기 전문가 기사를 읽어보세요.

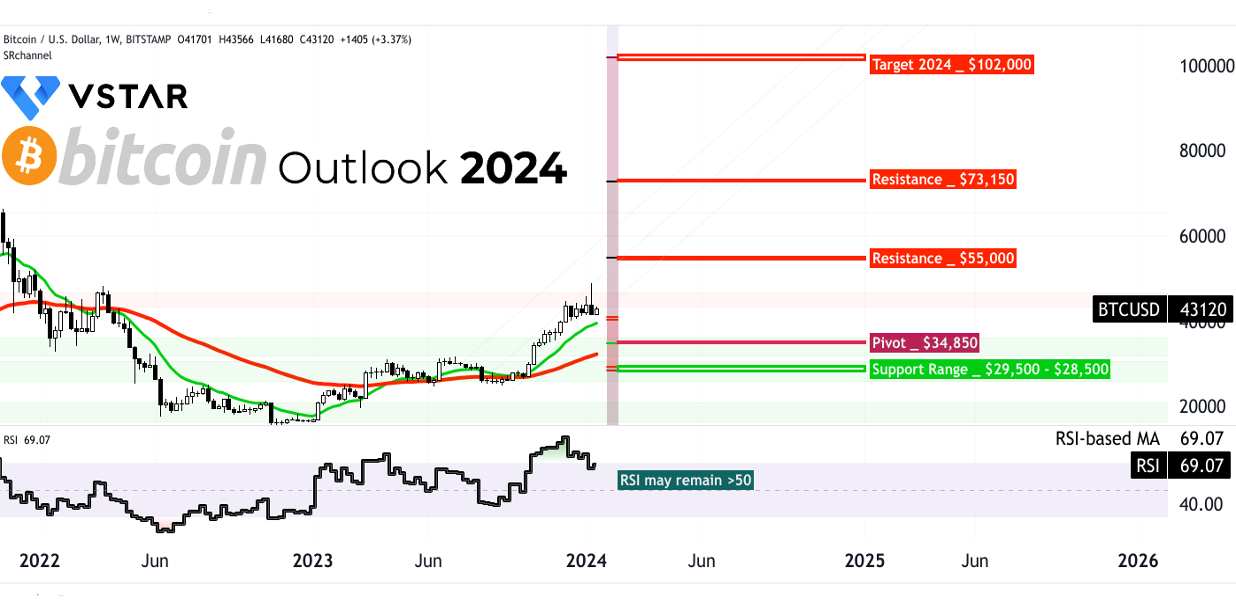

Decoding Bitcoin's Future: Market Trends and Potential Price Implications in 2024.

Charles Hoskinson, the founder of Cardano, has conveyed his endorsement of the "Crypto Bill of Rights" initiative by Vivek Ramaswamy, a Republican candidate for the forthcoming United States presidential election.

UAL Stock lost 10.66% value in a day when the U.S. aviation regulator extended the indefinite grounding of Boeing 737 MAX 9 aircraft.

Decentraland has recently experienced a substantial marketplace upgrade to enhance accessibility. This improvement facilitates cross-blockchain transactions, facilitating the integration of Polygon and Ethereum to optimize gaming interactions.

Plug Power is partnering with Amazon.com to power more than 225 forklifts at the site with an electrolyzer system that will produce low-carbon hydrogen.

In recent days, the wale’s accumulation in Uniswap (UNI) suggests an ongoing development of the v4 Uniswap project, which might enhance the system.

Shopify stock (SHOP) experienced a 5.93% surge in its share price during the previous week, surpassing the 0.13% growth in the industry average.

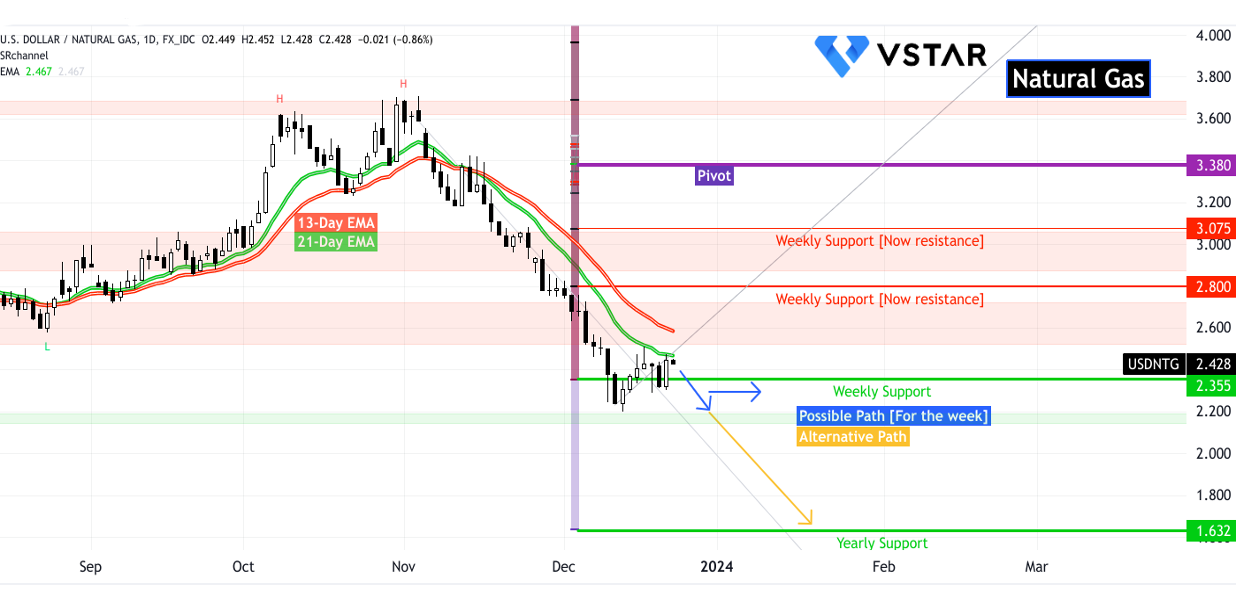

Analyzing storage dynamics, market trends, supply-demand equilibrium, and global influences on pricing for Natural Gas CFDs.

Cardano, a Layer-1 blockchain token, is positioned to sustain its recent upward pressure this week. A considerable price increase of approximately 20% was observed for the altcoin on the Binance exchange in the initial week of November.

Since September, an upward trend has been visible in the Chainlink price, culminating in an impressive 60% increase over the previous thirty days. The price has decreased by 2% daily, giving a chance of an imminent further decline.

Chainlink released the second iteration of its staking program for LINK holders on November 28. A considerable proportion of version 1 stakers promptly converted their assets to the upgraded iteration within 24 hours of the release. This led to a substantial outflow of LINK tokens from exchanges.

The Solana (SOL) cryptocurrency grabbed institutional investors’ attention, as the price of a single SOLUSD coin has increased by a remarkable 70% over the past month.

Dogecoin price showed a string selling pressure at the crucial Fibonacci Extension level, which could result in a bearish reversal.

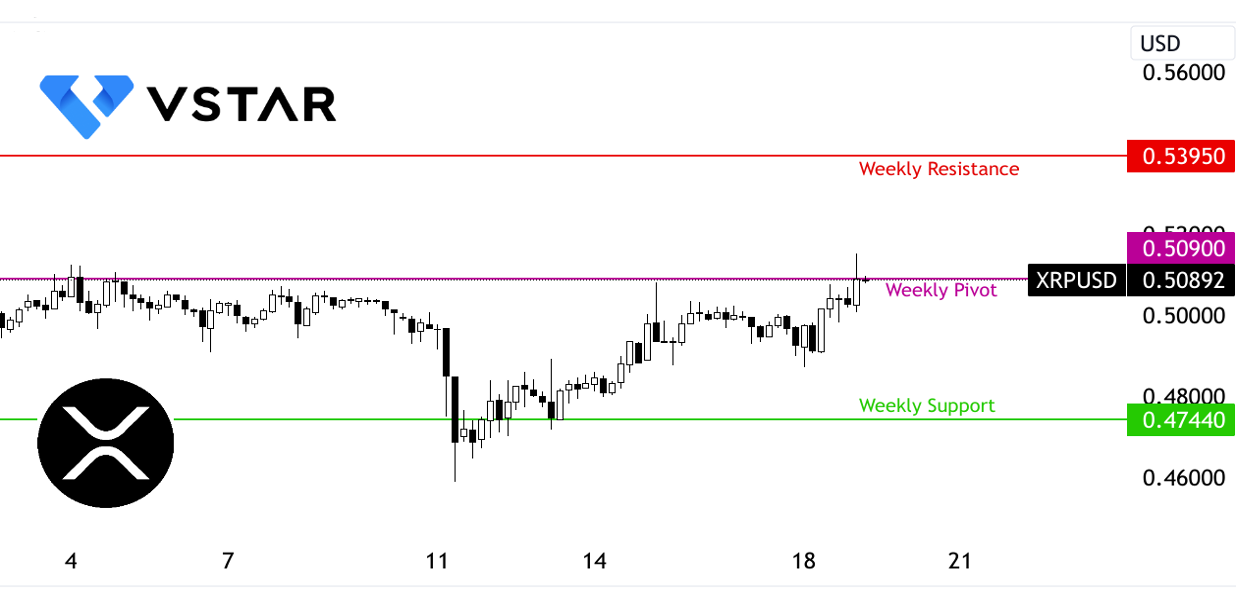

Ripple's removal from the approved-tokens list by NYDFS can create downside pressure.

Ethereum price soared above $2,100 on Friday, the question is whether the bullish momentum will enable ETH price to exceed $2,500 and establish a fresh peak in 2023.

Litecoin (LTC) encountered a substantial setback after a week of steady expansion, giving rise to apprehensions regarding its future prospects. Compared to Bitcoin, LTC's value has sunk by 55% over the last five months.

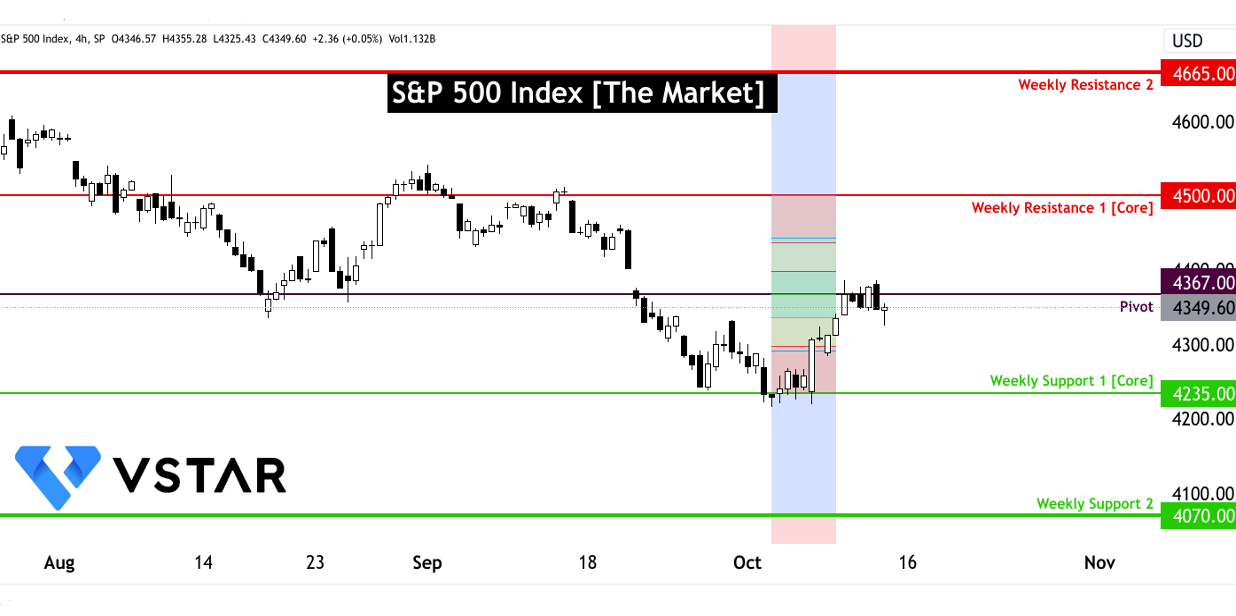

On Tuesday, the tech-heavy Nasdaq and the benchmark S&P 500 posted their largest daily percentage gains over six months. It was bolstered by consumer price data that was weaker than anticipated.

The current selling pressure came after the 2.4% loss in a week for the S&P 500. The current price hovers at the critical trading range of 4180 to 4200 area.

Inflation, interest rates, and market sentiment - deciphering the path forward for SP500 investors after September 2023 US inflation (CPI) report.

On Thursday, Bitcoin (BTC) showed substantial volatility, with a short squeeze. The price of Bitcoin experienced a significant 8% surge, surpassing psychological milestones of $36,000.00 and $37,000.00 en route to an intra-day high of over $38,400.

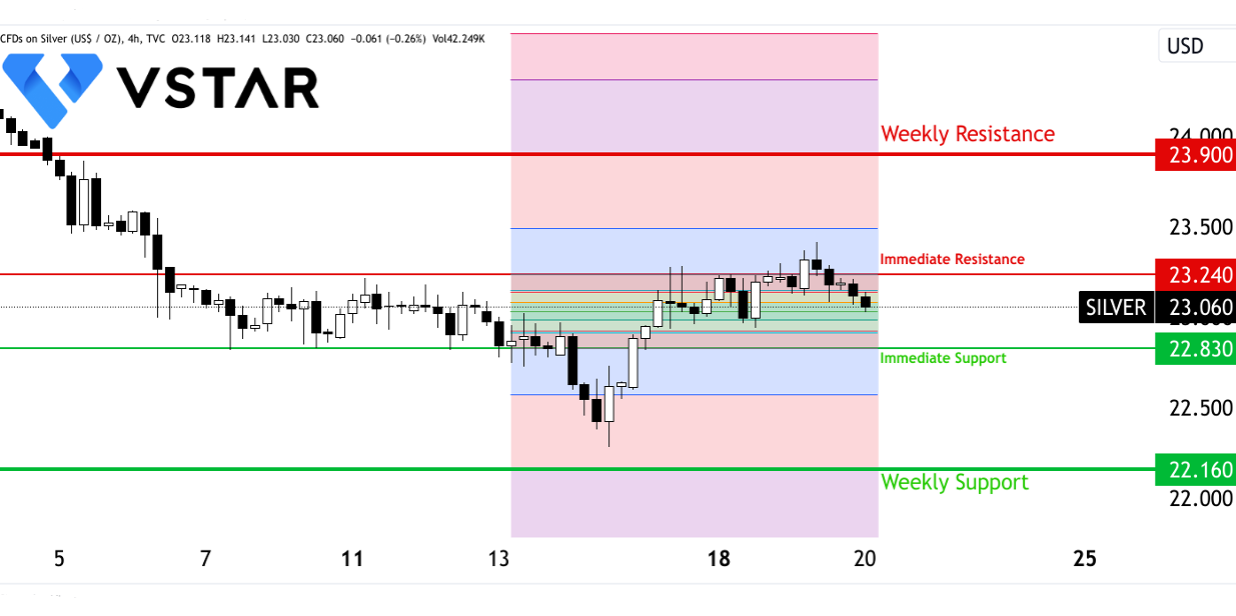

In U.S. trading on Thursday, Silver and gold prices increased marginally, expanding on this week's gains fueled by more moderate U.S. inflation data.

The upcoming FOMC meeting holds specific and numerical implications for the silver market.

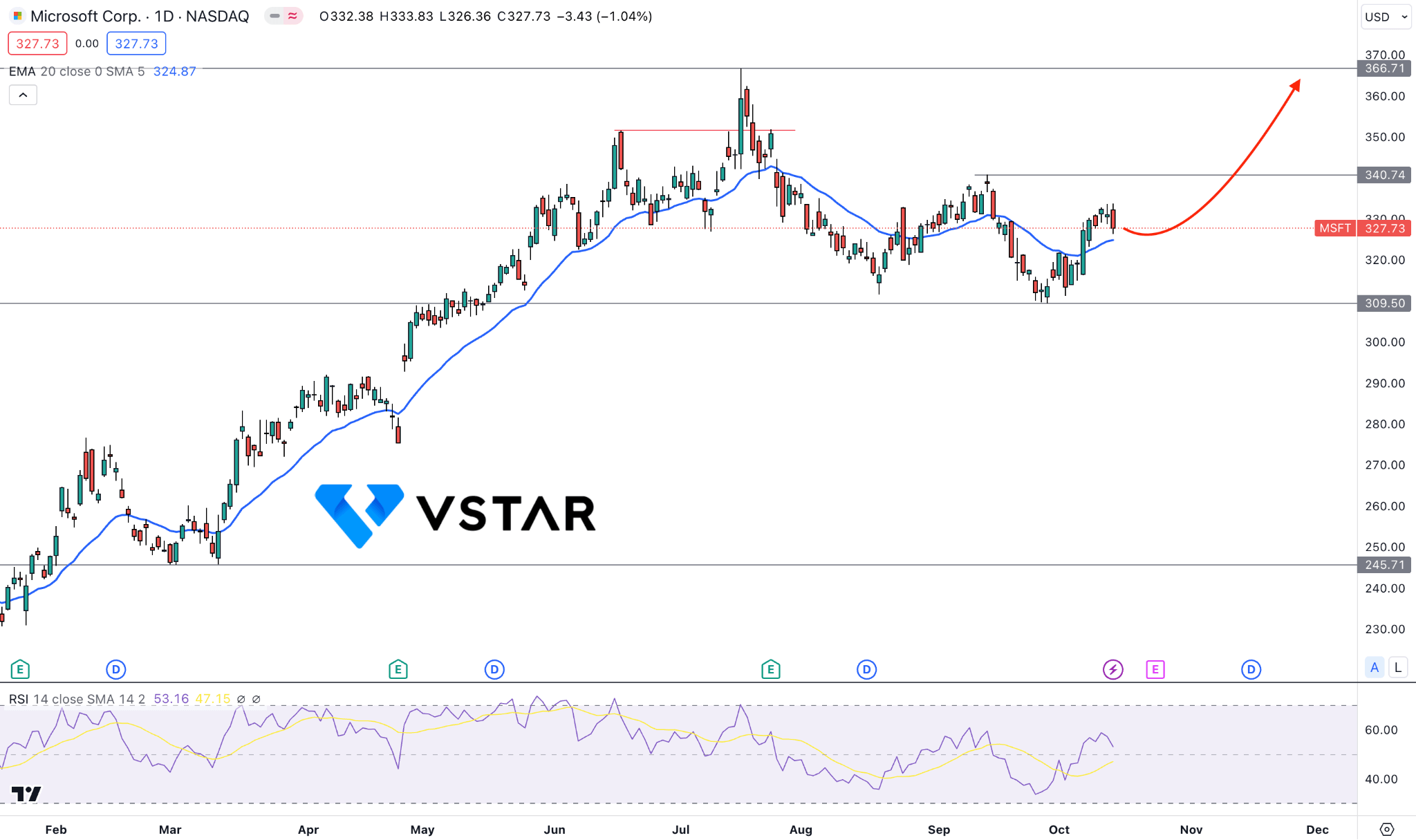

In a monumental transaction worth $69 billion, Microsoft acquired Activision Blizzard, making it the largest acquisition in the video game industry's history.

Amazon (NASDAQ: AMZN) has strategically positioned itself to benefit in the long term by actively addressing environmental concerns and investing in innovative carbon removal technologies.

VSTAR FINANCE PTY LTD

Address:UNIT 1, 5-7 Compark Circuit,

Mulgrave VIC 3170, Melbourne, Australia

WhatsApp (For general enquiries)

+61 423 180 864

Trading days: 9a.m. – 6p.m. (GMT+8)

Email: support@vstar.com

호주 증권 및 투자 위원회 ASIC (526187)

EU 금융 도구 시장 지침 (MiFID II) 적합화

폴란드 재무부 VASP8762471601

모리셔스 금융 서비스 위원회 FSC (GB21026599)

VS Group Limited. © VSTAR 저작권 소유, 모든 권리 보유.

VSTAR은 VS 그룹 소속의 인터넷 소매 거래 브랜드입니다.

본 웹사이트는 VS 그룹 회사에 의해 운영되며, 이 회사는 여러 국가에서 라이센스 허가를 받았습니다: •VSTAR Finance Pty Ltd (호주) •Vstar Limited (모리셔스) •VSTAR Global LLC (세인트빈센트 그레나딘)

VSTAR Finance Pty Ltd는 호주 증권 투자 위원회(ASIC)의 승인을 받아, 호주 금융 서비스 라이센스 AFSL 526187에 따라 금융 서비스를 제공합니다.

유럽연합 경제 지역(MiFID II) MiFID II는 투자 회사가 다른 회원국 및/또는 제3국 내에서 투자 및 부수 서비스를 제공할 수 있도록 허용합니다(단, 해당 투자 회사의 허가가 이러한 서비스에 포함되어 있어야 합니다).

VSTAR & SOHO MARKETS LTD는 유럽연합 금융 도구 시장 지침에 따라 독일, 프랑스, 이탈리아, 스페인, 포르투갈 등을 포함한 유럽연합 회원국에 금융 투자 및 거래 서비스를 제공합니다.

Vstar Limited는 모리셔스 공화국 법에 따라 설립된 투자 회사이며, 모리셔스 금융 서비스 위원회(FSC)의 규제를 받으며, 라이센스 번호는 GB21026599입니다.

VSTAR Global LLC는 세인트빈센트 그레나딘에 등록된 국제 상업 회사이며, 등록 번호는 1310 LLC 2021입니다.

www.vstar.com을 사용함으로써, 귀하는 귀하의 경험을 향상시키기 위해 우리의 쿠키 사용에 동의합니다.

지역 제한: VSTAR.COM은 터키, 이란, 이라크, 북한 및 미국 본토의 주민에게 서비스를 제공하지 않습니다.